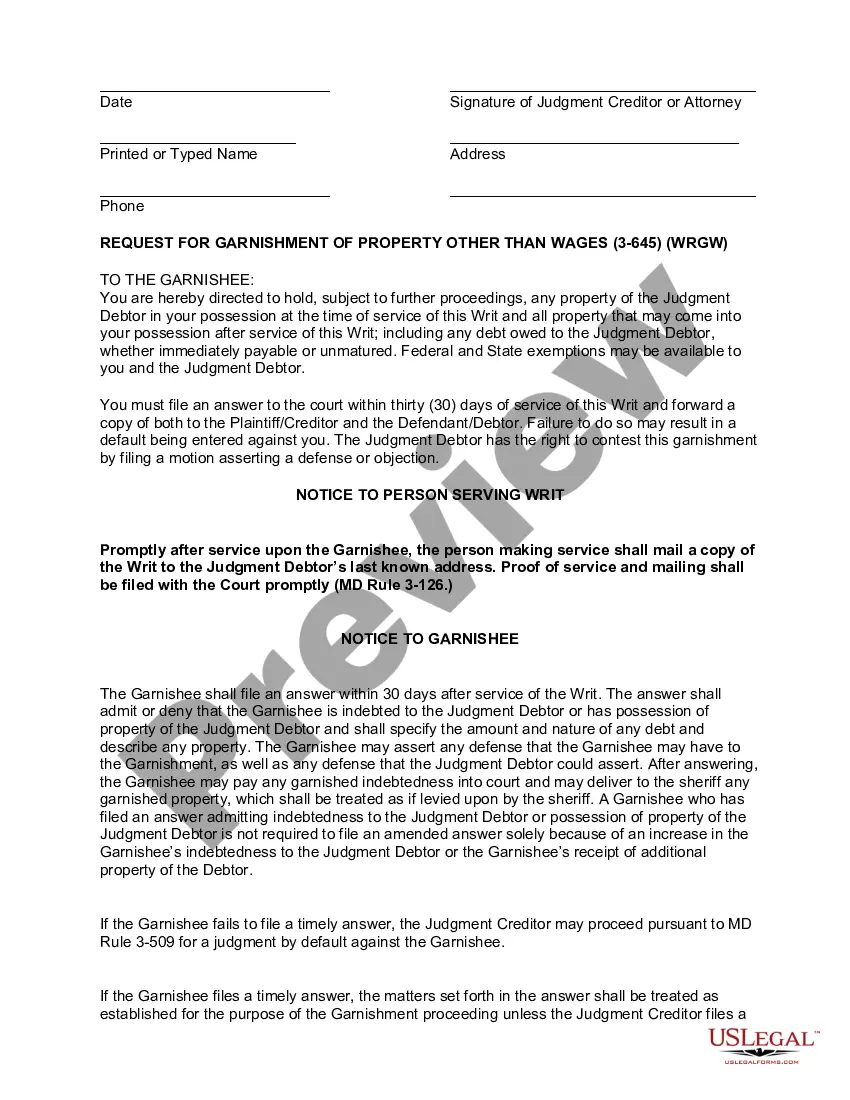

After a judgment has been entered against a debtor, the creditor has the legal right to garnish wages and/or bank accounts or attach any other asset to collect the debt. While a creditor may not garnish more than 25% of the debtors wages per pay period, there are no such limitations on how much a creditor may garnish from a bank account or other asset. However, the debtor may claim certain assets exempt from garnishment. The exemptions from garnishment can be found in The Maryland Annotated Code, Courts and Judicial Proceedings 11-504. These include $6,000.00 in cash, in a bank account or in property of any kind whose value is $6,000; an additional $1,000 in household furnishings, household goods, clothing or other property used for household purposes for the debtor or a dependent of the debtor; an additional $5,000 in real property or other personal property. Once a garnishment other than wages is entered, the debtor generally has 30 days to file a motion with the court to claim the property garnished as exempt under Maryland law.

Maryland Request for Garnishment of Property Other Than Wages

Description

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

Welcome to the most significant legal files library, US Legal Forms. Right here you will find any sample including Maryland Request for Garnishment of Property Other Than Wages templates and save them (as many of them as you want/need). Prepare official documents within a couple of hours, instead of days or even weeks, without having to spend an arm and a leg with an lawyer. Get the state-specific sample in clicks and feel confident knowing that it was drafted by our qualified attorneys.

If you’re already a subscribed customer, just log in to your account and click Download near the Maryland Request for Garnishment of Property Other Than Wages you need. Due to the fact US Legal Forms is web-based, you’ll always have access to your saved files, no matter the device you’re utilizing. Locate them inside the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check out our guidelines listed below to get started:

- If this is a state-specific form, check its validity in your state.

- Look at the description (if readily available) to understand if it’s the proper example.

- See more content with the Preview function.

- If the example fulfills all your requirements, just click Buy Now.

- To create an account, choose a pricing plan.

- Use a card or PayPal account to sign up.

- Save the document in the format you want (Word or PDF).

- Print the document and fill it out with your/your business’s info.

As soon as you’ve filled out the Maryland Request for Garnishment of Property Other Than Wages, send away it to your lawyer for verification. It’s an extra step but an essential one for being sure you’re entirely covered. Become a member of US Legal Forms now and get access to a mass amount of reusable examples.

Form popularity

FAQ

Wage garnishment is sometimes ordered by federal or state courts when you owe back taxes, alimony, child support and certain other debts.This garnishment cannot be strictly "confidential" because the employer must be informed about it in order to garnish the wages.

Once a judgment is issued and the creditor is able to receive payment through wage garnishment, you have little leverage for negotiating a settlement. At this point, the creditor has sufficiently proven the debt is valid and the court has ordered you to repay it.

1. If an alleged employer reports that the debtor is not employed, creditor must file a request for a hearing within 15 days, or the court may dismiss the garnishment. File your request in writing or on a Request/Order form (DC-001).

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

A Writ of Garnishment is a court order to the garnishee. It orders the garnishee to hold any property of the judgment debtor that the garnishee possesses at the time the Writ is filed. The Writ of Garnishment must be served on the garnishee via certified mail, restricted delivery, private process or sheriff/constable.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

The case number and case caption (ex: XYZ Bank vs. John Doe) the date of your objection. your name and current contact information. the reasons (or grounds) for your objection, and. your signature.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.