Massachusetts Proposed Amendment to Article 4 of Certificate of Incorporation to Authorize Issuance of Preferred Stock The Massachusetts Proposed Amendment to Article 4 of the Certificate of Incorporation aims to empower businesses to issue preferred stock in the state. This amendment can greatly impact the way companies raise capital and structure their ownership arrangements. By authorizing the issuance of preferred stock, businesses gain additional flexibility in attracting investors and facilitating growth opportunities. Preferred stock is a type of security that holds certain advantages over common stock. This form of stock typically grants shareholders preferential treatment in terms of dividends and liquidation rights. With the Massachusetts Proposed Amendment to Article 4, companies can create different classes or series of preferred stock, each with specific rights, preferences, and restrictions. This can allow companies to tailor investment opportunities to various investor preferences. The proposed amendment enables businesses to attract a wider range of investors by tailoring preferred stock offerings according to their risk appetite, dividend preferences, or voting rights. For instance, a company may issue preferred stock that provides a fixed dividend rate, ensuring steady income for investors. Alternatively, another class of preferred stock may offer potential capital gains with no fixed dividend. These options allow businesses to attract investors with diverse investment objectives and risk tolerances. Moreover, the amendment allows for variations in voting rights attached to preferred stock. While common shareholders generally have voting rights, preferred shareholders may not possess the same level of voting power. This enables businesses to protect the voting control of certain stakeholder groups, ensuring consistent decision-making processes. The Massachusetts Proposed Amendment to Article 4 also requires companies to file a copy of their preferred stock amendment with the appropriate state authorities. This ensures transparency and accountability in the issuance of preferred stock, as well as compliance with Massachusetts corporate laws. In summary, the Massachusetts Proposed Amendment to Article 4 of Certificate of Incorporation to Authorize Issuance of Preferred Stock provides companies with enhanced flexibility in raising capital and attracting investors. By offering different classes or series of preferred stock with distinct rights and restrictions, businesses can cater to various investor needs and objectives. This amendment can potentially stimulate economic growth and provide new opportunities for businesses in Massachusetts. Types of Massachusetts Proposed Amendments to Article 4 of Certificate of Incorporation to Authorize Issuance of Preferred Stock: 1. Dividend Preference Amendment: This amendment introduces a class of preferred stock that ensures a fixed dividend rate for investors. 2. Capital Gains Amendment: This amendment authorizes the issuance of preferred stock that allows investors to potentially earn capital gains without a fixed dividend. 3. Voting Rights Amendment: This amendment modifies the level of voting power attached to preferred stock to preserve control for specific stakeholder groups. 4. Amendment Filing Requirement: This amendment imposes the obligation on businesses to file a copy of their preferred stock amendment with state authorities.

Massachusetts Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment

Description

How to fill out Massachusetts Proposed Amendment To Article 4 Of Certificate Of Incorporation To Authorize Issuance Of Preferred Stock With Copy Of Amendment?

Are you in the position that you need to have paperwork for either company or specific reasons virtually every time? There are plenty of legitimate record templates accessible on the Internet, but locating versions you can trust isn`t straightforward. US Legal Forms gives 1000s of kind templates, much like the Massachusetts Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment, that are published in order to meet state and federal requirements.

Should you be presently familiar with US Legal Forms website and also have a free account, basically log in. Following that, it is possible to download the Massachusetts Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment format.

Unless you provide an profile and need to begin using US Legal Forms, follow these steps:

- Find the kind you will need and ensure it is for that proper metropolis/region.

