Maryland Buyer's Request for Accounting from Seller under Contract for Deed

Description

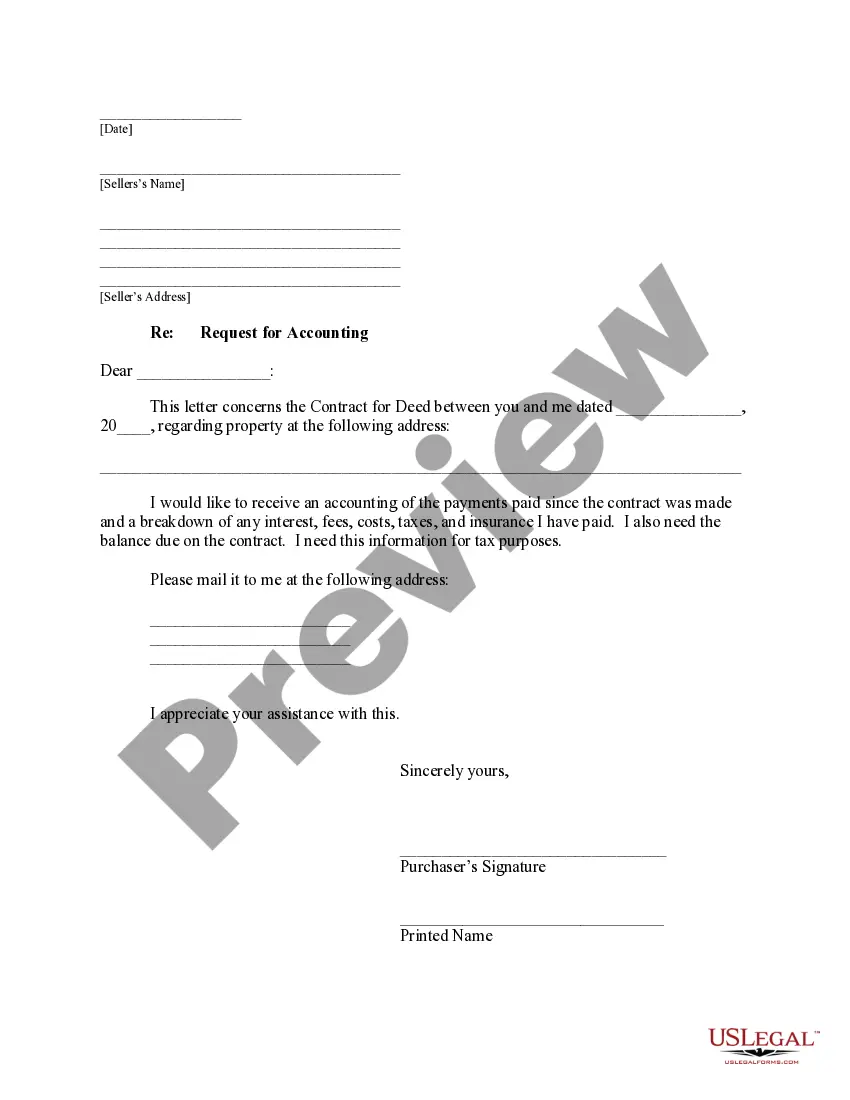

How to fill out Maryland Buyer's Request For Accounting From Seller Under Contract For Deed?

