Discovering the right legal document design might be a struggle. Naturally, there are plenty of layouts available on the net, but how do you get the legal type you want? Utilize the US Legal Forms website. The services gives 1000s of layouts, for example the Massachusetts Personal Property Inventory Questionnaire, that you can use for business and private requirements. All of the varieties are checked out by professionals and meet state and federal specifications.

Should you be previously listed, log in to your account and click the Download switch to get the Massachusetts Personal Property Inventory Questionnaire. Make use of account to search from the legal varieties you have ordered earlier. Visit the My Forms tab of the account and obtain another copy of the document you want.

Should you be a whole new user of US Legal Forms, listed below are basic instructions for you to comply with:

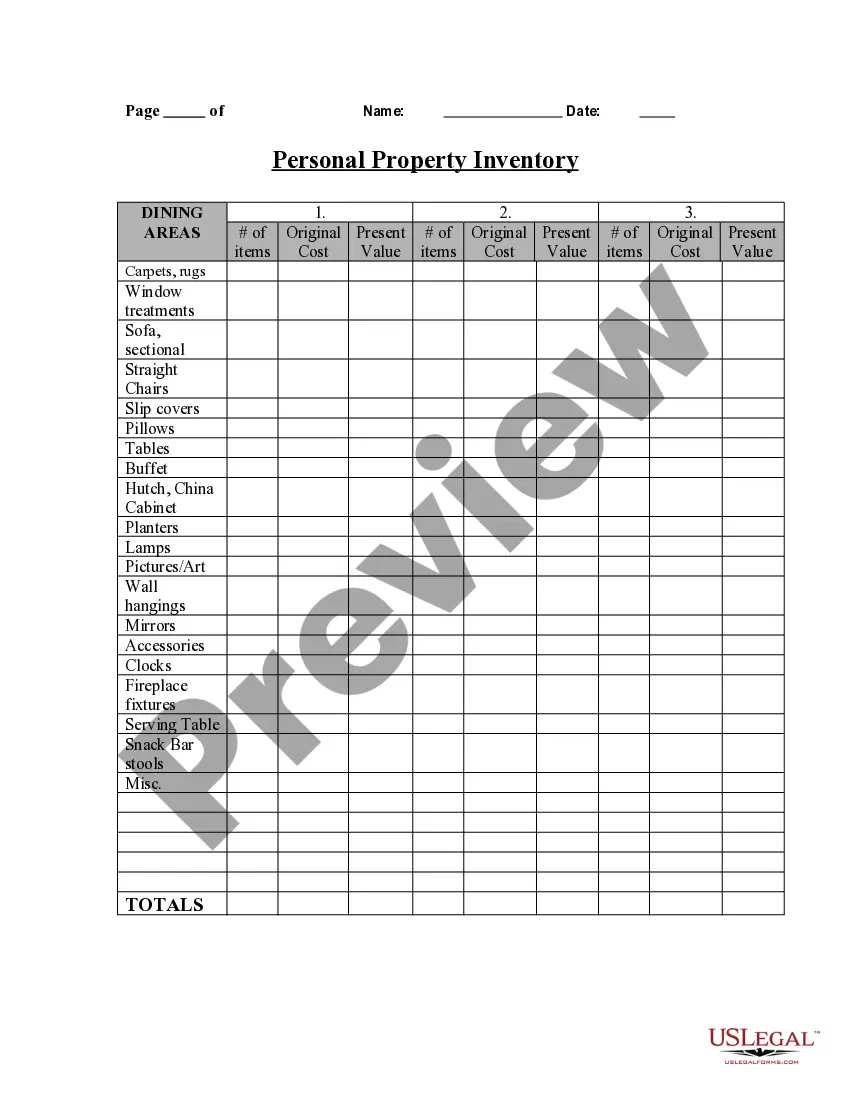

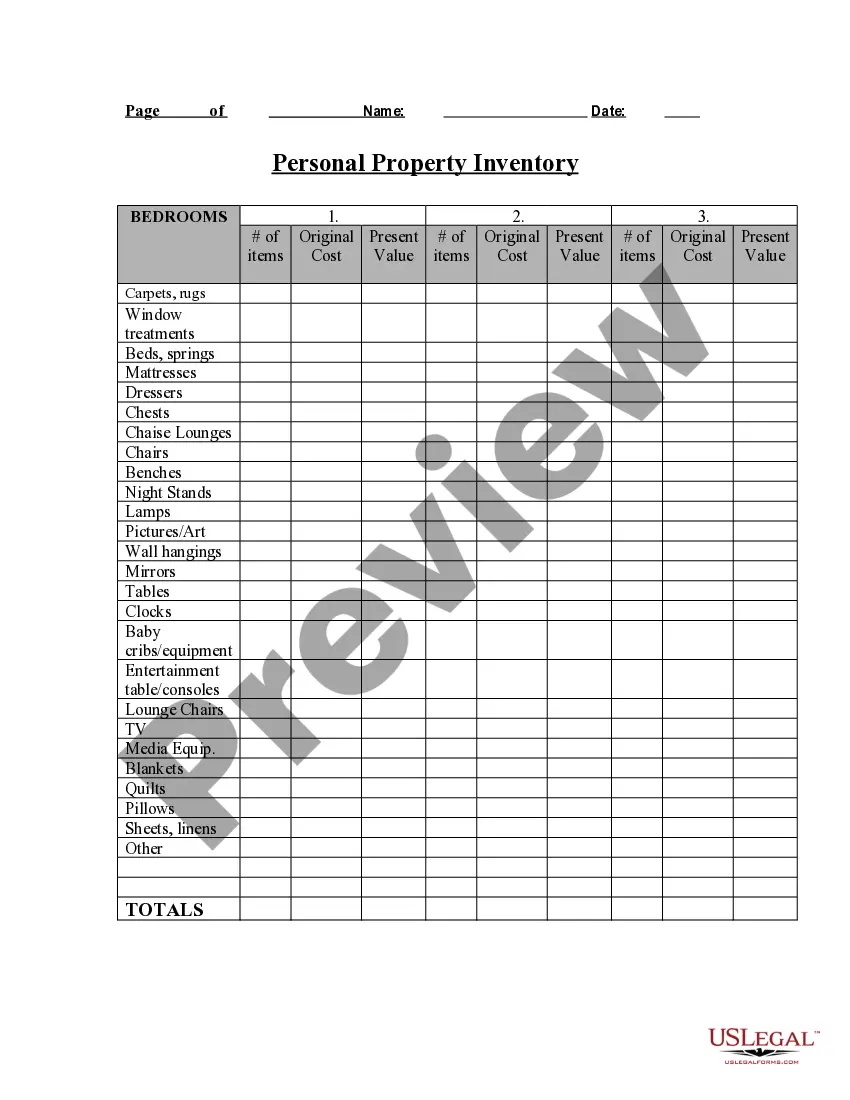

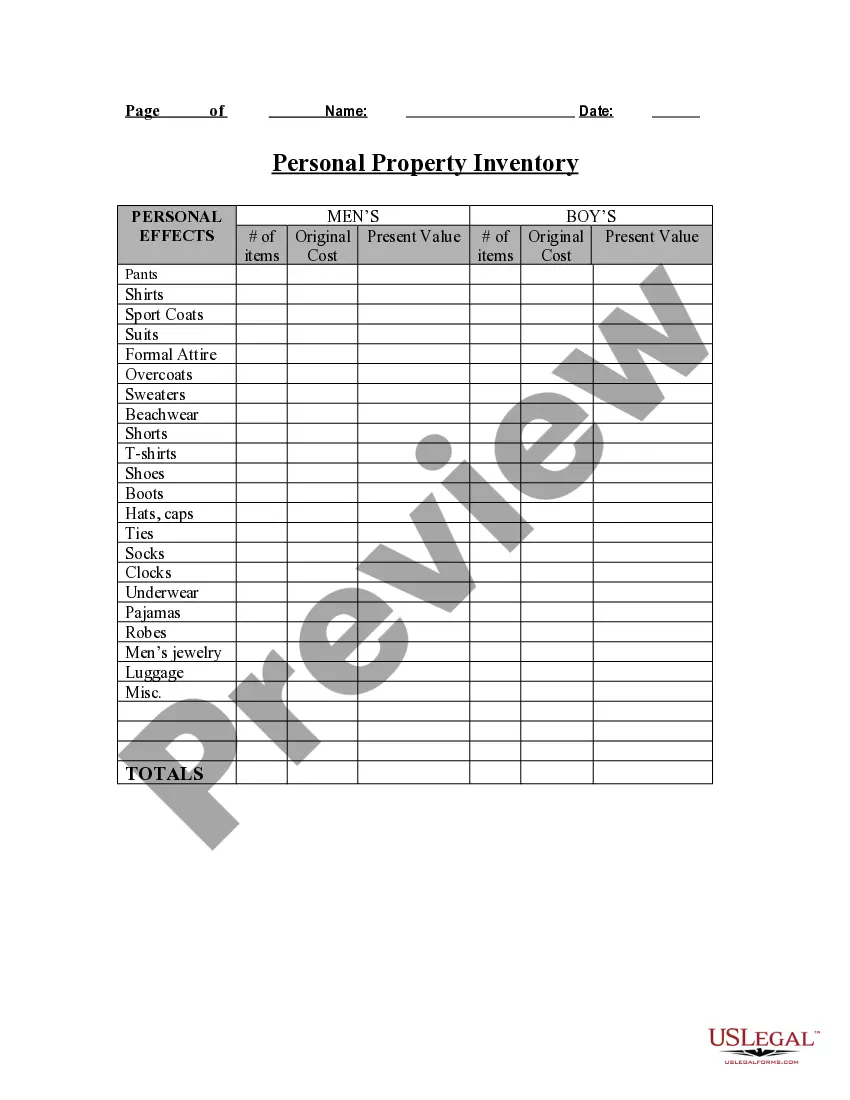

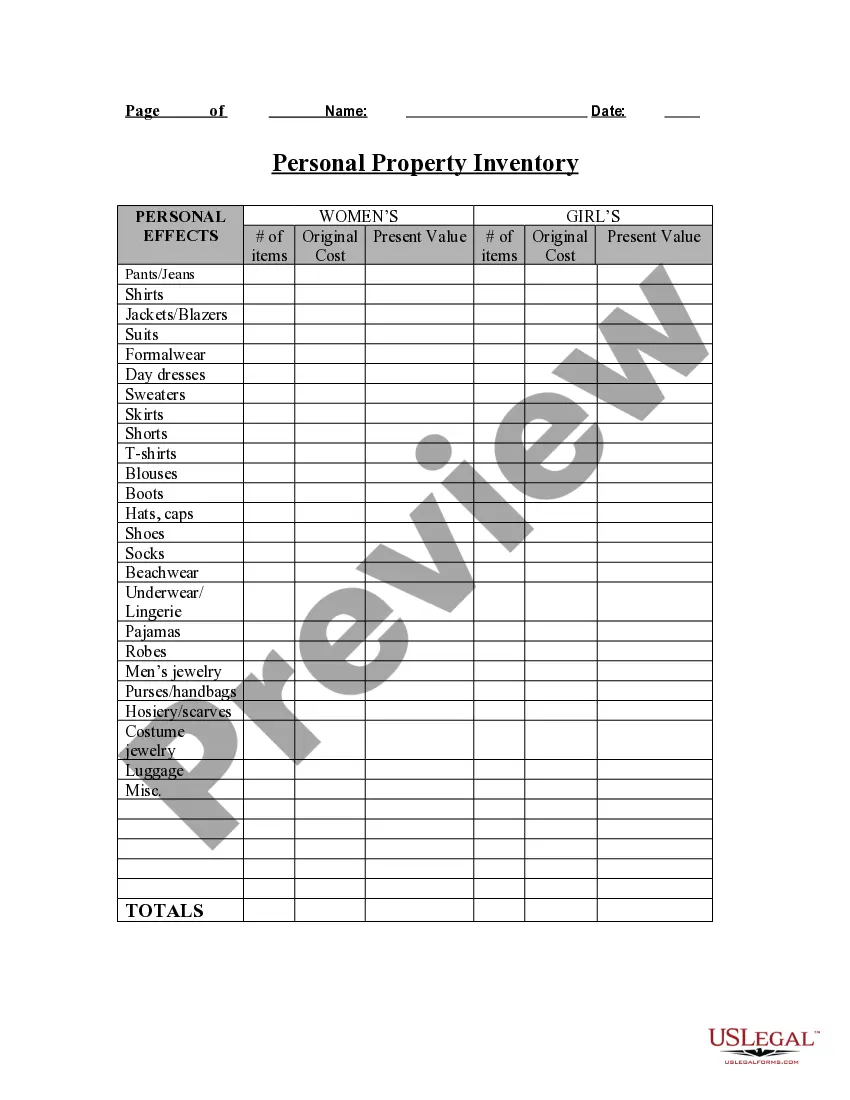

