The Massachusetts Retirement Plan Transfer Agreement is a legal document that pertains to the contribution plans established in the state of Massachusetts, ensuring compliance with the Internal Revenue Service (IRS) requirements. This agreement serves as a mechanism for facilitating the transfer of retirement funds between different retirement plans while adhering to the IRS guidelines. In Massachusetts, there are two primary types of Retirement Plan Transfer Agreements related to contribution plans meeting the IRS requirements: 1. 401(k) Retirement Plan Transfer Agreement: This type of agreement is specifically designed for 401(k) plans, which are employer-sponsored retirement savings plans. It regulates the transfer of funds from one 401(k) plan to another, ensuring that all necessary documentation and processes are followed to meet the IRS guidelines concerning contributions. 2. IRA (Individual Retirement Account) Transfer Agreement: This agreement applies to retirement plans established by individuals and covers the transfer of funds from one IRA to another. It ensures that the transfer process adheres to the IRS requirements for IRA contributions, protecting the retirement savings and maintaining their tax-advantaged status. Both types of transfer agreements address several crucial aspects to meet the IRS contribution plan requirements. These include: a. Tax Rules and Regulations: The transfer agreements outline the applicable tax rules and regulations governing the transfer of retirement funds. They ensure that the transfer process complies with the IRS guidelines to maintain the tax benefits associated with retirement plans. b. Eligible Transfers: The agreements define the eligible types of transfers that can take place under the IRS rules. These may include direct transfers, rollovers, or trustee-to-trustee transfers, among others, based on the specific requirements of the retirement plan and the IRS guidelines. c. Documentation and Reporting: The transfer agreements establish the necessary documentation and reporting requirements to ensure transparency and compliance. This involves the submission of relevant forms and reports to the IRS and other relevant authorities, accurately reflecting the details of the transfer. d. Plan Administrator Responsibilities: The agreements outline the responsibilities of the plan administrators in facilitating the transfer process. This includes verifying the eligibility of the transfer, preparing the necessary paperwork, and ensuring timely completion of the transfer in accordance with the IRS requirements. e. Participant Information Protection: The agreements prioritize the protection of participant information throughout the transfer process. They specify the data privacy standards that must be adhered to, ensuring that personal and sensitive information remains confidential and secure. By implementing the Massachusetts Retirement Plan Transfer Agreement, employers, plan administrators, and individuals can securely transfer retirement funds while meeting the rigorous contribution plan requirements set forth by the Internal Revenue Service.

Massachusetts Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service

Description

How to fill out Massachusetts Retirement Plan Transfer Agreement Regarding Contribution Plan Meeting Requirements Of The Internal Revenue Service?

If you need to complete, download, or print out authorized file layouts, use US Legal Forms, the largest selection of authorized kinds, which can be found online. Take advantage of the site`s simple and easy practical look for to obtain the files you want. Various layouts for company and person uses are sorted by types and suggests, or key phrases. Use US Legal Forms to obtain the Massachusetts Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service within a handful of mouse clicks.

If you are presently a US Legal Forms consumer, log in to the accounts and then click the Download option to find the Massachusetts Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service. Also you can access kinds you earlier downloaded inside the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, follow the instructions under:

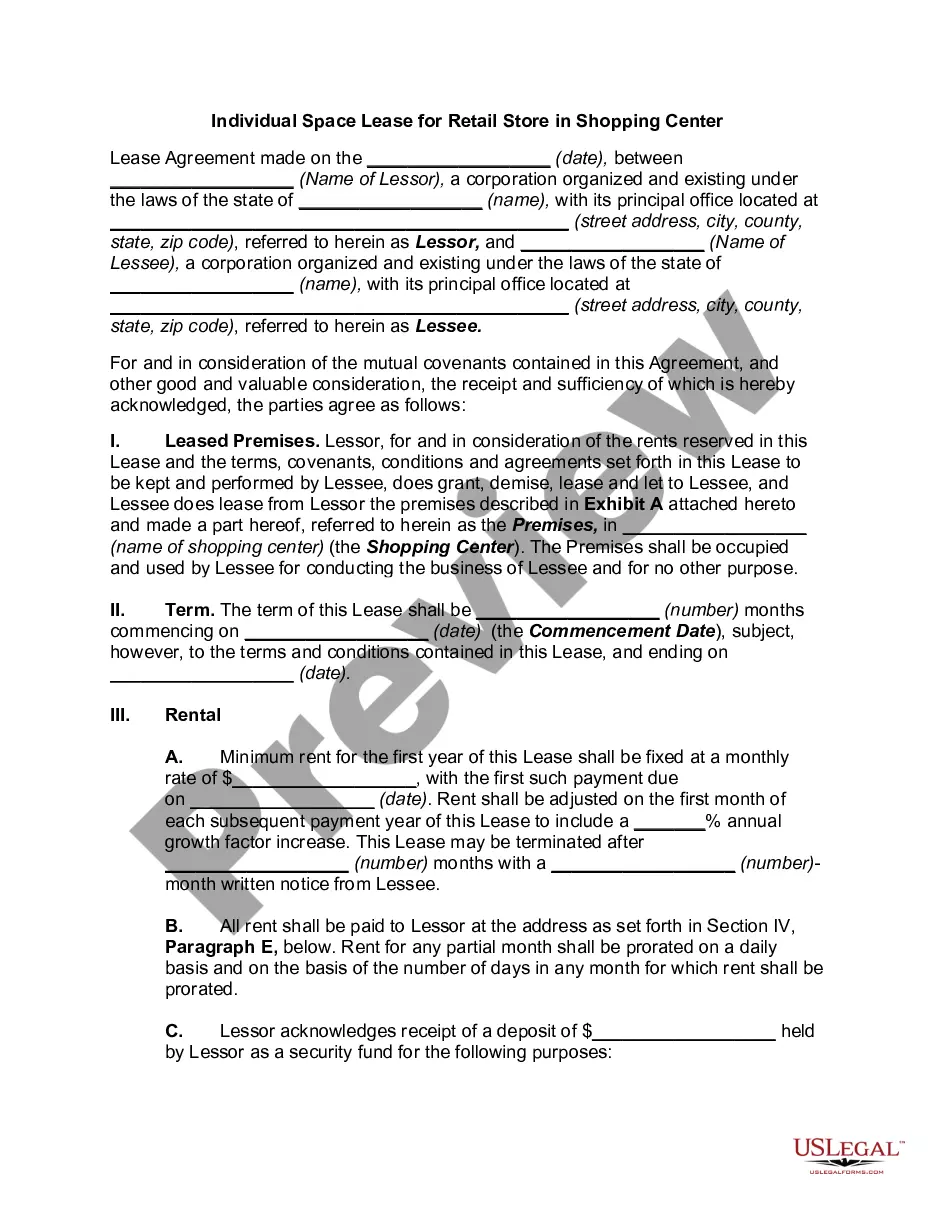

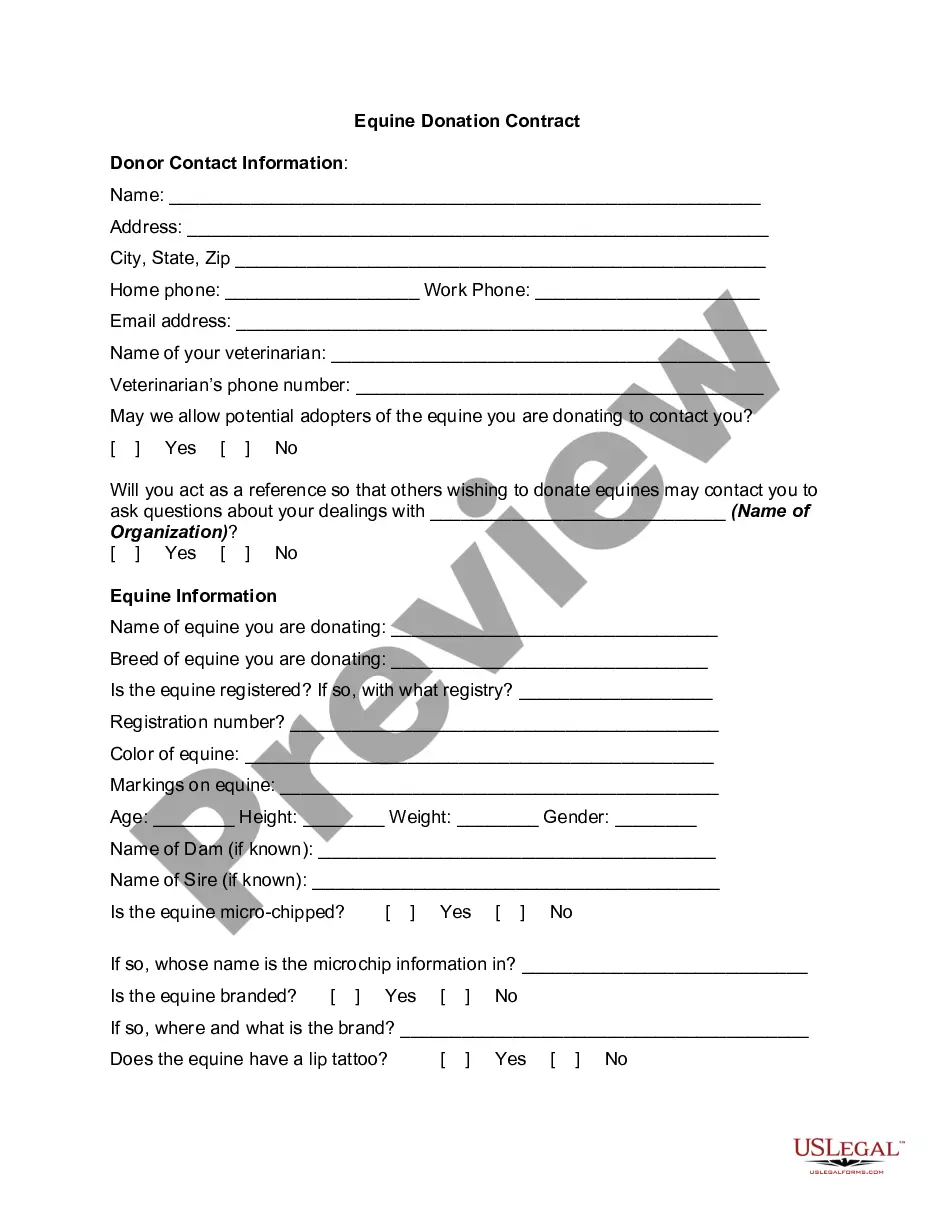

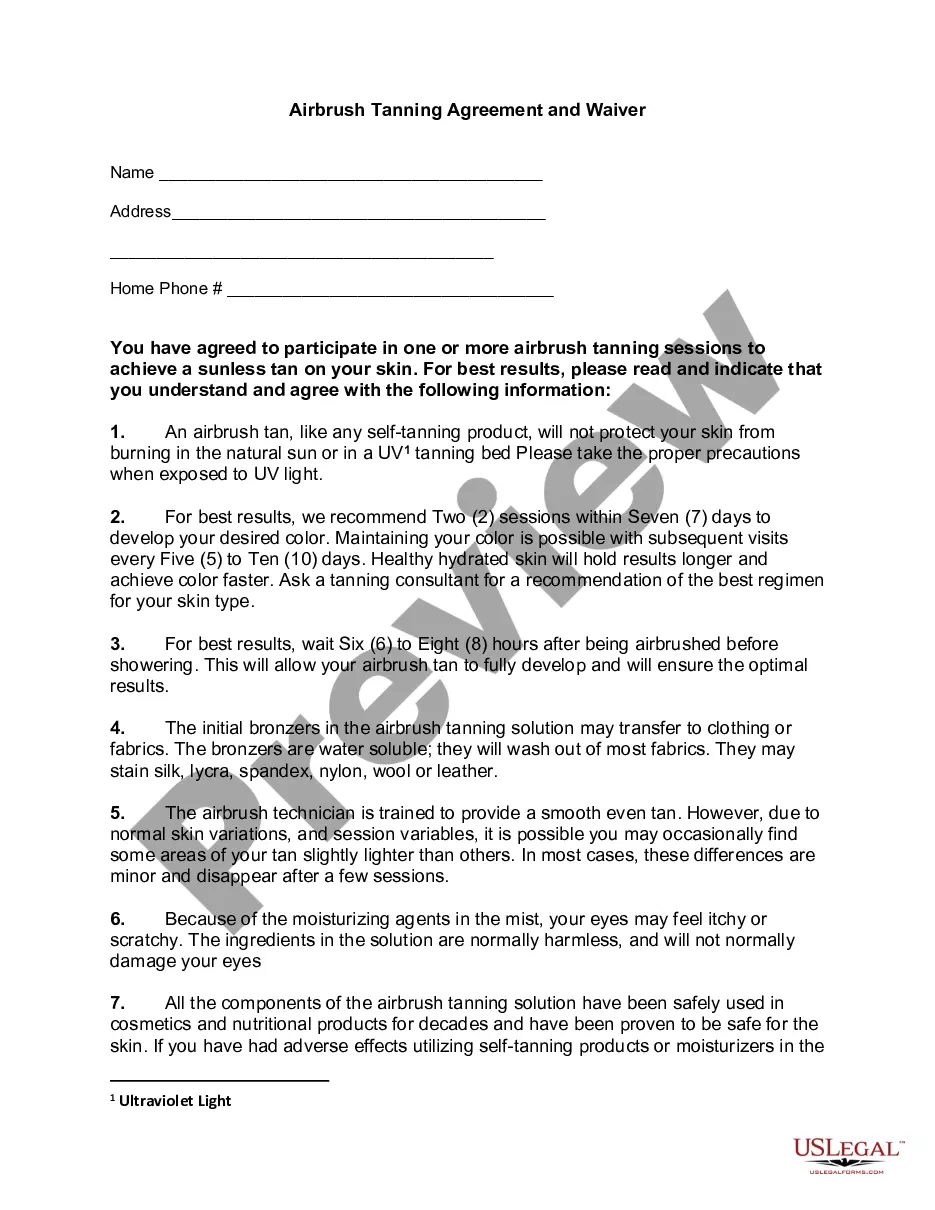

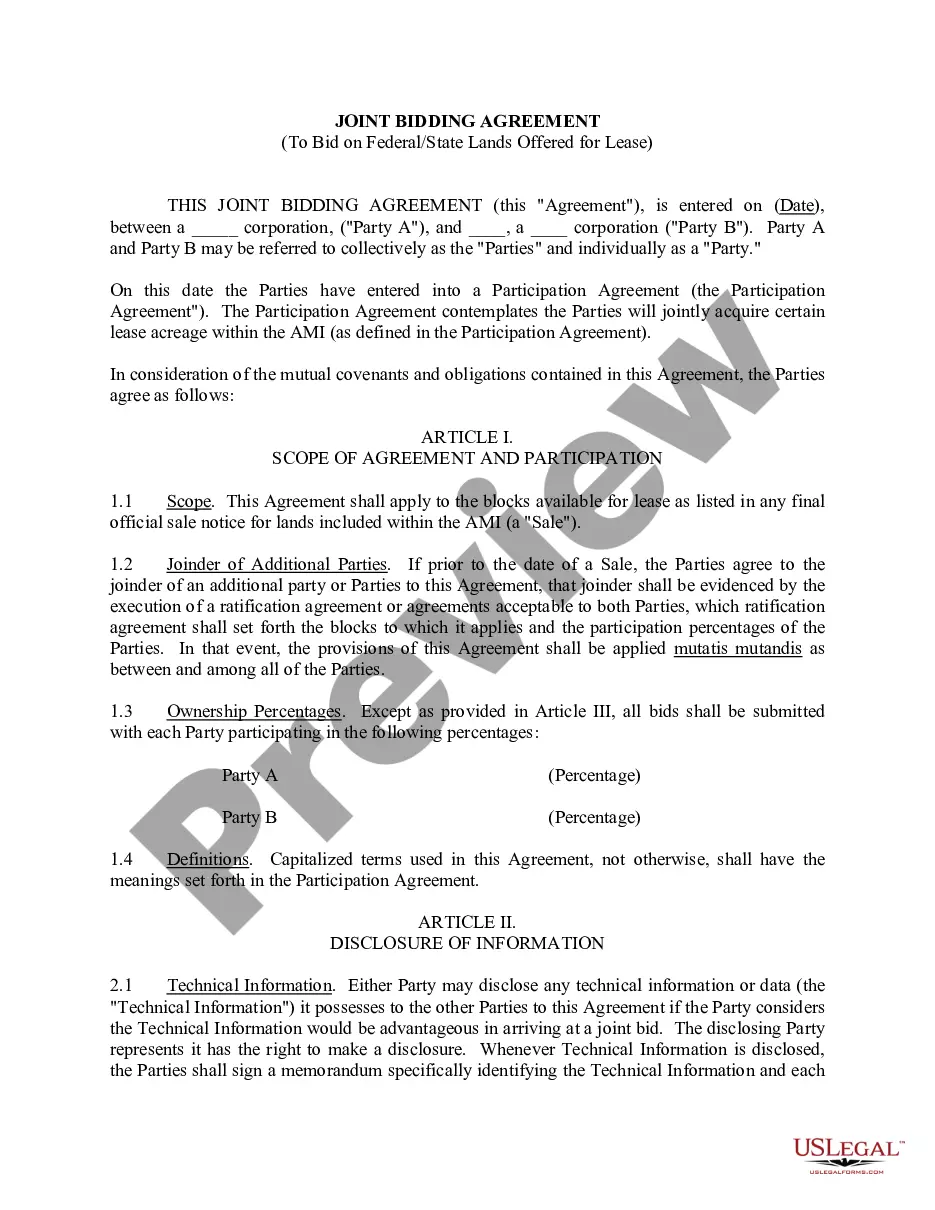

- Step 1. Ensure you have chosen the shape for that correct city/region.

- Step 2. Utilize the Preview solution to look through the form`s articles. Never overlook to read the explanation.

- Step 3. If you are not satisfied with the type, utilize the Look for area at the top of the monitor to locate other variations in the authorized type web template.

- Step 4. When you have located the shape you want, go through the Acquire now option. Choose the prices program you prefer and add your accreditations to sign up to have an accounts.

- Step 5. Method the transaction. You should use your credit card or PayPal accounts to perform the transaction.

- Step 6. Select the file format in the authorized type and download it on your system.

- Step 7. Full, modify and print out or signal the Massachusetts Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service.

