Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract

Maryland State Statutes

REAL PROPERTY

TITLE 10. Sale of Real Property.

Subtitle 1. Land Installment Contracts.

10-101 REAL PROP. Definitions.

(a) In general. -- In this subtitle the following words have the meanings indicated.

(b) Agricultural commodity. -- Agricultural commodity means livestock, poultry, field crops, including nursery stock, bulbs, and flowers; and other agricultural products having a domestic or foreign market.

(c) Certified agency. -- Certified agency means any association, board, council, or other entity authorized by the Secretary to conduct a referendum under this section among the persons qualifying as voters.

(d) Voter. -- Voter, with respect to a referendum on the question of an annual assessment on a particular agricultural commodity, means any person engaged in the production of the commodity, and includes the owner of the farm on which the commodity is produced, tenants, and sharecroppers.

HISTORY: An. Code 1957, art. 66C, 83A, 83F, 83J; 1973, 1st Sp. Sess., ch. 6, 1.

REAL PROPERTY

TITLE 10. Sale of Real Property.

Subtitle 1. Land Installment Contracts.

10-102. Form and delivery of land installment contracts

(a) Signed writing by all parties containing terms of agreement necessary. -- Every land installment contract shall be evidenced by a contract signed by all parties to it and containing all the terms to which they have agreed.

(b) Vendor to give copy of instrument and purchaser to give receipt. -- At or before the time the purchaser signs the instrument, the vendor shall deliver to him an exact copy and the purchaser shall give the vendor a receipt showing that he has received the copy of the instrument. If the copy was not executed by the vendor at the time the purchaser signed, the vendor shall deliver a copy of the instrument signed by him within 15 days after he receives notice that the purchaser has signed and the purchaser shall give the vendor a receipt showing that he has received the copy. If the vendor fails to deliver the copy within 15 days, the contract signed by the purchaser is void at his option, and the vendor, immediately, on demand, shall refund to the purchaser all payments and deposits that have been made.

(c) Receipt. -- The receipt for the delivery of a copy of a contract shall be printed in 12-point bold type or larger, typewritten or written in legible handwriting. If contained in the contract, the receipt shall be printed, typewritten, or written immediately below the signature on the contract and shall be signed separately.

(d) Right of purchaser to cancel and receive refund until copy instrument is given him. -- Until the purchaser signs a land installment contract and receives a copy signed by the vendor, the purchaser has an unconditional right to cancel the contract and to receive immediate refund of all payments and deposits made on account of or in contemplation of the contract. A request for a refund operates to cancel the contract.

(e) Vendor to give purchaser receipt for payment or deposit. -- When any payment or deposit is accepted by the vendor from a purchaser, before the purchaser signs a land installment contract and receives a copy, the vendor immediately shall deliver to him a receipt, which clearly states in 12-point type or larger, in typewriting or in legible handwriting, his rights under subsection (d) of this section.

(f) Vendor to record contract. -- Within 15 days after the contract is signed by both the vendor and purchaser, the vendor shall cause the contract to be recorded among the land records of the county where the property lies and shall mail the recorder's receipt to the purchaser. This duty of recordation and mailing of receipt shall be written clearly or printed on the contract. Failure to do so, or to record as required under this section within the time stipulated, gives the purchaser the unconditional right to cancel the contract and to receive immediate refund of all payments and deposits made on account of or in contemplation of the contract, if the purchaser exercises the right to cancel before the vendor records the contract.

HISTORY: An. Code 1957, art. 21, 10-102; 1974, ch. 12, 2; 1991, ch. 283; 2009, ch. 60, 5.

REAL PROPERTY

TITLE 10. Sale of Real Property.

Subtitle 1. Land Installment Contracts.

10-103. Contents of contract; application of payments; payments and mortgage when land sold

(a) Contents of contract generally. -- Every land installment contract shall contain all the following information:

(1) The full name, the place of residence, and post office address of every party to the contract;

(2) The date when signed by the purchaser;

(3) A legal description of the property covered by the contract;

(4) A disclosure, with respect to the six-month period prior to the date of purchase, of every transfer of title to the property, the sale price of each transfer, and the substantiated cost to the vendor of repairs or improvements;

(5) A provision that the vendee has the right to accelerate any installment payment;

(6) Provisions stating clearly (i) any collateral security taken for the purchaser's obligation under the contract, and (ii) whether or not the vendor has received any written notice from any public agency requiring any repairs or improvements to be made to the property described in the contract;

(7) The following notice in 12-point bold type or larger, typewritten or handwritten legibly directly above the space reserved in the contract for the signature of the purchaser:

Notice to Purchaser

You are entitled to a copy of this contract at the

time you sign it;

(8) The following notice, in 12-point bold type or larger, typewritten or handwritten legibly, directly below the space reserved in the contract for the signature of the purchaser acknowledging the receipt of a copy of the contract:

In the event of default,

the purchaser may be liable to a default judgment.

