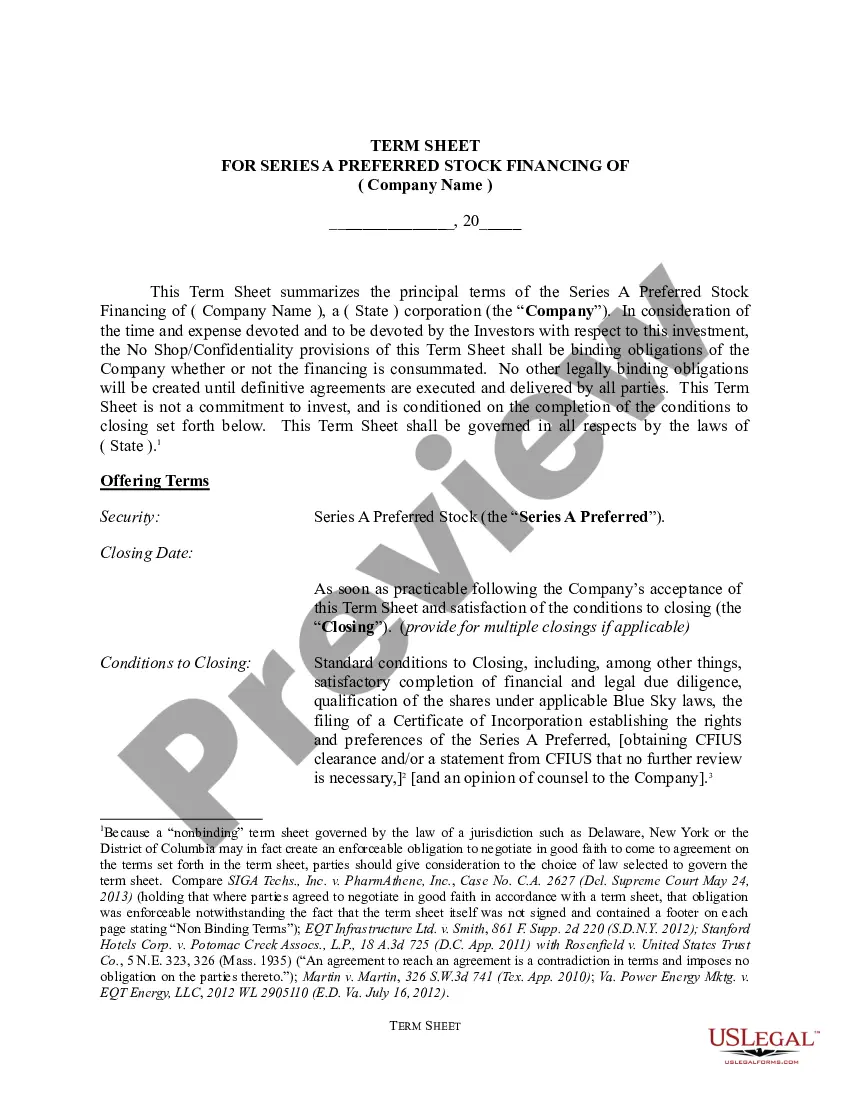

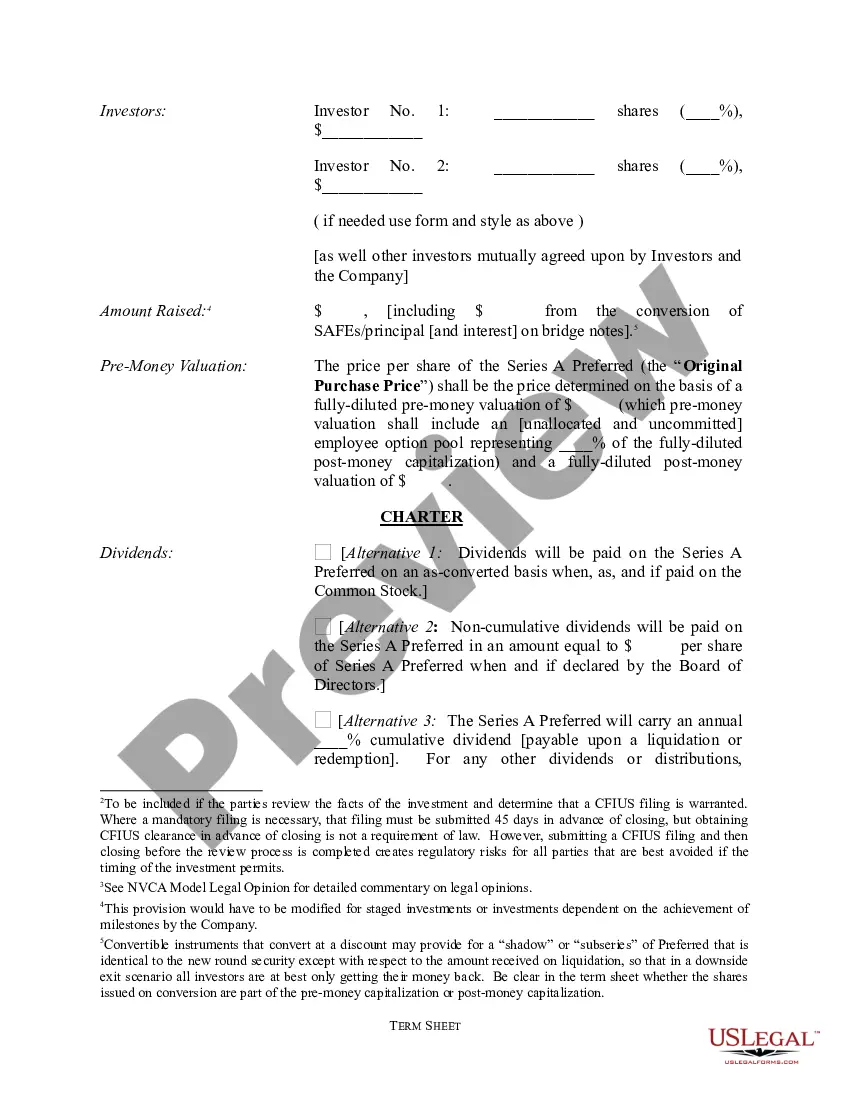

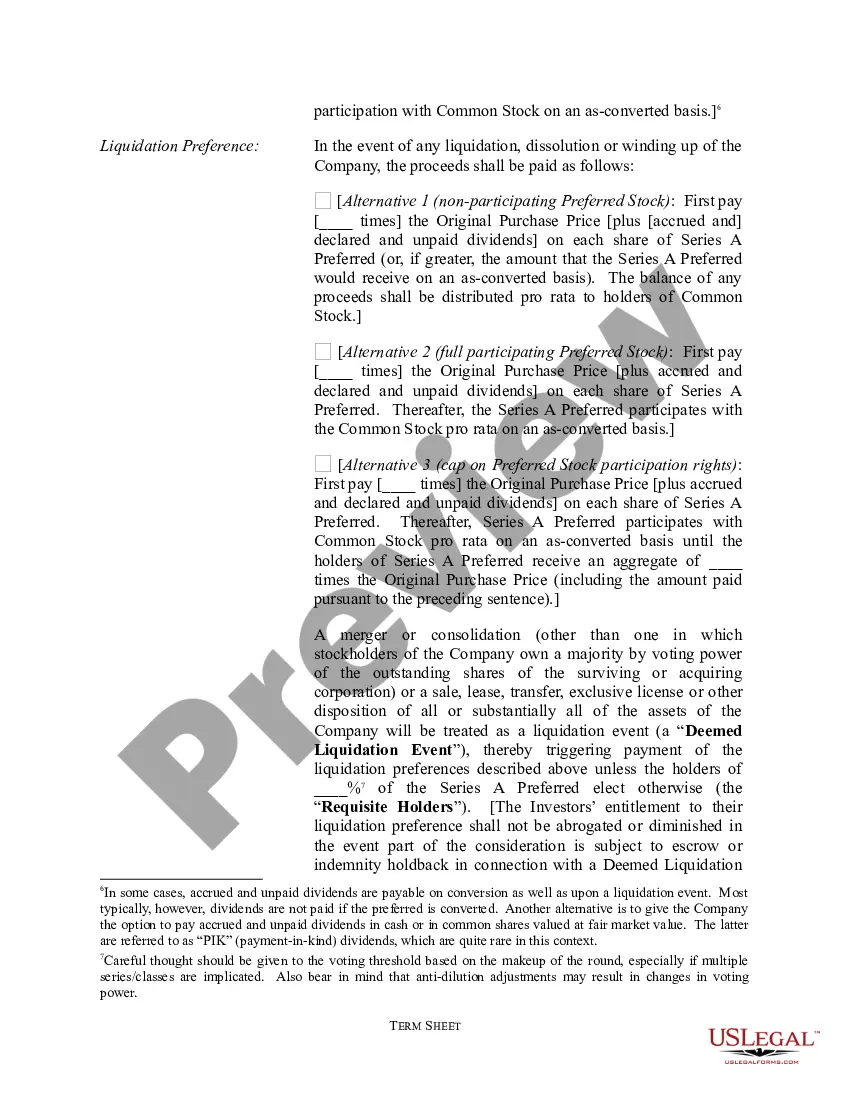

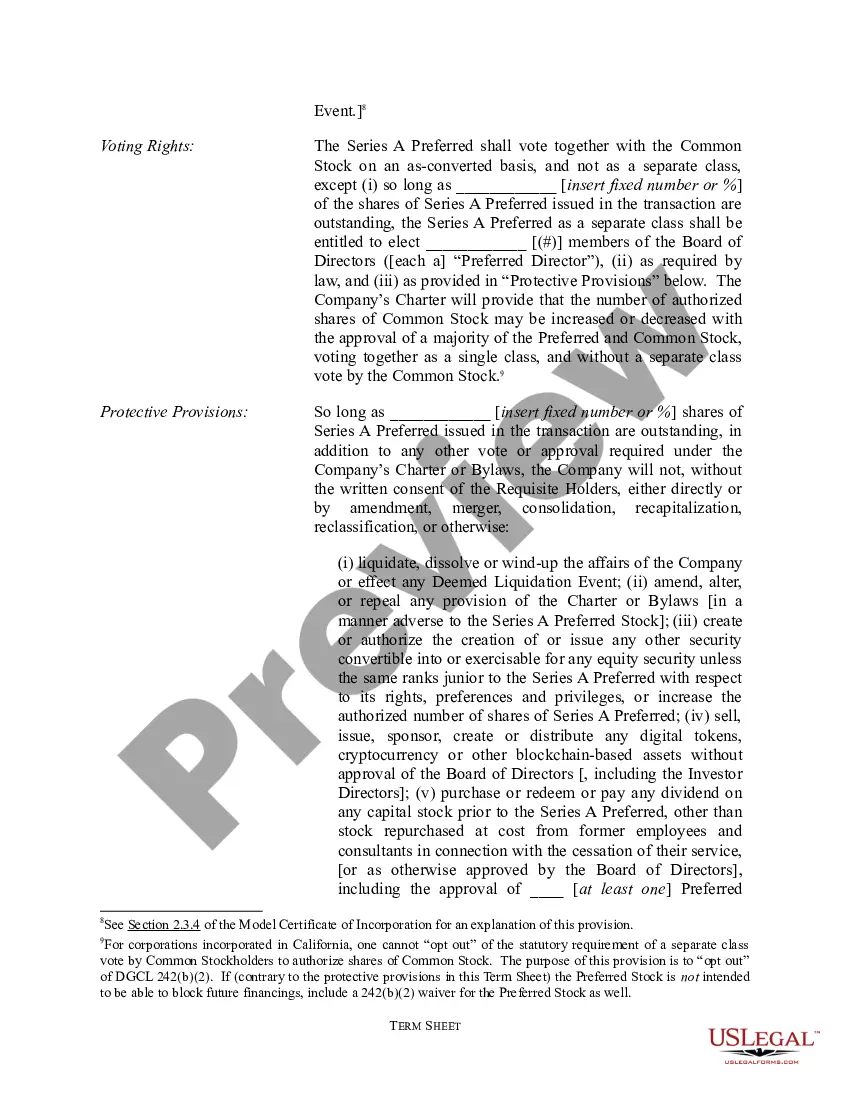

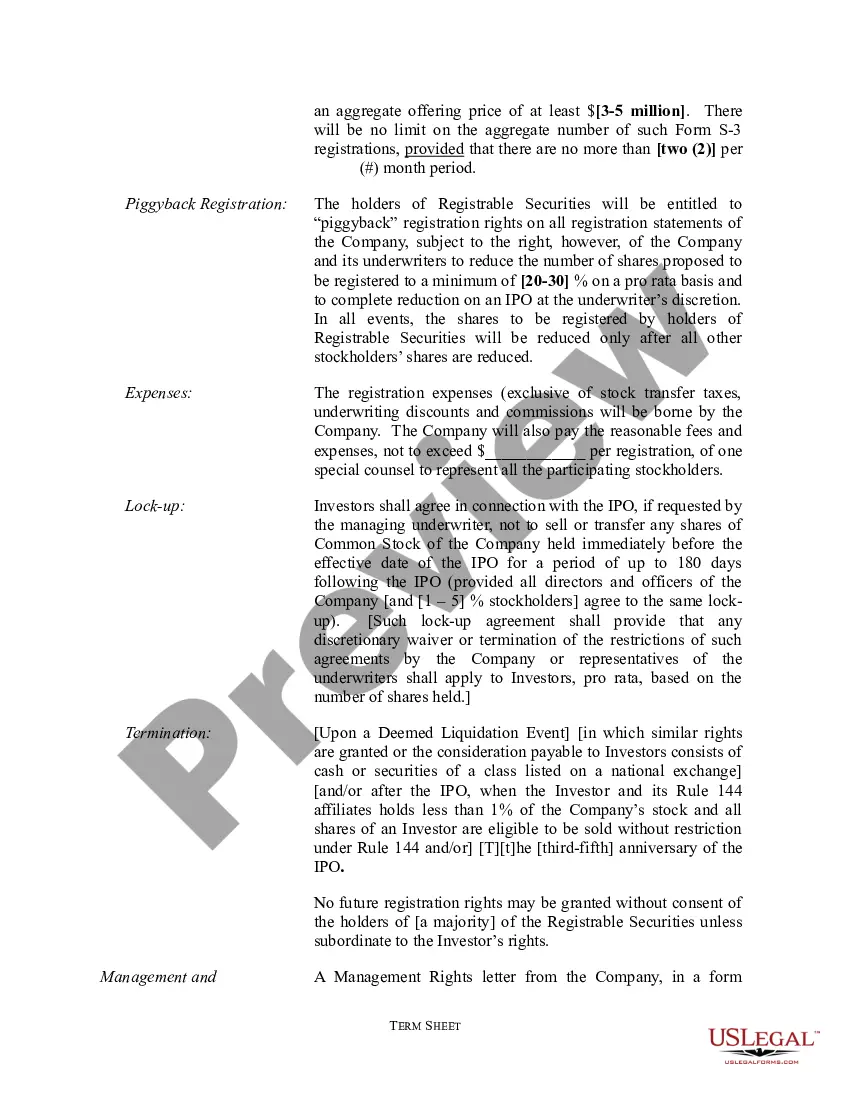

The Massachusetts Term Sheet — Series A Preferred Stock Financing is a legal document commonly used in the state of Massachusetts to outline the terms and conditions of a financing agreement between a company and investors during its Series A funding round. This term sheet serves as the foundation for negotiations and agreements between both parties before the formal issuance of preferred stock. Here is a detailed description of its key components and the potential variations: 1. Overview: The term sheet provides an overview of the financing arrangement, including the type of securities being issued (preferred stock), the intended use of funds, and the valuation of the company. 