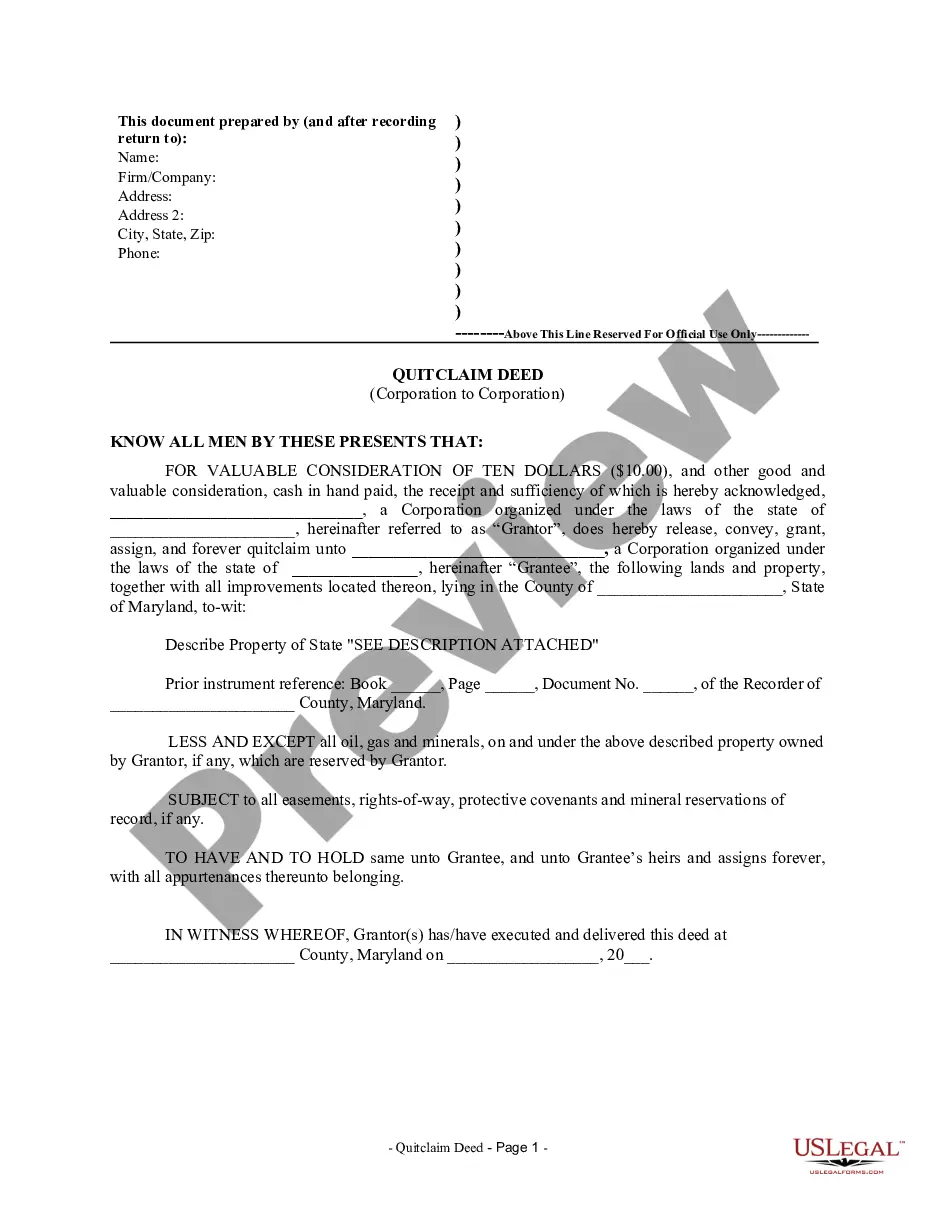

Maryland Quitclaim Deed from Corporation to Corporation

Description

How to fill out Maryland Quitclaim Deed From Corporation To Corporation?

Welcome to the largest legal files library, US Legal Forms. Right here you can get any template including Maryland Quitclaim Deed from Corporation to Corporation forms and save them (as many of them as you wish/need to have). Make official files in a few hours, rather than days or weeks, without having to spend an arm and a leg with an lawyer or attorney. Get the state-specific sample in clicks and be assured knowing that it was drafted by our state-certified attorneys.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Maryland Quitclaim Deed from Corporation to Corporation you need. Because US Legal Forms is web-based, you’ll always get access to your saved files, no matter the device you’re using. Locate them in the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check out our guidelines listed below to begin:

- If this is a state-specific form, check out its applicability in your state.

- See the description (if offered) to learn if it’s the proper template.

- See more content with the Preview function.

- If the example matches all of your requirements, click Buy Now.

- To create your account, choose a pricing plan.

- Use a card or PayPal account to register.

- Download the file in the format you require (Word or PDF).

- Print the file and fill it out with your/your business’s details.

When you’ve completed the Maryland Quitclaim Deed from Corporation to Corporation, give it to your legal professional for verification. It’s an extra step but a necessary one for making confident you’re fully covered. Become a member of US Legal Forms now and get thousands of reusable samples.

Form popularity

FAQ

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Typically, the only cost is between $25 and $55 to record the new deed and obtain a certificate from the city/county to show that all taxes are current. The deed should be notarized and must be prepared by one of the parties or under the supervision of a Maryland attorney.

A consenting individual may be removed from a deed by filing a quitclaim deed. Under Maryland law each county has a separate procedure and requirements for filing a quitclaim deed.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.

Documents: To submit the quitclaim deed to the Clerk of the Circuit Court, you must have a Land Intake Sheet with the deed. Filing: Quitclaim deeds in Maryland are filed with the Clerk of the Circuit Court in the county where the property is located. Each county has its own filing fee.

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.