Massachusetts Self-Employed Plumbing Services Contract

Description

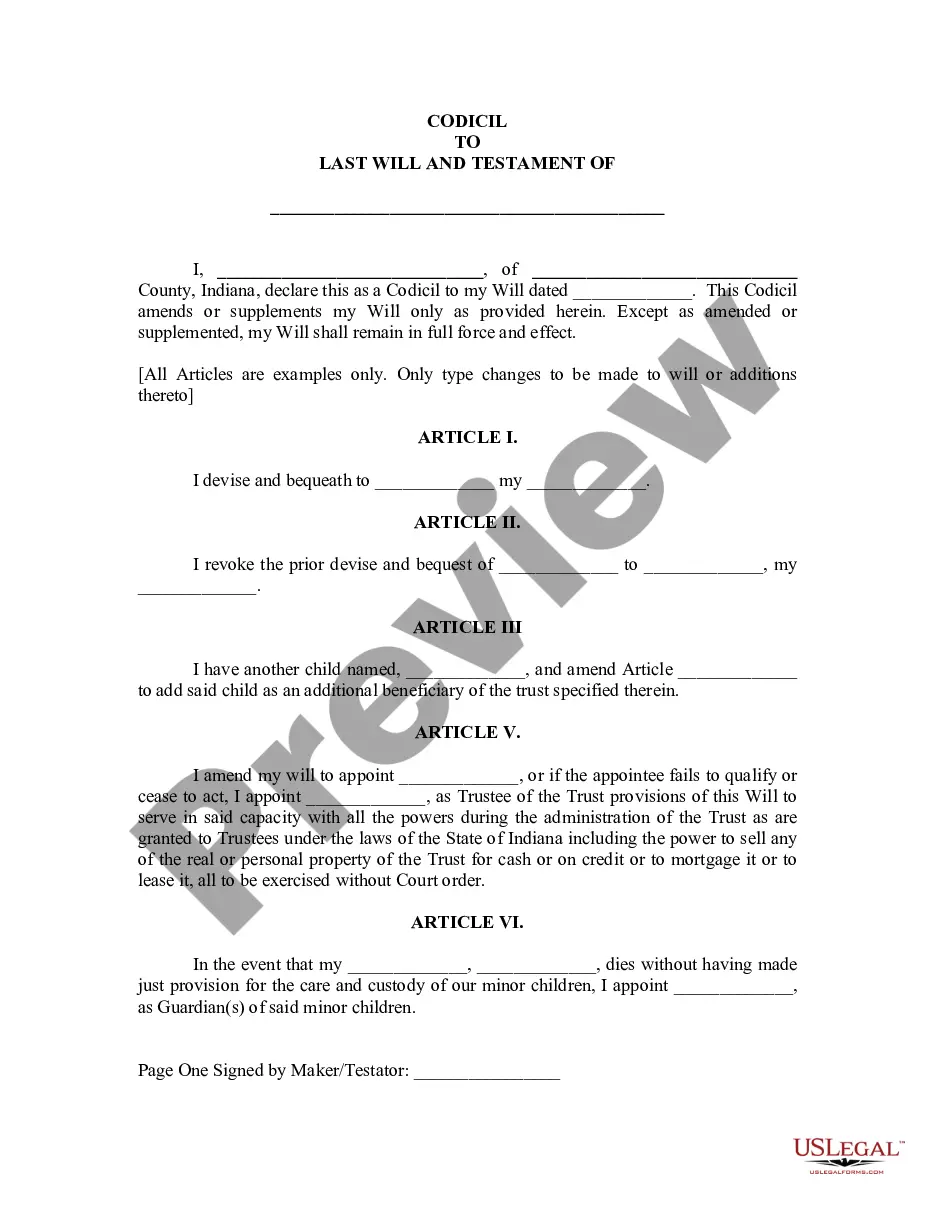

How to fill out Massachusetts Self-Employed Plumbing Services Contract?

Have you been in a position where you need to have papers for possibly company or person reasons nearly every time? There are a variety of authorized file layouts available on the Internet, but locating types you can depend on isn`t straightforward. US Legal Forms offers thousands of develop layouts, just like the Massachusetts Self-Employed Plumbing Services Contract, which can be written in order to meet state and federal specifications.

When you are presently familiar with US Legal Forms website and possess a merchant account, merely log in. After that, you may down load the Massachusetts Self-Employed Plumbing Services Contract format.

If you do not come with an account and want to begin using US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is for your right city/county.

- Make use of the Review switch to review the shape.

- See the description to actually have selected the appropriate develop.

- In the event the develop isn`t what you are seeking, utilize the Search industry to discover the develop that meets your needs and specifications.

- If you discover the right develop, click on Purchase now.

- Pick the pricing plan you want, fill out the necessary information and facts to make your money, and purchase the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a handy data file file format and down load your copy.

Locate each of the file layouts you possess purchased in the My Forms food selection. You can obtain a more copy of Massachusetts Self-Employed Plumbing Services Contract anytime, if possible. Just click the necessary develop to down load or produce the file format.

Use US Legal Forms, probably the most substantial variety of authorized kinds, to conserve time and steer clear of mistakes. The support offers professionally created authorized file layouts that you can use for an array of reasons. Generate a merchant account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

How much does a Plumber make at PLUMBERS LOCAL 12 in Boston? Average PLUMBERS LOCAL 12 Plumber yearly pay in Boston is approximately $100,000, which is 52% above the national average.

Are services subject to sales tax in Massachusetts? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Massachusetts, specified services are taxable.

A plumber who furnishes and installs material where the customer's real object of the transaction is to acquire the material is considered to be a vendor of that material. The plumber must collect sales tax on the sales price of the material sold to the customer. See Massachusetts Regulation 830 CMR 64H.

Traditional Goods or Services Goods that are subject to sales tax in Massachusetts include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, gasoline, and clothing are all tax-exempt. Some services in Massachusetts are subject to sales tax.

Services in Massachusetts are generally not taxable.

What Should Be in a Plumbing Contract?Both parties' names and contact information.Detailed outline of the project scope and depth.Detailed itemization of materials used.Written description of the service payment schedule.Types of permits required by law and local ordinances.More items...

The full price charged to the purchaser for a meal is subject to sales tax, including any mandatory service charge, unless the meal is served at a banquet or similar function.

What Should Be in a Plumbing Contract?Both parties' names and contact information.Detailed outline of the project scope and depth.Detailed itemization of materials used.Written description of the service payment schedule.Types of permits required by law and local ordinances.More items...

Massachusetts law prohibits any one but a licensed professional from installing, removing or repairing plumbing. The reasons for this may not, at first, be obvious, but public safety is of primary importance.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.