Massachusetts Acquisition Due Diligence Report

Description

How to fill out Acquisition Due Diligence Report?

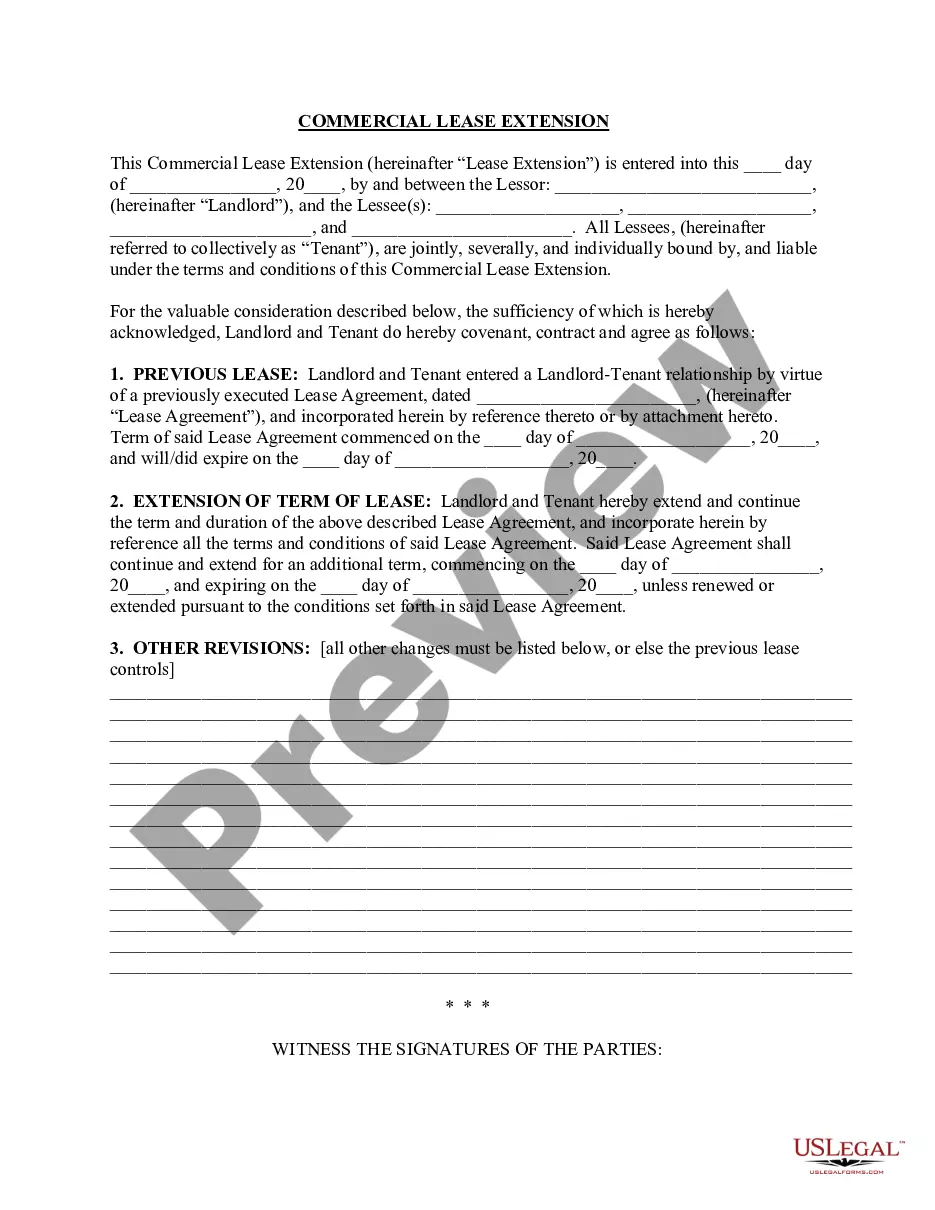

You are able to commit hours online trying to find the legitimate document design that fits the federal and state demands you need. US Legal Forms gives a huge number of legitimate kinds that happen to be reviewed by experts. You can easily acquire or produce the Massachusetts Acquisition Due Diligence Report from the services.

If you currently have a US Legal Forms accounts, you can log in and then click the Download button. Afterward, you can comprehensive, change, produce, or indication the Massachusetts Acquisition Due Diligence Report. Each and every legitimate document design you buy is the one you have forever. To get an additional duplicate for any acquired kind, visit the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms site for the first time, follow the straightforward directions beneath:

- Initial, make certain you have chosen the right document design for that county/area of your liking. See the kind description to make sure you have selected the appropriate kind. If offered, utilize the Review button to search with the document design at the same time.

