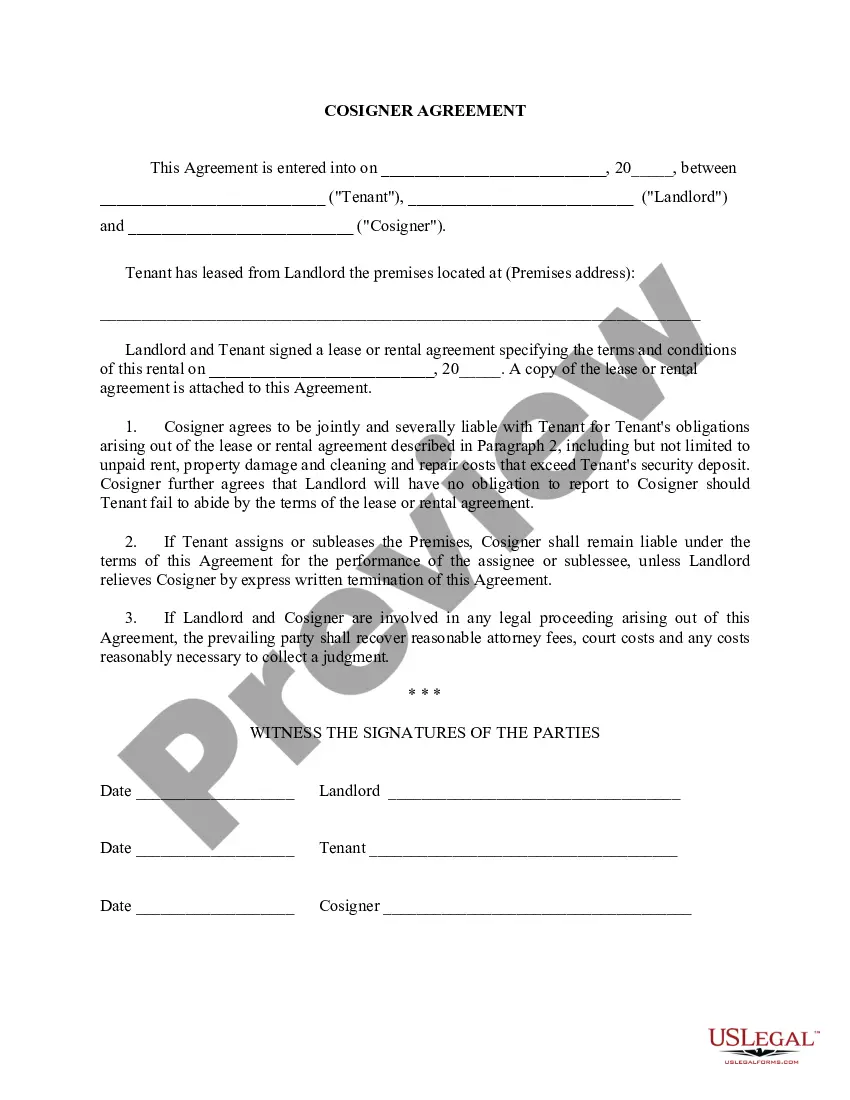

Massachusetts Compensation Agreement refers to a legally binding contract that outlines the terms and conditions of compensation between employers and employees in the state of Massachusetts. This agreement ensures a fair and transparent relationship between the employer and employee to avoid any potential misunderstandings or disputes related to compensation. The Massachusetts Compensation Agreement typically covers various aspects related to compensation, including salary or wages, bonuses, overtime pay, commissions, profit-sharing, benefits, and any other forms of monetary rewards. It lays out the agreed-upon payment frequency, such as weekly, bi-weekly, or monthly, and also specifies the method of payment, whether through direct deposit, checks, or any other approved means. One of the most important elements of the Massachusetts Compensation Agreement is the minimum wage requirement. Massachusetts has its own minimum wage laws, which employers must adhere to when compensating their employees. As of 2021, the state's minimum wage stands at $13.50 per hour, with certain exceptions for tipped employees and minors. In addition to the standard compensation provisions, there are various types of Massachusetts Compensation Agreements that cater to specific industries or employment arrangements. Some of these agreements include: 1. Collective Bargaining Agreements: These agreements are entered into between employers and labor unions representing groups of employees. They cover compensation, working hours, benefits, and other conditions of employment for a specific group or category of employees. 2. Executive Compensation Agreements: These agreements are designed for top-level executives and high-ranking employees within an organization. They often incorporate unique compensation structures, including stock options, performance-based bonuses, and specialized benefits packages. 3. Sales Compensation Agreements: These agreements are specific to sales professionals and outline the terms of their commission-based compensation. They define the commission structure, sales goals, and other performance targets to determine the total compensation. 4. Employment Contracts: While not specific to Massachusetts, employment contracts can include compensation agreements that outline the terms and conditions beyond the basic employment relationship. These contracts may provide details about severance packages, compensation during non-compete agreements, or other special arrangements. Employers in Massachusetts must ensure that their compensation agreements comply with all relevant state and federal laws, including anti-discrimination laws and regulations governing overtime pay. It is advisable for both employers and employees to seek legal advice or consult the Massachusetts Department of Labor Standards to ensure compliance and clarity in their compensation agreements.

