Massachusetts Voting Trust Certificate

Description

How to fill out Voting Trust Certificate?

US Legal Forms - among the greatest libraries of legitimate kinds in the United States - offers an array of legitimate document themes you may download or produce. Utilizing the site, you may get thousands of kinds for enterprise and specific purposes, categorized by categories, states, or key phrases.You can get the most recent types of kinds just like the Massachusetts Voting Trust Certificate within minutes.

If you already possess a registration, log in and download Massachusetts Voting Trust Certificate from your US Legal Forms local library. The Acquire switch will show up on each form you view. You gain access to all previously acquired kinds from the My Forms tab of your respective account.

If you wish to use US Legal Forms the first time, allow me to share simple recommendations to obtain began:

- Make sure you have selected the right form for the town/region. Select the Review switch to review the form`s articles. Read the form description to ensure that you have selected the right form.

- When the form doesn`t satisfy your needs, take advantage of the Research industry towards the top of the display to obtain the the one that does.

- If you are pleased with the shape, validate your choice by clicking on the Purchase now switch. Then, select the prices strategy you want and provide your accreditations to sign up to have an account.

- Method the transaction. Make use of bank card or PayPal account to accomplish the transaction.

- Pick the file format and download the shape on your product.

- Make changes. Fill up, change and produce and indicator the acquired Massachusetts Voting Trust Certificate.

Each and every web template you included in your money lacks an expiration time which is your own property permanently. So, if you would like download or produce yet another version, just visit the My Forms section and click on the form you need.

Gain access to the Massachusetts Voting Trust Certificate with US Legal Forms, probably the most considerable local library of legitimate document themes. Use thousands of specialist and express-particular themes that fulfill your organization or specific demands and needs.

Form popularity

FAQ

A voting trust agreement also goes under the name, pooling agreement. Two or more shareholders transfer their shares to a trustee under a voting arrangement. The trustee will then vote for those shares as a group following the agreement's terms or the majority's will.

While the proxy may be a temporary or one-time arrangement, often created for a specific vote, the voting trust is usually more permanent, intended to give a bloc of voters increased power as a group?or indeed, control of the company, which is not necessarily the case with proxy voting.

The trustee model of representation is a model of a representative democracy, frequently contrasted with the delegate model of representation. In this model, constituents elect their representatives as 'trustees' for their constituency.

Voting trusts are often formed by company directors, but sometimes a group of shareholders will form one to exercise some control over the corporation. It can also be used to resolve conflicts of interest, increase shareholders' voting power, or ward off a hostile takeover.

A voting trust is an arrangement whereby the shares in a company of one or more shareholders and the voting rights attached thereto are legally transferred to a trustee, usually for a specified period of time (the "trust period").

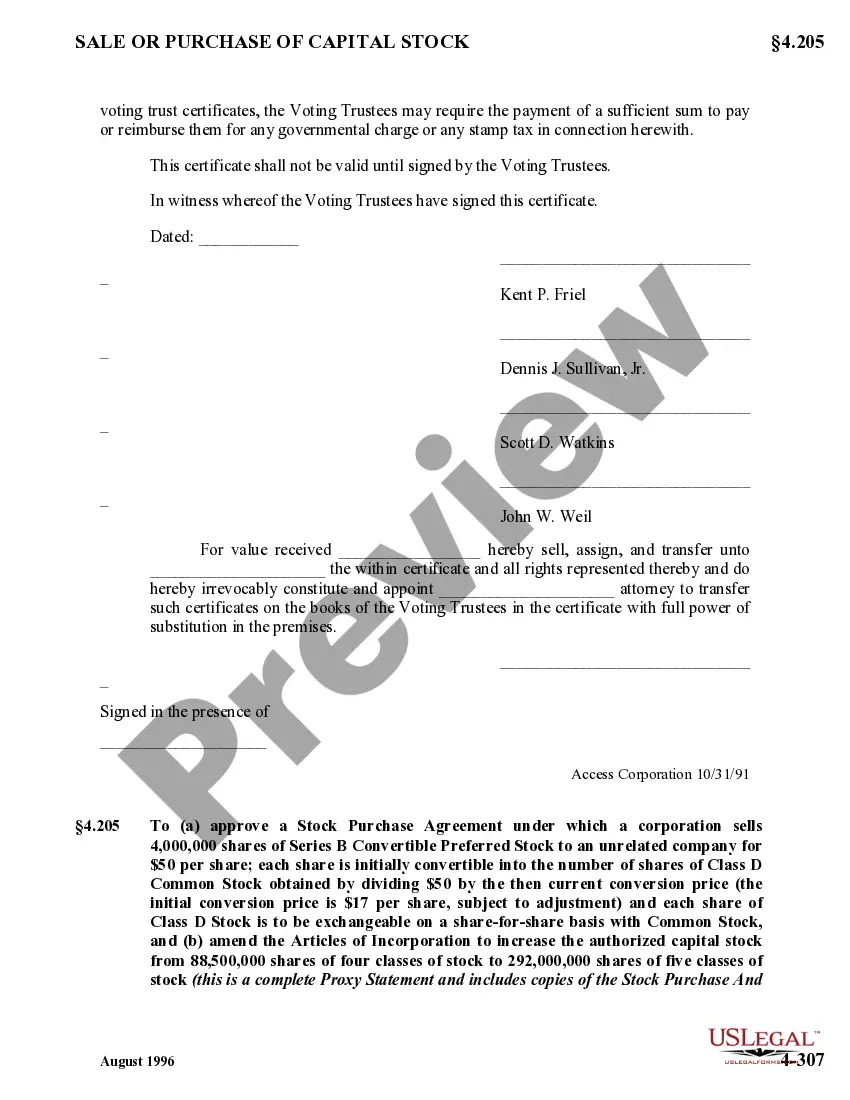

A voting trust certificate is a document used to give temporary voting control over a corporation to one or several individuals. It is issued to a shareholder and represents the normal rights of any other stockholder, such as receiving quarterly dividends in exchange for their common shares.

Voting trust certificates are "securities" as that term is defined by Section 2(1) of the Securities Act of 1933,37 and by many similar provisions under the various state securities laws.

A voting trust is a contract between shareholders in which their shares and voting rights are temporarily transferred to a trustee. A voting agreement is a contract in which shareholders agree to vote a certain way on specific issues without giving up their shares or voting rights.