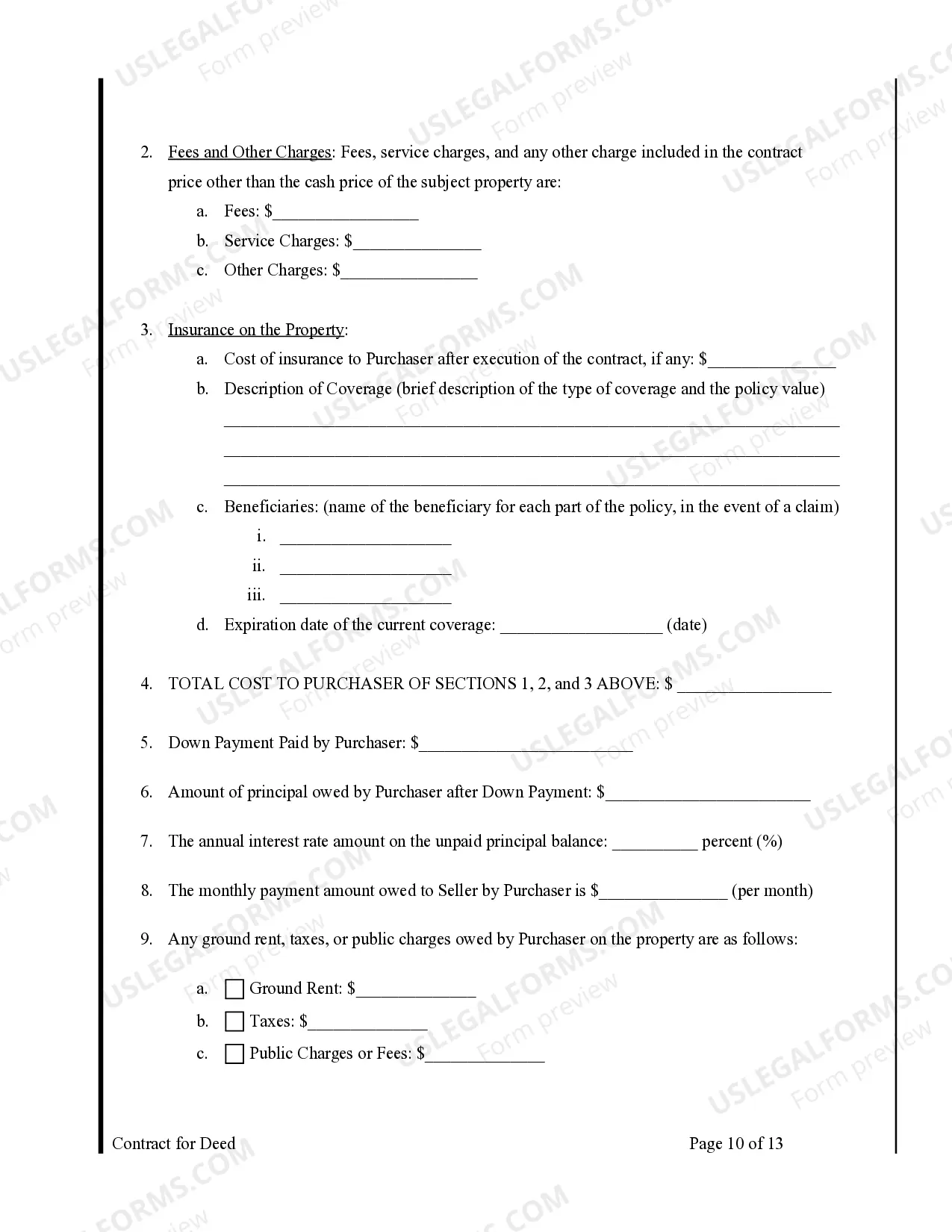

(b) Contents of contract listed in tabular form. -- The contract also shall recite in simple tabular form, the following separate items in the following order:

(1) The cash price of the property sold;

(2) Any charge or fee for any service which is included in the contract separate from the cash price;

(3) The cost to the purchaser of any insurance coverage from the date of the contract, for the payment of which credit is to be extended to the purchaser, the amount or extent and expiration date of the coverage, a concise description of the type of coverage, and every party to whom the insurance is payable;

(4) The sum of items (1), (2), and (3);

(5) The amount of any down payment on behalf of the purchaser;

(6) The principal balance owed, which is the sum of item (4) less item (5);

(7) The amount and time of each installment payment and the total number of periodic installments;

(8) The interest on the unpaid balance not exceeding the percentage per annum allowed by 12-404(b) of the Commercial Law Article, provided that points may not be charged;

(9) Any ground rent, taxes, and other public charges.

