This provision provides for the assignor to except from this assignment and reserve an overriding royalty interest of all oil, gas, casinghead gas, and other minerals that may be produced from the lands under the terms of the Leases that are the subject of this assignment.

Massachusetts Reservation of Overriding Royalty Interest

Description

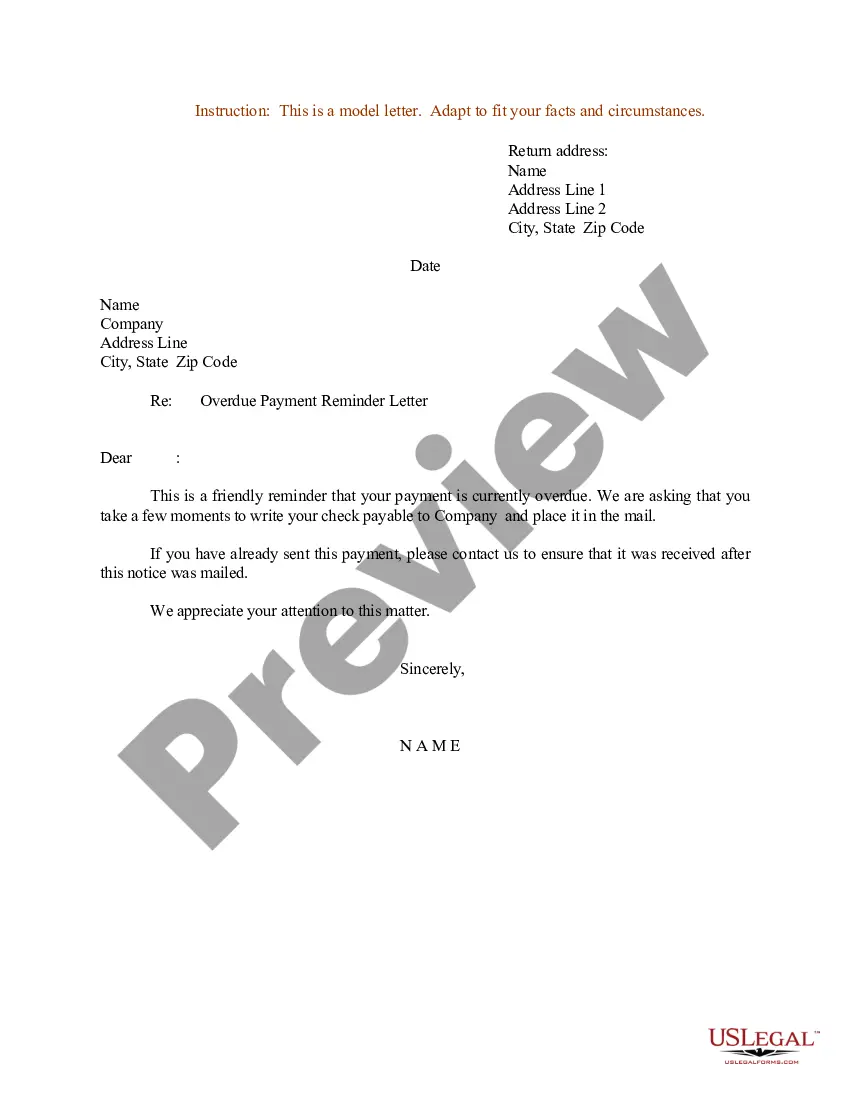

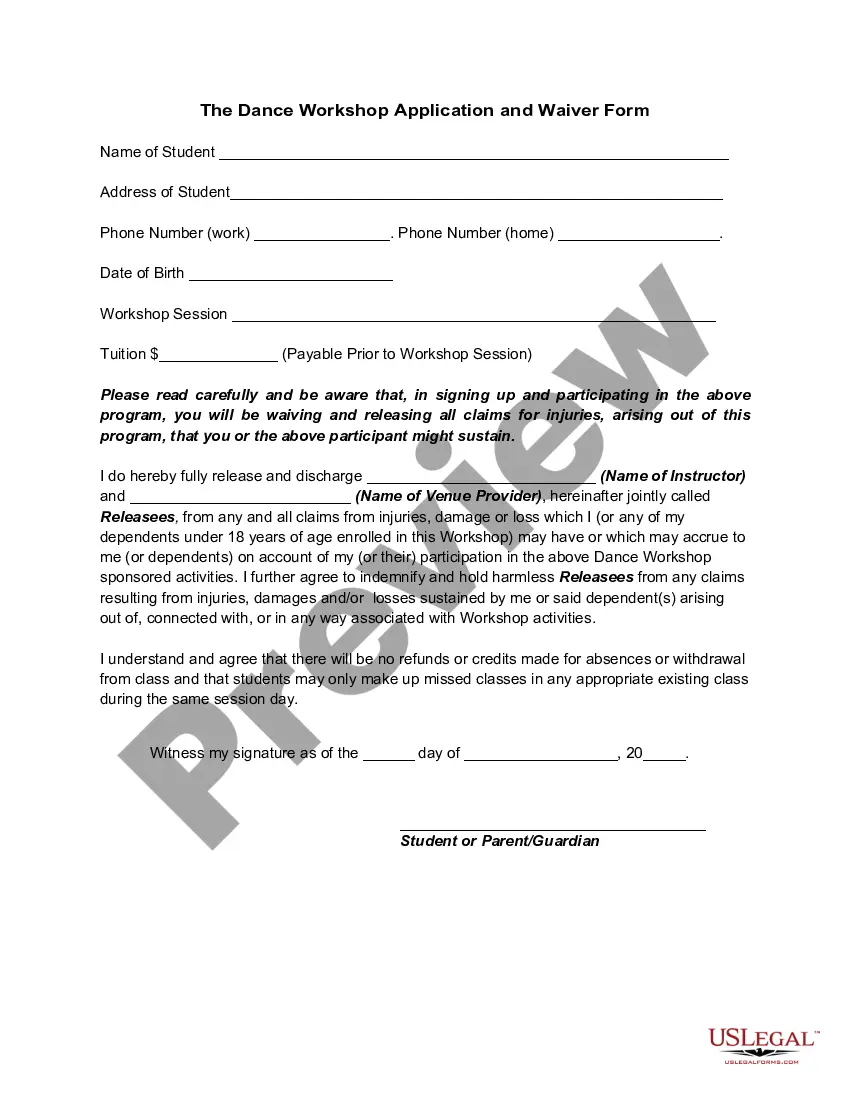

How to fill out Reservation Of Overriding Royalty Interest?

You can commit hrs online attempting to find the legitimate papers format that fits the federal and state requirements you want. US Legal Forms offers 1000s of legitimate kinds that are examined by experts. You can actually obtain or produce the Massachusetts Reservation of Overriding Royalty Interest from my support.

If you already possess a US Legal Forms accounts, you are able to log in and click the Acquire key. Next, you are able to full, revise, produce, or indication the Massachusetts Reservation of Overriding Royalty Interest. Each and every legitimate papers format you get is yours eternally. To acquire another backup for any obtained kind, check out the My Forms tab and click the related key.

If you are using the US Legal Forms internet site the first time, adhere to the basic instructions beneath:

- First, be sure that you have chosen the correct papers format to the area/metropolis of your choosing. See the kind outline to ensure you have selected the right kind. If available, utilize the Preview key to search through the papers format too.

- If you would like discover another model in the kind, utilize the Look for field to discover the format that fits your needs and requirements.

