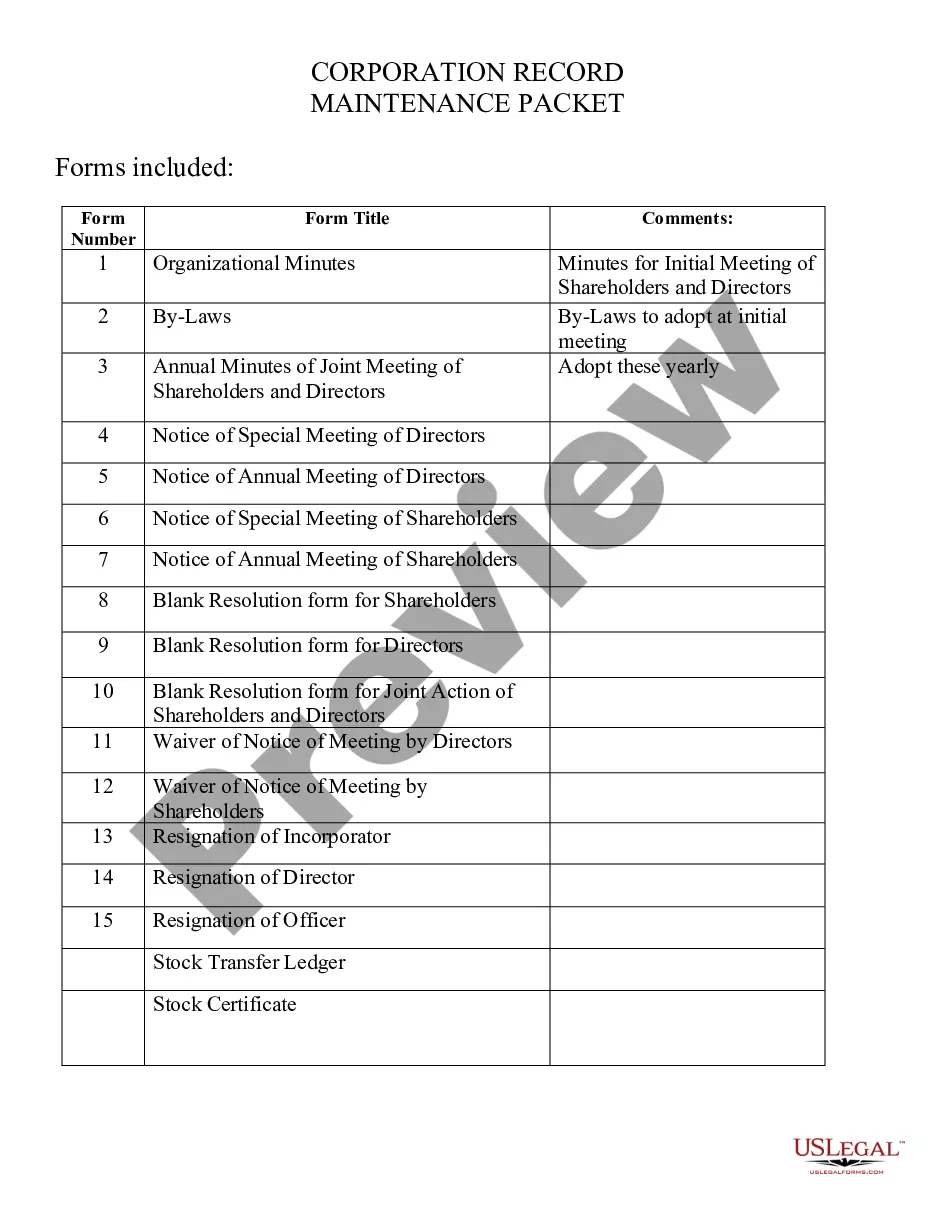

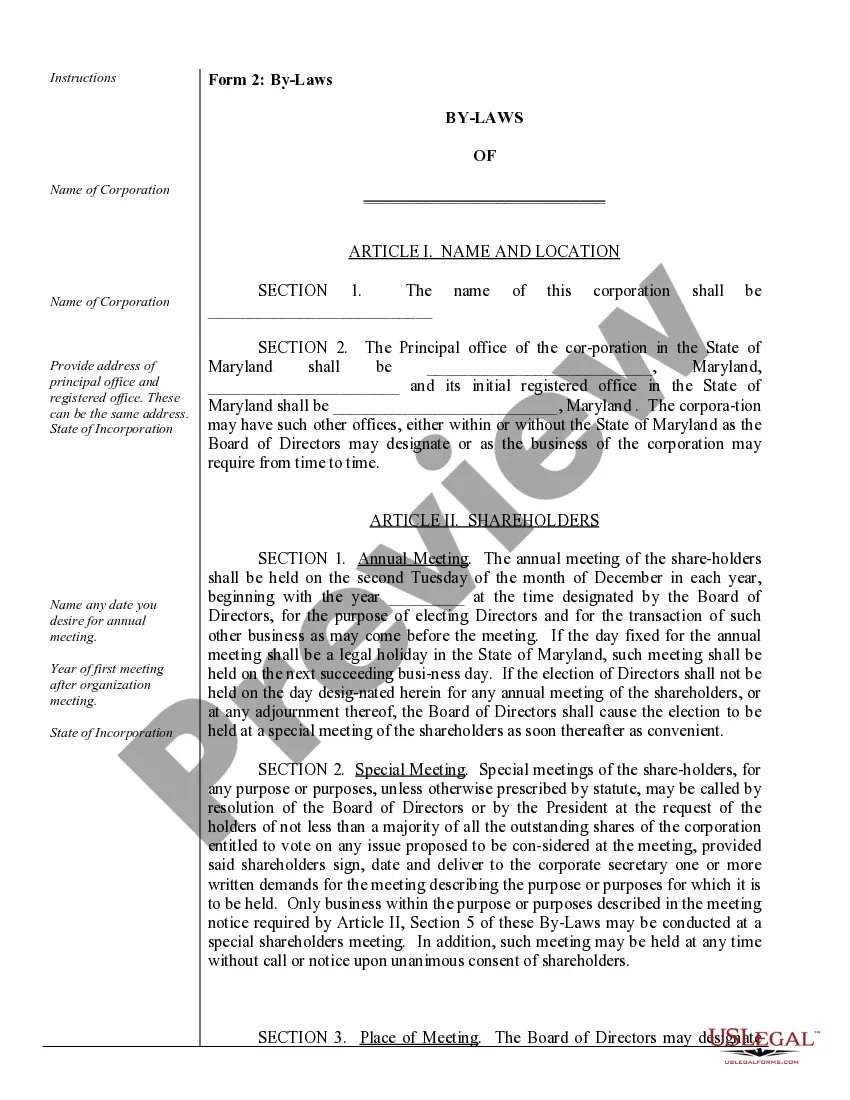

This package includes the following forms: Organizational Minutes, Minutes for Initial Meeting of Shareholders and Directors, By-Laws, Annual Minutes of Joint Meeting of Shareholders and Directors, Notice of Special Meeting of Directors, Notice of Annual Meeting of Directors, Notice of Special Meeting of Shareholders, Notice of Annual Meeting of Shareholders, Blank Resolution form for Shareholders, Blank Resolution form for Directors, Blank Resolution form for Joint Action of Shareholders and Directors, Waiver of Notice of Meeting by Directors, Waiver of Notice of Meeting by Shareholders, Resignation of Incorporator, Resignation of Director, Resignation of Officer, Stock Transfer Ledger and Simple Stock Certificate.

