Massachusetts Clauses Relating to Accounting Matters In the state of Massachusetts, there are specific clauses and regulations pertaining to accounting matters that businesses and individuals must adhere to. These clauses aim to promote transparency, accuracy, and accountability in financial reporting and ensure compliance with state laws. One crucial clause is the "Massachusetts General Laws Chapter 156B, Section 42," which addresses accounting matters related to corporations. This particular clause requires corporations operating in Massachusetts to maintain accurate financial records and accounts. It further mandates that corporations must prepare annual financial statements within 120 days after the end of their fiscal year. Another important clause is the "Massachusetts General Laws Chapter 71, Section 38Q." This clause relates to accounting matters specifically for public schools and education departments in Massachusetts. It outlines the requirements for recording and reporting financial transactions, including budget preparation, revenue collection, and expenditure tracking. Compliance with this clause is crucial to ensure transparency and proper allocation of funds within the education system. One more significant clause is the "Massachusetts General Laws Chapter 156D, Section 16.02." This clause applies to limited liability companies (LCS) operating in Massachusetts. It governs accounting matters within the LCS and emphasizes the importance of maintaining accurate financial records and statements. It also sets guidelines for the distribution of profits and losses among LLC members, ensuring fair and equitable allocation. Furthermore, Massachusetts has specific clauses regarding tax accounting matters, such as the "Massachusetts General Laws Chapter 62C, Section 25A." This clause defines the criteria for determining Massachusetts taxable income and provides guidelines for tax accounting methods. It helps businesses and individuals calculate their tax liabilities accurately and remain compliant with the state's tax regulations. Overall, Massachusetts Clauses Relating to Accounting Matters encompass a range of key provisions applicable to various entities and industries. Adhering to these clauses ensures uniformity, accuracy, and transparency in financial reporting, bolstering the trust and integrity of Massachusetts' business environment.

