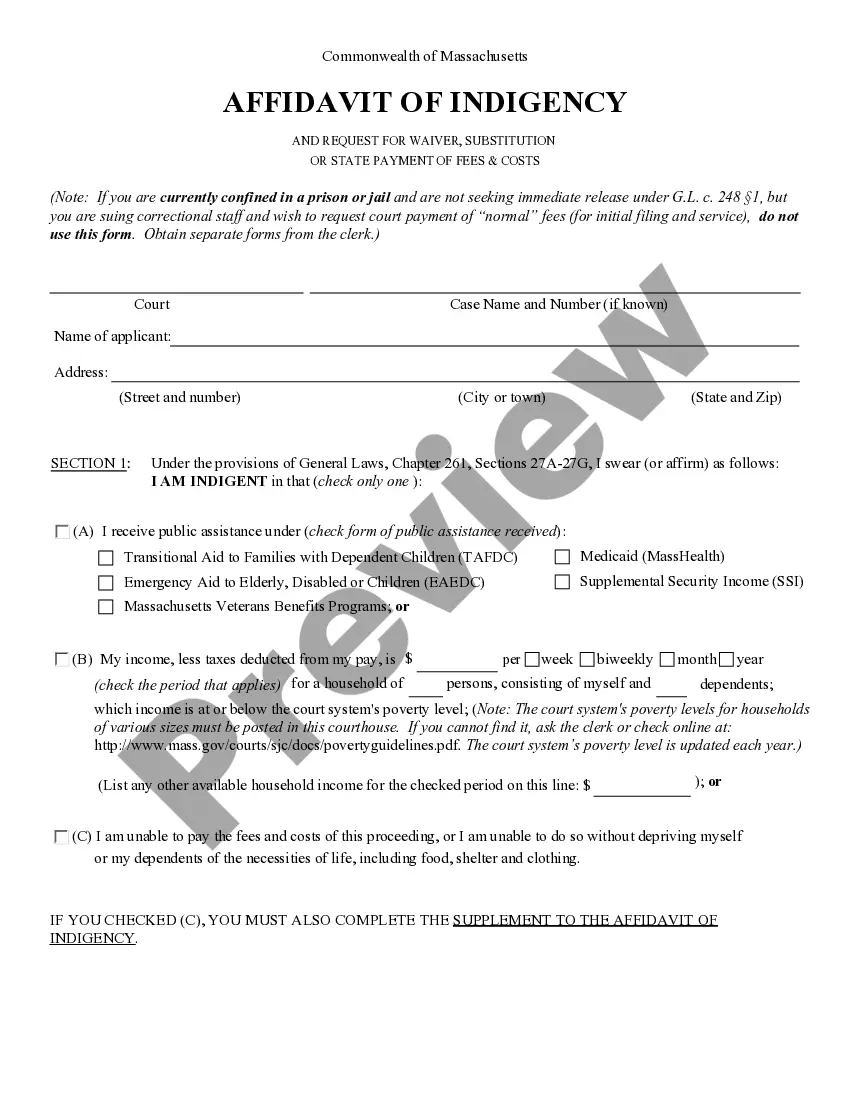

The Massachusetts Notice of Violation of Fair Debt Act — Improper Document Appearance is a legal document that addresses the improper appearance of debt collection documents under the Fair Debt Collection Practices Act (FD CPA) in the state of Massachusetts. Debt collectors are required to provide accurate and complete information to debtors while handling their outstanding debts. As such, this notice specifically focuses on the appearance of any documentation related to debt collection activities that may be in violation of the FD CPA guidelines. Keywords: Massachusetts, Notice of Violation, Fair Debt Act, improper document appearance, debt collection, FD CPA, documentation, debtors. Types of Massachusetts Notice of Violation of Fair Debt Act — Improper Document Appearance: 1. Inaccurate or incomplete documents: This category refers to debt collection documents that contain errors, inconsistencies, or are missing crucial information required by the FD CPA. These inaccuracies may include incorrect personal details, wrong debt amounts, or inadequate disclosure of the debtor's rights. 2. Misleading or deceptive documents: This type of violation occurs when debt collection documents are designed or presented in a way that misleads or deceives the debtor. Examples may include using unclear language, coercive or threatening statements, or deceptive formatting that obscures important information. 3. Non-compliant disclosure: Debt collection documents must adhere to specific disclosure requirements outlined in the FD CPA. A violation may occur if the document fails to include required disclosures, such as the debtor's right to dispute the debt or demand verification within a specified timeframe. 4. Unprofessional or questionable document appearance: This relates to the overall visual and aesthetic presentation of debt collection documents. Violations may include using intimidating or offensive language, excessive use of capitalization or bold text, or including irrelevant or confusing information in an attempt to confuse or pressure the debtor. 5. Improper use of official logos or emblems: The misuse of official logos or emblems, such as those belonging to government agencies or entities, is a violation of the FD CPA. Debt collection documents should not create a false impression of having been endorsed or issued by a governmental authority or any other official institution. Understanding the nuances of the Massachusetts Notice of Violation of Fair Debt Act — Improper Document Appearance is essential for both debt collectors and debtors alike. Debtors can utilize this notice to protect themselves from unfair or misleading debt collection practices, while debt collectors must ensure that their documentation adheres to the guidelines set forth by the FD CPA and relevant state laws. Note: It is important to consult with a legal professional to obtain accurate and up-to-date information regarding the Massachusetts Notice of Violation of Fair Debt Act — Improper Document Appearance and its specific implications in your particular situation.