- Once you have identified the format you need, click on Acquire now to proceed.

- Find the pricing strategy you need, type your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal accounts to pay for the legitimate kind.

- Find the structure in the papers and obtain it to your product.

- Make modifications to your papers if necessary. You can full, revise and indication and produce Massachusetts Reservation of Overriding Royalty Interest.

Acquire and produce 1000s of papers layouts making use of the US Legal Forms website, which provides the biggest assortment of legitimate kinds. Use skilled and state-distinct layouts to tackle your company or person needs.

Form popularity

FAQ

The term ?non-participating? indicates that the interest owner does not share in the bonus, rentals from a lease, nor the right (or obligation) to make decisions regarding execution of those leases (i.e., no executive rights).

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Non-operating working interests include overriding royalty interests, production payments, and net profit interests. Unlike royalty interests, non-operating working interest must include a portion of the costs associated with the day-to-day operation of the well.

An NPRI owner also does not have the right to produce the minerals by himself, and they are not responsible for the operational costs associated with production or drilling. An NPRI has fewer rights than a 'regular' mineral rights owner as they do not have the right to make decisions related to the execution of leases.

An ORRI is an undivided interest in a mineral lease that gives you the right to a proportional share of the gas and oil that is produced. The overriding royalty interest is carved from the lease or working interest.