Massachusetts General Home Repair Services Contract - Long Form - Self-Employed

Description

How to fill out Massachusetts General Home Repair Services Contract - Long Form - Self-Employed?

US Legal Forms - among the largest libraries of legitimate forms in the States - gives a variety of legitimate document templates you are able to acquire or produce. Using the website, you can get a large number of forms for organization and specific purposes, categorized by types, suggests, or search phrases.You can get the most recent versions of forms such as the Massachusetts General Home Repair Services Contract - Long Form - Self-Employed within minutes.

If you have a membership, log in and acquire Massachusetts General Home Repair Services Contract - Long Form - Self-Employed from your US Legal Forms collection. The Down load key can look on every single kind you view. You gain access to all previously delivered electronically forms from the My Forms tab of your own profile.

In order to use US Legal Forms the very first time, allow me to share basic recommendations to obtain started off:

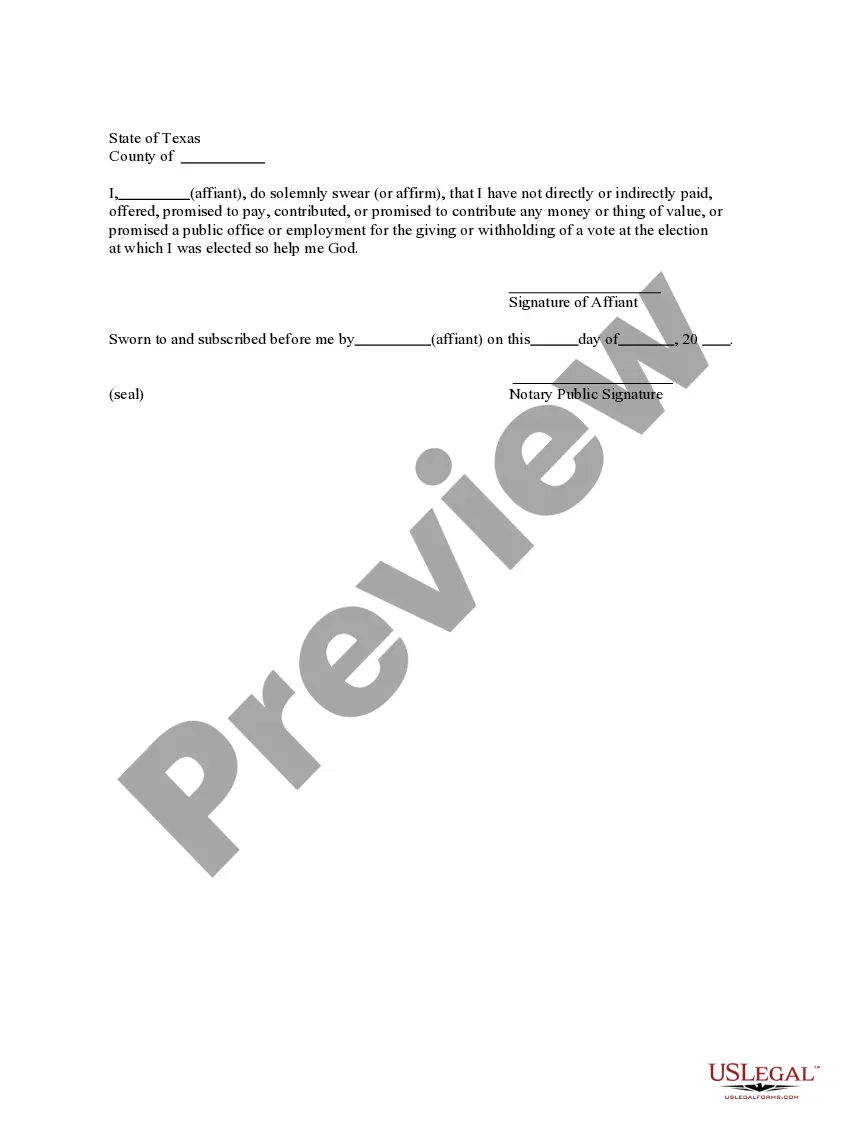

- Make sure you have chosen the right kind for your area/county. Go through the Preview key to analyze the form`s content material. Look at the kind outline to actually have chosen the appropriate kind.

- In case the kind doesn`t satisfy your specifications, make use of the Look for area near the top of the screen to find the the one that does.

- If you are content with the shape, affirm your choice by clicking the Purchase now key. Then, choose the pricing program you like and provide your accreditations to sign up for the profile.

- Method the financial transaction. Make use of your credit card or PayPal profile to finish the financial transaction.

- Pick the file format and acquire the shape in your device.

- Make adjustments. Fill out, revise and produce and indication the delivered electronically Massachusetts General Home Repair Services Contract - Long Form - Self-Employed.

Every format you included with your bank account lacks an expiration particular date and it is the one you have for a long time. So, if you wish to acquire or produce yet another version, just proceed to the My Forms portion and click on in the kind you want.

Gain access to the Massachusetts General Home Repair Services Contract - Long Form - Self-Employed with US Legal Forms, probably the most substantial collection of legitimate document templates. Use a large number of expert and express-certain templates that meet up with your business or specific requires and specifications.

Form popularity

FAQ

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

Employment StatusA subcontractor receives a portion of what the contractor earns for an overall job. Contractors receive payment per job or by the hour. As a contractor, you a receive 1099 form, and the IRS determines if a worker is a contractor or an employee.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.