Maryland Site Work Contract for Contractor

Description

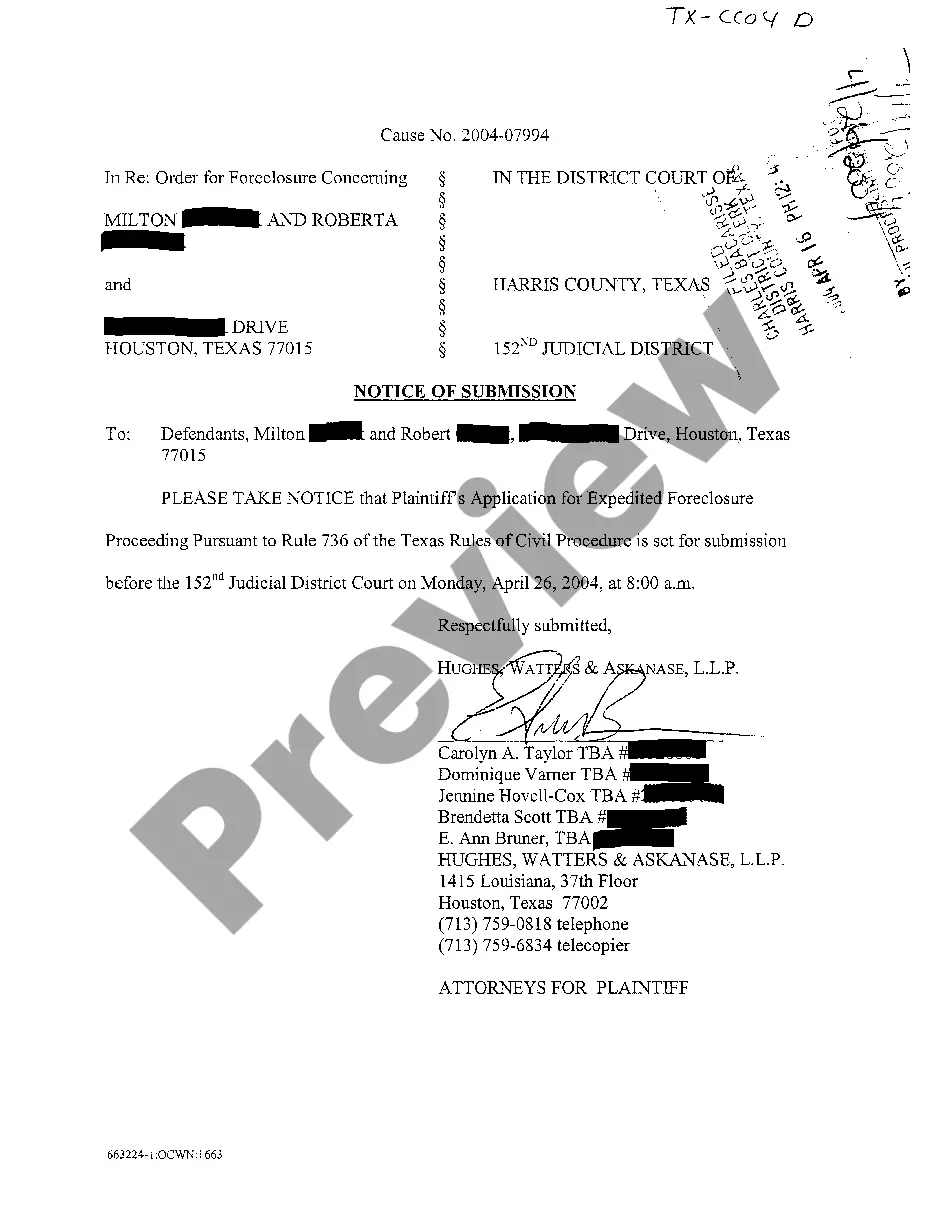

How to fill out Maryland Site Work Contract For Contractor?

Welcome to the most significant legal files library, US Legal Forms. Here you can get any sample such as Maryland Site Work Contract for Contractor templates and download them (as many of them as you want/need). Make official files in just a several hours, instead of days or even weeks, without spending an arm and a leg on an lawyer or attorney. Get the state-specific form in a couple of clicks and be assured with the knowledge that it was drafted by our state-certified lawyers.

If you’re already a subscribed user, just log in to your account and then click Download next to the Maryland Site Work Contract for Contractor you require. Due to the fact US Legal Forms is online solution, you’ll always get access to your saved templates, regardless of the device you’re using. Locate them within the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check our instructions below to begin:

- If this is a state-specific form, check its applicability in the state where you live.

- Look at the description (if available) to learn if it’s the proper template.

- See a lot more content with the Preview function.

- If the sample fulfills your requirements, click Buy Now.

- To make an account, pick a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Download the template in the format you want (Word or PDF).

- Print out the file and fill it with your/your business’s details.

When you’ve completed the Maryland Site Work Contract for Contractor, send out it to your lawyer for verification. It’s an additional step but a necessary one for making certain you’re fully covered. Become a member of US Legal Forms now and access thousands of reusable samples.

Form popularity

FAQ

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Workers who complete tasks or work on individual projects will fall under a 1099. An independent contractor is able to earn a living on his or her own rather than depending on an employer.

An independent contractor agreement, also known as a '1099 agreement', is a contract between a client willing to pay for the performance of services by a contractor.In most cases, the contractor is paid on a per-job basis and not by the hour, unless, the contractor is a lawyer, accountant, or equivalent.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

An independent contractor agreement is a document that an employer uses to hire a freelancer for a specific job. By extension, it distinguishes the independent contractor from an employee of the business for legal and tax purposes.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

In Maryland, general contractors do not need a license to perform work in the state. A license is only required if you wish to work on home improvement projects or do electrical, plumbing or HVACR work. The licensing process is handled by the Department of Labor, Licensing and Regulation (DLLR).

Yes, employees still have better benefits and job security, but now 1099 contractors and self-employed individuals will pay considerably lower taxes on equivalent pay so long as you qualify for the deduction and stay under certain high income limits.

Writing Your Construction Contract. Write the title and a little preamble. Your title should describe the purpose of the contract. The preamble should simply state basics like: the date the agreement was entered into, the parties' names, the project, the work site location, and work commencement and end dates.