Maryland Corporate Records Maintenance Package for Existing Corporations

Description Md Records Corporations

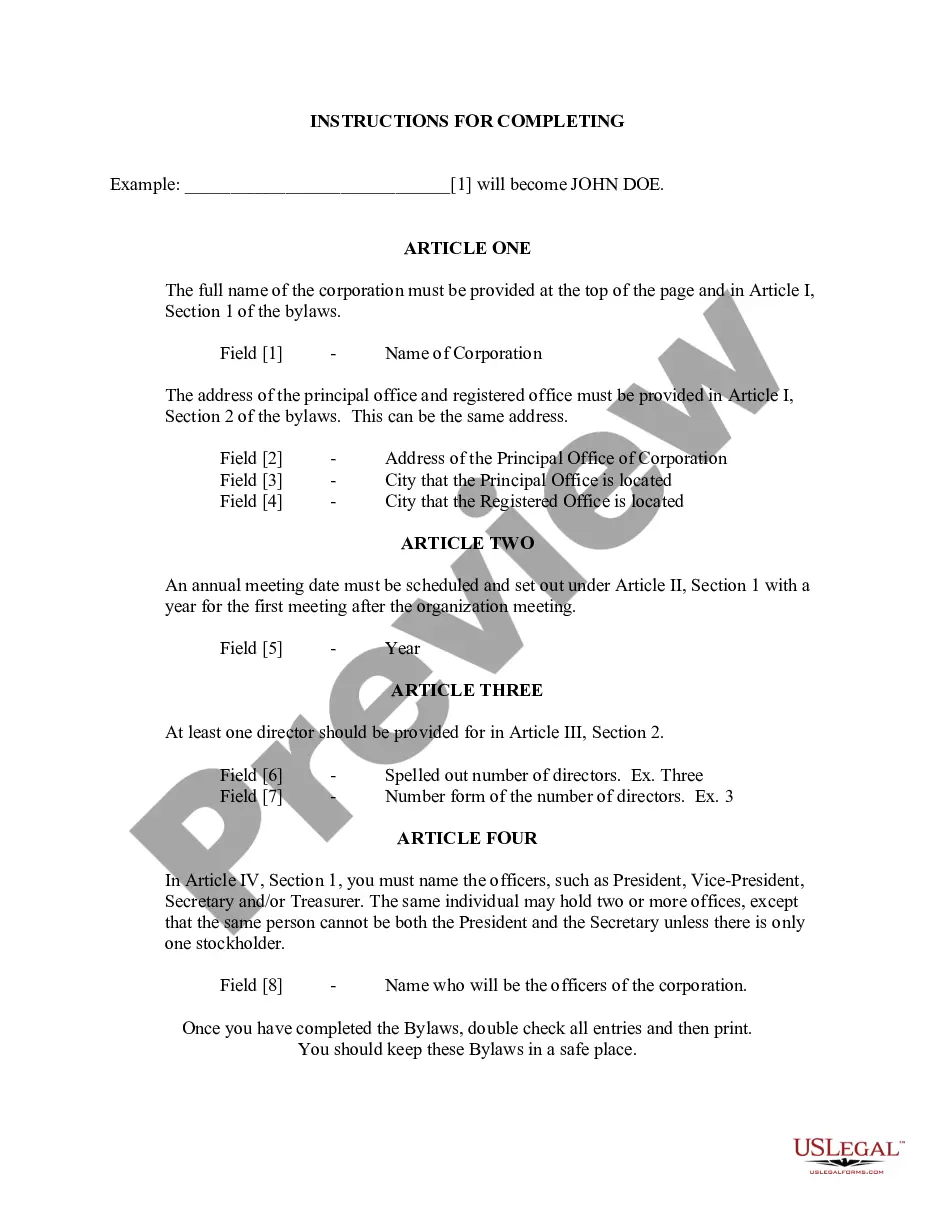

How to fill out Maryland Corporate Records Maintenance Package For Existing Corporations?

Welcome to the greatest legal files library, US Legal Forms. Here you can find any example such as Maryland Corporate Records Maintenance Package for Existing Corporations forms and save them (as many of them as you want/need). Make official files in a couple of hours, rather than days or even weeks, without having to spend an arm and a leg with an lawyer or attorney. Get the state-specific form in a few clicks and feel assured with the knowledge that it was drafted by our accredited legal professionals.

If you’re already a subscribed consumer, just log in to your account and click Download near the Maryland Corporate Records Maintenance Package for Existing Corporations you want. Because US Legal Forms is online solution, you’ll generally get access to your downloaded files, no matter the device you’re utilizing. Find them within the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check our guidelines listed below to start:

- If this is a state-specific sample, check its applicability in your state.

- View the description (if offered) to learn if it’s the right template.

- See more content with the Preview feature.

- If the example meets all of your needs, click Buy Now.

- To create your account, pick a pricing plan.

- Use a credit card or PayPal account to sign up.

- Save the template in the format you need (Word or PDF).

- Print out the file and fill it out with your/your business’s info.

When you’ve filled out the Maryland Corporate Records Maintenance Package for Existing Corporations, give it to your attorney for verification. It’s an additional step but a necessary one for making sure you’re entirely covered. Become a member of US Legal Forms now and get access to a large number of reusable samples.

Corporate Records Pack Form popularity

Records Corporations Bundle Other Form Names

Maryland Corporation Search FAQ

Filed with the Division of Corporations may be obtained by submitting a written request to the New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

A company or organization that has legal rights and responsibilities, for example the right to make contracts and the responsibility to pay debts: All companies whose affairs are regulated by the Corporation Act are legal entities.

Almost all businesses in Maryland need a business license issued by the Clerks of the Circuit Court. Contact the Clerk of the Circuit Court in your county or Baltimore City. Construction licenses are issued by the Clerks of the Circuit Court and are required for commercial work and new home construction.

You can search for registered business trademark information on the DAT Business Express database, available here: https://egov.maryland.gov/BusinessExpress/EntitySearch . Regulatory licenses are issued by the Department of Labor.

Obtaining a copy of a company's Articles of Incorporation is a relatively simple process. In most states, a certified copy can be requested by visiting the office of the Secretary of State in person or by phone, mail, or the state's online system.

Order Documents Online To view or order copies of documents, follow these steps: Visit the Business Entity Search. Enter the business name or Department ID for the business for which you need documents. Select the appropriate business from the results.

Articles of incorporation, also referred to as the certificate of incorporation or the corporate charter, are a document or charter that establishes the existence of a corporation in the United States and Canada.An equivalent term for limited liability companies (LLCs) in the United States is articles of organization.

Accountant. Armed forces officer. Bank/building society official. Commissioner of Oaths. Councillor (local or county) FCA regulated person (identified using the FCA authorised persons lists)

Make a copy of the original document. Take the original document and your copy to the certifier. They will check your copy is the same as the original. On a single-page document, the certifier must write or stamp, 'This is a certified true copy of the original as sighted by me'

All states have an online location where you can check the status of any corporation registered in that state. Information provided can include the name, date of incorporation, registered number or ID, and current standing. To check the status of a company, click the link next to the state in which it is incorporated.