The Massachusetts Equity Compensation Plan is a comprehensive program that allows businesses incorporated in Massachusetts to provide employee compensation in the form of equity, such as company stock or stock options. This plan offers an attractive incentive for employees to participate in the company's growth and success. Equity compensation plans are designed to align the interests of employees with the company's goals and objectives. By offering employees a stake in the company's performance and profitability, these plans encourage employee loyalty, motivation, and increased productivity. This arrangement also promotes a sense of ownership, as employees become shareholders, giving them the opportunity to benefit financially as the company succeeds. There are various types of equity compensation plans available in Massachusetts, depending on the specific needs and preferences of the company. Some commonly used equity compensation plans include: 1. Stock Options: Stock options grant employees the right to purchase company stock at a predetermined price, known as the exercise price, within a specified time period. This gives employees the opportunity to acquire shares in the future, usually at a favorable price, if the company's stock value rises. 2. Restricted Stock Units (RSS): RSS are essentially a promise to grant shares of company stock to employees at a predetermined future date. Unlike stock options, employees do not purchase RSS; instead, they receive shares upon the vesting period's completion. Vesting typically occurs over a specific period, motivating employees to remain with the company for the long term. 3. Employee Stock Purchase Plans (ESPN): ESPN enable employees to purchase company stock, often at a discounted price, through regular payroll deductions. These plans provide employees with an opportunity to accumulate company stock over time, fostering a sense of pride and commitment to the organization's success. 4. Performance Shares: Under performance share plans, employees receive shares of the company's stock based on predetermined performance metrics or goals. As the employee achieves or exceeds these targets, they become eligible for the allocation of additional shares, effectively tying their compensation to the company's performance. Massachusetts Equity Compensation Plans are subject to certain legal and regulatory requirements, ensuring transparency and fairness. Companies offering these plans typically consult legal professionals familiar with Massachusetts securities laws, tax implications, and compliance guidelines. In conclusion, the Massachusetts Equity Compensation Plan is a well-structured and flexible program that enables companies in Massachusetts to offer equity-based compensation to their employees. By aligning employee interests with the company's growth and success, these plans foster employee loyalty, motivation, and engagement.

Massachusetts Equity Compensation Plan

Description

How to fill out Massachusetts Equity Compensation Plan?

Choosing the best lawful record design could be a have difficulties. Obviously, there are plenty of web templates accessible on the Internet, but how will you find the lawful develop you will need? Make use of the US Legal Forms site. The service provides a huge number of web templates, for example the Massachusetts Equity Compensation Plan, which you can use for company and personal demands. Each of the forms are inspected by experts and fulfill federal and state requirements.

In case you are currently signed up, log in in your profile and then click the Down load option to get the Massachusetts Equity Compensation Plan. Use your profile to look through the lawful forms you might have purchased earlier. Visit the My Forms tab of your own profile and acquire an additional duplicate in the record you will need.