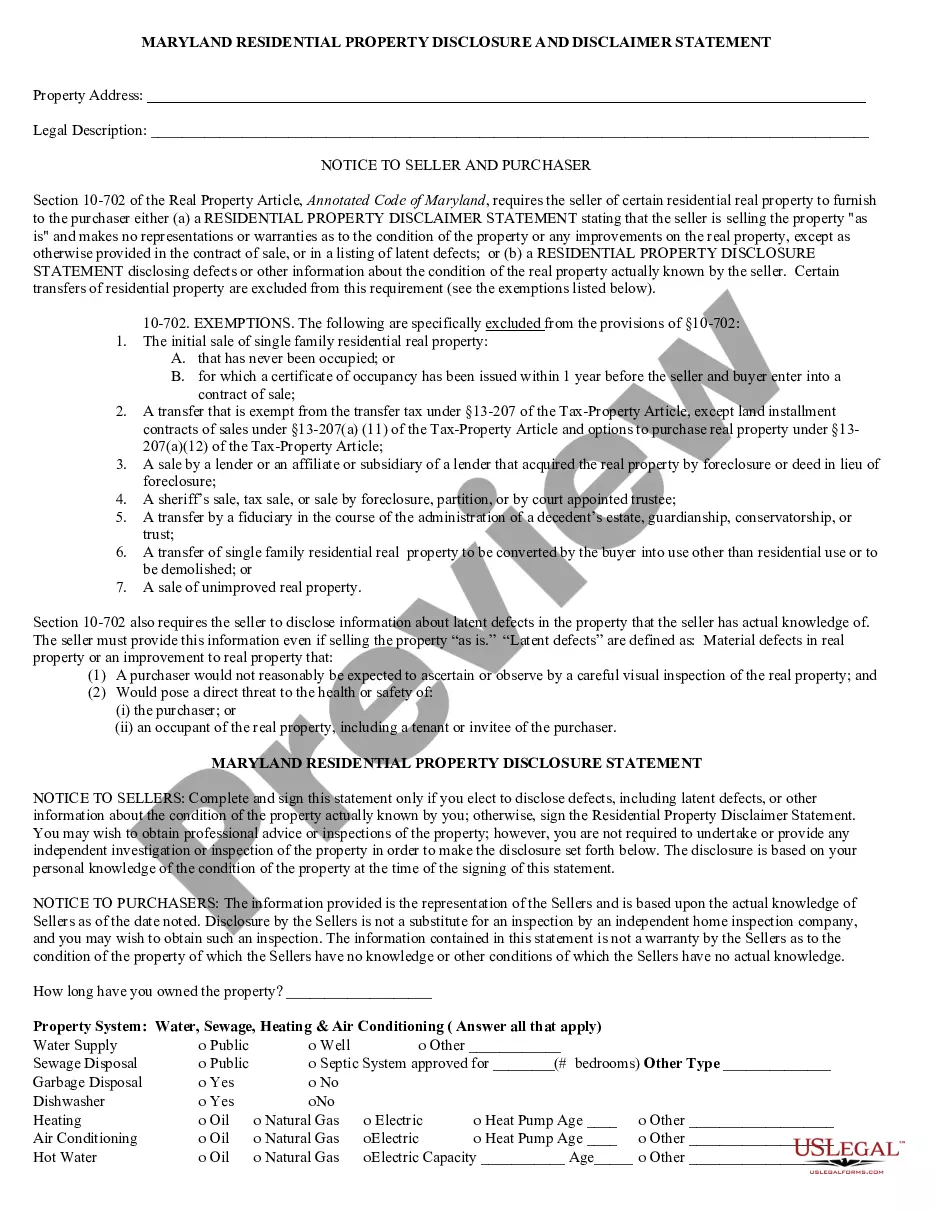

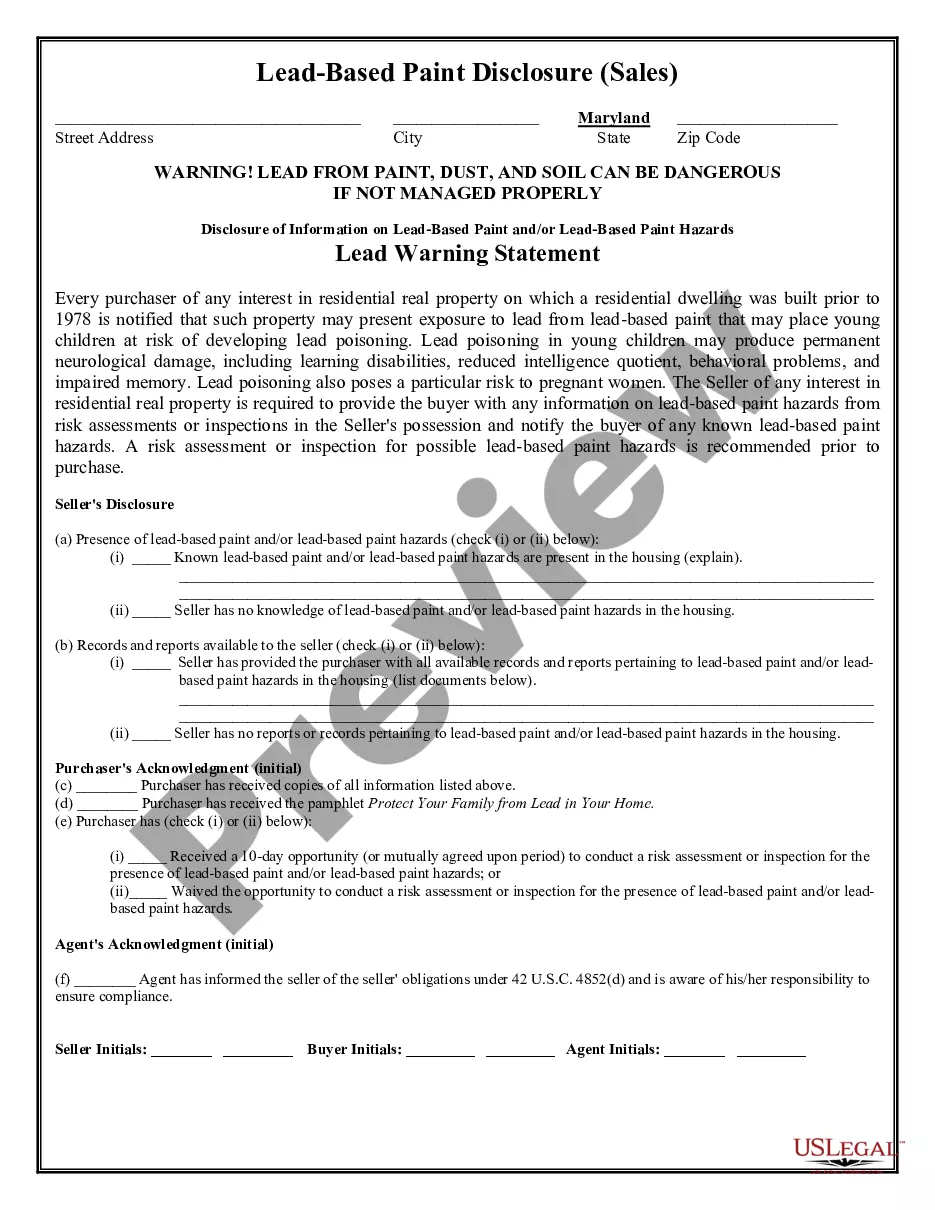

Use US Legal Forms to obtain a printable Maryland Buyer's Request for Accounting from Seller under Contract for Deed. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms catalogue on the internet and provides affordable and accurate templates for consumers and lawyers, and SMBs. The templates are grouped into state-based categories and many of them might be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to easily find and download Maryland Buyer's Request for Accounting from Seller under Contract for Deed:

- Check to make sure you get the proper form in relation to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Hit Buy Now if it’s the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search engine if you need to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Maryland Buyer's Request for Accounting from Seller under Contract for Deed. More than three million users have already used our platform successfully. Select your subscription plan and have high-quality documents within a few clicks.

Form popularity

FAQ

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

Contact the other party and ask whether they are willing to negotiate the cancellation of the contract. Offer the other party an incentive to cancel the contract for deed.

Who Prepares The Real Estate Purchase Agreement? Typically, the buyer's agent writes up the purchase agreement. However, unless they are legally licensed to practice law, real estate agents generally can't create their own legal contracts.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

Other benefits include: no loan qualifying, low or flexible down payment, favorable interest rates and flexible terms, and a quicker settlement. The biggest risk when buying a home contract for deed is that you really don?t have a legal claim to the property until you have paid off the entire purchase price.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

Generally, contract for deed sellers use IRS Form 6252 to report installment sales in the year in which they take place. You also use Form 6252 during each year you receive income from your contract for deed.