2. Investment Amount: The term sheet specifies the total investment amount to be raised during the financing round. This can vary based on the company's funding requirements and investor interest. 3. pre-Roman Valuation: It outlines the valuation of the company before the investment is made, which determines the percentage ownership stakes of existing shareholders and potential dilution for future funding rounds. 4. Liquidation Preference: This section details the rights of preferred stockholders in the event of a company liquidation or sale. It determines the order in which investors receive their investment back, including any accrued dividends, before common shareholders. 5. Dividend Provisions: If applicable, the term sheet may outline the dividends payable to preferred stockholders, including the rate, timing, and whether they are cumulative or noncumulative. 6. Conversion Rights: It specifies the conditions or triggers under which preferred stock can be converted into common stock. It may include conversion ratios, conversion price, and anti-dilution protection mechanisms. 7. Voting Rights: The term sheet outlines the voting rights of preferred stockholders, including significant corporate events or changes that require their approval. 8. Board of Directors: If investors require board representation, this section specifies the number of board seats they will be entitled to and any voting or observer rights they may have. 9. Protective Provisions: This clause safeguards investor interests by granting them the right to approve certain corporate actions, such as mergers, acquisitions, or changes in the company's capital structure. 10. Information Rights: It details the level of financial and operational information that the company will be required to provide to investors on a regular basis, ensuring transparency and accountability. There may be different types of term sheets used for Series A Preferred Stock Financing, depending on the specific terms negotiated between the company and investors. These variations can include differences in liquidation preferences, dividend provisions, conversion rights, anti-dilution protections, and voting rights. It's important for both parties to carefully review and negotiate the terms outlined in the term sheet to ensure a mutually beneficial and legally binding agreement.

Massachusetts Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Massachusetts Term Sheet - Series A Preferred Stock Financing Of A Company?

If you want to total, down load, or print out authorized file layouts, use US Legal Forms, the greatest assortment of authorized varieties, that can be found on the Internet. Use the site`s basic and hassle-free lookup to obtain the documents you want. Various layouts for organization and personal reasons are categorized by classes and claims, or key phrases. Use US Legal Forms to obtain the Massachusetts Term Sheet - Series A Preferred Stock Financing of a Company within a handful of mouse clicks.