(c) Application of payments. -- The installment payments first shall be applied by the vendor to the payment of:

(1) Taxes, assessments, and other public charges levied or assessed against the property and paid by the vendor;

(2) Any ground rent paid by the vendor;

(3) Insurance premiums on the property paid by the vendor;

(4) Interest on unpaid balance owed by the purchaser at a rate not exceeding the percentage per annum allowed by 12-404(b) of the Commercial Law Article;

(5) Principal balance owed by purchaser.

(d) Amount of mortgage and payments when land is sold. No vendor may place or hold any mortgage on any property sold under a land installment contract in any amount greater than the balance due under the contract, nor may any mortgage require payments in excess of the periodic payments required under the contract.

HISTORY: An. Code 1957, art. 21, 10-103; 1974, ch. 12, 2; 1975, ch. 605; ch. 817, 9; 1981, chs. 598, 781; 1982, ch. 17, 7; 1997, ch. 14, 1; 2002, ch. 10, 19.

REAL PROPERTY

TITLE 10. Sale of Real Property.

Subtitle 1. Land Installment Contracts.

10-104. Recordation

Every land installment contract shall be indexed and recorded among the land records in the office of the clerk of the circuit court of the county where the property which is the subject of the contract is located. With regard to any person who claims any interest in or lien on the property arising after the time of recording, the property is deemed to be held from the time of recording by the then record owner of fee simple or leasehold title to the property, subject to the rights and interest of the purchaser of the contract as stated in the contract.

HISTORY: An. Code 1957, art. 21, 10-104; 1974, ch. 12, 2; 1982, ch. 820, 3.

REAL PROPERTY

TITLE 10. Sale of Real Property.

Subtitle 1. Land Installment Contracts.

10-105. Purchase money mortgage

(a) Right to demand grant upon execution of mortgage; expenses. If the contract fixes no earlier period, when 40 percent or more of the original cash price of the property is paid, the purchaser may demand a grant of the premises mentioned in the contract, on the condition that he execute a purchase money mortgage to the vendor, or to a mortgagee procured by the purchaser. If any mortgage is executed pursuant to the purchaser's demand for grant under this subsection, the purchaser is liable for expenses, such as title search, drawing deed and mortgage, one half of cost of federal and State revenue stamps, notary fees, recording, reasonable building association fees, judgment reports, and tax lien report.

(b) Payments. The periodic principal and interest payments required by the mortgage may not exceed the periodic principal and interest payments otherwise required by the land installment contract, except with the consent of the mortgagor. This consent may be evidenced by the execution of a mortgage.

(c) Covenants; remedies on default. The mortgagee may require the usual covenants by the mortgagor for the payment of the mortgage debt, the taxes on the mortgaged property, any ground rent, and the premiums on fire and extended coverage insurance in an amount equal to the mortgage indebtedness, if obtainable, and if not, then in the highest amount of insurance obtainable. The mortgage also may require the usual remedies on default by way of a power of sale to the mortgagee, his assigns, or his attorney or assent to a decree for sale by the mortgagor pursuant to the Maryland Rules, or both.

(d) Deed and mortgage supersedes land installment contract. The deed and mortgage executed pursuant to this section shall supersede entirely the land installment contract.

HISTORY: An. Code 1957, art. 21, 10-103; 1974, ch. 12, 2.

REAL PROPERTY

TITLE 10. Sale of Real Property.

Subtitle 1. Land Installment Contracts.

10-106. Compliance with terms and conditions by purchaser on or before date designated in notice to terminate

If the purchaser, on or before the date designated in a notice from the vendor of intention to terminate a land installment contract due to the purchaser's default, complies with the terms and conditions in respect to which the default has occurred, the contract continues in full force and effect, notwithstanding any contrary provision in the contract.

HISTORY: An. Code 1957, art. 21, 10-105; 1974, ch. 12, 2.

REAL PROPERTY

TITLE 10. Sale of Real Property.

Subtitle 1. Land Installment Contracts.

