Title: Massachusetts Accredited Investor Verification Letter: Types and Detailed Description Introduction: Understanding the intricacies of the Massachusetts Accredited Investor Verification Letter is essential for individuals or entities seeking to comply with securities regulations. This article provides a detailed description of what the Massachusetts Accredited Investor Verification Letter entails, its purpose, and various types one may encounter. 1. Overview of Massachusetts Accredited Investor Verification Letter: The Massachusetts Accredited Investor Verification Letter is a crucial document used primarily in compliance with state securities laws to validate an investor's accredited status. It serves as evidence that the investor meets specific financial thresholds, granting them access to exclusive investment opportunities that are otherwise restricted. 2. Purpose and Importance: The fundamental purpose of the Massachusetts Accredited Investor Verification Letter is to ensure investor protection by preventing unqualified individuals from participating in high-risk investments. By verifying an investor's accredited status, this letter allows them to engage in private placements, hedge funds, venture capital, private equity, and other types of investments, increasing economic growth and fostering innovation. 3. Types of Massachusetts Accredited Investor Verification Letters: a. General Verification Letter: This type of letter is issued to individuals or entities that meet the standard accredited investor criteria defined by the Securities and Exchange Commission (SEC). The general criteria typically include having an annual income exceeding $200,000 (or $300,000 for couples) over the past two years or possessing a net worth exceeding $1 million (excluding the primary residence). b. Verification Letter for Entities: This specific letter applies to legal entities such as corporations, partnerships, or trust funds. The letter confirms that the entity qualifies as an accredited investor based on factors like net assets, total assets, or income. c. Massachusetts Specific Verification: Massachusetts has some additional requirements for accredited investor status. Applicants may need to demonstrate experience in investment, financial services, or business development or possess specialized knowledge in a related field. The Massachusetts Accredited Investor Verification Letter validates compliance with these additional state-specific criteria. d. Renewal Verification Letter: If an accredited investor's status requires periodic reevaluation, a renewal verification letter is issued to update and reaffirm their eligibility. This ensures ongoing compliance with applicable regulations. Conclusion: Obtaining a Massachusetts Accredited Investor Verification Letter enables individuals and entities to access a range of high-risk, high-return investments while meeting legal obligations. Understanding the various types of verification letters, including general, entity-specific, Massachusetts-specific, and renewal letters, is critical for potential investors navigating the complex landscape of securities regulations. By adhering to these requirements, investors can participate in opportunities that can foster economic growth and generate substantial returns while remaining compliant with Massachusetts securities laws.

Massachusetts Accredited Investor Verification Letter

Description

How to fill out Massachusetts Accredited Investor Verification Letter?

Finding the right legal document web template could be a have a problem. Needless to say, there are a lot of templates accessible on the Internet, but how will you find the legal type you need? Utilize the US Legal Forms internet site. The service delivers thousands of templates, including the Massachusetts Accredited Investor Verification Letter, which you can use for enterprise and personal demands. All of the kinds are inspected by pros and meet federal and state specifications.

Should you be already authorized, log in to your account and click the Down load switch to get the Massachusetts Accredited Investor Verification Letter. Use your account to check from the legal kinds you might have ordered formerly. Go to the My Forms tab of your respective account and acquire one more version of the document you need.

Should you be a whole new user of US Legal Forms, listed here are easy instructions that you should adhere to:

