Massachusetts Self-Employed Roofing Services Agreement

Description

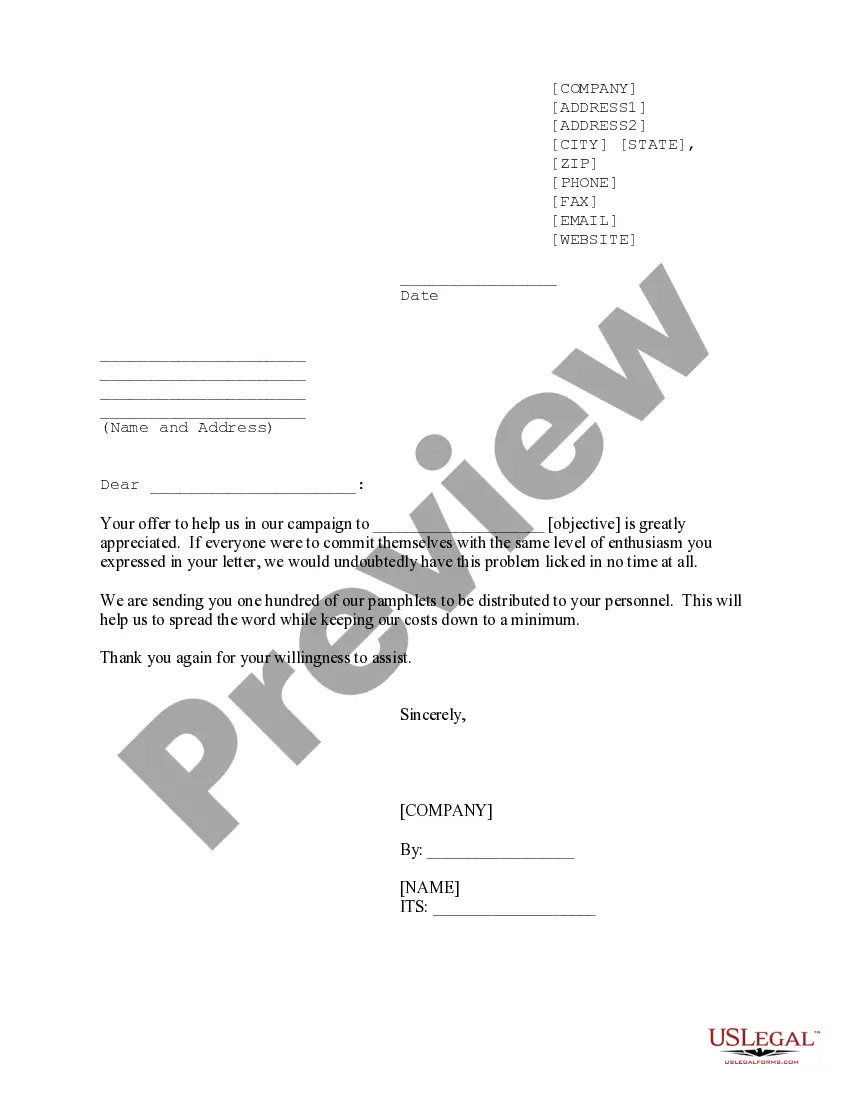

How to fill out Massachusetts Self-Employed Roofing Services Agreement?

If you have to complete, down load, or produce legitimate file web templates, use US Legal Forms, the most important collection of legitimate kinds, that can be found online. Make use of the site`s simple and easy convenient look for to find the files you need. Different web templates for enterprise and specific functions are sorted by types and says, or keywords and phrases. Use US Legal Forms to find the Massachusetts Self-Employed Roofing Services Agreement with a handful of click throughs.

In case you are currently a US Legal Forms customer, log in to the account and click on the Download switch to find the Massachusetts Self-Employed Roofing Services Agreement. You may also access kinds you formerly saved within the My Forms tab of your own account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have selected the shape for your proper area/country.

- Step 2. Use the Review method to look through the form`s information. Don`t forget to read through the description.

- Step 3. In case you are unhappy together with the kind, make use of the Search industry near the top of the screen to get other models of the legitimate kind format.

- Step 4. Once you have found the shape you need, click on the Get now switch. Pick the costs prepare you like and add your qualifications to sign up for the account.

- Step 5. Method the purchase. You should use your bank card or PayPal account to finish the purchase.

- Step 6. Pick the structure of the legitimate kind and down load it on the product.

- Step 7. Complete, revise and produce or indication the Massachusetts Self-Employed Roofing Services Agreement.

Each legitimate file format you buy is yours eternally. You might have acces to each kind you saved with your acccount. Select the My Forms section and choose a kind to produce or down load again.

Remain competitive and down load, and produce the Massachusetts Self-Employed Roofing Services Agreement with US Legal Forms. There are many skilled and status-particular kinds you can utilize for your enterprise or specific requirements.

Form popularity

FAQ

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Five Things Your Contracts Should IncludeGet it in Writing. The most important part of every contract is that it must be in writing.Be Specific in Your Terms. Your contract should be specific in its terms.Dictate Terms for Contract Termination.Confidentiality Matters.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.