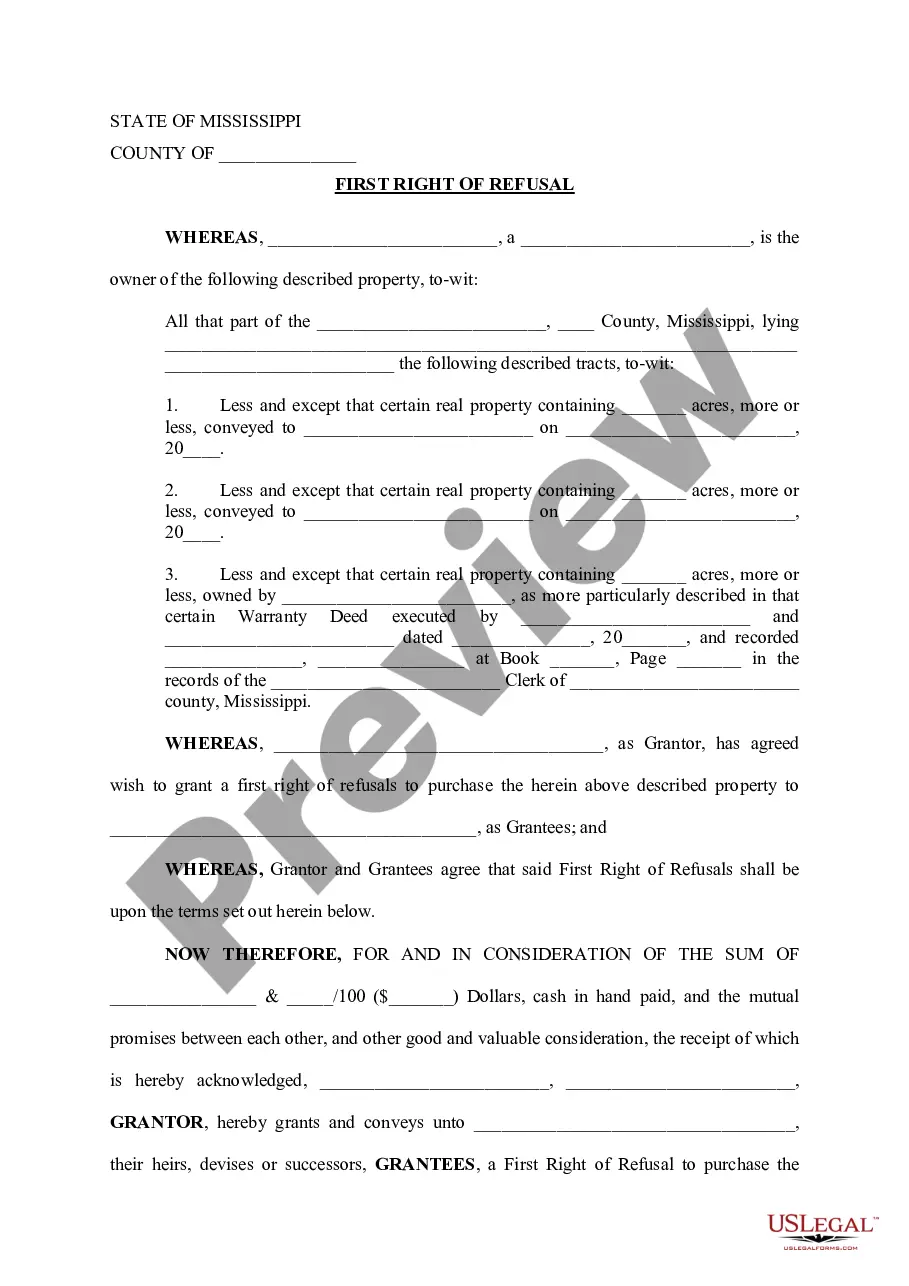

- Make use of the Review switch to review the shape.

- See the outline to ensure that you have selected the right kind.

- When the kind isn`t what you`re searching for, utilize the Lookup industry to find the kind that suits you and requirements.

- Once you find the proper kind, just click Purchase now.

- Choose the rates plan you want, submit the specified information and facts to generate your bank account, and buy the transaction using your PayPal or credit card.

- Decide on a convenient paper format and download your version.

Discover every one of the record templates you have bought in the My Forms food selection. You can obtain a additional version of Massachusetts Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment whenever, if possible. Just click the essential kind to download or print out the record format.

Use US Legal Forms, probably the most extensive selection of legitimate kinds, to save time and steer clear of errors. The assistance gives skillfully produced legitimate record templates which you can use for a selection of reasons. Make a free account on US Legal Forms and initiate generating your life a little easier.