Massachusetts Form of Note

Description

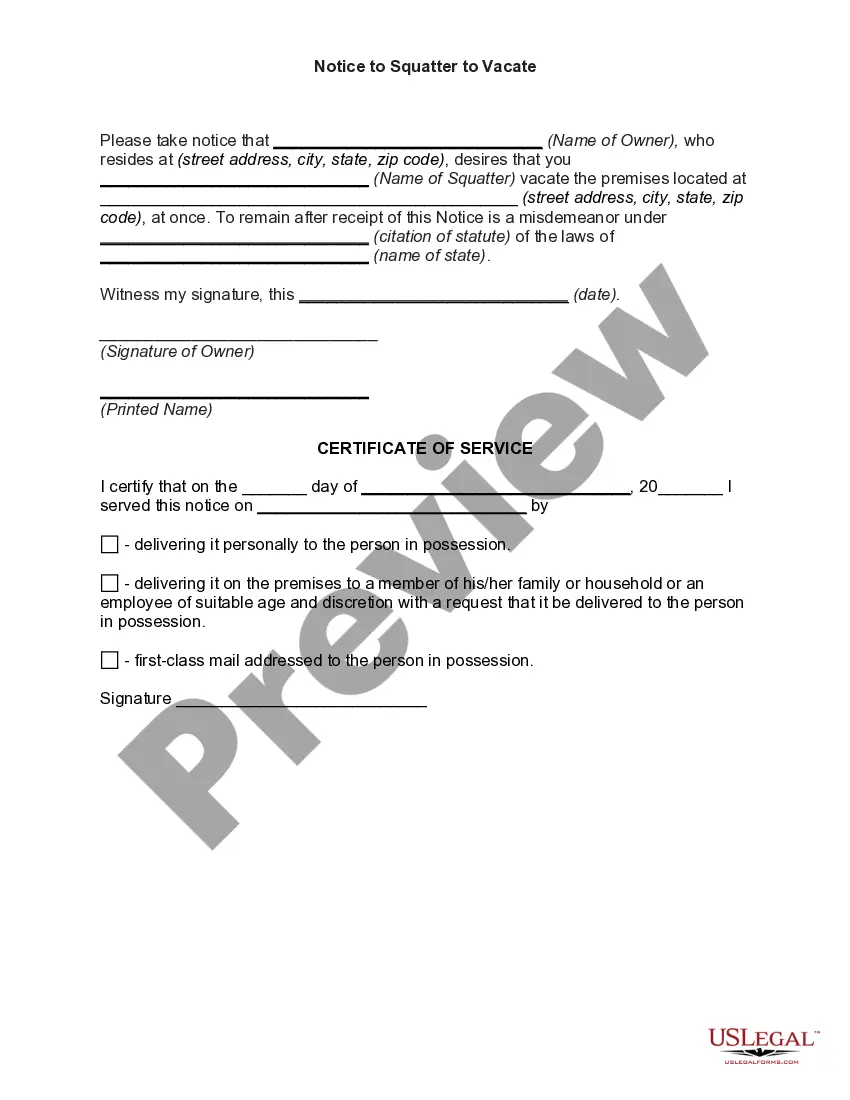

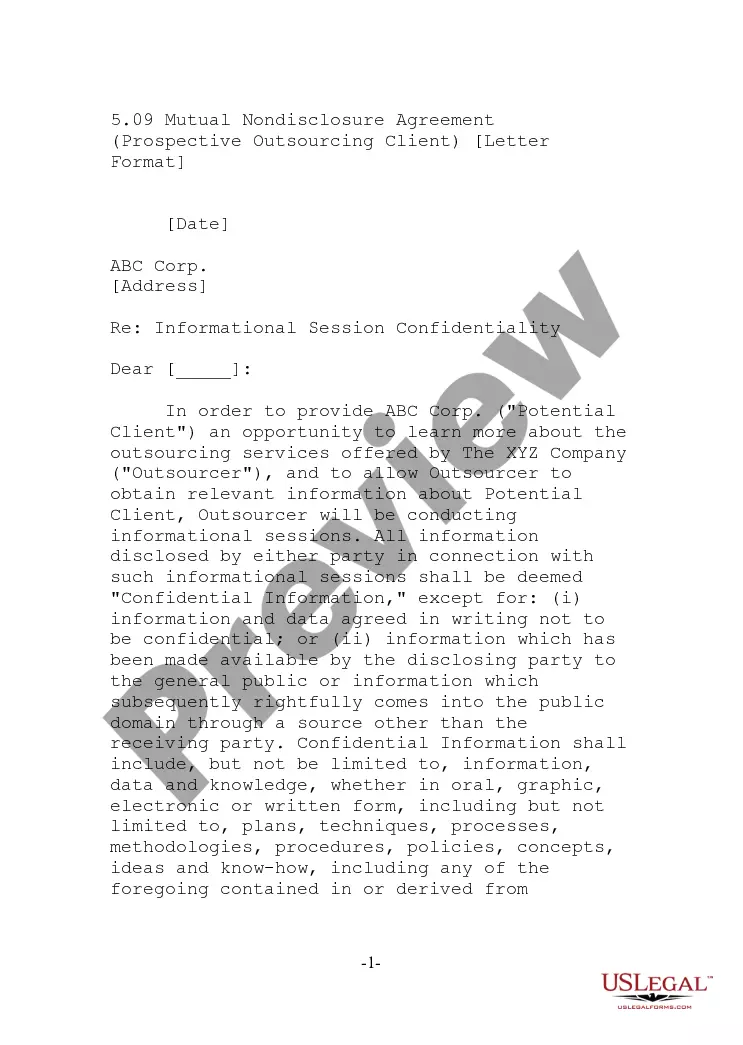

How to fill out Form Of Note?

If you need to total, acquire, or produce legitimate record templates, use US Legal Forms, the biggest assortment of legitimate types, which can be found on the web. Make use of the site`s simple and easy practical lookup to obtain the files you will need. A variety of templates for organization and personal functions are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to obtain the Massachusetts Form of Note in a couple of clicks.

In case you are previously a US Legal Forms client, log in to the account and click on the Down load button to get the Massachusetts Form of Note. You can even accessibility types you earlier downloaded in the My Forms tab of your respective account.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for the appropriate town/nation.

- Step 2. Utilize the Review solution to look over the form`s articles. Don`t overlook to read through the information.

- Step 3. In case you are not satisfied with the form, make use of the Look for field towards the top of the screen to locate other variations of the legitimate form design.

- Step 4. Upon having located the shape you will need, go through the Purchase now button. Opt for the costs program you choose and include your credentials to sign up for an account.

- Step 5. Approach the deal. You should use your credit card or PayPal account to perform the deal.

- Step 6. Select the structure of the legitimate form and acquire it on your own product.

- Step 7. Total, modify and produce or indication the Massachusetts Form of Note.

Each and every legitimate record design you purchase is your own property eternally. You possess acces to every form you downloaded within your acccount. Click on the My Forms area and select a form to produce or acquire yet again.

