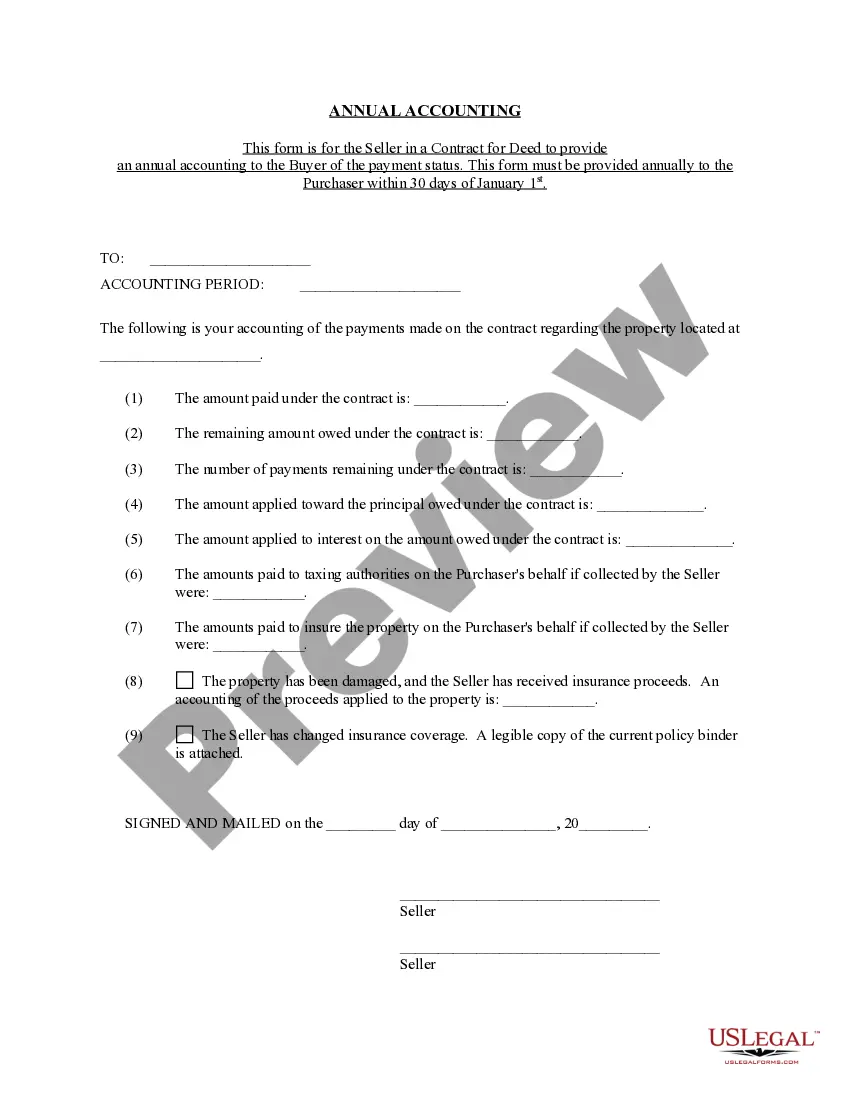

Maryland Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Maryland Contract For Deed Seller's Annual Accounting Statement?

Use US Legal Forms to obtain a printable Maryland Contract for Deed Seller's Annual Accounting Statement. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue on the internet and provides reasonably priced and accurate samples for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and a few of them might be previewed prior to being downloaded.

To download samples, users need to have a subscription and to log in to their account. Press Download next to any template you want and find it in My Forms.