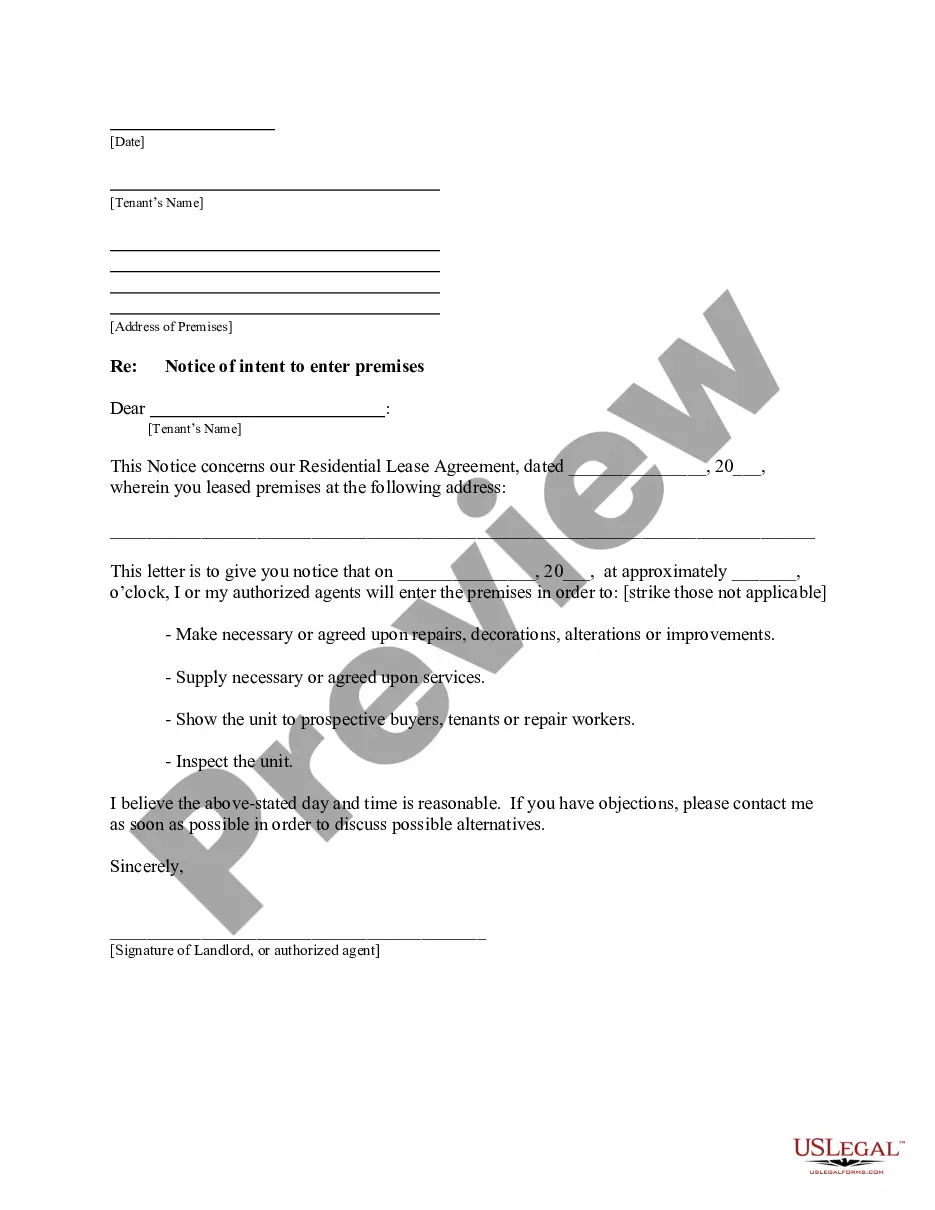

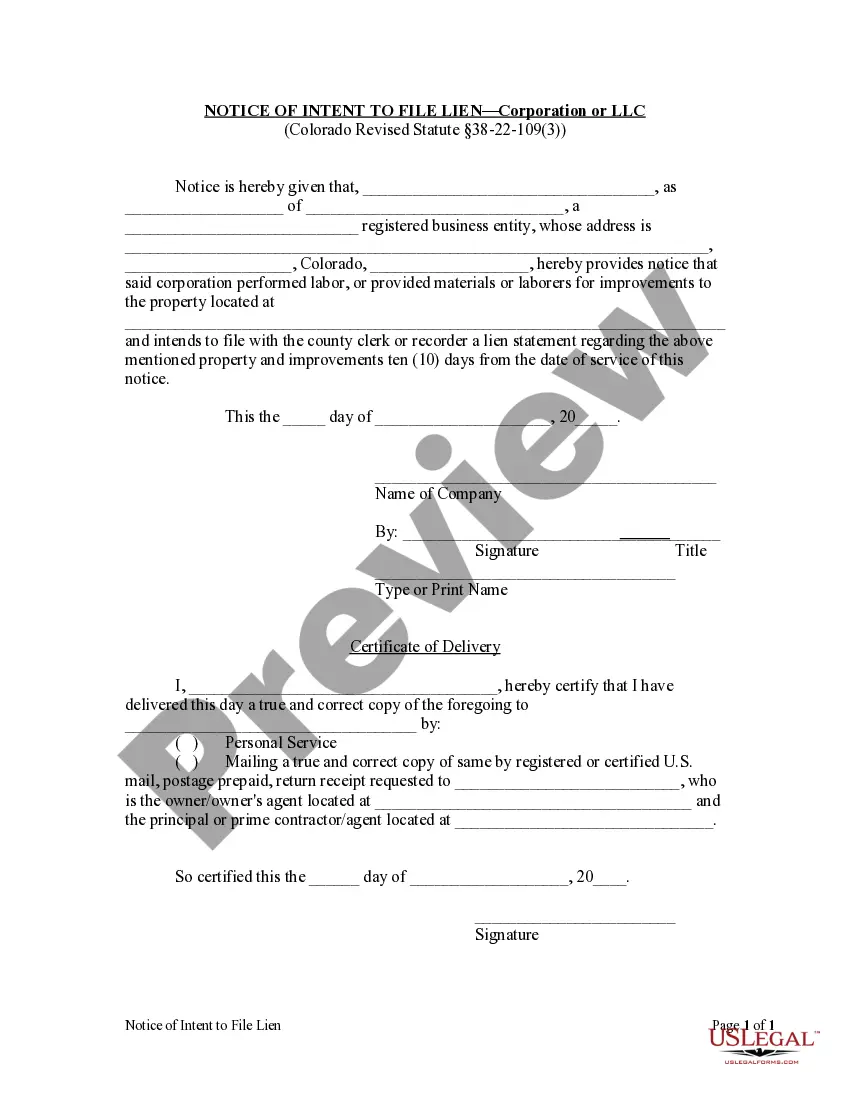

- Initially, ensure you have chosen the correct type for the metropolis/region. You are able to check out the form making use of the Preview switch and browse the form outline to guarantee this is the right one for you.

- In the event the type fails to meet your expectations, utilize the Seach field to obtain the appropriate type.

- Once you are certain that the form is proper, go through the Purchase now switch to get the type.

- Select the prices strategy you would like and enter the required info. Build your account and purchase the transaction utilizing your PayPal account or Visa or Mastercard.

- Choose the submit file format and download the legal document web template to your system.

- Complete, revise and produce and signal the attained Massachusetts Accredited Investor Verification Letter.

US Legal Forms is definitely the greatest catalogue of legal kinds in which you can discover a variety of document templates. Utilize the service to download expertly-produced files that adhere to state specifications.