Be competitive and acquire, and produce the Massachusetts Form of Note with US Legal Forms. There are many specialist and status-certain types you may use to your organization or personal requires.

Form popularity

FAQ

Massachusetts Form 1 ? Personal Income Tax Return for Residents. Massachusetts Form 1-NR/PY ? Personal Income Tax Return for Part-Year and Nonresidents.

Massachusetts has a graduated individual income tax, with rates ranging from 5.00 to 9.00 percent. Massachusetts has an 8.00 percent corporate income tax rate. Massachusetts has a 6.25 percent state sales tax rate and does not levy local sales taxes.

Massachusetts Employee's Withholding Allowance Certificate. The M-4 form tells Harvard how much to withhold for state income taxes.

Massachusetts individual income tax forms and instructions can be found on the Massachusetts Department of Revenue website. The Massachusetts tax forms for part-year resident and nonresident individuals is Form 1-NR/PY. Please refer to the MA state guides for part-year and nonresident individuals for more information.

Rates Type of TaxMeasureRateTax year 2022 WithholdingWages5.00%EstateFederal taxable estate Massachusetts real and tangible property0.8% - 16%Alcoholic BeveragesMalt (31-gal. bbl.)$3.30Alcoholic BeveragesCider 3%-6% (wine gal.)$0.0368 more rows ?

As an employer, you must withhold Massachusetts personal income taxes from all Massachusetts residents' wages for services performed either in or outside Massachusetts and from nonresidents' wages for services performed in Massachusetts.

Form 1-NR/PY is the form needed by all Massachusetts part-year and nonresidents to file their Massachusetts returns. Although Form 1-NR/PY may be supplemented by additional forms and schedules, it is required in all Massachusetts part-year and nonresident returns.

State. If you would like your State Income Tax withholding exemptions to be different than what you are claiming on your W-4 (Federal), you will need to fill out a Massachusetts Employee's Withholding Exemption Certificate (M-4).