Massachusetts Partition Deed for Mineral / Royalty Interests

Description

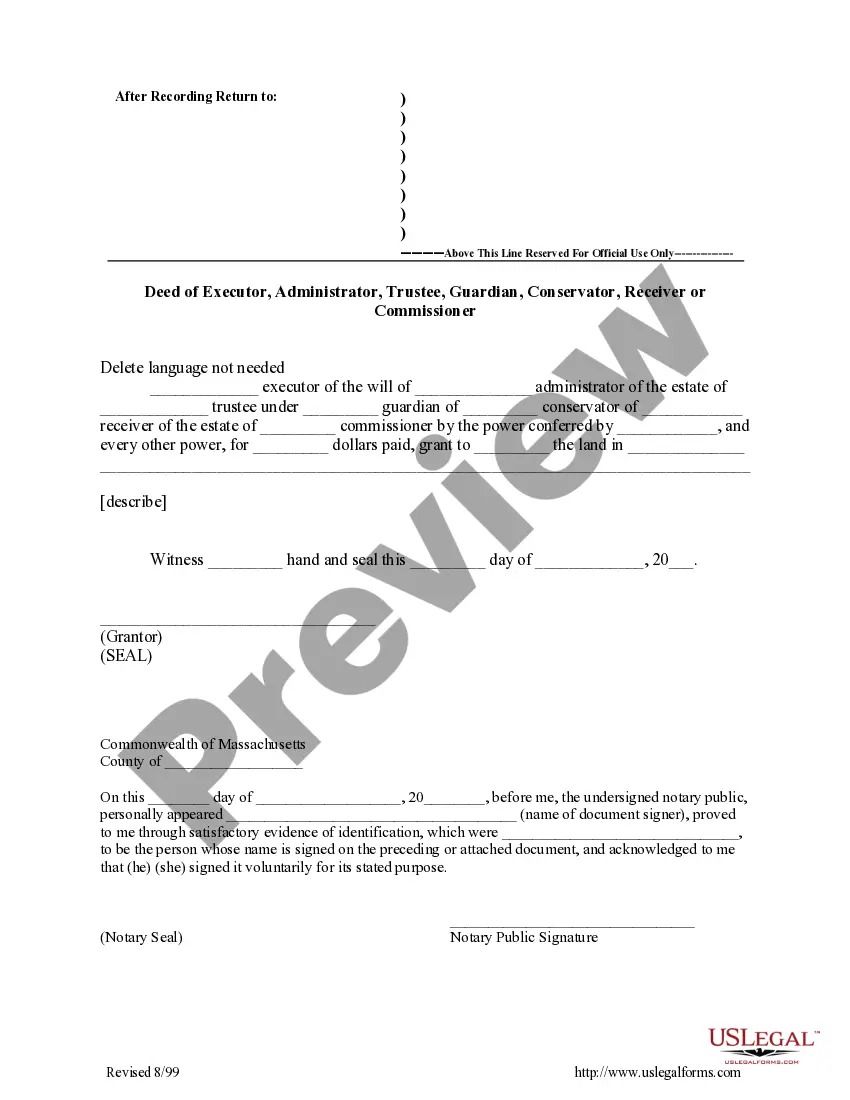

How to fill out Partition Deed For Mineral / Royalty Interests?

If you wish to full, download, or print lawful papers web templates, use US Legal Forms, the largest selection of lawful kinds, that can be found on-line. Make use of the site`s simple and easy handy search to discover the files you will need. A variety of web templates for business and individual purposes are sorted by categories and says, or search phrases. Use US Legal Forms to discover the Massachusetts Partition Deed for Mineral / Royalty Interests with a handful of mouse clicks.

In case you are already a US Legal Forms consumer, log in to the account and then click the Acquire option to obtain the Massachusetts Partition Deed for Mineral / Royalty Interests. You can also gain access to kinds you formerly downloaded inside the My Forms tab of the account.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the form to the appropriate metropolis/country.

- Step 2. Use the Preview method to look over the form`s content material. Don`t forget about to see the information.

- Step 3. In case you are not satisfied with all the form, utilize the Look for industry at the top of the display to locate other variations of your lawful form format.

- Step 4. Upon having located the form you will need, click on the Get now option. Pick the rates program you prefer and add your credentials to sign up for the account.

- Step 5. Procedure the financial transaction. You should use your Мisa or Ьastercard or PayPal account to finish the financial transaction.

- Step 6. Find the structure of your lawful form and download it on the product.

- Step 7. Total, change and print or indication the Massachusetts Partition Deed for Mineral / Royalty Interests.

Each and every lawful papers format you buy is your own property eternally. You might have acces to every form you downloaded within your acccount. Click on the My Forms area and choose a form to print or download yet again.

Contend and download, and print the Massachusetts Partition Deed for Mineral / Royalty Interests with US Legal Forms. There are millions of expert and state-certain kinds you may use for your business or individual needs.

Form popularity

FAQ

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Like surface interests, mineral interests are passed down by inheritance. If there is a valid will, it controls who gets the property. If not, Texas laws of heirship controls.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

How to transfer mineral rights in Texas? Review The Current Title. Review the current title before transferring the mineral rights. Negotiate And Execute A Transfer Agreement. An agreement should be outlined in the terms of transfer. ... Record The Transfer. ... Pay Any Fees. Mineral Rights Probate & Estate Planning - Legacy Royalties legacyroyalties.com ? oil-gas-royalties-estate-and-... legacyroyalties.com ? oil-gas-royalties-estate-and-...

?Either the landowner sells the minerals and retains the surface, or more commonly, the landowner sells the surface and retains the minerals. If the seller fails to reserve the minerals when selling the surface, the buyer automatically receives any mineral interest the grantor owned at the time of conveyance.?