A Massachusetts Complex Will is a legal document that outlines the desires and intentions of an individual regarding the distribution of their assets upon their death. In particular, the Max. Credit Shelter Marital Trust to Children is a specific provision within the will that is designed to minimize estate tax while ensuring the financial security of the surviving spouse and the children. The purpose of a Max. Credit Shelter Marital Trust to Children in a Massachusetts Complex Will is to take full advantage of the estate tax exemption available to each spouse, thus maximizing the amount that can ultimately pass to the intended beneficiaries — the children. This type of trust is generally created when a married couple has significant assets and wants to preserve as much wealth as possible for future generations. There are a few different types of Massachusetts Complex Will — Max. Credit Shelter Marital Trust to Children that can be established, depending on the specific circumstances and goals of the individuals involved: 1. TIP Trust: This stands for "Qualified Terminable Interest Property," and it allows the marital assets to pass into a trust for the surviving spouse's benefit while still utilizing the deceased spouse's estate tax exemption. The TIP Trust provides income for the surviving spouse during their lifetime, with the remaining assets passing to the children upon the surviving spouse's death. 2. Dynasty Trust: A Dynasty Trust is a long-term trust established to benefit multiple generations. This trust can be effective in avoiding estate taxes on wealth that may grow over time. By placing assets in a Dynasty Trust, these assets can be protected from estate taxes when they pass to children, grandchildren, and even great-grandchildren. 3. Generation-Skipping Trust: Also known as a "skip" trust, this type of trust allows assets to be transferred directly to grandchildren or subsequent generations, bypassing the surviving spouse. By doing so, this trust can help ensure the preservation and growth of family wealth while avoiding taxation at the surviving spouse's passing. Overall, the Massachusetts Complex Will — Max. Credit Shelter Marital Trust to Children is a sophisticated estate planning tool that aims to provide financial security for the surviving spouse while preserving and maximizing assets for the benefit of the children and future generations. It's important to consult with an experienced estate planning attorney to determine the most appropriate type of trust based on individual circumstances.

Massachusetts Complex Will - Max. Credit Shelter Marital Trust to Children

Description

How to fill out Massachusetts Complex Will - Max. Credit Shelter Marital Trust To Children?