- If you want to find an additional variation in the kind, utilize the Look for field to get the design that meets your needs and demands.

- Upon having identified the design you need, click Acquire now to move forward.

- Choose the rates strategy you need, type in your accreditations, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal accounts to fund the legitimate kind.

- Choose the formatting in the document and acquire it in your device.

- Make changes in your document if needed. You are able to comprehensive, change and indication and produce Massachusetts Acquisition Due Diligence Report.

Download and produce a huge number of document web templates using the US Legal Forms website, that offers the greatest collection of legitimate kinds. Use professional and status-specific web templates to deal with your company or person demands.

Form popularity

FAQ

It's true that a Masters is a big step up from an undergraduate degree. With a condensed timetable, less contact time and more focus on self-study, it's very different from what you've done before. But that doesn't mean you can't do it!

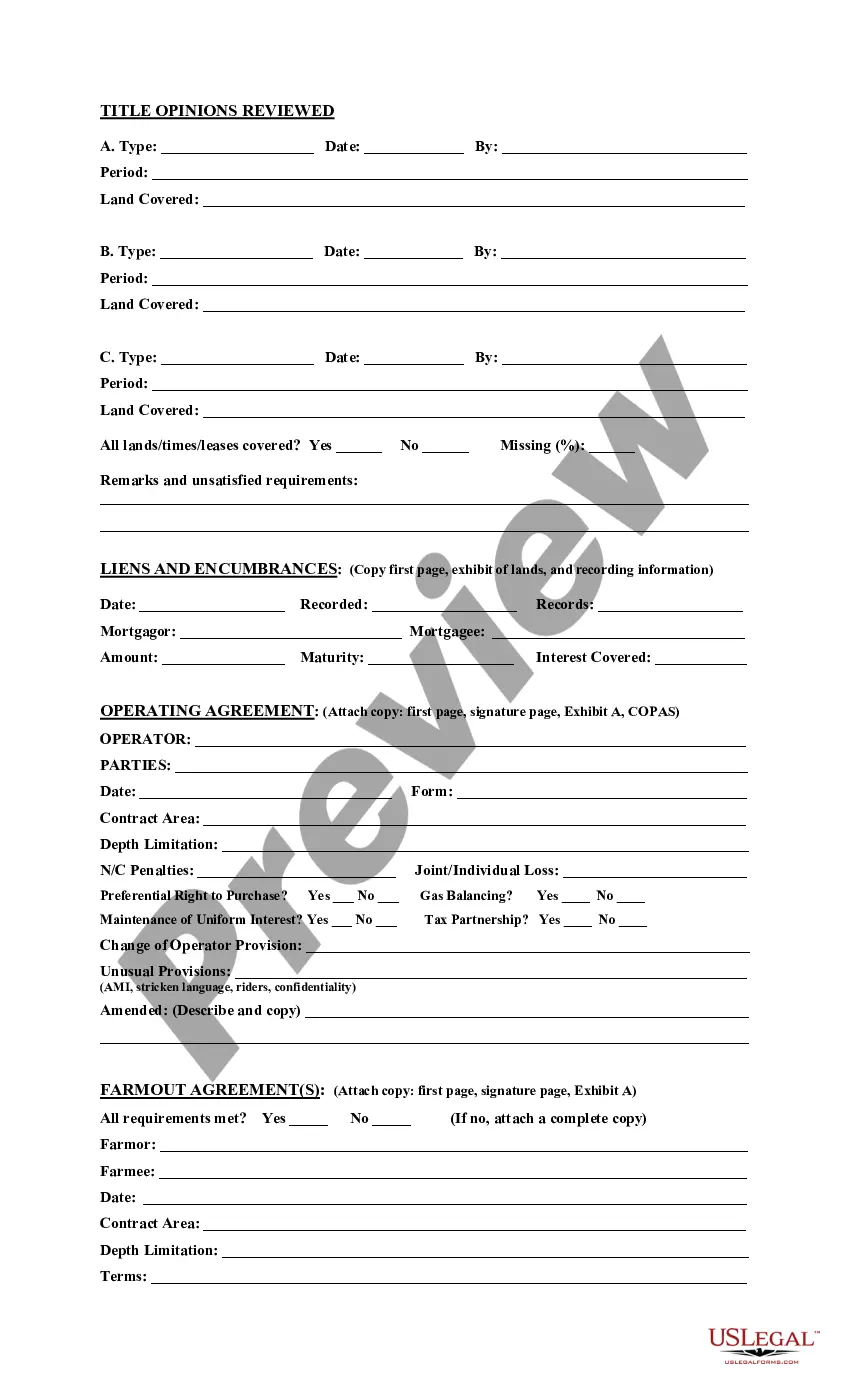

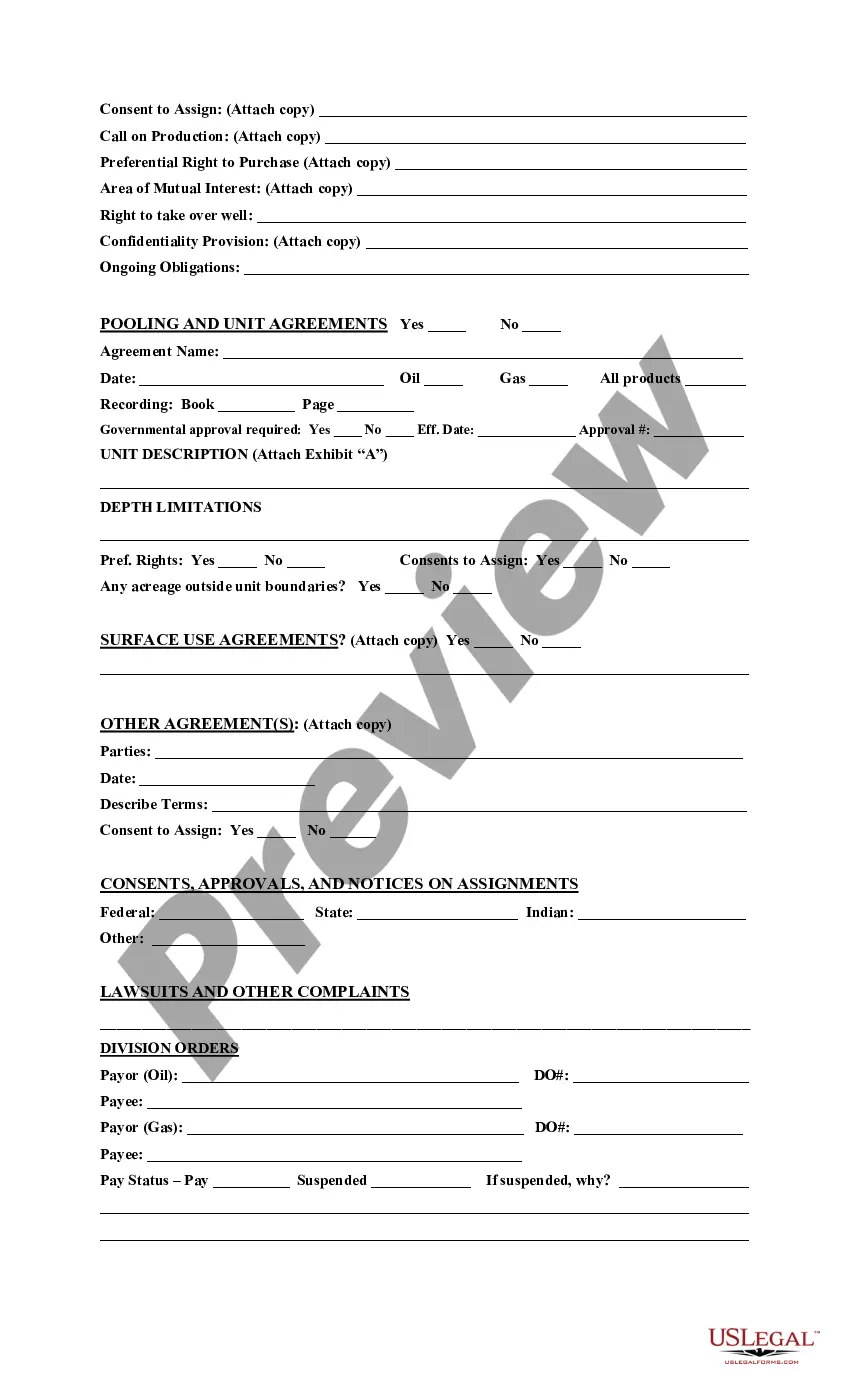

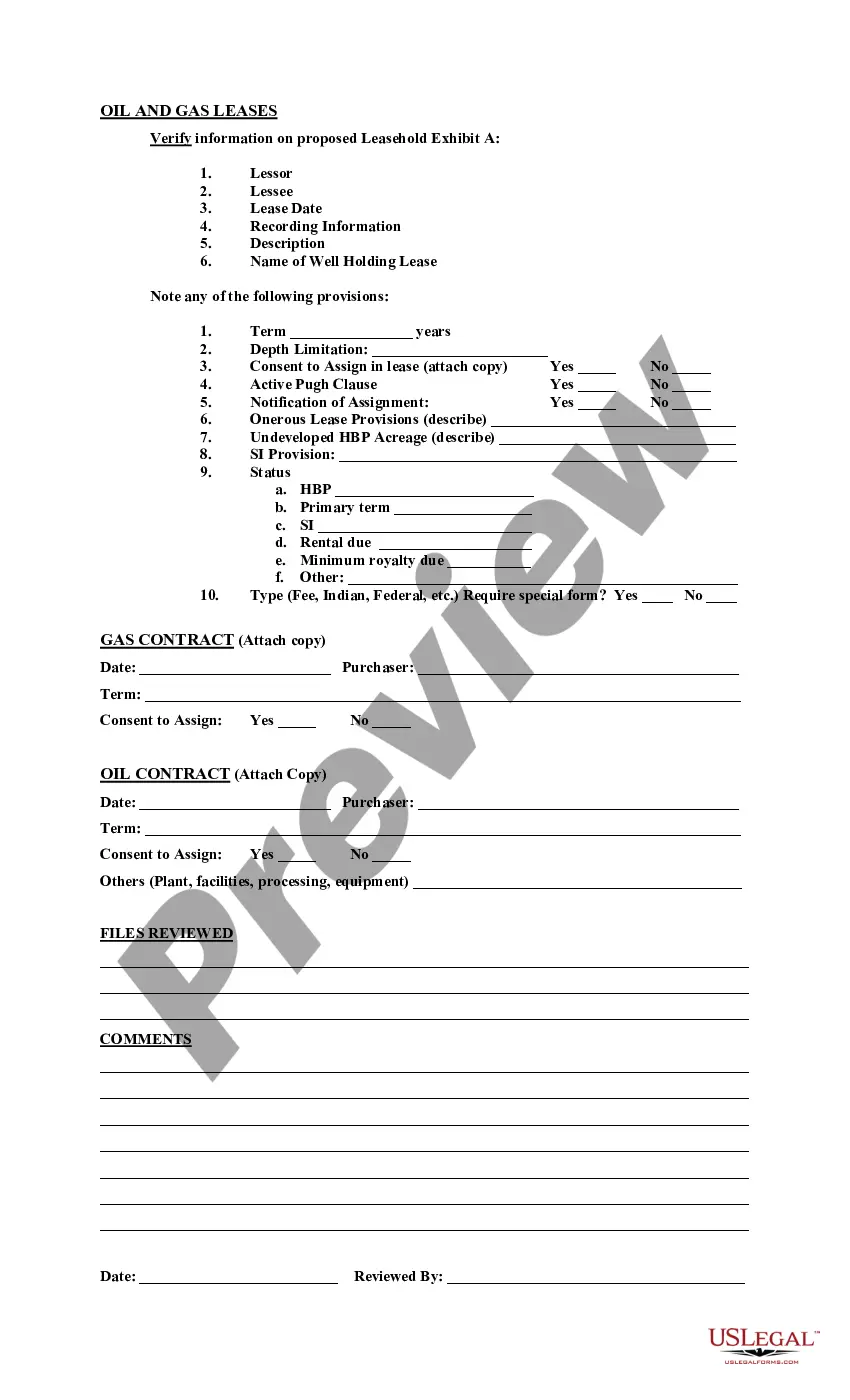

Comprehensive M&A due diligence checklist steps Handle preliminary matters. Assemble the due diligence team. Submit the due diligence request. Distribute and organize materials. Communicate and report due diligence findings. Review key sources of information. Determine whether specialist review is necessary.

Medical assistant programs or courses usually take approximately 4 to 24 months, depending on the type of course or program you opt for. Today, we'll give you a breakdown of the different training programs, how long it takes to complete a medical assistant program, and which program you should go for.

The due diligence process helps stakeholders understand the synergies and potential scalability of the businesses after the merger/acquisition. During the process, all internal and external factors that create risk in the acquisition are identified and focus is driven towards key factors that drive profitability.

Preparing for Graduate School assess your level of interest. identify the skills and education you need to launch your career. relate and apply your studies to actual work and professional settings. acquire new knowledge and skills. gain hands-on experience relevant to your area of interest.

If you're starting out on the journey towards finding the right master's program, here are some stages to follow: Choose a university. ... Decide on a specialization. ... Consider the length of the program. ... Investigate the curriculum. ... Think about your career prospects.

What Should Be in a Due Diligence Report Checklist? Information on the finances of the company. ... Information about the company's employees. ... Information on the assets of the company. ... Information on partners, suppliers, and customers. ... Legal information about the company.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.