Massachusetts Plan of Conversion from state stock savings bank to federal stock savings bank

Description

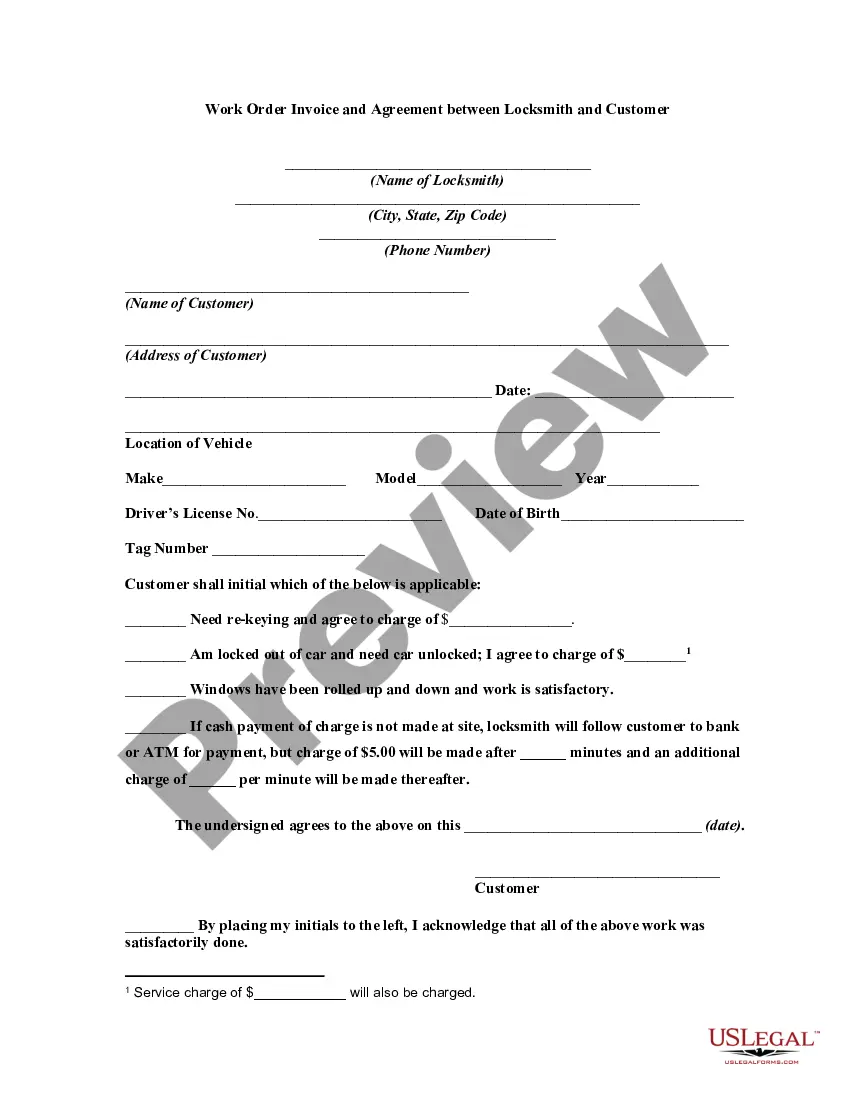

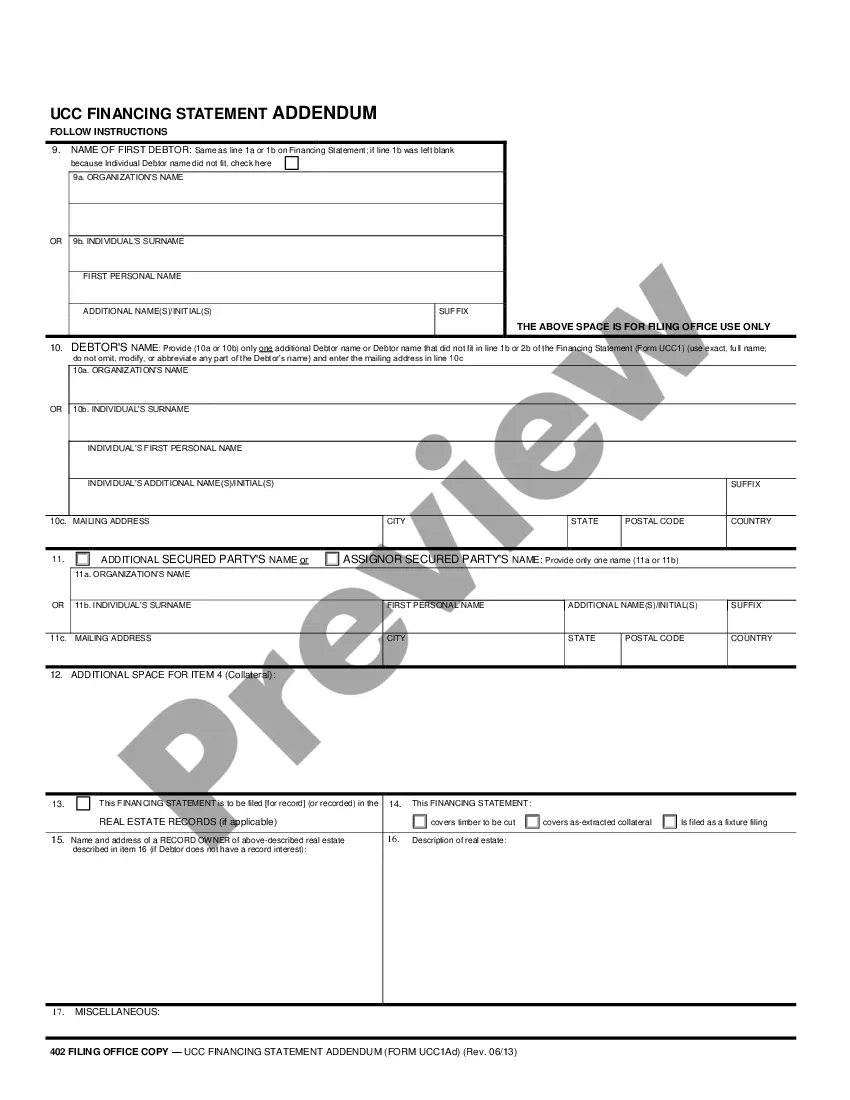

How to fill out Plan Of Conversion From State Stock Savings Bank To Federal Stock Savings Bank?

US Legal Forms - one of many most significant libraries of legitimate forms in America - gives a wide array of legitimate papers layouts you may obtain or printing. Making use of the internet site, you can find 1000s of forms for company and individual reasons, sorted by types, claims, or keywords and phrases.You will find the newest versions of forms like the Massachusetts Plan of Conversion from state stock savings bank to federal stock savings bank within minutes.

If you currently have a monthly subscription, log in and obtain Massachusetts Plan of Conversion from state stock savings bank to federal stock savings bank in the US Legal Forms local library. The Obtain key can look on every kind you view. You have accessibility to all formerly delivered electronically forms in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the very first time, listed here are straightforward recommendations to help you started:

- Make sure you have chosen the right kind for your personal metropolis/state. Click the Preview key to review the form`s articles. Read the kind description to actually have selected the correct kind.

- When the kind does not satisfy your needs, take advantage of the Research area on top of the monitor to discover the one that does.

- If you are satisfied with the shape, verify your selection by clicking the Get now key. Then, select the pricing program you want and supply your credentials to sign up on an accounts.

- Approach the deal. Make use of your credit card or PayPal accounts to complete the deal.

- Select the formatting and obtain the shape in your system.

- Make changes. Complete, change and printing and indicator the delivered electronically Massachusetts Plan of Conversion from state stock savings bank to federal stock savings bank.

Every design you included in your bank account does not have an expiry particular date and is your own property forever. So, in order to obtain or printing yet another copy, just proceed to the My Forms portion and click on the kind you will need.

