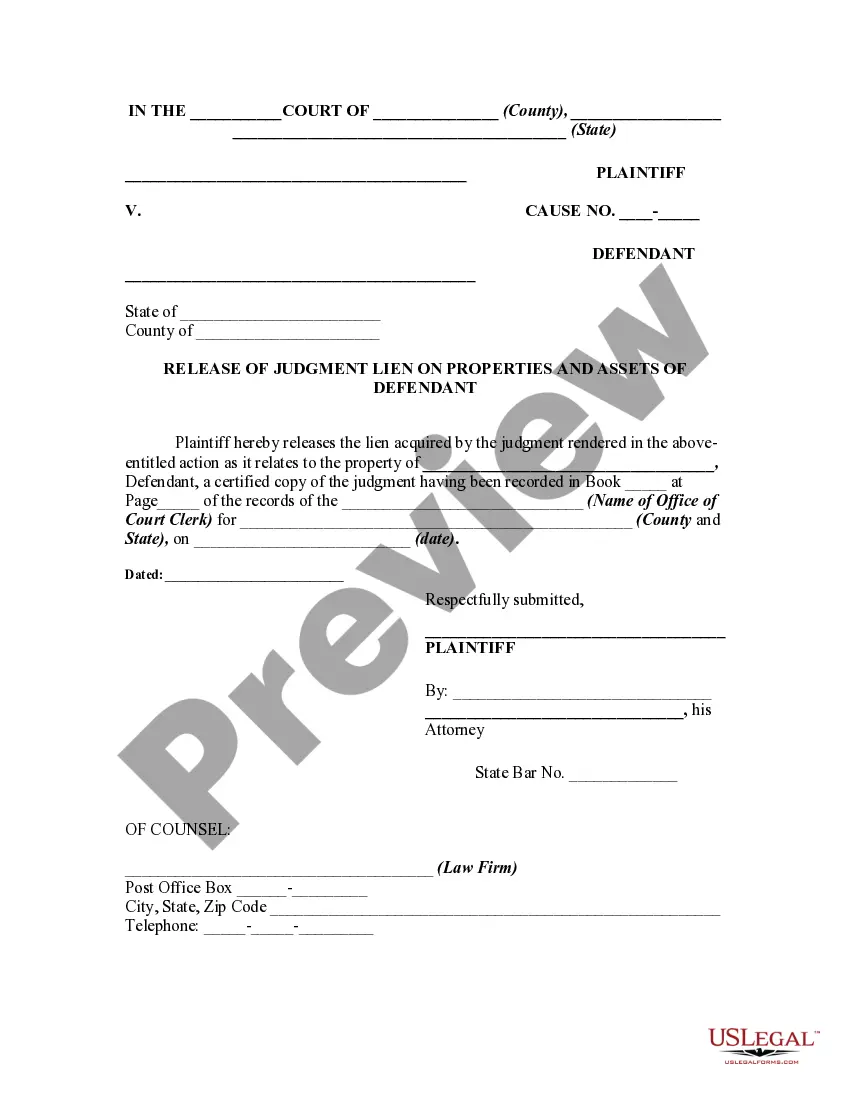

Massachusetts Release of Judgment Lien - Full Release

Description

How to fill out Release Of Judgment Lien - Full Release?

If you have to comprehensive, down load, or print lawful file templates, use US Legal Forms, the greatest selection of lawful types, which can be found on the Internet. Use the site`s basic and hassle-free search to get the documents you require. A variety of templates for enterprise and person functions are sorted by categories and states, or keywords. Use US Legal Forms to get the Massachusetts Release of Judgment Lien - Full Release within a few mouse clicks.

When you are already a US Legal Forms customer, log in to the bank account and then click the Acquire button to get the Massachusetts Release of Judgment Lien - Full Release. Also you can access types you formerly downloaded within the My Forms tab of the bank account.

If you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape to the appropriate area/country.

- Step 2. Make use of the Preview method to check out the form`s articles. Never forget to read through the information.

- Step 3. When you are not happy with all the kind, make use of the Lookup area at the top of the monitor to locate other versions of your lawful kind web template.

- Step 4. After you have identified the shape you require, select the Acquire now button. Choose the prices strategy you prefer and add your references to sign up on an bank account.

- Step 5. Process the transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Choose the file format of your lawful kind and down load it on the device.

- Step 7. Comprehensive, revise and print or signal the Massachusetts Release of Judgment Lien - Full Release.

Each lawful file web template you acquire is the one you have forever. You may have acces to every kind you downloaded with your acccount. Click the My Forms section and pick a kind to print or down load again.

Compete and down load, and print the Massachusetts Release of Judgment Lien - Full Release with US Legal Forms. There are many skilled and status-distinct types you can utilize for your enterprise or person demands.

Form popularity

FAQ

How Can I Get Rid of my Judgement Lien in Massachusetts? Contact the creditor that filed the lien and try to come to a deal with them directly. Make payment arrangements with the creditor if you cannot pay in full. Simply pay the lien amount in full.

(a) Unless the tax imposed by this chapter is sooner paid in full, it shall be a lien for ten years from the date of death upon the Massachusetts gross estate of the decedent, except that such part of the Massachusetts gross estate as is used for the payment of charges against the estate and expenses of its ...

A Municipal Lien Certificate is a legal document that lists all unpaid taxes, assessments, and utility charges on a particular parcel. All requests must contain a parcel number, the property location, and the current owner's name. A self-addressed stamped envelope must be sent with the request.

How long does a judgment lien last in Massachusetts? A judgment lien in Massachusetts will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or 30 days (for liens on personal property).

Tax Lien Certificates and Tax Deeds in Massachusetts MA. By law Massachusetts can have tax lien sales, but most municipalities conduct tax deed sales instead. 16%, but municipalities do not conduct tax lien sales. Following a tax deed sale there is no right of redemption.

The standard method of obtaining a release of estate tax lien is to file an estate tax return with the Massachusetts Department of Revenue (DOR) and obtain from the DOR a Release of Estate Tax Lien, known as an M-792 certificate. This is the required method when dealing with estates that are worth $1,000,000 or more.

Full Release of Lien. A taxpayer that wants to obtain a full release of a lien must pay the amount shown on the lien plus any additional interest and penalties accrued to the date of payment.