Massachusetts Appraisal Agreement - Self-Employed Independent Contractor

Description

How to fill out Massachusetts Appraisal Agreement - Self-Employed Independent Contractor?

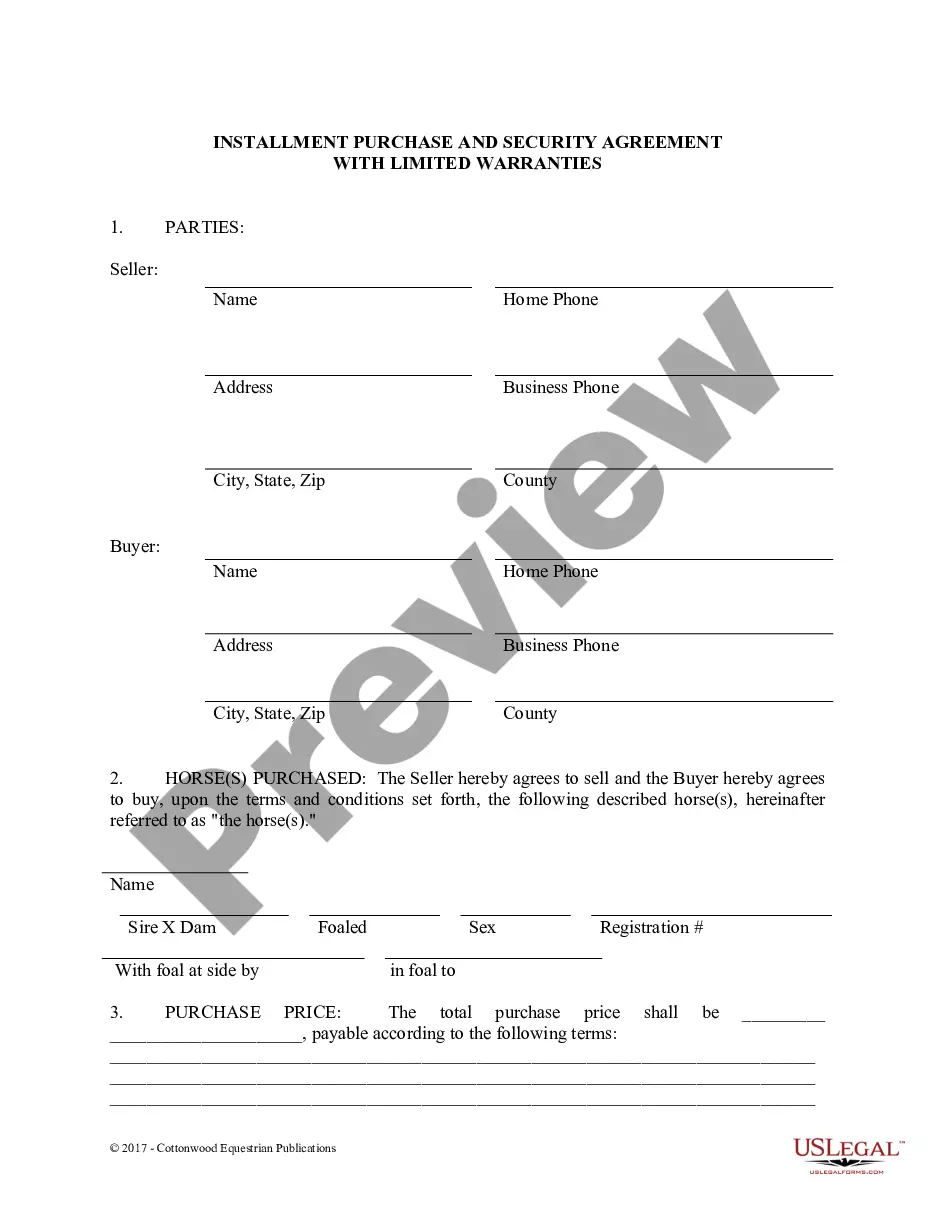

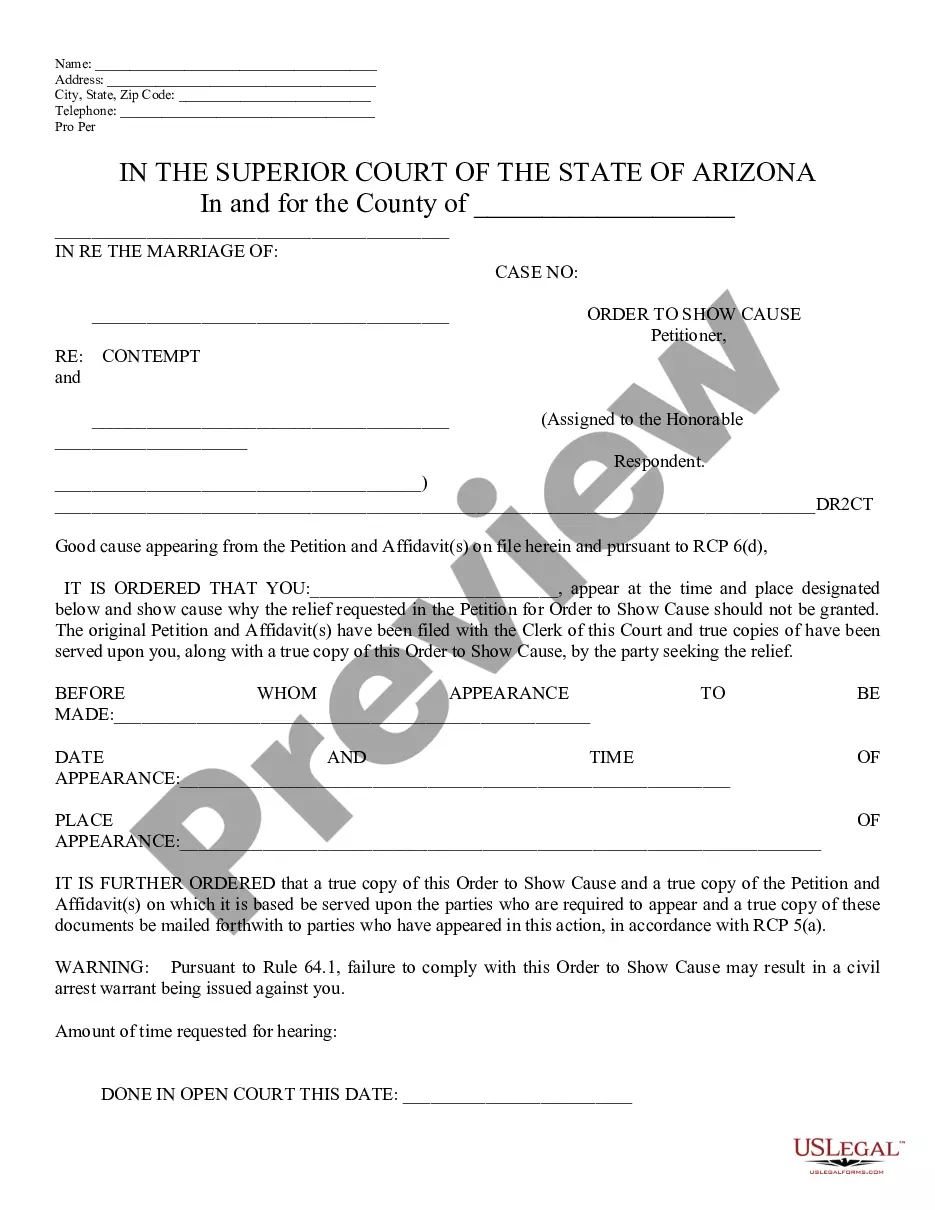

Choosing the right lawful record web template might be a struggle. Needless to say, there are a variety of web templates available online, but how would you discover the lawful develop you need? Use the US Legal Forms web site. The services offers a large number of web templates, for example the Massachusetts Appraisal Agreement - Self-Employed Independent Contractor, which can be used for enterprise and private requirements. Each of the types are examined by experts and fulfill state and federal demands.

If you are currently listed, log in to your profile and click the Download button to have the Massachusetts Appraisal Agreement - Self-Employed Independent Contractor. Make use of profile to check with the lawful types you might have purchased in the past. Check out the My Forms tab of your respective profile and obtain one more version in the record you need.

If you are a fresh consumer of US Legal Forms, listed below are easy guidelines that you can adhere to:

- Very first, make certain you have chosen the correct develop for your town/region. You can look over the form making use of the Preview button and read the form outline to guarantee it is the best for you.

- In the event the develop fails to fulfill your requirements, make use of the Seach industry to discover the appropriate develop.

- When you are sure that the form is proper, click the Buy now button to have the develop.

- Select the pricing program you desire and type in the required details. Make your profile and pay for an order using your PayPal profile or bank card.

- Pick the submit format and download the lawful record web template to your gadget.

- Full, modify and printing and sign the obtained Massachusetts Appraisal Agreement - Self-Employed Independent Contractor.

US Legal Forms is the largest library of lawful types in which you can find numerous record web templates. Use the service to download professionally-manufactured papers that adhere to condition demands.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Under no circumstances should an employer use its employee performance review process to evaluate the work done by an independent contractor. It is also advisable to require independent contrac-tors to provide periodic progress reports and to submit regular invoices as defined tar-gets are met.

Tests for Independent Contractor StatusThe degree of control. Courts focus on the degree of control the company has over the worker performing the service.The relative investment in facilities.The worker's opportunity for profit and loss.The permanency of the parties' relationship.The skill required.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you work for an employer, you're an employee. If you're self-employed, you're an independent contractor.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

California Gov. Gavin Newsom on Sept. 4 signed AB 2257, legislation that clarifies how the state's employment laws apply to services provided by state-licensed and state-certified real estate appraisers, allowing them to work as independent contractors.

Final Thoughts. Performance reviews are not only helpful for facilities managers, but they are also useful tools for contractors. Contractors want to be able to provide the best service possible, since this is how they win and retain business.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.