Every single authorized file web template you acquire is your own property forever. You have acces to every single type you downloaded with your acccount. Click on the My Forms portion and choose a type to print out or download yet again.

Compete and download, and print out the Massachusetts Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service with US Legal Forms. There are thousands of skilled and status-particular kinds you can use to your company or person requirements.

Form popularity

FAQ

The MSERS is a contributory defined benefit retirement system governed by Massachusetts General Law Chapter 32. The system provides retirement, disability, survivor, and death benefits to members and their beneficiaries. The State Retirement Board is composed of five members and is chaired by State Treasurer Deborah B. MASSACHUSETTS STATE EMPLOYEES' RETIREMENT ... Mass.gov ? doc ? download Mass.gov ? doc ? download PDF

Also, if you have ten or more years of creditable service, call the State Retirement Board ? you may be vested and eligible for retirement at age 55.

Qualifying for a Retirement Benefit For most members, that means you have a minimum of 10 years of full-time creditable service.

Correctional employees of the Department of Correction seeking a ?20/50? retirement benefit must have 20 years of creditable service with the department and must be classified in Group 4 to retire at any age. Group Classification FAQ'S (MSRB) - Mass.gov mass.gov ? info-details ? group-classificatio... mass.gov ? info-details ? group-classificatio...

The yearly pension is determined by your age at retirement, years of state service, salary and group classification. The maximum pension that can be received is 80% of the average three or five highest consecutive years of salary. You can file for retirement no sooner than 120 days before you plan to retire.

60 days When should I roll over? You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. Rollovers of Retirement Plan and IRA Distributions - IRS irs.gov ? plan-participant-employee ? rollov... irs.gov ? plan-participant-employee ? rollov...

The state sets specific windows when teachers can retire with benefits based on age and years of experience. For new teachers starting out in Massachusetts, they can retire with their full benefits when they reach 60 years of age and have accrued at least 10 years of service.

The 60-day rollover rule requires that you deposit all the funds from a retirement account into another IRA, 401(k), or another qualified retirement account within 60 days. If you don't follow the 60-day rule, the funds withdrawn will be subject to taxes and an early withdrawal penalty if you are younger than 59½. The 60-Day Rollover Rule for Retirement Plans - Investopedia investopedia.com ? distribution-traditional-ira investopedia.com ? distribution-traditional-ira