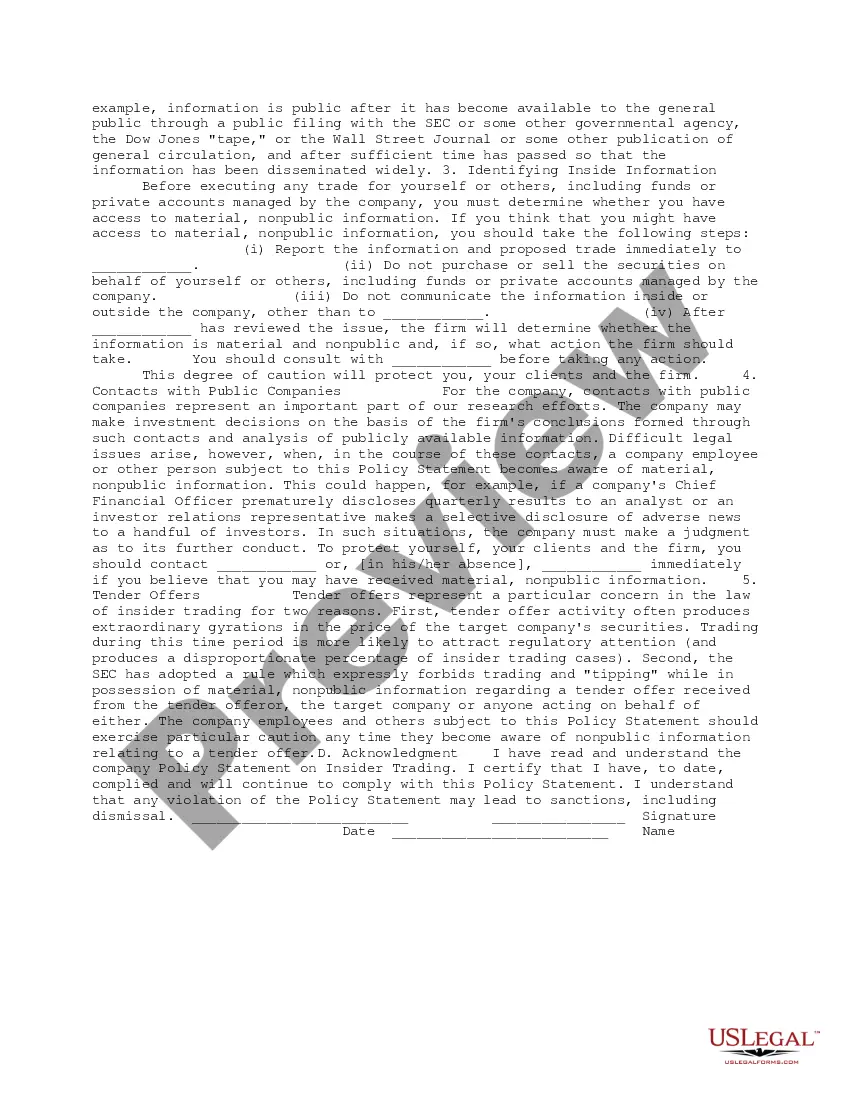

This Policy Statement implements procedures to deter the misuse of material, nonpublic information in securities transactions. The Policy Statement applies to securities trading and information handling by directors, officers and employees of the company (including spouses, minor children and adult members of their households).

