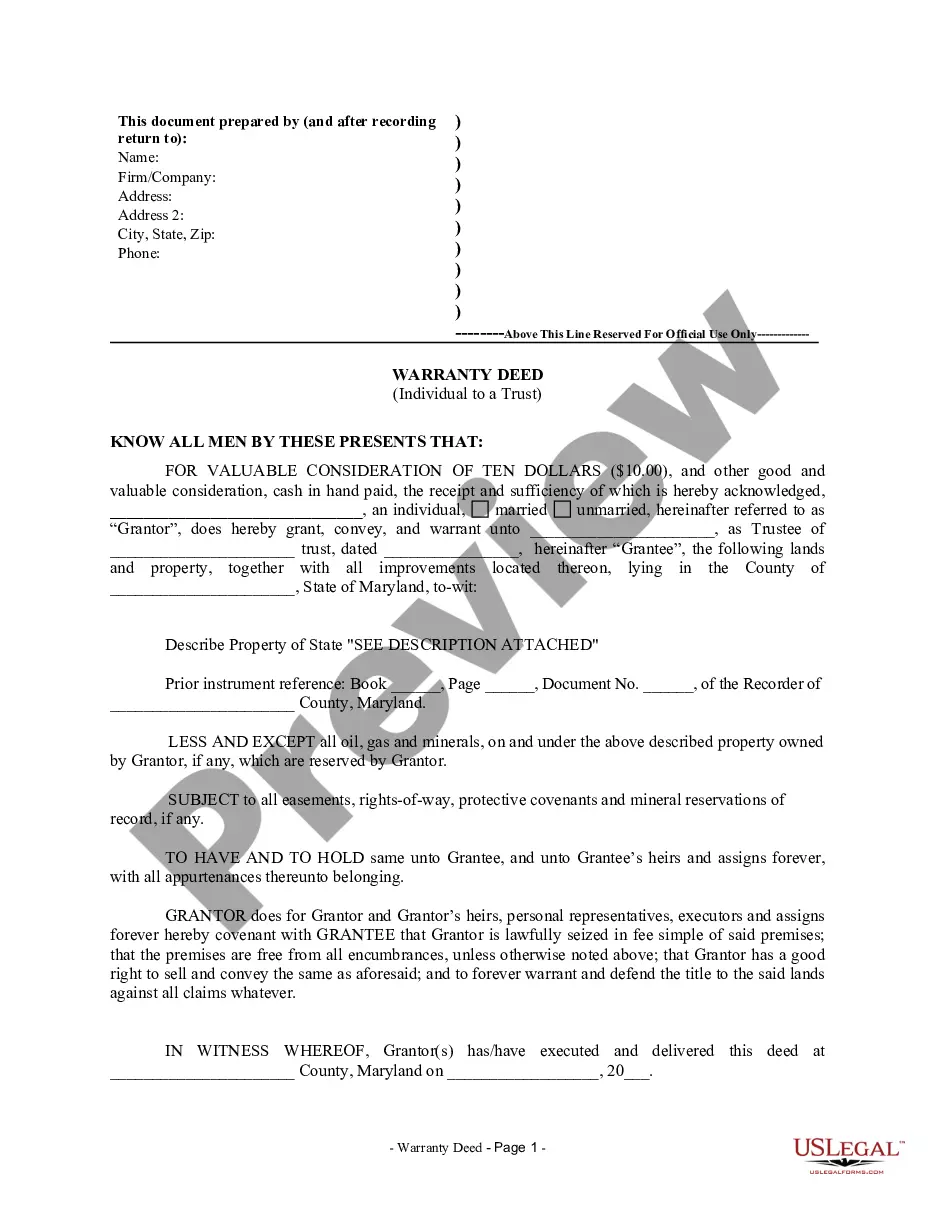

Maryland Warranty Deed from Individual to a Trust

Description Md Deed Trust

How to fill out Maryland Warranty Deed From Individual To A Trust?

Welcome to the most significant legal documents library, US Legal Forms. Here you will find any template including Maryland Warranty Deed from Individual to a Trust forms and download them (as many of them as you want/require). Get ready official files in a several hours, rather than days or weeks, without spending an arm and a leg on an lawyer. Get the state-specific sample in clicks and feel confident understanding that it was drafted by our qualified attorneys.

If you’re already a subscribed consumer, just log in to your account and then click Download next to the Maryland Warranty Deed from Individual to a Trust you want. Due to the fact US Legal Forms is online solution, you’ll always have access to your saved forms, regardless of the device you’re using. Locate them in the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check our instructions below to begin:

- If this is a state-specific document, check out its applicability in the state where you live.

- See the description (if readily available) to understand if it’s the right example.

- See much more content with the Preview feature.

- If the sample fulfills all of your needs, just click Buy Now.

- To make an account, select a pricing plan.

- Use a card or PayPal account to join.

- Download the file in the format you need (Word or PDF).

- Print out the document and fill it with your/your business’s info.

Once you’ve completed the Maryland Warranty Deed from Individual to a Trust, give it to your attorney for confirmation. It’s an extra step but an essential one for being sure you’re entirely covered. Become a member of US Legal Forms now and get a large number of reusable examples.

Form popularity

FAQ

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

Choose the type of trust you want. Take inventory of your property. Decide who will be your trustee. Create a trust document, either by yourself using an online program or with the assistance of a lawyer. Sign the trust in front of a notary public. Fund the trust by transferring your property into it.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

A trustee deed offers no such warranties about the title.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.