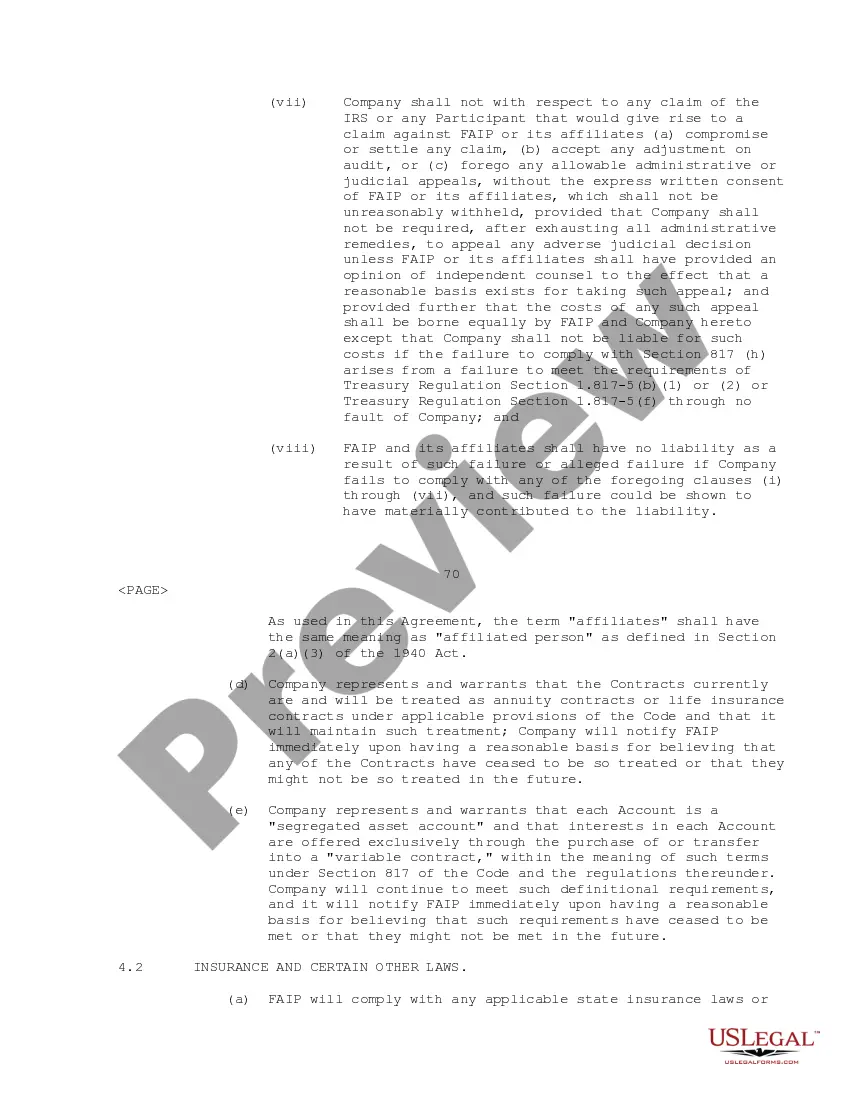

Massachusetts Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co.

Description

How to fill out Participation Agreement Between First American Ins. Portfolios, Inc., SEI Investments Distribution Co.?

You can invest hours on-line attempting to find the lawful papers design which fits the federal and state needs you need. US Legal Forms supplies 1000s of lawful varieties that happen to be examined by professionals. You can actually down load or print out the Massachusetts Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co. from my services.

If you already have a US Legal Forms account, you may log in and then click the Down load switch. Afterward, you may comprehensive, change, print out, or sign the Massachusetts Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co.. Every single lawful papers design you get is the one you have eternally. To have yet another copy of any acquired kind, check out the My Forms tab and then click the related switch.

If you use the US Legal Forms web site for the first time, stick to the straightforward recommendations listed below:

- Initial, make sure that you have chosen the proper papers design for your state/city of your choosing. Look at the kind description to make sure you have chosen the correct kind. If readily available, make use of the Review switch to search throughout the papers design also.

- If you would like locate yet another edition in the kind, make use of the Search area to get the design that suits you and needs.

- After you have located the design you want, simply click Acquire now to proceed.

- Choose the rates strategy you want, key in your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You should use your charge card or PayPal account to purchase the lawful kind.

- Choose the file format in the papers and down load it for your product.

- Make adjustments for your papers if required. You can comprehensive, change and sign and print out Massachusetts Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co..

Down load and print out 1000s of papers web templates utilizing the US Legal Forms web site, that offers the greatest collection of lawful varieties. Use skilled and state-specific web templates to take on your small business or personal needs.

Form popularity

FAQ

SEI Investments Company, formerly Simulated Environments Inc, is a financial services company headquartered in Oaks, Pennsylvania, United States. The company describes itself as "a global provider of investment processing, investment management, and investment operations solutions".

Going Public: How it started, how it's going looks back on the decision to take SEI public in 1981, during a time of economic uncertainty.

Sheltered English Immersion (SEI) is an approach to teaching academic content in English to ELLs. Generally, but not always, ELLs are in the same classrooms as native English-speaking students.

The ownership structure of SEI Investments Company (SEIC) stock is a mix of institutional, retail and individual investors. Approximately 62.23% of the company's stock is owned by Institutional Investors, 9.04% is owned by Insiders and 28.72% is owned by Public Companies and Individual Investors.

Vanguard owns the most shares of Sei Investments Company (SEIC).

SEI Investments Company is currently listed on NASDAQ under SEIC. One share of SEIC stock can currently be purchased for approximately $57.69.

SEI Investments Company, formerly Simulated Environments Inc, is a financial services company headquartered in Oaks, Pennsylvania, United States. The company describes itself as "a global provider of investment processing, investment management, and investment operations solutions".

What is a Fund Participation Agreement? A fund participation agreement is where a 3rd party buys an interest in the underlying loan under the condition that the lender keeps control over the loan.