Massachusetts Graphic Artist Agreement - Self-Employed Independent Contractor

Description

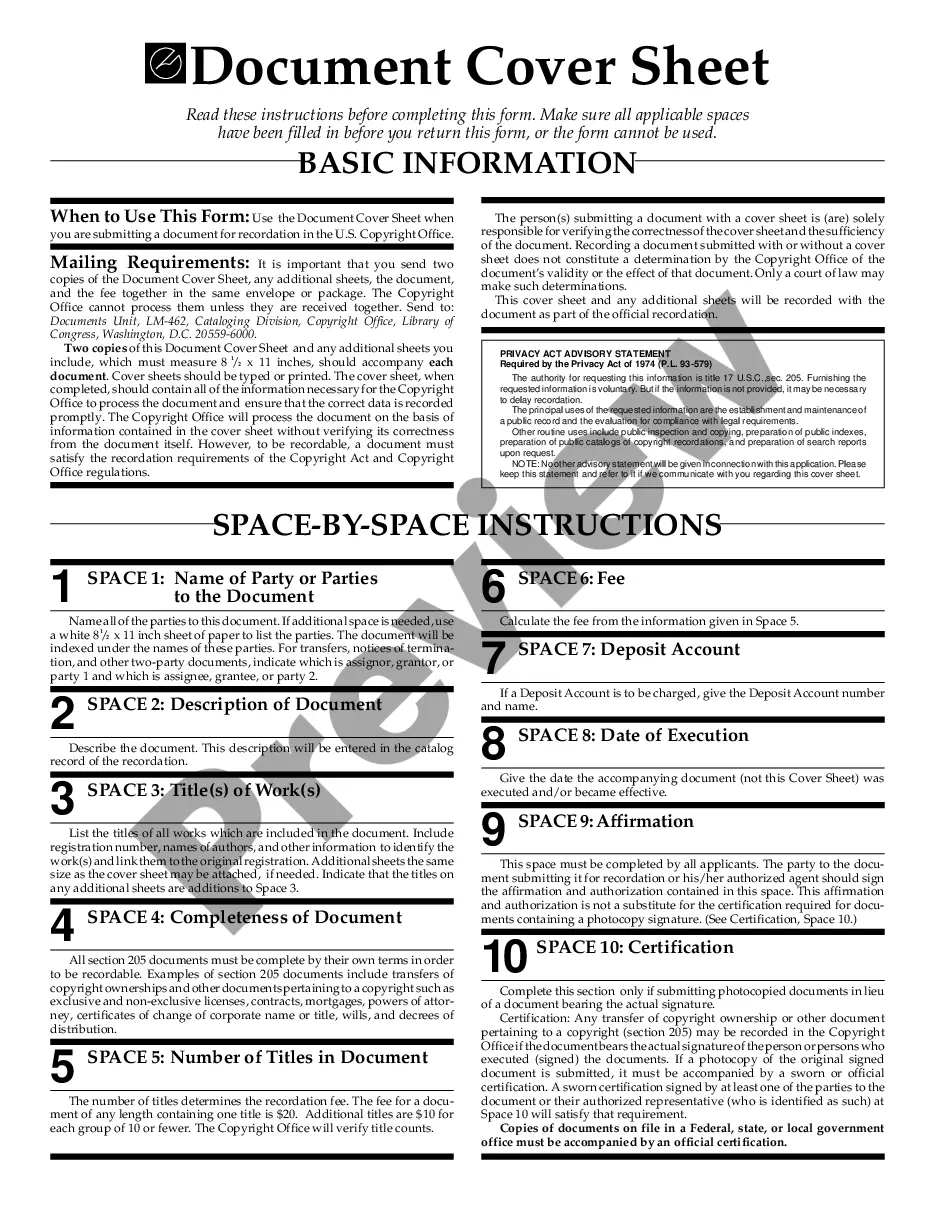

How to fill out Massachusetts Graphic Artist Agreement - Self-Employed Independent Contractor?

Are you currently in the placement where you need to have papers for sometimes business or personal reasons virtually every time? There are plenty of authorized papers web templates available online, but discovering ones you can rely on is not easy. US Legal Forms gives a huge number of develop web templates, just like the Massachusetts Graphic Artist Agreement - Self-Employed Independent Contractor, that are published to satisfy federal and state needs.

If you are currently acquainted with US Legal Forms site and also have a free account, simply log in. Afterward, you may download the Massachusetts Graphic Artist Agreement - Self-Employed Independent Contractor template.

Should you not have an accounts and wish to start using US Legal Forms, follow these steps:

- Find the develop you require and ensure it is for your proper city/region.

- Utilize the Preview option to examine the form.

- See the outline to actually have chosen the proper develop.

- In case the develop is not what you`re searching for, take advantage of the Research field to obtain the develop that meets your needs and needs.

- Once you find the proper develop, click Get now.

- Opt for the costs program you desire, complete the required info to make your money, and pay money for the order using your PayPal or charge card.

- Pick a convenient file structure and download your version.

Get every one of the papers web templates you have purchased in the My Forms food list. You may get a additional version of Massachusetts Graphic Artist Agreement - Self-Employed Independent Contractor at any time, if needed. Just click the essential develop to download or print the papers template.

Use US Legal Forms, the most extensive collection of authorized varieties, to save some time and steer clear of errors. The support gives appropriately manufactured authorized papers web templates that can be used for a range of reasons. Produce a free account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

4 answers. Artists/event hosts are called and hired as independent contractors, but by legal definition they are not. An independent contractor makes their own schedule and sets the pay for the job.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

An independent contractor is someone who is self-employed and provides services to clients. It's also known as contracting or sub-contracting. Usually, independent contractors set up as a sole trader and run their business with their own Australian Business Number (ABN).

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Similarities. Independent contractors and subcontractors are both considered self-employed by the IRS. Both are responsible for making quarterly tax payments including self-employment tax.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

An independent contractor is a self-employed person, that is, a consultant, lawyer, accountant, engineer or any other person who provides services to other organization for a fee. Common law principles further define independent contractor status by method of payment.