A Massachusetts Release of Lien, also known as a lien release or lien discharge, is a legal document that removes a previous lien on a property, typically filed by a creditor or contractor, to ensure payment for services rendered or debt owed. Once the lien is released, the property can be freely bought, sold, or refinanced without any encumbrances. There are two main types of Massachusetts Release of Lien: 1. Voluntary Release of Lien: This type of release is initiated by the lien holder (the party who placed the lien) once the debt or obligation has been satisfied. The lien holder acknowledges the receipt of the payment, removes the lien from the property, and provides the property owner with a release of lien document. 2. Involuntary Release of Lien: In certain circumstances, a property owner can request an involuntary release of lien when they believe that the lien was placed wrongfully or without sufficient legal grounds. They can challenge the lien in court, and if successful, the court will order the release of the lien, protecting the property owner's rights. Keywords: Massachusetts Release of Lien, Massachusetts lien release, lien discharge, voluntary release of lien, involuntary release of lien, property encumbrances, creditor lien, contractor lien, lien holder, debt satisfaction.

Massachusetts Release of Lien

Description

How to fill out Massachusetts Release Of Lien?

You may spend time online trying to find the authorized papers format that fits the state and federal needs you need. US Legal Forms supplies a large number of authorized types that are examined by pros. It is possible to acquire or printing the Massachusetts Release of Lien from my assistance.

If you currently have a US Legal Forms profile, you may log in and click the Download switch. Afterward, you may comprehensive, revise, printing, or indication the Massachusetts Release of Lien. Every authorized papers format you purchase is the one you have permanently. To acquire an additional version for any obtained kind, visit the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms website the very first time, follow the straightforward directions beneath:

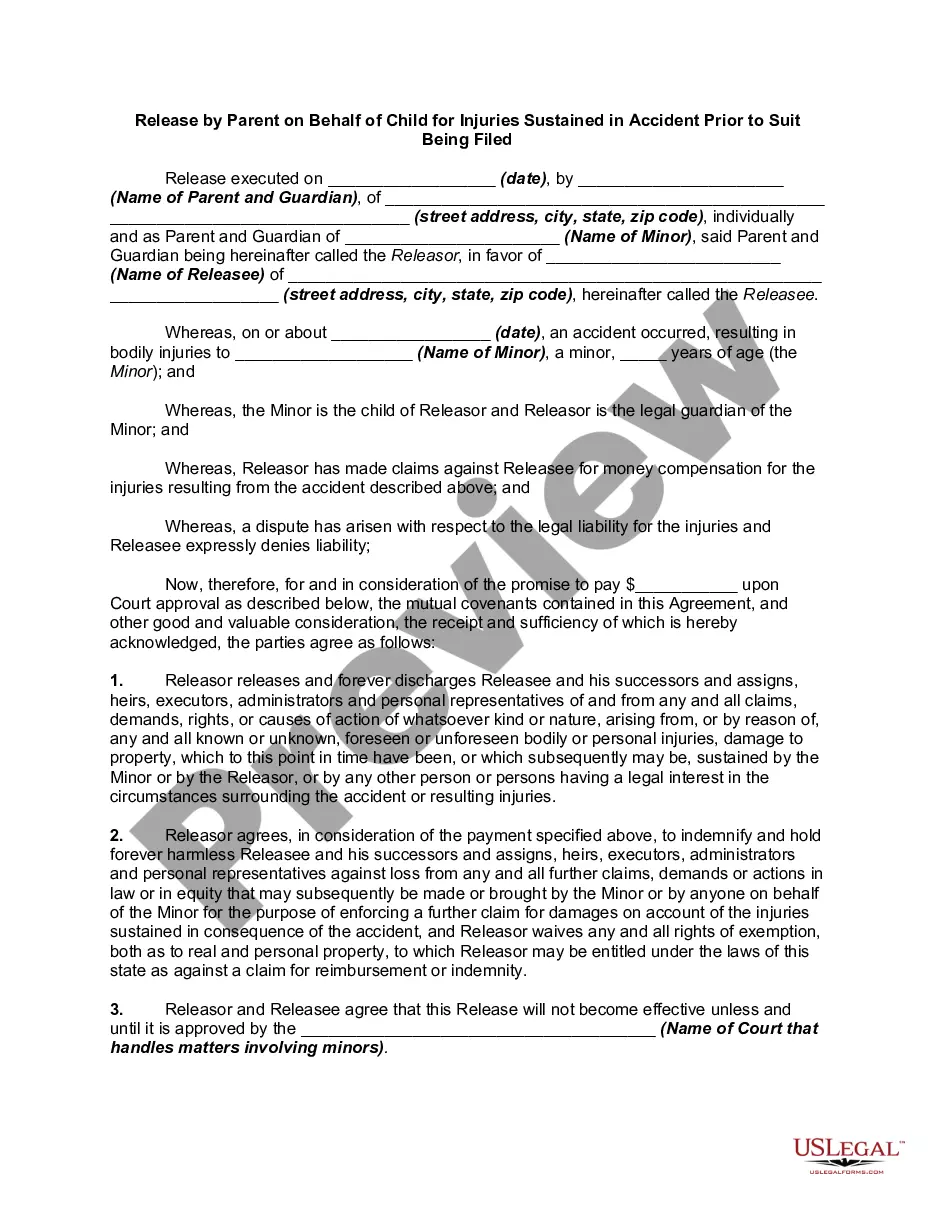

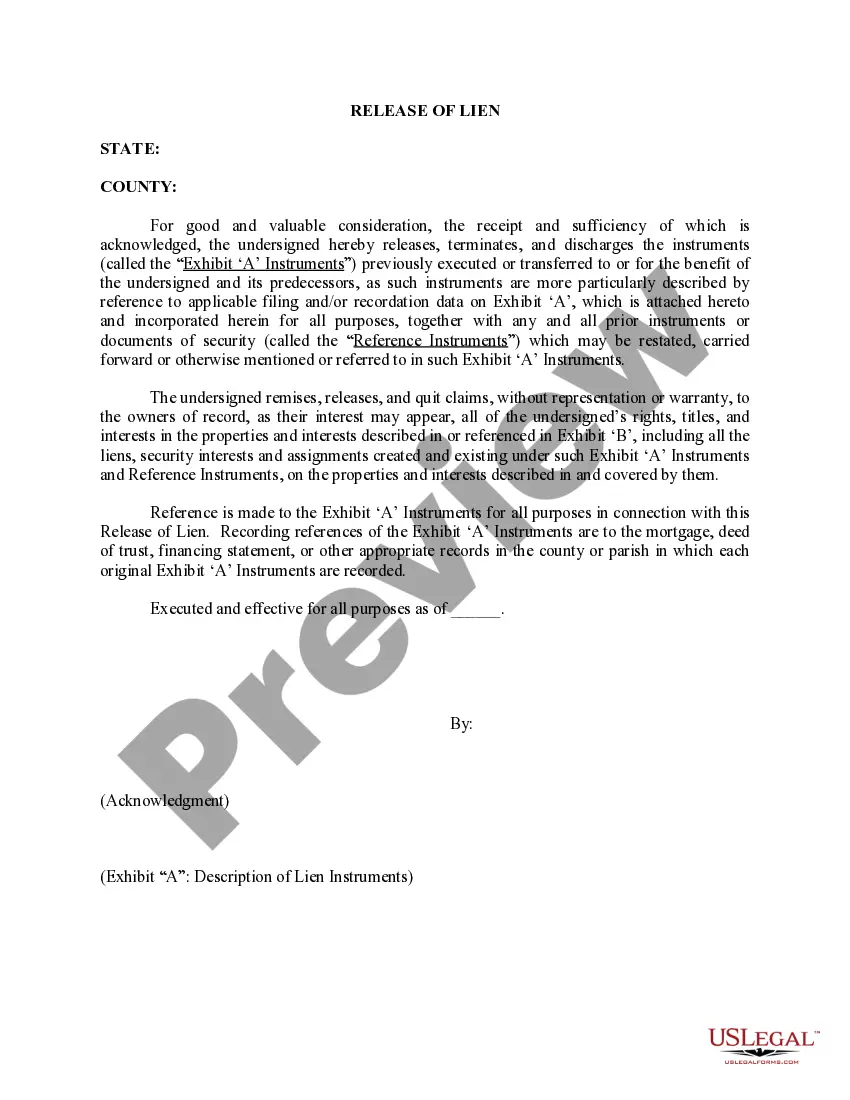

- First, make sure that you have selected the best papers format for the state/metropolis of your choosing. Read the kind explanation to ensure you have selected the right kind. If accessible, take advantage of the Review switch to appear throughout the papers format at the same time.

- In order to discover an additional variation of the kind, take advantage of the Search area to obtain the format that fits your needs and needs.

- After you have identified the format you desire, click Acquire now to move forward.

- Find the prices program you desire, type in your references, and sign up for an account on US Legal Forms.

- Complete the deal. You may use your credit card or PayPal profile to fund the authorized kind.

- Find the file format of the papers and acquire it to your gadget.

- Make modifications to your papers if possible. You may comprehensive, revise and indication and printing Massachusetts Release of Lien.

Download and printing a large number of papers web templates utilizing the US Legal Forms website, which offers the most important collection of authorized types. Use expert and condition-specific web templates to handle your organization or personal demands.

Form popularity

FAQ

This form must be completed to obtain a release of estate tax lien in cases where the estate is selling or refinancing real es- tate which is includible in the decedent's estate, and the transac- tion is occurring sooner than nine months after the decedent's death and a Massachusetts estate tax will be due.

Tax Lien Certificates and Tax Deeds in Massachusetts MA. By law Massachusetts can have tax lien sales, but most municipalities conduct tax deed sales instead. 16%, but municipalities do not conduct tax lien sales. Following a tax deed sale there is no right of redemption.

Technically, there is a statute of limitation on the lien of 20 years which, if expired, may result in the lien being extinguished.

A Municipal Lien Certificate is a legal document that lists all unpaid taxes, assessments, and utility charges on a particular parcel. All requests must contain a parcel number, the property location, and the current owner's name. A self-addressed stamped envelope must be sent with the request.

(a) Unless the tax imposed by this chapter is sooner paid in full, it shall be a lien for ten years from the date of death upon the Massachusetts gross estate of the decedent, except that such part of the Massachusetts gross estate as is used for the payment of charges against the estate and expenses of its ...

The standard method of obtaining a release of estate tax lien is to file an estate tax return with the Massachusetts Department of Revenue (DOR) and obtain from the DOR a Release of Estate Tax Lien, known as an M-792 certificate. This is the required method when dealing with estates that are worth $1,000,000 or more.

Full Release of Lien. A taxpayer that wants to obtain a full release of a lien must pay the amount shown on the lien plus any additional interest and penalties accrued to the date of payment.