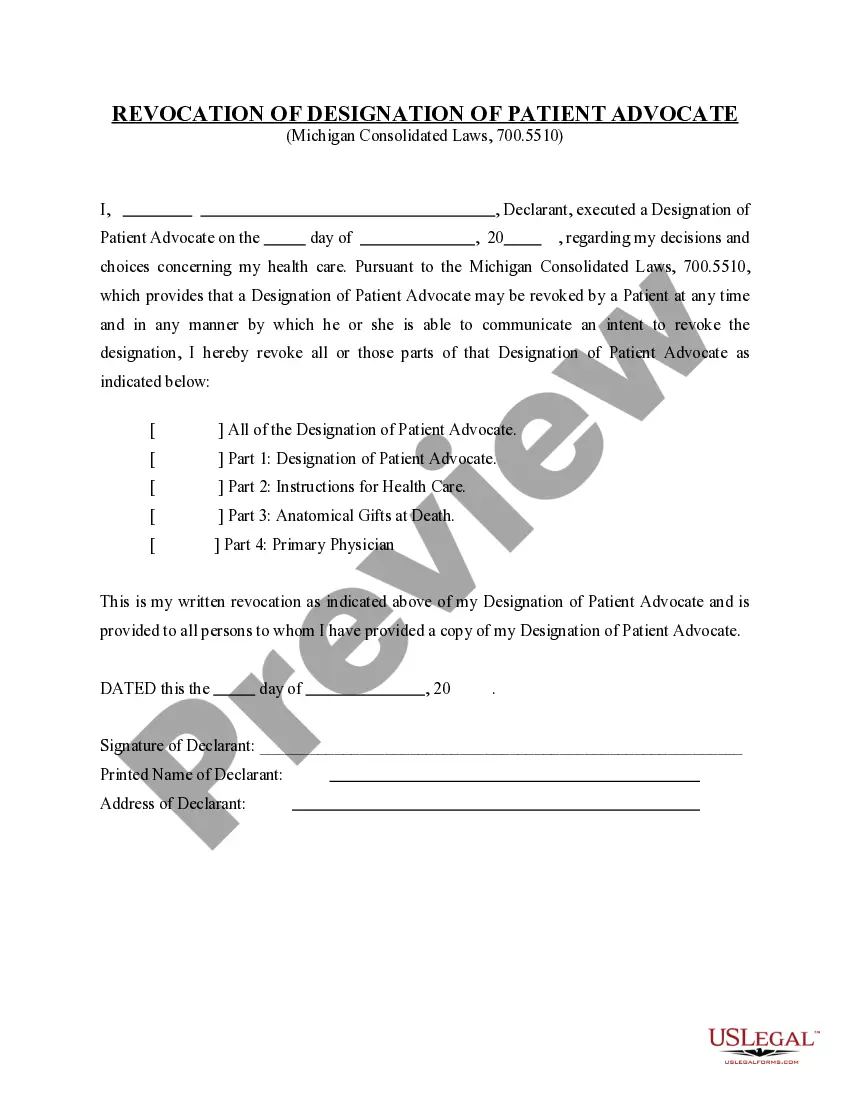

In case you are a fresh consumer of US Legal Forms, listed below are basic instructions that you can adhere to:

- Initial, ensure you have chosen the correct develop for your town/state. You may check out the form utilizing the Preview option and look at the form explanation to make sure this is the best for you.

- If the develop will not fulfill your preferences, utilize the Seach area to find the correct develop.

- When you are certain that the form is suitable, click on the Buy now option to get the develop.

- Choose the prices plan you want and enter the required info. Make your profile and purchase the transaction utilizing your PayPal profile or bank card.

- Pick the data file file format and acquire the lawful record design in your device.

- Complete, modify and print and indication the received Massachusetts Equity Compensation Plan.

US Legal Forms is the most significant library of lawful forms where you can see various record web templates. Make use of the service to acquire expertly-produced files that adhere to state requirements.

