Massachusetts Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

How to fill out Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

Discovering the right lawful document web template could be a battle. Needless to say, there are a lot of layouts available online, but how would you get the lawful form you require? Utilize the US Legal Forms site. The assistance offers thousands of layouts, including the Massachusetts Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer, that you can use for organization and private requires. All the forms are inspected by pros and fulfill federal and state needs.

If you are presently listed, log in in your profile and click on the Obtain button to have the Massachusetts Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer. Make use of your profile to check throughout the lawful forms you may have purchased earlier. Go to the My Forms tab of the profile and acquire an additional duplicate of the document you require.

If you are a fresh end user of US Legal Forms, here are straightforward directions that you should follow:

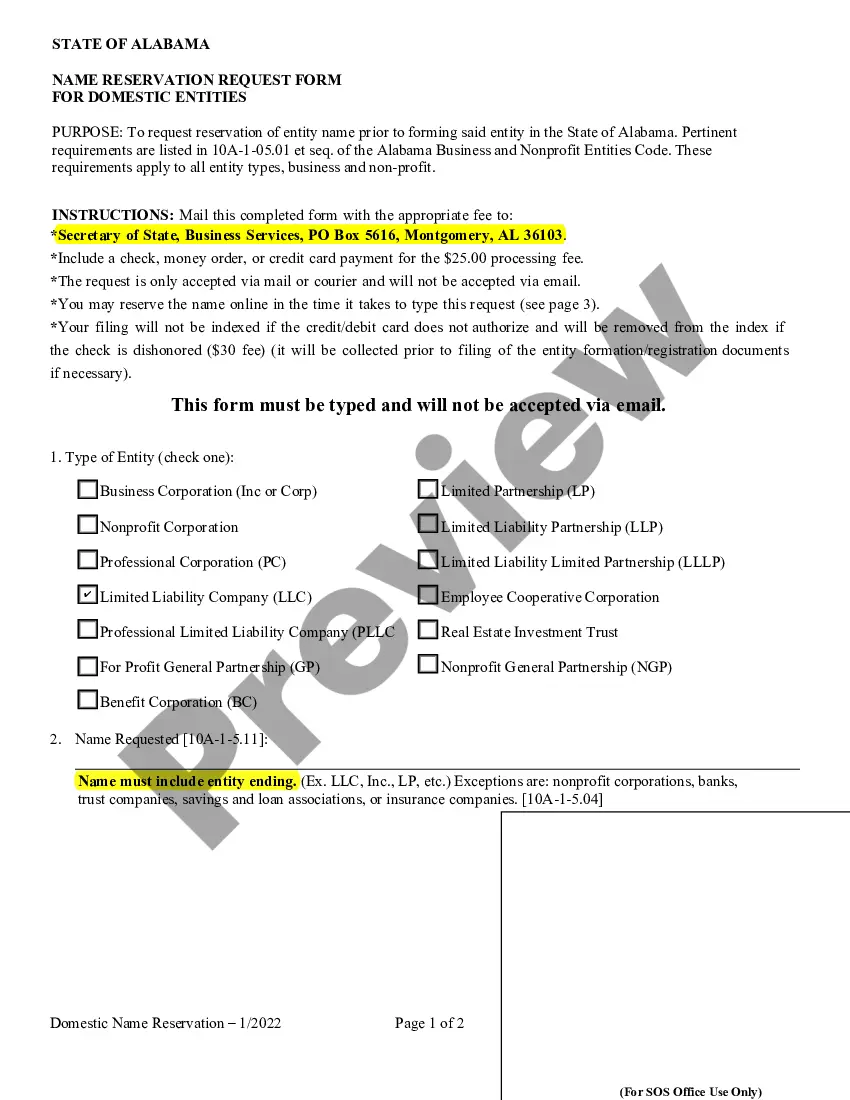

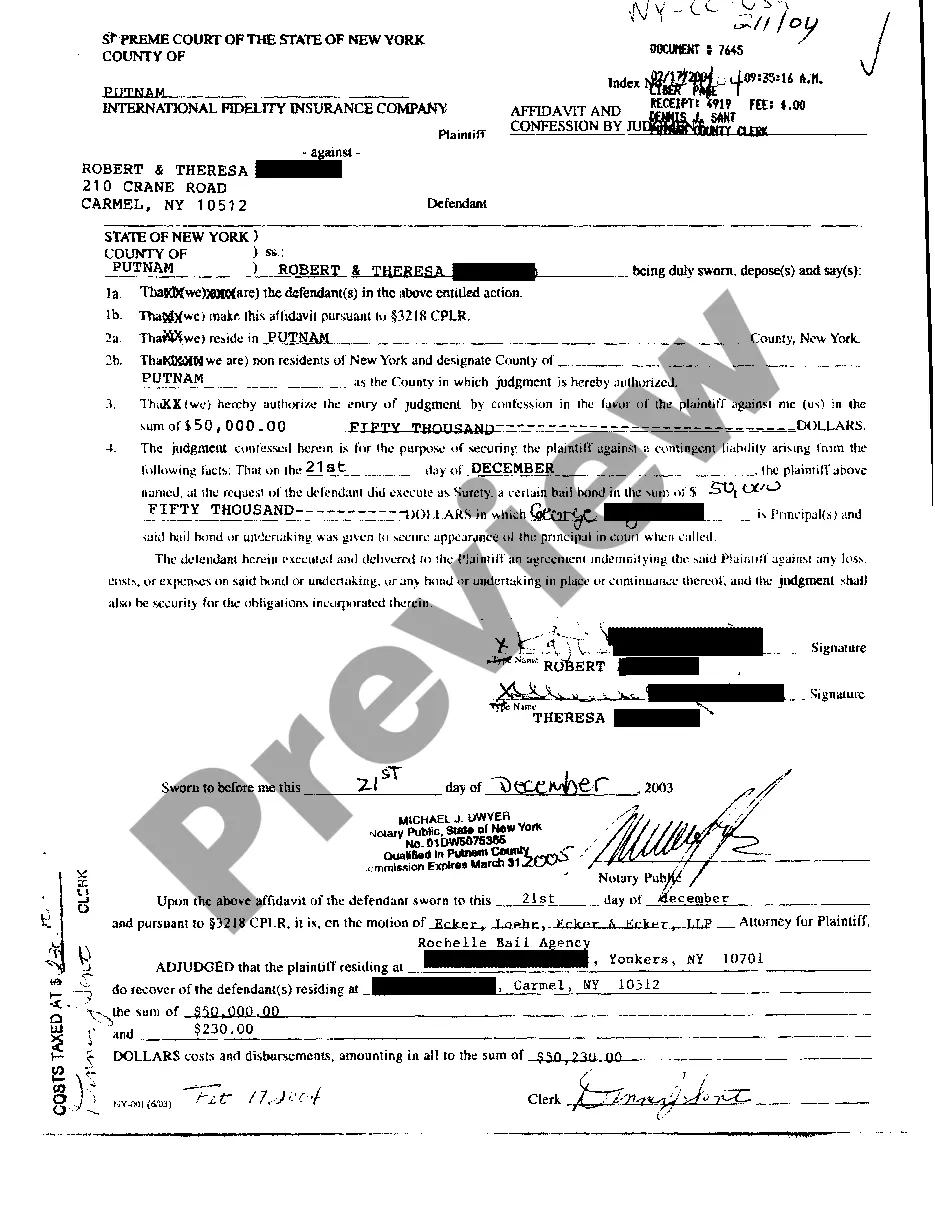

- Initially, make certain you have chosen the correct form for your metropolis/region. You are able to check out the shape while using Review button and read the shape outline to guarantee it will be the best for you.

- In case the form will not fulfill your expectations, make use of the Seach field to find the correct form.

- Once you are positive that the shape would work, click the Purchase now button to have the form.

- Choose the pricing plan you want and type in the essential information. Create your profile and pay money for an order with your PayPal profile or credit card.

- Pick the document structure and download the lawful document web template in your system.

- Complete, change and produce and signal the received Massachusetts Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer.

