A Massachusetts Convertible Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Massachusetts. This promissory note combines elements of both a traditional promissory note and a convertible note, giving it unique features and benefits. In simple terms, a promissory note is a written promise by the borrower to repay a specific amount of money to the lender, along with any agreed-upon interest, within a certain period of time. However, what sets a Massachusetts Convertible Secured Promissory Note apart is its conversion feature, which allows the lender to convert the outstanding loan balance into equity in the borrower's company at a later date. The use of a Massachusetts Convertible Secured Promissory Note provides certain advantages for both parties involved. For the borrower, it offers more flexible repayment terms, as the convertibility feature allows for a potential reduction in debt if the lender chooses to convert the loan into equity. This can be particularly beneficial for startups or early-stage companies looking to secure funding without immediately sacrificing ownership or control. On the other hand, for the lender, the inclusion of a conversion option provides potential upside if the borrower's company experiences significant growth or achieves a predetermined milestone. The lender can convert the loan into ownership in the form of shares or equity, potentially resulting in a profit if the company becomes successful. There are several variations of Massachusetts Convertible Secured Promissory Notes tailored to specific needs or scenarios. Some common types include: 1. Traditional Convertible Secured Promissory Note: This is the basic form of the note, offering standard terms and conditions for both the loan and conversion aspects. 2. Safe (Simple Agreement for Future Equity) Note: This type of note is a simplified version of a convertible note, typically used in early-stage financing rounds. It allows for a quicker and easier fundraising process. 3. Secured Convertible Note: This variation adds a layer of protection for the lender, as it secures the loan with assets or collateral of the borrower. This reduces the lender's risk if the borrower defaults on the loan. 4. Senior Convertible Note: This type of promissory note takes priority over other debt in case of bankruptcy or liquidation, protecting the lender's interests in potentially adverse situations. It is crucial to consult with a legal professional or experienced financial advisor when considering the use of a Massachusetts Convertible Secured Promissory Note. Different scenarios and circumstances may require specific modifications or additional legal considerations to best suit the needs of all parties involved.

Massachusetts Convertible Secured Promissory Note

Description

How to fill out Massachusetts Convertible Secured Promissory Note?