Obtain access to the Massachusetts Plan of Conversion from state stock savings bank to federal stock savings bank with US Legal Forms, by far the most substantial local library of legitimate papers layouts. Use 1000s of specialist and express-distinct layouts that meet up with your organization or individual requires and needs.

Form popularity

FAQ

Mutual banks are owned by their borrowers and depositors. Ownership and profit sharing are what differentiate mutual banks from stock banks, which are owned and controlled by individual and institutional shareholders that profit from them.

A conversion merger is when a mutual institution simultaneously acquires a stock institution at the same time it completes a standard stock conversion. A mutual FSA may acquire another insured institution that is already in the stock form of ownership at the time of its stock conversion transaction.

Mutual banks are owned by their borrowers and depositors. Ownership and profit sharing are what differentiate mutual banks from stock banks, which are owned and controlled by individual and institutional shareholders that profit from them.

The Demutualization Process In a demutualization, a mutual company elects to change its corporate structure to a public company, where prior members may receive a structured compensation or ownership conversion rights in the transition, in the form of shares in the company.

Merger/conversions (the purchase of a mutual savings bank by a stock bank, with the depositors of the mutual bank offered the opportunity to purchase stock of the acquiring bank or holding company) are closely reviewed by the FDIC to ensure that (i) the value of the converting institution is fairly determined, and (ii) ...

A conversion is the exchange of a convertible type of asset into another type of asset?usually at a predetermined price?on or before a predetermined date. The conversion feature is a financial derivative instrument that is valued separately from the underlying security.

Mutual savings banks also have several disadvantages including being too conservative at times, having no member control, and having the possibility of being acquired or going public.