Massachusetts Compensation Agreement

Description

How to fill out Massachusetts Compensation Agreement?

US Legal Forms - one of the most significant libraries of legal varieties in America - offers a wide array of legal papers themes you are able to down load or printing. Making use of the internet site, you will get 1000s of varieties for business and person reasons, categorized by categories, says, or keywords and phrases.You will discover the most up-to-date variations of varieties much like the Massachusetts Compensation Agreement within minutes.

If you already have a subscription, log in and down load Massachusetts Compensation Agreement from your US Legal Forms collection. The Down load key can look on each kind you perspective. You gain access to all previously acquired varieties inside the My Forms tab of the bank account.

In order to use US Legal Forms the very first time, listed here are straightforward guidelines to get you started:

- Make sure you have selected the correct kind for your metropolis/state. Click the Review key to review the form`s content. Browse the kind outline to ensure that you have chosen the proper kind.

- When the kind does not satisfy your requirements, utilize the Lookup area at the top of the display screen to get the one which does.

- If you are satisfied with the form, verify your option by clicking on the Acquire now key. Then, select the costs program you favor and give your accreditations to sign up for the bank account.

- Approach the purchase. Utilize your charge card or PayPal bank account to finish the purchase.

- Find the formatting and down load the form on your own device.

- Make changes. Complete, modify and printing and signal the acquired Massachusetts Compensation Agreement.

Each and every format you put into your account does not have an expiry day and is also your own for a long time. So, if you would like down load or printing one more copy, just go to the My Forms area and then click on the kind you need.

Gain access to the Massachusetts Compensation Agreement with US Legal Forms, probably the most extensive collection of legal papers themes. Use 1000s of skilled and status-specific themes that fulfill your organization or person requires and requirements.

Form popularity

FAQ

In Massachusetts, workers' compensation benefits remain tax-free if the insurance company makes the payments ing to state law. However, if you receive Social Security disability benefits, you might face an offset that may impact your taxes.

You have 7 calendar days (except for Sundays and legal holidays) after the injured worker's 5th day of full or partial disability to report the injury to the DIA.

Workers' comp helps pay for any necessary medical care for work-related injuries or illnesses. It also helps partially compensate employees for lost wages after the first five calendar days of a disability. The Department of Industrial Accidents (DIA) administers Massachusetts workers' compensation law.

Workers who receive total disability benefits may obtain 60 percent of their average weekly pay (with a max amount capped by state law). That weekly amount is determined by averaging what the worker earned in the 52 weeks prior to injury. Workers can receive total disability benefits for up to three years.

To file a claim, download and complete Form 110 ? Employee Claim. You will need 3 copies of this form and all other materials: 1 copy for the DIA. 1 copy for the workers' compensation carrier.

To file a claim, download and complete Form 110 ? Employee Claim. You will need 3 copies of this form and all other materials: 1 copy for the DIA. 1 copy for the workers' compensation carrier.

Types of Workers' Compensation Benefits in Massachusetts The weekly TTI payments are calculated as 60% of your average weekly wage before your injury or illness, subject to a maximum and minimum based on the statewide average weekly wage (SAWW) at the time of your injury.

The average cost of workers' compensation in Massachusetts is $30 per month.