Form popularity

FAQ

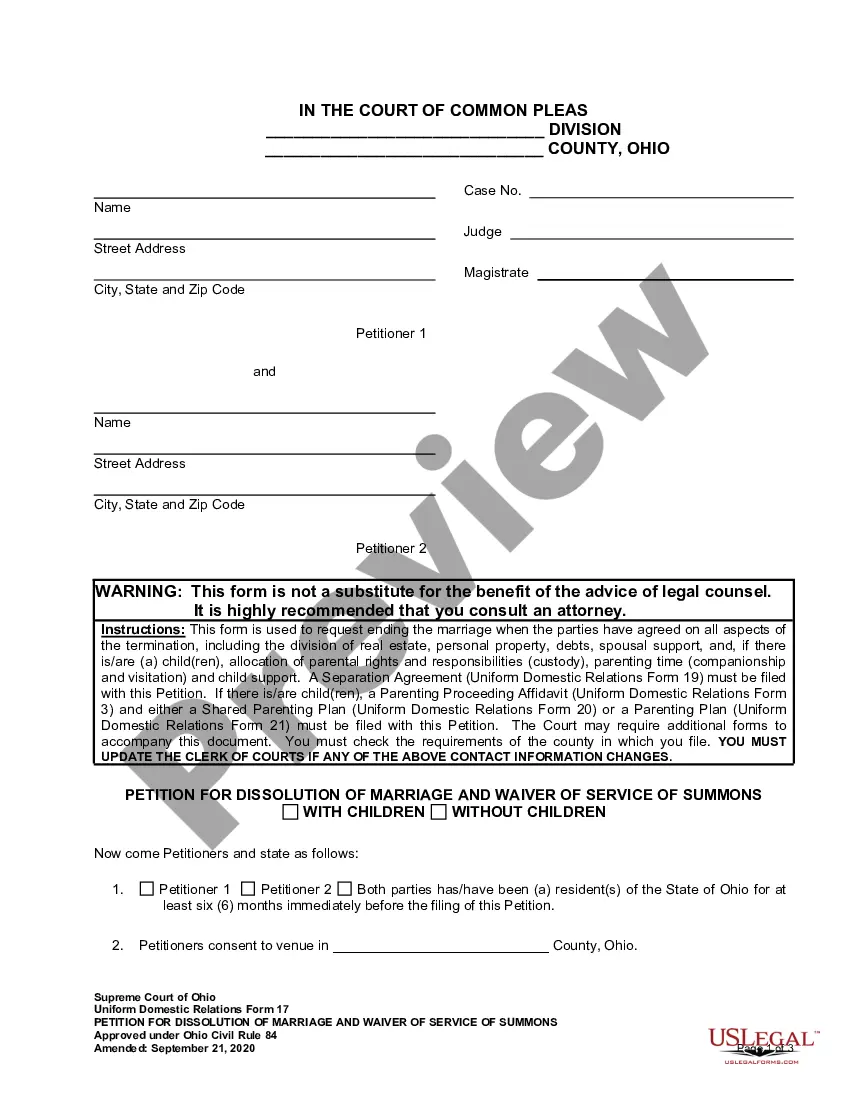

The Act requires that employees of different genders be paid equally for comparable work. What is ?comparable work?? The Act defines ?comparable work? as work that requires substantially similar skill, effort, and responsibility, and is performed under similar working conditions.

The Act requires that employees of different genders be paid equally for comparable work. What is ?comparable work?? The Act defines ?comparable work? as work that requires substantially similar skill, effort, and responsibility, and is performed under similar working conditions.

How to implement effective pay equity policies in the workplace Set salary bands and levels early. And stick with them. ... Be transparent. Speaking of public ? ... Prioritize data. ... Create a structured process opportunities for salary increases. ... Treat new hires and existing employees the same.

To prohibit discrimination on account of sex in the payment of wages by employers engaged in commerce or in the production of goods for commerce. Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, That this Act may be cited as the "Equal Pay Act of 1963."

The Massachusetts Equal Pay Act (MEPA) says that employers cannot discriminate against employees because of their gender when deciding and paying wages. Employers cannot pay workers a salary or wage less than what they pay employees of a different gender for comparable work.

Following a recent tidal wave of pay transparency legislation in other states, the Massachusetts House and Senate overwhelmingly supported and passed a bill that will require employers with over 25 employees in the Commonwealth to disclose salary range information on job postings, and to provide pay range information ...

The Massachusetts Equal Pay Act, M.G.L. c. 149 § 105A, prohibits discrimination based on gender in the payment of wages. Your employer may not pay you less than it pays an employee of a different gender performing comparable work.

The Equal Pay Act requires that men and women in the same workplace be given equal pay for equal work. The jobs need not be identical, but they must be substantially equal. Job content (not job titles) determines whether jobs are substantially equal.

The Act requires that employees of different genders be paid equally for comparable work. What is ?comparable work?? The Act defines ?comparable work? as work that requires substantially similar skill, effort, and responsibility, and is performed under similar working conditions.

The Massachusetts Equal Pay Act (MEPA) says that employers cannot discriminate against employees because of their gender when deciding and paying wages. Employers cannot pay workers a salary or wage less than what they pay employees of a different gender for comparable work.