The Massachusetts Notice of Violation of Fair Debt Act — Improper Document Appearance is a legal document that addresses the improper appearance of debt collection documents under the Fair Debt Collection Practices Act (FD CPA) in the state of Massachusetts. Debt collectors are required to provide accurate and complete information to debtors while handling their outstanding debts. As such, this notice specifically focuses on the appearance of any documentation related to debt collection activities that may be in violation of the FD CPA guidelines. Keywords: Massachusetts, Notice of Violation, Fair Debt Act, improper document appearance, debt collection, FD CPA, documentation, debtors. Types of Massachusetts Notice of Violation of Fair Debt Act — Improper Document Appearance: 1. Inaccurate or incomplete documents: This category refers to debt collection documents that contain errors, inconsistencies, or are missing crucial information required by the FD CPA. These inaccuracies may include incorrect personal details, wrong debt amounts, or inadequate disclosure of the debtor's rights. 2. Misleading or deceptive documents: This type of violation occurs when debt collection documents are designed or presented in a way that misleads or deceives the debtor. Examples may include using unclear language, coercive or threatening statements, or deceptive formatting that obscures important information. 3. Non-compliant disclosure: Debt collection documents must adhere to specific disclosure requirements outlined in the FD CPA. A violation may occur if the document fails to include required disclosures, such as the debtor's right to dispute the debt or demand verification within a specified timeframe. 4. Unprofessional or questionable document appearance: This relates to the overall visual and aesthetic presentation of debt collection documents. Violations may include using intimidating or offensive language, excessive use of capitalization or bold text, or including irrelevant or confusing information in an attempt to confuse or pressure the debtor. 5. Improper use of official logos or emblems: The misuse of official logos or emblems, such as those belonging to government agencies or entities, is a violation of the FD CPA. Debt collection documents should not create a false impression of having been endorsed or issued by a governmental authority or any other official institution. Understanding the nuances of the Massachusetts Notice of Violation of Fair Debt Act — Improper Document Appearance is essential for both debt collectors and debtors alike. Debtors can utilize this notice to protect themselves from unfair or misleading debt collection practices, while debt collectors must ensure that their documentation adheres to the guidelines set forth by the FD CPA and relevant state laws. Note: It is important to consult with a legal professional to obtain accurate and up-to-date information regarding the Massachusetts Notice of Violation of Fair Debt Act — Improper Document Appearance and its specific implications in your particular situation.