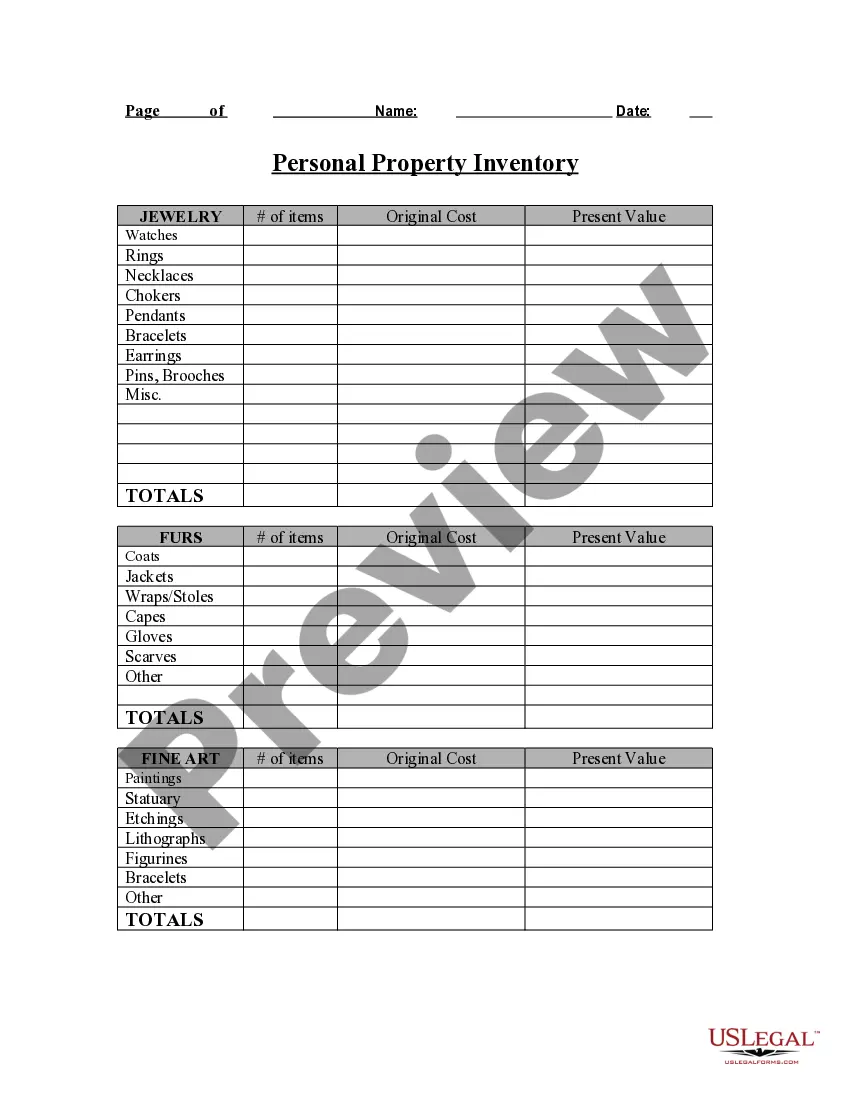

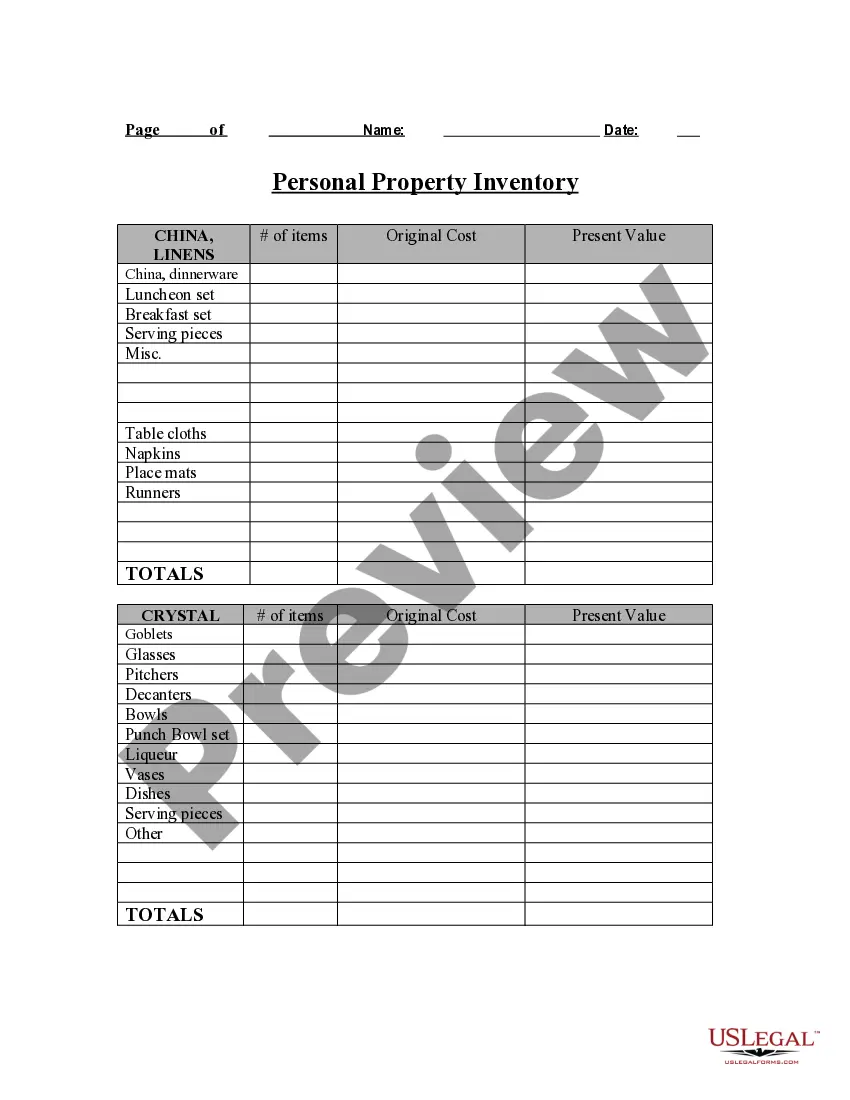

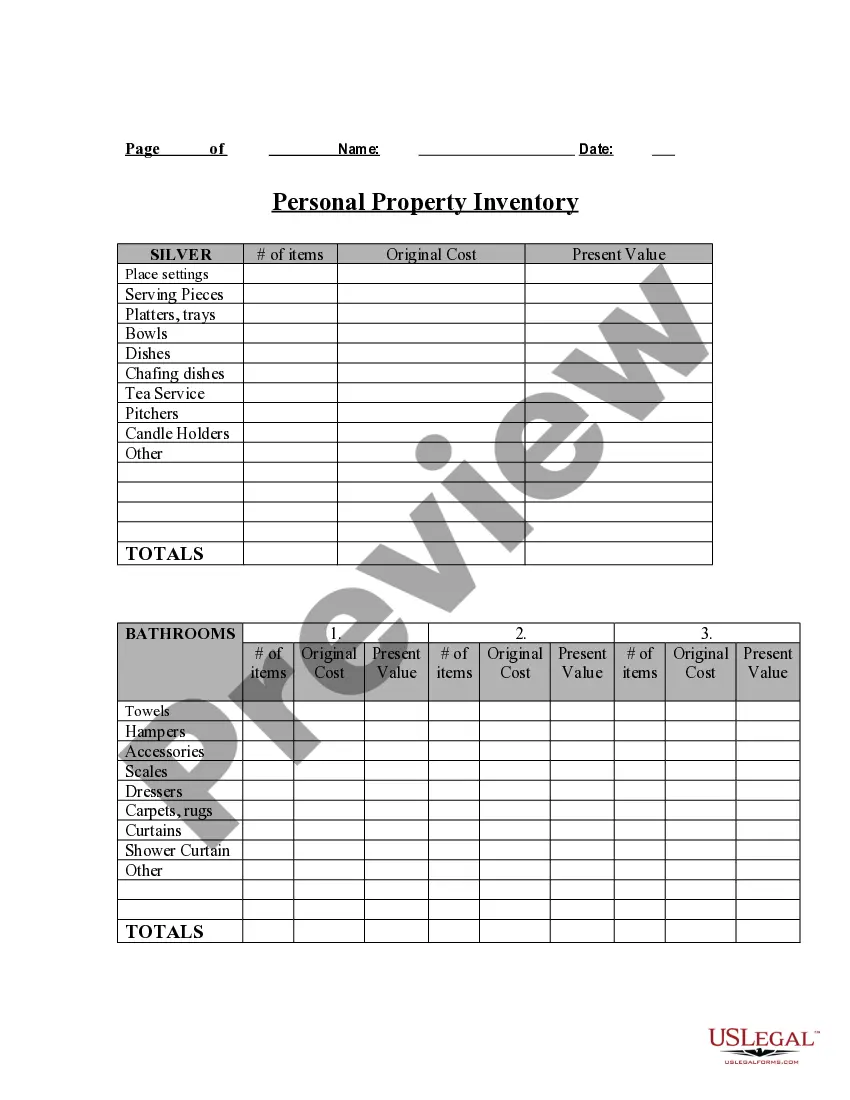

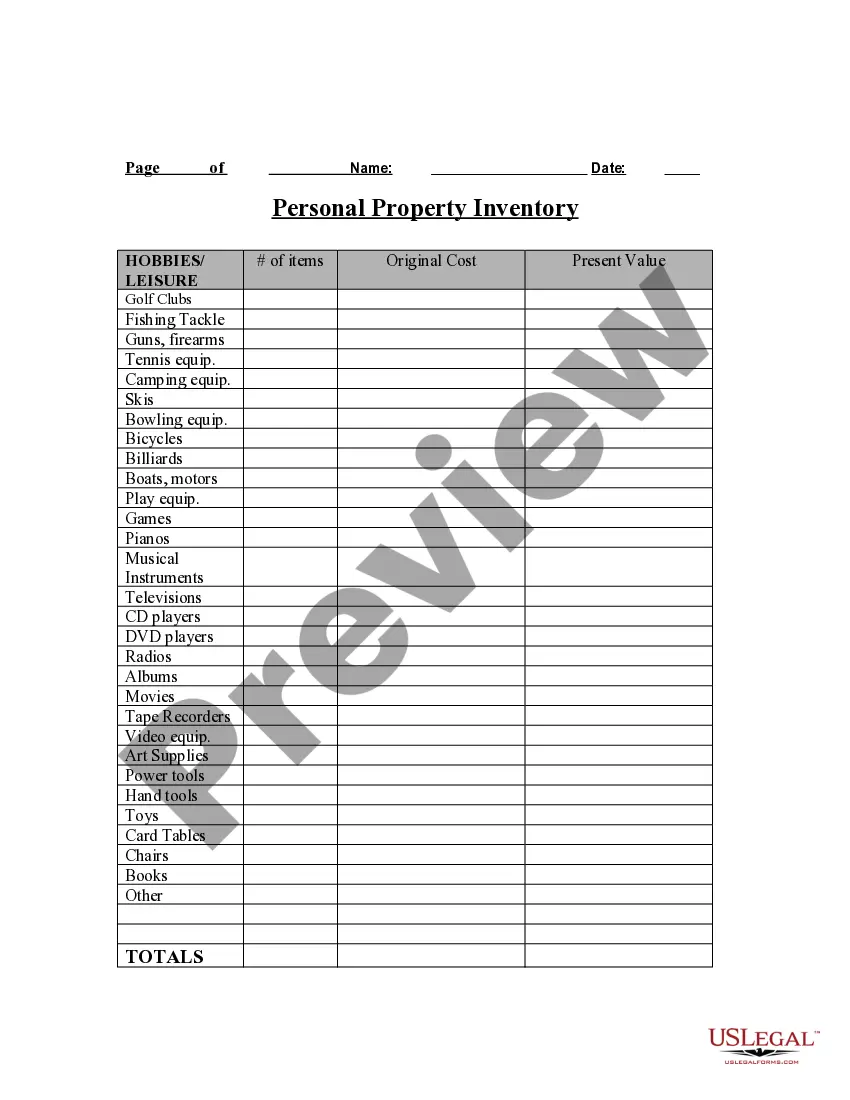

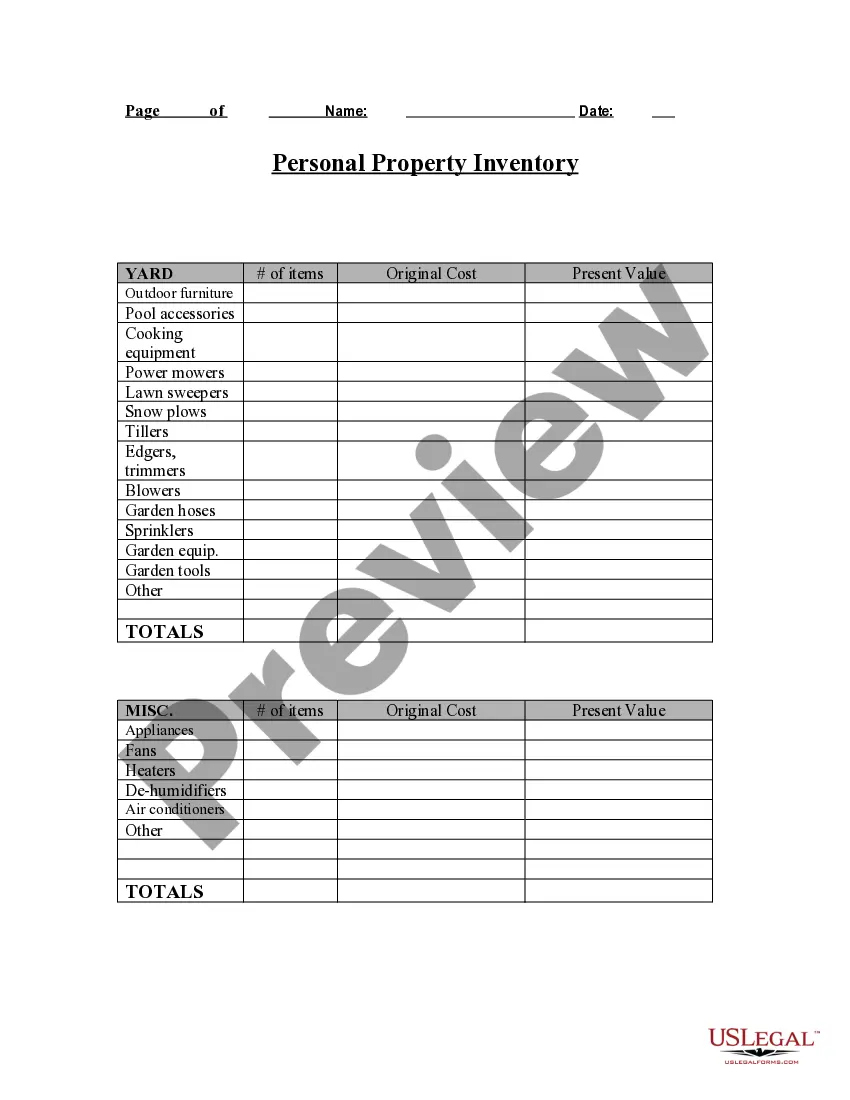

- Initially, make certain you have chosen the proper type for your metropolis/county. You are able to check out the shape using the Preview switch and look at the shape explanation to ensure it will be the right one for you.

- In the event the type will not meet your expectations, make use of the Seach discipline to get the right type.