10-107. Statement to be furnished by vendor

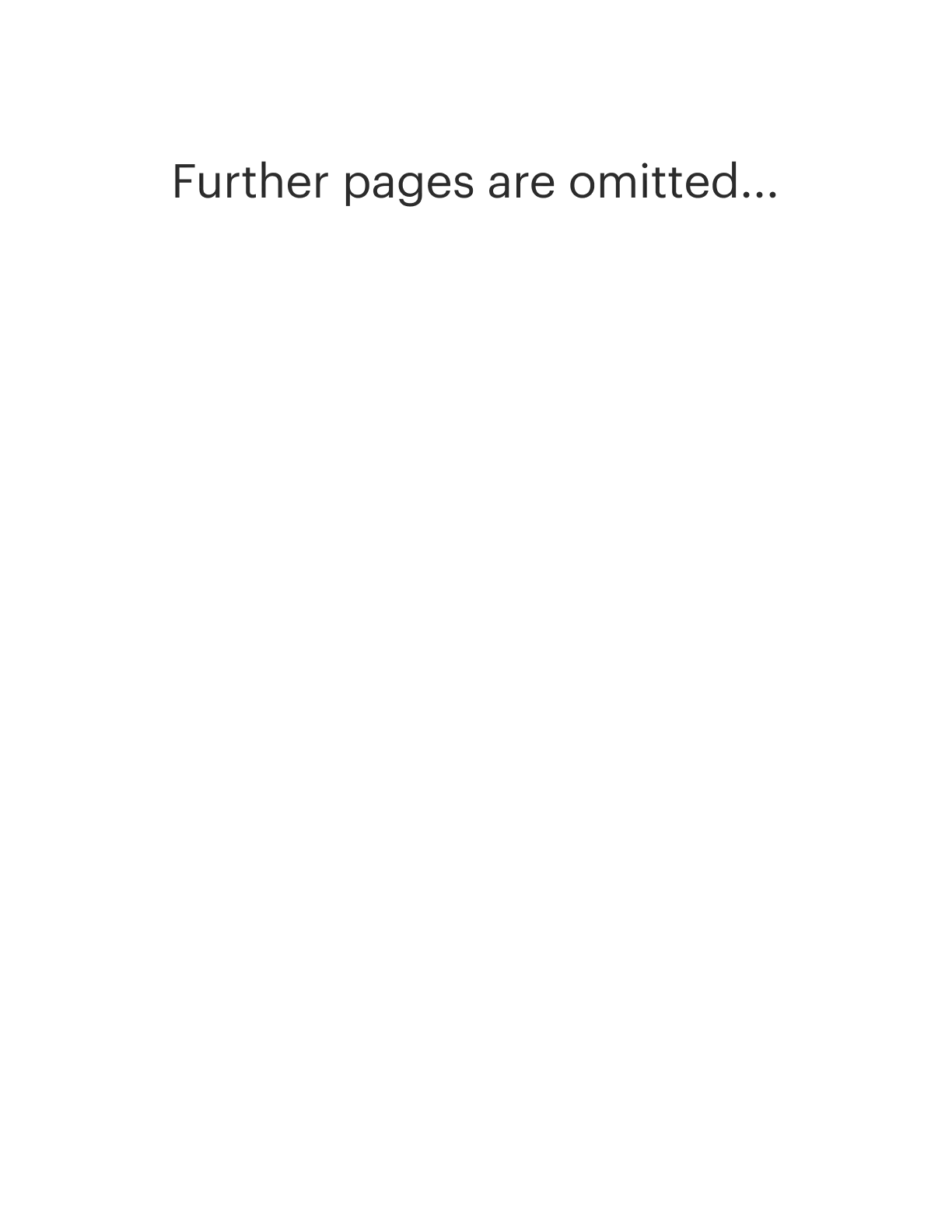

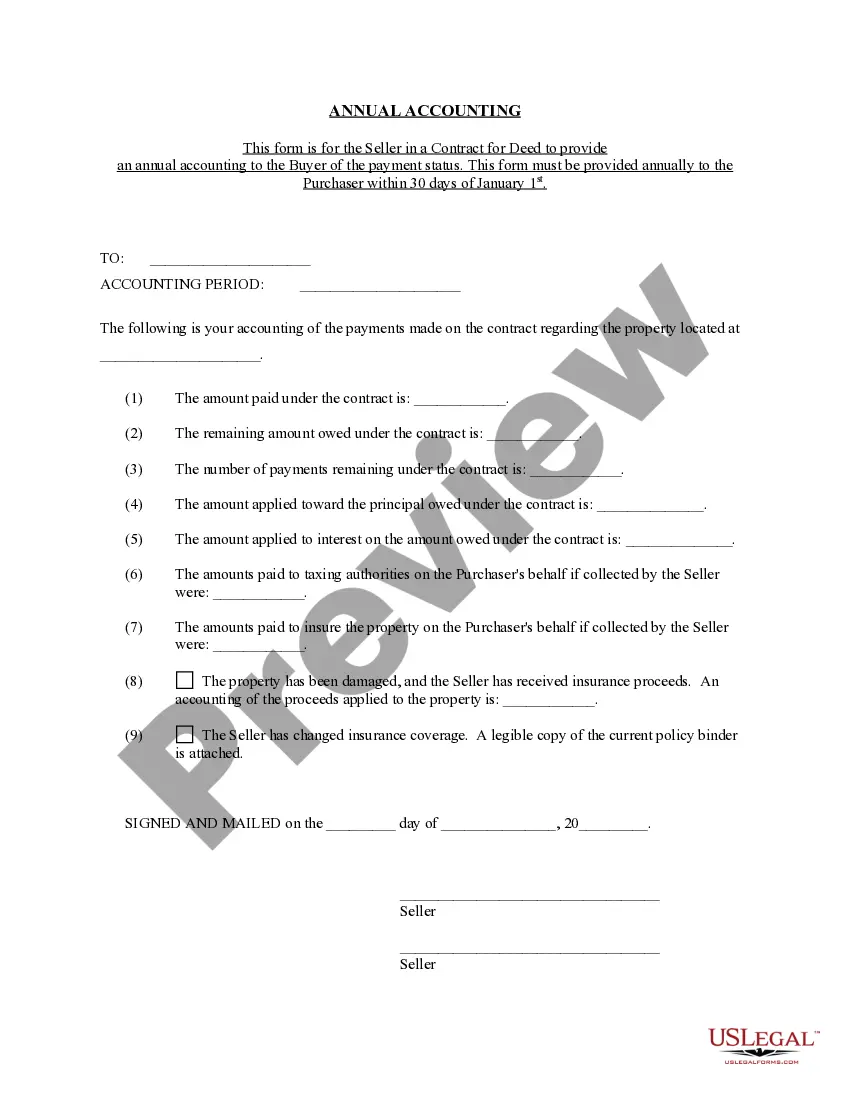

(a) Furnishing of statement required. Every vendor under a land installment contract shall mail or deliver a statement to the purchaser:

(1) When 40 percent of the original cash price has been paid; and

(2) (i) Annually within 30 days of January 1; or

(ii) On demand of the purchaser no more than twice a year.

(b) Contents of statement. The statement shall show:

(1) The total amount paid for any ground rent, insurance, taxes, and any other periodic charge;

(2) The amount credited to principal and interest; and

(3) The balance due.

HISTORY: An. Code 1957, art. 21, 10-106; 1974, ch. 12, 2; 1976, ch. 272.

REAL PROPERTY

TITLE 10. Sale of Real Property.

Subtitle 1. Land Installment Contracts.

10-108. Right of purchaser to enforce provisions of subtitle

If a vendor fails to comply with the provisions of 10-105 or 10-107 of this subtitle, the purchaser has the right to enforce these sections in a court of equity. If the court finds that the vendor has failed to comply with these provisions, the court shall grant appropriate relief and shall require the vendor to assume all court costs as well as a reasonable counsel fee for the purchaser's attorney.

HISTORY: An. Code 1957, art. 21, 10-107; 1974, ch. 12, 2; 1976, ch. 272.

Maryland Case Law

In Md. Code Ann., Real Prop. 10-101(b), the Maryland Land Installment Contract Act defines a land installment contract as a legally binding executory agreement under which (1) the vendor agrees to sell an interest in certain types of real property to the purchaser and the purchaser agrees to pay the purchase price in five or more subsequent payments exclusive of the down payment, if any, and (2) the vendor retains title as security for the purchaser's obligation. Archway Motors Inc. v. Herman, 37 Md.App. 674 (1977).

The Maryland Land Installment Contract Act requires that within fifteen days after the contract has been signed by both parties,the vendor shall cause the contract to be recorded among the land records of the county where the property lies and shall mail the recorder's receipt to the purchaser. This duty of recordation and mailing of receipt shall be written clearly or printed on the contract. Failure to do so, or to record as required under this section within the time stipulated, gives the purchaser the unconditional right to cancel the contract and to receive immediate refund of all payments and deposits on account of or in contemplation of the contract. Sidhu v. Shigo, 61 Md.App. 61 (1984).

v

One purpose of the Land Installment Contract Act was to provide a mechanism whereby a vendee would not lose the equity and interest he had built in his home in the event of default. Russ v. Barnes, 23 Md.App. 691 (1974).