Massachusetts Due Diligence List

Description

How to fill out Due Diligence List?

Finding the right legitimate record template can be quite a have difficulties. Of course, there are tons of layouts available on the Internet, but how would you find the legitimate type you will need? Take advantage of the US Legal Forms internet site. The support offers a huge number of layouts, for example the Massachusetts Due Diligence List, that you can use for business and private requirements. All of the kinds are inspected by professionals and fulfill federal and state requirements.

Should you be previously authorized, log in to the bank account and click on the Obtain switch to get the Massachusetts Due Diligence List. Make use of bank account to appear from the legitimate kinds you may have ordered previously. Proceed to the My Forms tab of your own bank account and get an additional version in the record you will need.

Should you be a whole new customer of US Legal Forms, allow me to share basic recommendations for you to stick to:

- Initially, be sure you have chosen the appropriate type for the city/county. You may examine the shape utilizing the Preview switch and read the shape outline to ensure it is the best for you.

- In case the type does not fulfill your requirements, utilize the Seach discipline to discover the right type.

- Once you are certain that the shape is suitable, click the Acquire now switch to get the type.

- Select the rates plan you need and enter in the needed details. Create your bank account and pay for your order making use of your PayPal bank account or charge card.

- Choose the file file format and obtain the legitimate record template to the device.

- Full, revise and print out and indication the obtained Massachusetts Due Diligence List.

US Legal Forms may be the greatest collection of legitimate kinds in which you will find numerous record layouts. Take advantage of the service to obtain expertly-made documents that stick to condition requirements.

Form popularity

FAQ

Due Diligence Examples A business exhaustively examining another to determine whether it is a sound investment prior to initiating a merger. Consumers reading reviews online prior to purchasing an item or service. People checking their bank accounts and credit cards frequently to ensure that there is no unusual ...

There are many possible examples of due diligence. Some common examples include investigating the financials of a company before making an investment, researching a person's background before hiring them, or reviewing environmental impact reports before committing to a construction project.

The due diligence guidelines for third parties involve gathering information about the third party's background, financial stability, legal and compliance history, business practices, and overall reputation.

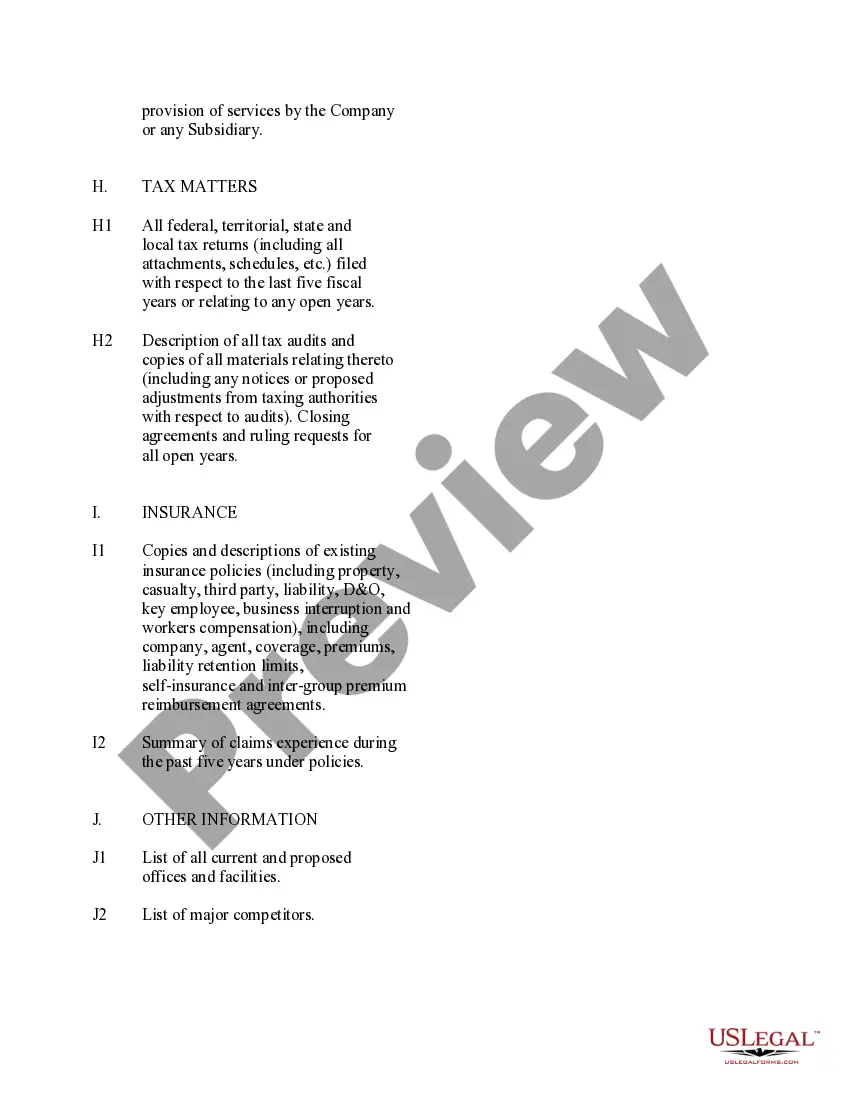

A due diligence checklist is a way to analyze a company that you are acquiring through a sale or merger. In the context of an M&A transaction, ?due diligence? describes a thorough and methodical investigation and assessment.

Top due diligence questions every VC firm should be asking General company information. Detailed company activity. Contracts and commitments. Competitor information. Accounting and finance. Asset information. Employment information. Risk and compliance.

Due diligence is the steps an organization takes to thoroughly investigate and verify an entity before initiating a business arrangement, whether that's with a vendor, a third party or a client. In the general business sense, due diligence means vetting issues that affect the business thoughtfully and carefully.

Other examples of hard due diligence activities include: Reviewing and auditing financial statements. Scrutinizing projections for future performance. Analyzing the consumer market. Seeking operating redundancies that can be eliminated. Reviewing potential or ongoing litigation. Reviewing antitrust considerations.

Due diligence falls into three main categories: legal due diligence. financial due diligence. commercial due diligence.