Massachusetts Clauses Relating to Accounting Matters

Description

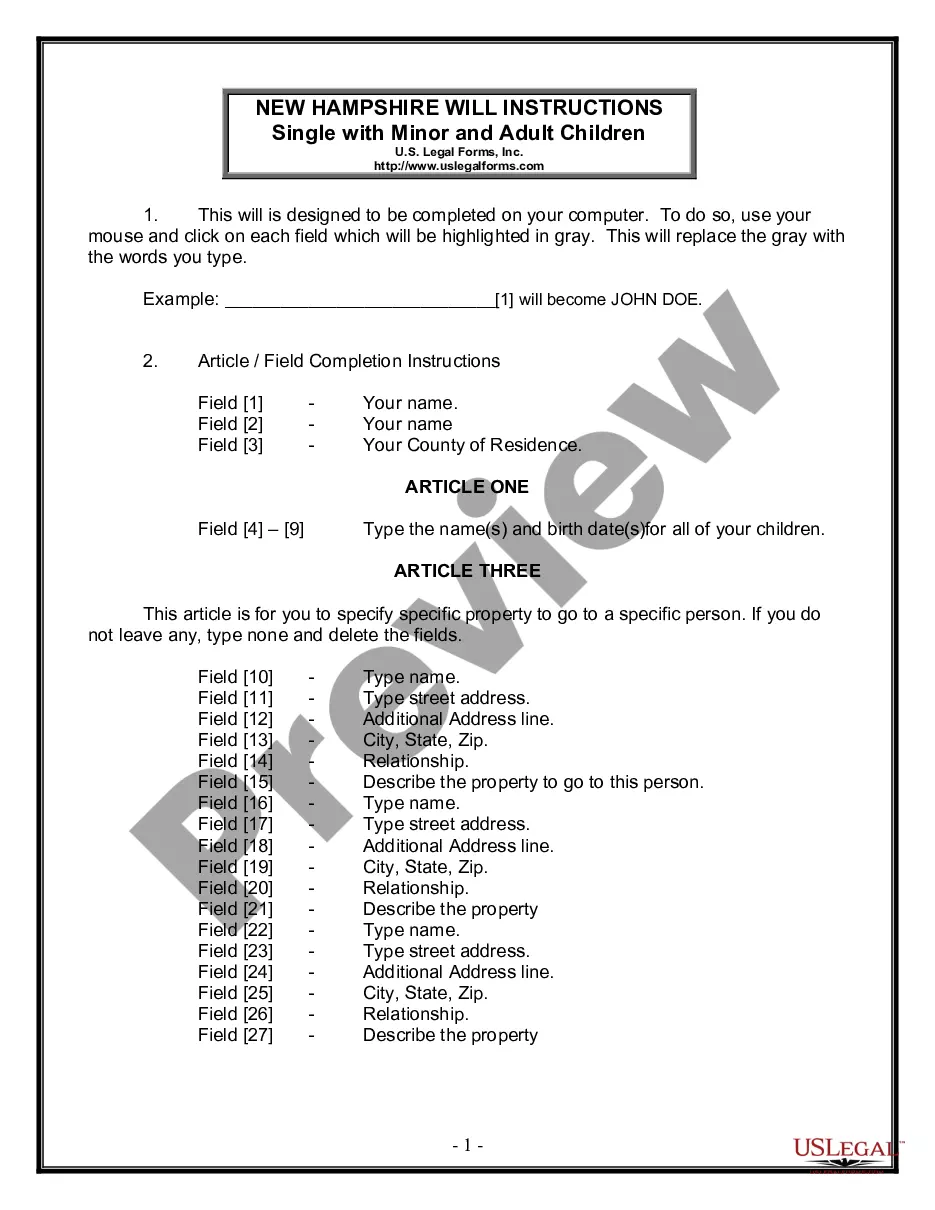

How to fill out Massachusetts Clauses Relating To Accounting Matters?

You may spend several hours on the web attempting to find the legitimate file template that meets the state and federal demands you require. US Legal Forms gives a large number of legitimate kinds that happen to be reviewed by specialists. It is possible to down load or print the Massachusetts Clauses Relating to Accounting Matters from the services.

If you already possess a US Legal Forms accounts, you can log in and click on the Obtain key. Following that, you can complete, change, print, or indicator the Massachusetts Clauses Relating to Accounting Matters. Each legitimate file template you buy is your own permanently. To have another copy associated with a purchased develop, go to the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms internet site initially, adhere to the simple recommendations listed below:

- Very first, ensure that you have chosen the best file template for the state/town that you pick. Browse the develop description to make sure you have selected the correct develop. If accessible, use the Preview key to search from the file template at the same time.

- If you wish to find another variation of your develop, use the Research area to find the template that meets your requirements and demands.

- Once you have identified the template you would like, click on Buy now to move forward.

- Pick the pricing plan you would like, key in your qualifications, and sign up for an account on US Legal Forms.

- Total the purchase. You should use your credit card or PayPal accounts to pay for the legitimate develop.

- Pick the formatting of your file and down load it for your device.

- Make changes for your file if possible. You may complete, change and indicator and print Massachusetts Clauses Relating to Accounting Matters.

Obtain and print a large number of file web templates while using US Legal Forms Internet site, which offers the most important assortment of legitimate kinds. Use expert and state-certain web templates to take on your organization or person needs.

Form popularity

FAQ

Board of Accountancy (BOA) is the professional board of Certified Public Accountants in the Philippines under Professional Regulation Commission (PRC), a government agency administered to register and regulate professionals in the Philippines.

Every two years, you will need to submit a license renewal application and fee to the Division of Public Licensure and provide evidence of completion of 80 hours (credits) of Continuing Professional Education (CPE) that includes four credits in professional ethics.

Contracts & Legal Definition: A Basic Ordering Agreement (BOA) is a written agreement that contains pre-negotiated contract conditions applicable to future procurements between the parties during the agreement's term.

A Basic Ordering Agreement is a written instrument of understanding, negotiated between an agency, contracting activity, or contracting office and a contractor, that contains (1) terms and clauses applying to future contracts (orders) between the parties during its term, (2) a description, as specific as practicable, ...

2. Accounting (ACCG) Accounting (ACCG) definition: A systematic way of recording and reporting financial transactions for a business or organization.

Definition of Bill Of Activities (boa) Sequential list of activities performed in producing a unit of service and the associated costs of resources consumed.