Massachusetts Nonqualified Stock Option Agreement of N(2)H(2), Inc.

Description

How to fill out Nonqualified Stock Option Agreement Of N(2)H(2), Inc.?

Have you been in the situation that you need to have papers for sometimes business or individual purposes nearly every working day? There are a variety of lawful document layouts available on the net, but finding ones you can trust is not straightforward. US Legal Forms delivers 1000s of develop layouts, just like the Massachusetts Nonqualified Stock Option Agreement of N(2)H(2), Inc., that are composed to meet federal and state demands.

When you are presently knowledgeable about US Legal Forms web site and possess your account, basically log in. After that, you can obtain the Massachusetts Nonqualified Stock Option Agreement of N(2)H(2), Inc. design.

Should you not offer an bank account and would like to begin using US Legal Forms, adopt these measures:

- Get the develop you require and make sure it is for the correct city/county.

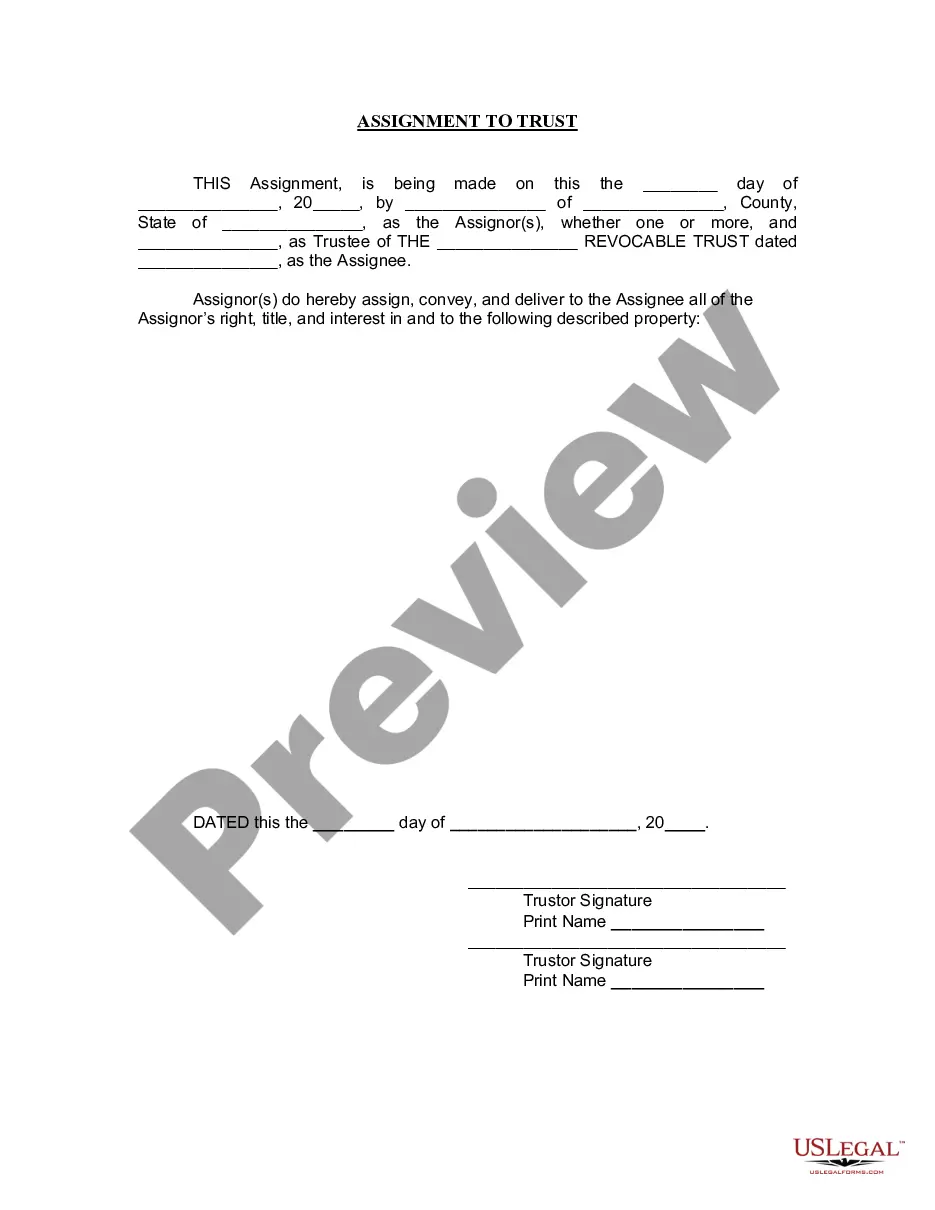

- Utilize the Review switch to analyze the shape.

- See the description to ensure that you have chosen the proper develop.

- In the event the develop is not what you are searching for, utilize the Research area to discover the develop that fits your needs and demands.

- Whenever you find the correct develop, just click Purchase now.

- Pick the costs strategy you need, submit the necessary details to make your money, and buy an order with your PayPal or credit card.

- Choose a convenient document format and obtain your backup.

Find all the document layouts you may have purchased in the My Forms menu. You can aquire a more backup of Massachusetts Nonqualified Stock Option Agreement of N(2)H(2), Inc. anytime, if needed. Just go through the needed develop to obtain or produce the document design.

Use US Legal Forms, by far the most comprehensive collection of lawful varieties, to conserve time and prevent faults. The service delivers appropriately manufactured lawful document layouts that you can use for a range of purposes. Produce your account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

In this situation, you exercise your option to purchase the shares but you do not sell the shares. Your compensation element is the difference between the exercise price ($25) and the market price ($45) on the day you exercised the option and purchased the stock, times the number of shares you purchased.

The excess of the fair market value of the stock at the date the option was exercised over the amount paid for the stock is taxed as compensation at the time the stock is sold. Any additional profit is taxed as capital gain.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.

If you exercise the nonstatutory option, you must include the fair market value of the stock when you acquired it, less any amount you paid for the stock. When you sell the stock, you report capital gains or losses for the difference between your tax basis and what you receive on the sale.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation. Box 3: Social Security wages (up to the income ceiling)

For stock options not issued pursuant to section 422 (?nonqualified options?), there are four basic requirements that must be met to be exempt under section 409A, as follows: For nonqualified stock options, the exercise price must be at least equal to the fair market value of the underlying shares as of the grant date.