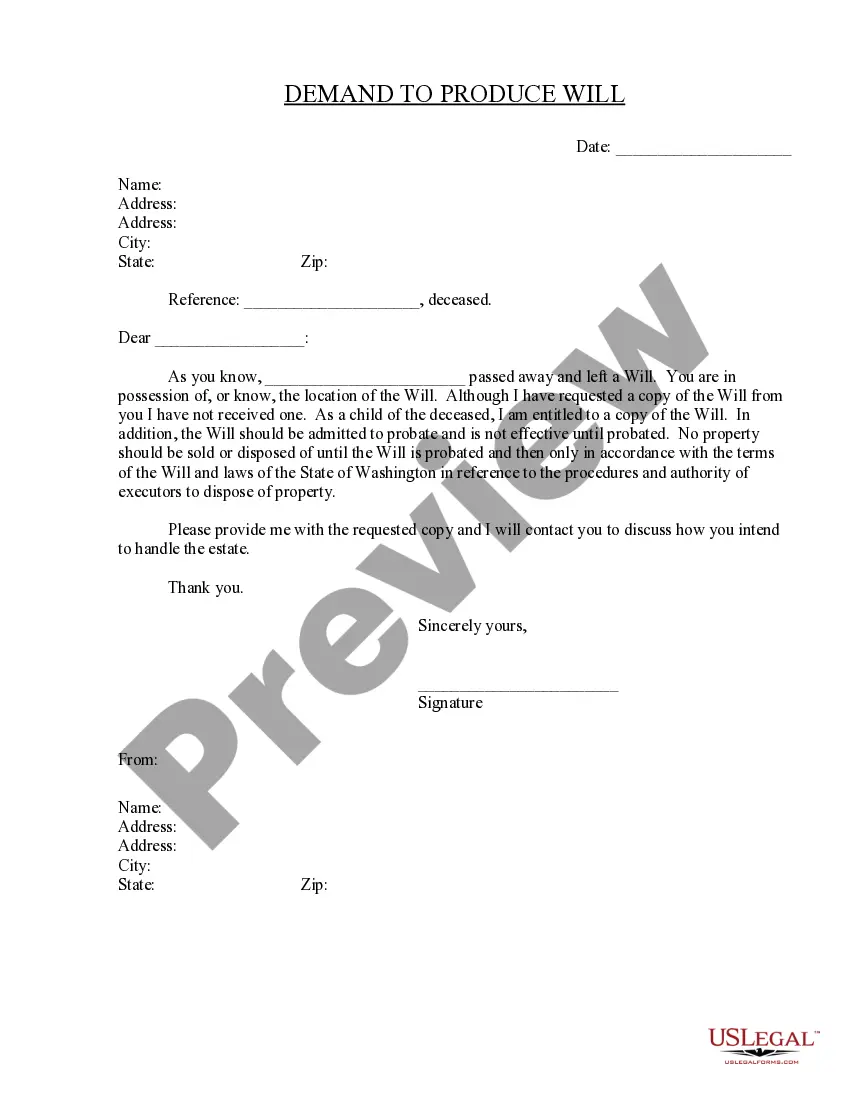

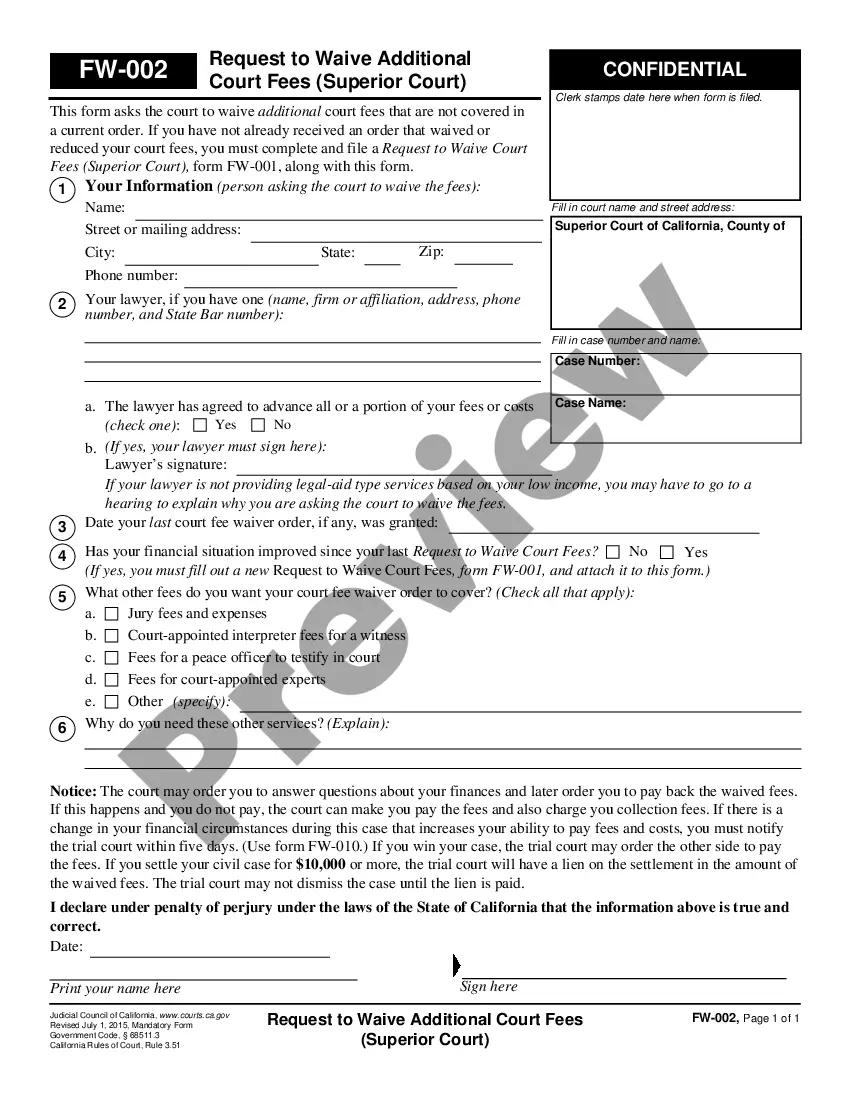

Are you currently in the place where you need to have documents for either enterprise or specific uses almost every day? There are a lot of legitimate file web templates available on the Internet, but finding types you can rely on isn`t simple. US Legal Forms offers thousands of type web templates, such as the Massachusetts Complex Will - Max. Credit Shelter Marital Trust to Children, that are published to fulfill federal and state specifications.

When you are presently familiar with US Legal Forms site and possess an account, simply log in. Afterward, you are able to down load the Massachusetts Complex Will - Max. Credit Shelter Marital Trust to Children format.

Unless you provide an profile and would like to begin to use US Legal Forms, adopt these measures:

- Discover the type you need and make sure it is for the proper town/state.

- Use the Preview switch to review the shape.

- See the explanation to ensure that you have selected the appropriate type.

- In case the type isn`t what you`re seeking, utilize the Look for field to find the type that meets your requirements and specifications.

- If you discover the proper type, just click Acquire now.

- Pick the prices prepare you want, submit the specified information to make your money, and pay for the order utilizing your PayPal or Visa or Mastercard.

- Pick a convenient document file format and down load your version.

Discover each of the file web templates you may have purchased in the My Forms menu. You can get a additional version of Massachusetts Complex Will - Max. Credit Shelter Marital Trust to Children whenever, if possible. Just click the required type to down load or print out the file format.

Use US Legal Forms, by far the most comprehensive collection of legitimate varieties, to save time and steer clear of faults. The services offers professionally created legitimate file web templates that you can use for a selection of uses. Make an account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

When the credit shelter trust is initially funded upon the death of one spouse, the assets that are placed under the trust receive a step-up in basis. This is an important consideration, because any assets held in a CST don't receive a second step-up in basis upon the death of the surviving spouse.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.

Using credit shelter trusts allows a married couple to take full advantage of their individual exemptions. Each member of the couple creates their own trust. When the first spouse dies, his trust is funded with his assets up to the amount allowed by the exemption.

Upon the death of the first spouse, the marital trust receives the marital deduction amount for use by the surviving spouse. The second trust, the family trust, receives the rest of the estate.

The primary benefit of CSTs is that the surviving spouse can use the trust's principal and income during the remainder of their lifetime, for example, for medical or educational expenses. The remaining assets then pass to the beneficiaries and are not subject to estate taxes.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.