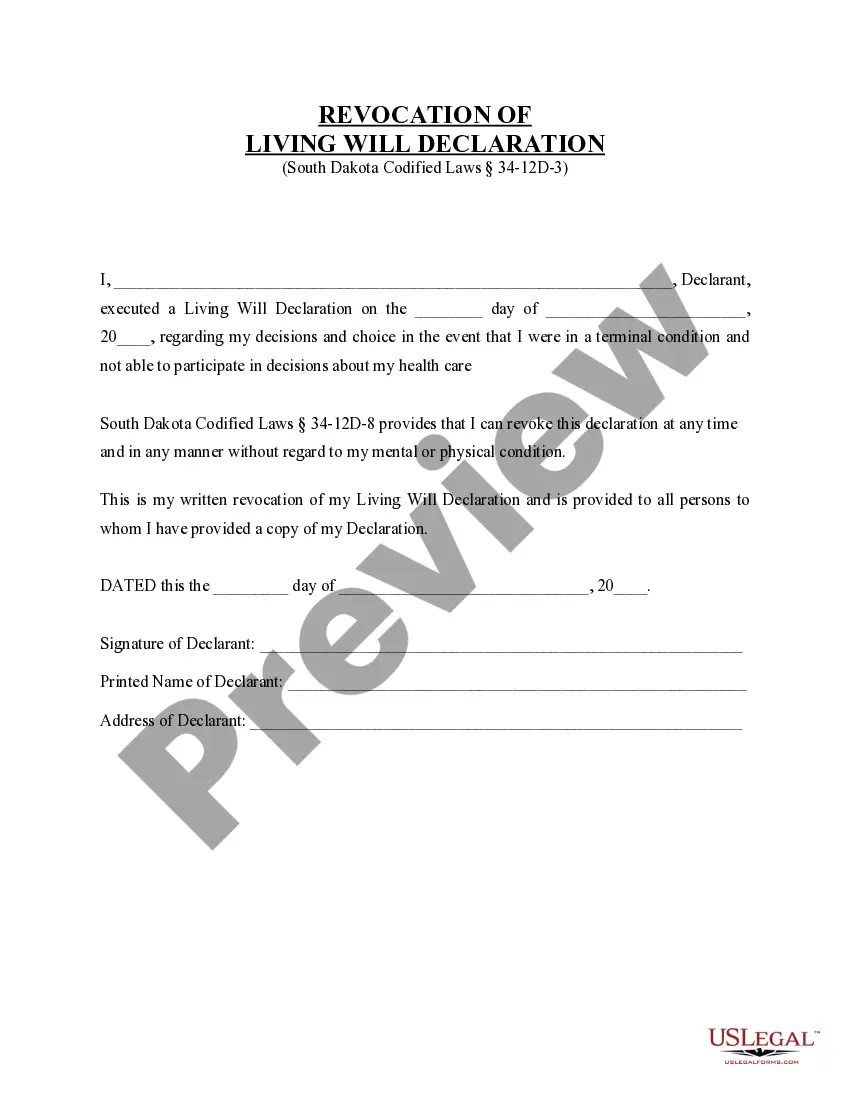

Are you currently inside a situation in which you require papers for possibly business or individual functions virtually every working day? There are tons of legal file web templates available online, but locating ones you can trust is not straightforward. US Legal Forms provides a huge number of develop web templates, like the Massachusetts Convertible Secured Promissory Note, which are composed to meet federal and state needs.

Should you be presently familiar with US Legal Forms site and possess a free account, simply log in. Following that, it is possible to download the Massachusetts Convertible Secured Promissory Note design.

Should you not offer an bank account and want to begin using US Legal Forms, follow these steps:

- Find the develop you need and make sure it is for the right town/region.

- Utilize the Review switch to examine the form.

- Look at the information to actually have selected the proper develop.

- In case the develop is not what you`re searching for, utilize the Research area to find the develop that fits your needs and needs.

- If you obtain the right develop, click on Acquire now.

- Opt for the pricing prepare you would like, submit the desired details to make your bank account, and purchase your order using your PayPal or Visa or Mastercard.

- Select a practical data file formatting and download your duplicate.

Locate all the file web templates you might have bought in the My Forms food list. You can aquire a extra duplicate of Massachusetts Convertible Secured Promissory Note whenever, if needed. Just select the necessary develop to download or produce the file design.

Use US Legal Forms, probably the most comprehensive collection of legal varieties, to save time and avoid faults. The service provides skillfully manufactured legal file web templates which can be used for a variety of functions. Produce a free account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

In recent years, SAFEs have become the most common convertible instrument due to their relative simplicity. Like convertible notes, SAFEs convert into stock in a future priced round. Unlike convertible notes, they are not debt and do not require the company to pay back the investment with interest. Convertible Securities: SAFEs vs.Convertible Notes - Carta carta.com ? blog ? convertible-securities carta.com ? blog ? convertible-securities

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. ... Repayment schedule. ... Any interest on the loan. ... The details of the collateral.

Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable.

A convertible promissory note is a debt instrument that converts into equity of the issuing company upon certain events. Typically, a note would convert into equity in a subsequent equity financing round and perhaps upon the note's maturity or a sale of the company. An Introduction to Convertible Notes | WyrickRobbins Wyrick Robbins ? news-insights ? an-introduc... Wyrick Robbins ? news-insights ? an-introduc...

A convertible note is a debt instrument often used by angel or seed investors looking to fund an early-stage startup that has not been valued explicitly. After more information becomes available to establish a reasonable value for the company, convertible note investors can convert the note into equity. Senior Convertible Note: How They're Used and Role in Offering investopedia.com ? terms ? senior-convertib... investopedia.com ? terms ? senior-convertib...

The main disadvantages of convertible note offerings are equity dilution and near?term stock price impact and, if the stock price fails to appreciate above the conversion price, potential refinancing risk. Convertible Note Offerings ? An Overview for Issuers - Gibson Dunn gibsondunn.com ? uploads ? 2018/01 ? CA... gibsondunn.com ? uploads ? 2018/01 ? CA...

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A secured convertible promissory note, or SCP for short, is a type of security instrument that gives the holder the right to convert their debt into equity in the issuer company. Typically, an SCP will convert at a discount to the market value of the company's shares at the time of conversion.