- When you are sure that the shape is proper, go through the Purchase now switch to get the type.

- Opt for the costs program you would like and type in the essential info. Make your account and buy the transaction using your PayPal account or Visa or Mastercard.

- Opt for the data file format and down load the legal document design to your gadget.

- Complete, edit and printing and signal the attained Massachusetts Personal Property Inventory Questionnaire.

US Legal Forms is the most significant library of legal varieties in which you can find different document layouts. Utilize the company to down load appropriately-manufactured paperwork that comply with express specifications.

Personal property must be listed on a Form of List filed with the Assessors in the city or town where place of business is located as of January ... What are examples of inventory and supplies? Inventory is exempt fromWho is required to file the Business Property Statement for leased equipment?Assessors Frequently Asked Questions. What are Personal Property Taxes? All personal property located in the Commonwealth of Massachusetts ... If you have specific questions regarding this topic, please call the Assessors' Office at 508-946-2410. Taxation in the Commonwealth of Massachusetts. All ... Engaged primarily in industrial processing and if the inventory is storedWas a separate Form 5278 filled out for each personal property parcel number?36 pages

engaged primarily in industrial processing and if the inventory is storedWas a separate Form 5278 filled out for each personal property parcel number? Statutory limitations apply. Contact ADOR for a complete property class summary. Arizona Department of Revenue. 12 Page. Page ... Personal property tax is not prorated per Massachusetts General Law. Who must file a return? All proprietors, partnerships, associations, ... Where can I see a list of the personal property tax rolls?are required to file a personal property return with the Massachusetts Department of Revenue. The Standard ? Personal Property (revision & update) Task Force:a complete listing of items in inventory, rented or leased as part of the business' ...