In case you are presently a US Legal Forms customer, log in in your accounts and then click the Down load option to have the Massachusetts Term Sheet - Series A Preferred Stock Financing of a Company. You can even entry varieties you in the past acquired within the My Forms tab of your own accounts.

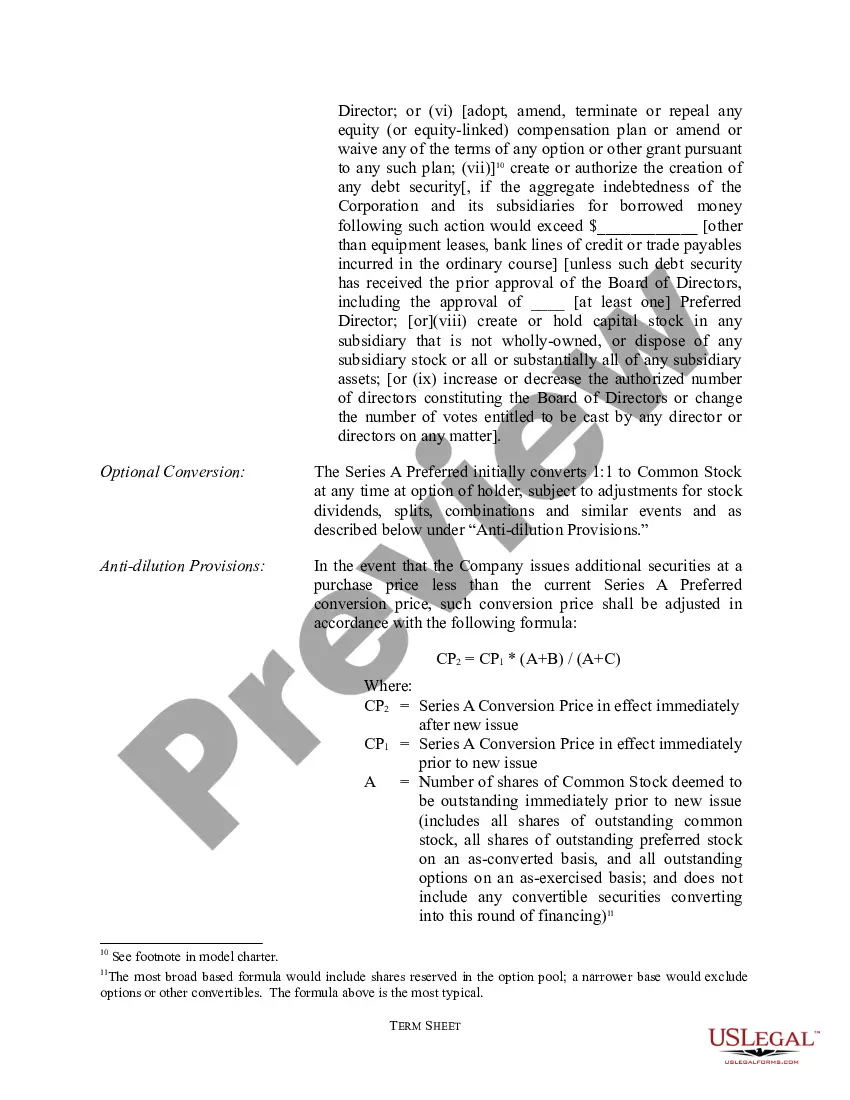

Should you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for that proper town/land.

- Step 2. Take advantage of the Preview method to look over the form`s articles. Do not forget about to learn the description.

- Step 3. In case you are not happy with all the type, utilize the Research industry near the top of the monitor to find other variations in the authorized type web template.

- Step 4. After you have identified the form you want, select the Get now option. Opt for the pricing plan you favor and include your qualifications to register to have an accounts.

- Step 5. Process the purchase. You can use your charge card or PayPal accounts to accomplish the purchase.

- Step 6. Choose the format in the authorized type and down load it on your gadget.

- Step 7. Complete, edit and print out or signal the Massachusetts Term Sheet - Series A Preferred Stock Financing of a Company.

Every authorized file web template you get is your own permanently. You have acces to every type you acquired with your acccount. Click the My Forms portion and select a type to print out or down load yet again.

Compete and down load, and print out the Massachusetts Term Sheet - Series A Preferred Stock Financing of a Company with US Legal Forms. There are millions of specialist and status-certain varieties you can utilize for the organization or personal requires.