Title: Massachusetts Proposal to Amend Certificate: Reducing Par Value, Increasing Authorized Common Stock, and Reverse Stock Split with Exhibit Introduction: The Massachusetts Proposal to Amend Certificate is a legal action taken by a company incorporated in Massachusetts to make significant changes to its capital structure. In this detailed description, we will delve into the various aspects of this proposal, including reducing par value, increasing authorized common stock, and executing a reverse stock split. Additionally, we explore the importance of providing an exhibit along with the proposal. Let's dive in! 1. Reducing Par Value: In some instances, a company may opt to reduce the par value of its common stock. Par value refers to the nominal or face value assigned to each share of stock. By reducing the par value through the proposal, the company seeks to create greater flexibility in its capital structure, potentially attracting new investors or enhancing liquidity. The Massachusetts Proposal aims to outline the mechanics, justification, and specific changes to the par value. 2. Increasing Authorized Common Stock: The proposal also includes an increase in the authorized common stock. Authorized common stock refers to the total number of shares a company is legally permitted to issue. By increasing this threshold, the business gains' flexibility to issue additional equity to support its growth plans, acquisitions, or employee compensation. This proposed amendment to the certificate allows for greater equity financing capacity, enhancing the long-term stability and viability of the company. 3. Reverse Stock Split: A reverse stock split entails consolidating existing outstanding shares into a fewer number, thereby increasing the stock's price per share. This restructuring mechanism is commonly utilized to boost the stock's attractiveness to institutional investors, enhance market visibility, and regain compliance with listing requirements. Massachusetts Proposal aims to provide the necessary details like the ratio for the reverse stock split, how it aligns with the company's objectives, and how it benefits the existing shareholders. 4. Importance of an Exhibit: To support transparency and provide shareholders and potential investors with comprehensive information, it is crucial to include an exhibit along with the Massachusetts Proposal. The exhibit typically incorporates relevant financial statements, historical stock performance data, pro forma tables illustrating the par value reduction, authorized stock increase, and reverse stock split's impact. This exhibit provides stakeholders with a clearer understanding of the proposed changes and allows for informed decision-making. Different Types of Massachusetts Proposal to Amend Certificate: Although the core concepts of the Massachusetts Proposal to Amend Certificate remain unchanged, there may be variations in specific provisions and objectives depending on each company's unique circumstances. Examples of such proposals could include: 1. Par value reduction without increasing authorized common stock or executing a reverse stock split. 2. Increasing authorized common stock without reducing par value or reverse stock split. 3. Combined proposal involving reducing par value, increasing authorized common stock, and executing a reverse stock split in a single amendment. Conclusion: The Massachusetts Proposal to Amend Certificate provides an avenue for companies to implement significant changes to their capital structure, including par value reduction, increasing authorized common stock, and executing a reverse stock split. By utilizing an exhibit to support the proposal, stakeholders gain valuable insights into the rationale, impact, and potential benefits associated with the amendments. Understanding the various types of proposals helps businesses tailor their approach based on their specific requirements and goals.

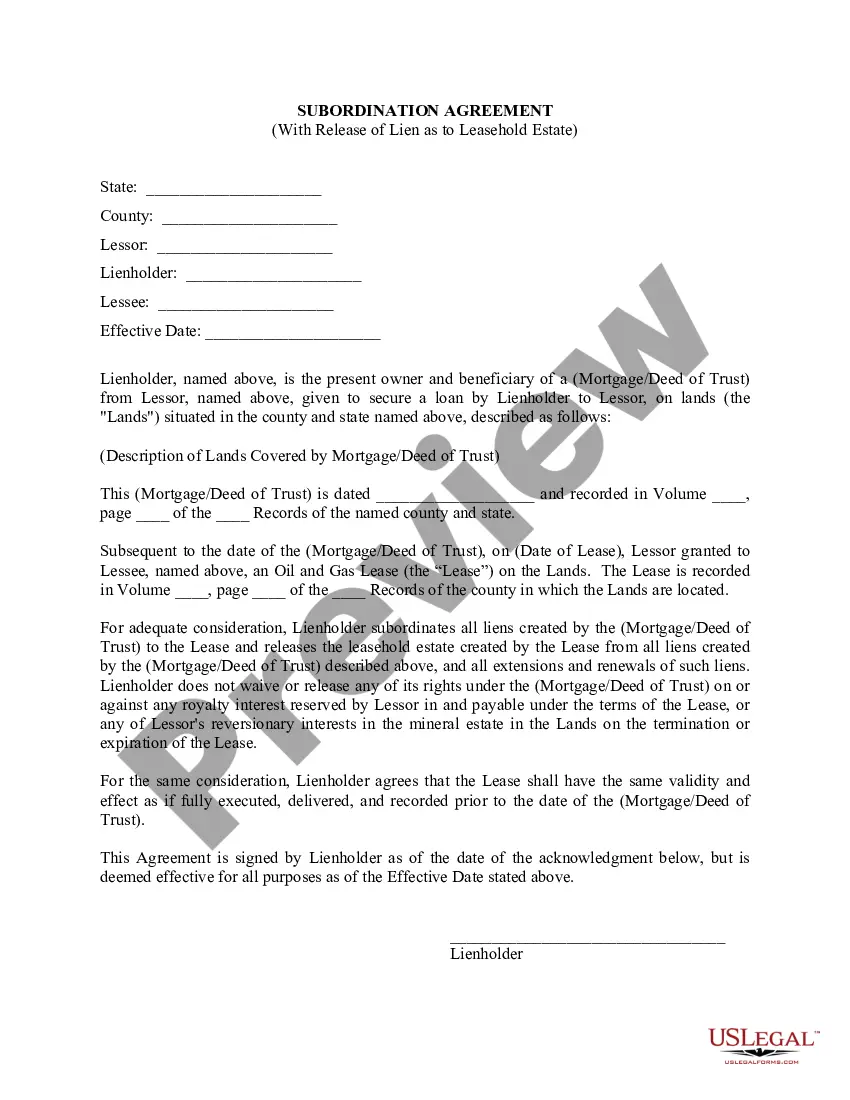

Massachusetts Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description

How to fill out Massachusetts Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

If you have to full, down load, or print authorized file themes, use US Legal Forms, the most important collection of authorized kinds, which can be found on the Internet. Use the site`s easy and hassle-free research to discover the files you need. Numerous themes for organization and person functions are sorted by categories and says, or search phrases. Use US Legal Forms to discover the Massachusetts Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit within a few click throughs.

In case you are currently a US Legal Forms client, log in for your accounts and click on the Down load switch to have the Massachusetts Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit. You can even accessibility kinds you formerly delivered electronically within the My Forms tab of your accounts.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for your correct area/region.

- Step 2. Make use of the Preview method to look over the form`s articles. Don`t forget about to learn the information.

- Step 3. In case you are unhappy with all the develop, make use of the Research industry towards the top of the display screen to find other versions in the authorized develop web template.

- Step 4. Once you have located the shape you need, go through the Buy now switch. Pick the prices plan you favor and put your qualifications to register on an accounts.

- Step 5. Approach the deal. You can utilize your credit card or PayPal accounts to accomplish the deal.

- Step 6. Pick the formatting in the authorized develop and down load it in your device.

- Step 7. Comprehensive, edit and print or sign the Massachusetts Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit.

Each and every authorized file web template you buy is your own for a long time. You have acces to every develop you delivered electronically within your acccount. Click on the My Forms area and pick a develop to print or down load once more.

Contend and down load, and print the Massachusetts Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit with US Legal Forms. There are thousands of skilled and condition-certain kinds you can utilize for your personal organization or person needs.