US Legal Forms is definitely the largest collection of lawful forms where you can discover different document layouts. Utilize the service to download professionally-made documents that follow state needs.

Form popularity

FAQ

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.

What are Outstanding and Reserved mineral rights? Outstanding mineral rights are owned by a party other than the surface owner at the time the surface was conveyed to the United States. Reserved mineral rights are those rights held by the surface owner at the time the surface was conveyed to the United States.

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage. Why Sell Your Mineral Rights - 6 Factors to Consider pheasantenergy.com ? why-sell-mineral-rights pheasantenergy.com ? why-sell-mineral-rights

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership. Why Mineral Rights Issues Can Be a Deal Buster | Mossy Oak mossyoak.com ? blogs ? conservation ? wh... mossyoak.com ? blogs ? conservation ? wh...

In general terms, the executive right holder is the party who has the right to take or authorize actions which affect the exploration and development of the mineral estate, including the right to execute oil and gas leases. Non-executive mineral interest owners do not have the power to lease the minerals. What does it mean to have the executive rights? theaustintriallawyer.com ? faqs ? what-does-... theaustintriallawyer.com ? faqs ? what-does-...

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir. How are Mineral Rights Passed Down? - Lovell, Isern & Farabough, LLP. lovell-law.net ? blog ? business-litigation lovell-law.net ? blog ? business-litigation

People sell their mineral rights for a variety of reasons. Some need immediate cash, while others are seeking to improve the quality of their lives. Most want to sell while their minerals still have value and to avoid burdening their heirs with the learning curve and management duties.