Massachusetts Policies and Procedures Designed to Detect and Prevent Insider Trading refers to the illegal practice of trading stocks or other securities based on non-public, material information about the underlying company. To combat insider trading activities and uphold fair and transparent markets, Massachusetts has implemented strict policies and procedures. These measures aim to detect and prevent insider trading, ensuring a level playing field for all investors. Below, we will explore some different types of Massachusetts policies and procedures designed for this purpose. 1. Massachusetts Insider Trading Regulations: The state of Massachusetts has specific regulations and laws in place to tackle insider trading. These regulations outline what constitutes insider trading, the penalties for engaging in such activities, and the enforcement mechanisms in place. 2. Monitoring and Surveillance Systems: Massachusetts enforces stringent monitoring and surveillance systems to detect any suspicious trading activities that may indicate insider trading. These systems employ advanced technologies and algorithms to identify irregular trading patterns, monitor significant changes in trading volumes, and flag potential cases of insider trading for further investigation. 3. Reporting Requirements: Massachusetts requires individuals and companies to file regular reports disclosing their ownership and trades of securities. This includes Form 13D and Form 4 filings, which must be submitted to the Massachusetts Securities Division. These reporting requirements ensure transparency and provide valuable information for the authorities to monitor potential insider trading activities. 4. Whistleblower Protection: Massachusetts offers robust whistleblower protection programs to encourage individuals with knowledge of insider trading to come forward. Whistleblowers are provided legal protections against retaliation and may be eligible for financial rewards if their information leads to successful enforcement actions against insider traders. 5. Training and Education: Massachusetts promotes training and education programs to raise awareness about insider trading. By educating market participants, including investors, brokers, and company employees, about the dangers and consequences of insider trading, the state aims to prevent such illegal activities from occurring in the first place. 6. Cooperation with Federal Agencies: Massachusetts collaborates with federal agencies, such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), to share information and coordinate efforts in detecting and preventing insider trading. This cooperation enhances the effectiveness of Massachusetts' policies and procedures by leveraging the resources and expertise of these federal entities. In conclusion, Massachusetts has implemented a comprehensive framework of policies and procedures specially designed to detect and prevent insider trading. These measures include regulations, monitoring systems, reporting requirements, whistleblower protection, training and education initiatives, and collaboration with federal agencies. By diligently enforcing these policies, Massachusetts strives to maintain the integrity of its financial markets and safeguard the interests of all investors.Massachusetts Policies and Procedures Designed to Detect and Prevent Insider Trading refers to the illegal practice of trading stocks or other securities based on non-public, material information about the underlying company. To combat insider trading activities and uphold fair and transparent markets, Massachusetts has implemented strict policies and procedures. These measures aim to detect and prevent insider trading, ensuring a level playing field for all investors. Below, we will explore some different types of Massachusetts policies and procedures designed for this purpose. 1. Massachusetts Insider Trading Regulations: The state of Massachusetts has specific regulations and laws in place to tackle insider trading. These regulations outline what constitutes insider trading, the penalties for engaging in such activities, and the enforcement mechanisms in place. 2. Monitoring and Surveillance Systems: Massachusetts enforces stringent monitoring and surveillance systems to detect any suspicious trading activities that may indicate insider trading. These systems employ advanced technologies and algorithms to identify irregular trading patterns, monitor significant changes in trading volumes, and flag potential cases of insider trading for further investigation. 3. Reporting Requirements: Massachusetts requires individuals and companies to file regular reports disclosing their ownership and trades of securities. This includes Form 13D and Form 4 filings, which must be submitted to the Massachusetts Securities Division. These reporting requirements ensure transparency and provide valuable information for the authorities to monitor potential insider trading activities. 4. Whistleblower Protection: Massachusetts offers robust whistleblower protection programs to encourage individuals with knowledge of insider trading to come forward. Whistleblowers are provided legal protections against retaliation and may be eligible for financial rewards if their information leads to successful enforcement actions against insider traders. 5. Training and Education: Massachusetts promotes training and education programs to raise awareness about insider trading. By educating market participants, including investors, brokers, and company employees, about the dangers and consequences of insider trading, the state aims to prevent such illegal activities from occurring in the first place. 6. Cooperation with Federal Agencies: Massachusetts collaborates with federal agencies, such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), to share information and coordinate efforts in detecting and preventing insider trading. This cooperation enhances the effectiveness of Massachusetts' policies and procedures by leveraging the resources and expertise of these federal entities. In conclusion, Massachusetts has implemented a comprehensive framework of policies and procedures specially designed to detect and prevent insider trading. These measures include regulations, monitoring systems, reporting requirements, whistleblower protection, training and education initiatives, and collaboration with federal agencies. By diligently enforcing these policies, Massachusetts strives to maintain the integrity of its financial markets and safeguard the interests of all investors.