Massachusetts Bylaws of Bankers Trust Corporation

Description

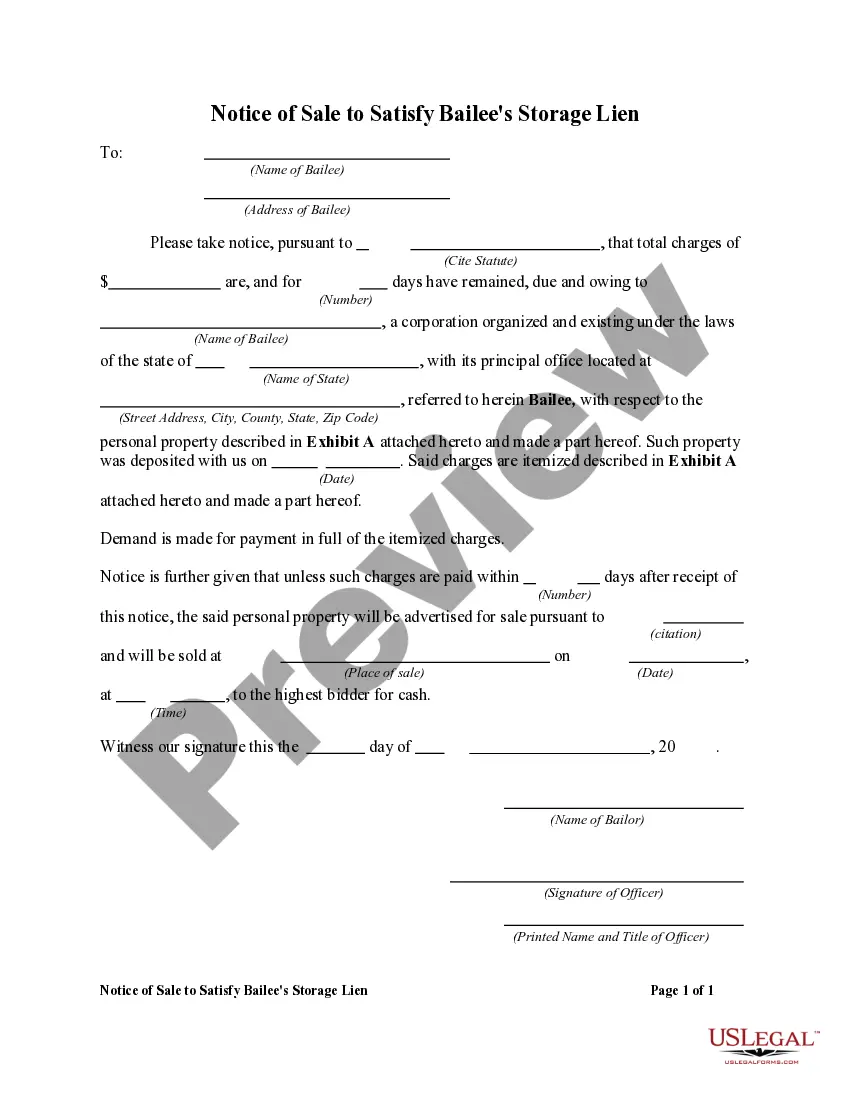

How to fill out Bylaws Of Bankers Trust Corporation?

If you wish to complete, down load, or produce authorized papers layouts, use US Legal Forms, the greatest selection of authorized kinds, which can be found on-line. Utilize the site`s basic and hassle-free search to find the papers you require. Numerous layouts for enterprise and specific functions are categorized by types and states, or search phrases. Use US Legal Forms to find the Massachusetts Bylaws of Bankers Trust Corporation in just a number of mouse clicks.

If you are currently a US Legal Forms customer, log in in your bank account and then click the Acquire button to find the Massachusetts Bylaws of Bankers Trust Corporation. You may also entry kinds you previously downloaded in the My Forms tab of your respective bank account.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for the correct town/land.

- Step 2. Use the Preview method to check out the form`s articles. Do not forget to learn the information.

- Step 3. If you are not satisfied with all the develop, take advantage of the Lookup field near the top of the monitor to locate other versions of the authorized develop format.

- Step 4. When you have located the form you require, click on the Acquire now button. Pick the pricing plan you favor and add your accreditations to register for an bank account.

- Step 5. Method the deal. You should use your bank card or PayPal bank account to perform the deal.

- Step 6. Choose the structure of the authorized develop and down load it on your own device.

- Step 7. Complete, edit and produce or indicator the Massachusetts Bylaws of Bankers Trust Corporation.

Each authorized papers format you acquire is yours for a long time. You possess acces to every develop you downloaded in your acccount. Go through the My Forms section and decide on a develop to produce or down load once again.

Be competitive and down load, and produce the Massachusetts Bylaws of Bankers Trust Corporation with US Legal Forms. There are many professional and state-distinct kinds you can use for the enterprise or specific needs.

Form popularity

FAQ

The Division of Banks (DOB) is the chartering authority and primary regulator for financial service providers in Massachusetts.

Bankers Trust Mission: Reasonable Profit, Ethically Earned. Bankers Trust Vision: To be one of the top performing independent banks in the country.

The Division of Banks (DOB) regulates Massachusetts state-chartered banks and credit unions.

The Federal Credit Union Act authorizes the NCUA Board to oversee America's credit union system and administer and manage the National Credit Union Share Insurance Fund. The NCUA also has statutory responsibility for supervising compliance with and enforcing laws and regulations that protect all credit union members.

On June 4, 1999, Deutsche Bank merged its Bankers Trust and Deutsche Morgan Grenfell to became Deutsche Asset Management (DAM) with Robert Smith as the CEO.

The NCUA works to protect credit union members and consumers, raise awareness of potential frauds, facilitate access to affordable financial services, and educate consumers on the importance of savings and how they can improve their financial well-being.

Supervision and regulation Federally chartered credit unions are regulated by the National Credit Union Administration, while state-chartered credit unions are regulated at the state level. The Fed is one of several banking regulatory agencies at the federal level.

The National Credit Union Administration charters and supervises federal credit unions, and insures savings in federal and most state-chartered credit unions.