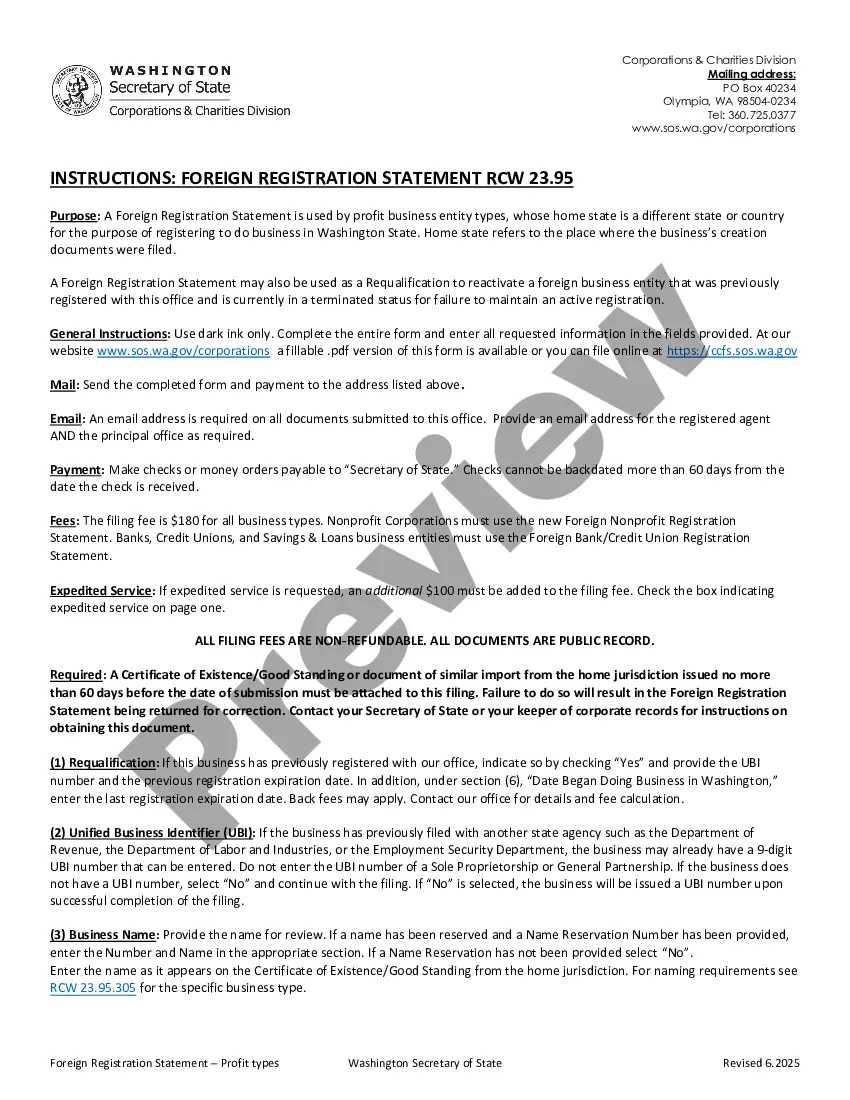

For those who do not have a subscription, follow the following guidelines to quickly find and download Maryland Contract for Deed Seller's Annual Accounting Statement:

- Check out to make sure you get the correct form in relation to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search engine if you need to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Maryland Contract for Deed Seller's Annual Accounting Statement. Above three million users already have used our service successfully. Select your subscription plan and have high-quality documents in a few clicks.

Form popularity

FAQ

To obtain a transient vendor license, you must have a Maryland sales and use tax license. You may apply for a sales and use tax license online. You may also need to obtain a local license (such as a trader's license) from the Clerk of the Circuit Court in the jurisdiction in which you do business.

Unless you are a grower or manufacturer, you may not offer for sale, sell or otherwise dispose of any goods within Maryland, without first obtaining a trader's license from the Clerk of the Circuit Court and opening a sales tax account.

4. How much does it cost to apply for a sales tax permit in Maryland? It is free to register for a sales tax permit in Maryland.

Maryland businesses must register using the Maryland Business Express200b portal, administered by the Department of Assessments and Taxation. The portal offers a step-by-step process to register a business online. Many businesses require permits or licenses to operate.

Unless you are a grower or manufacturer, you may not offer for sale, sell or otherwise dispose of any goods within Maryland, without first obtaining a trader's license from the Clerk of the Circuit Court and opening a sales tax account.

Licenses & Permits A business license is required for most businesses, including retailers and wholesalers. A trader's license is required for buying and re-selling goods. And you, or the professionals you hire, may need individual occupational and professional licenses.

In Maryland, closing costs can total up to 7% of the home's final sales price. Typically, buyers pay the majority of closing costs and the money comes out of pocket.

Licenses & Permits A business license is required for most businesses, including retailers and wholesalers. A trader's license is required for buying and re-selling goods. And you, or the professionals you hire, may need individual occupational and professional licenses.