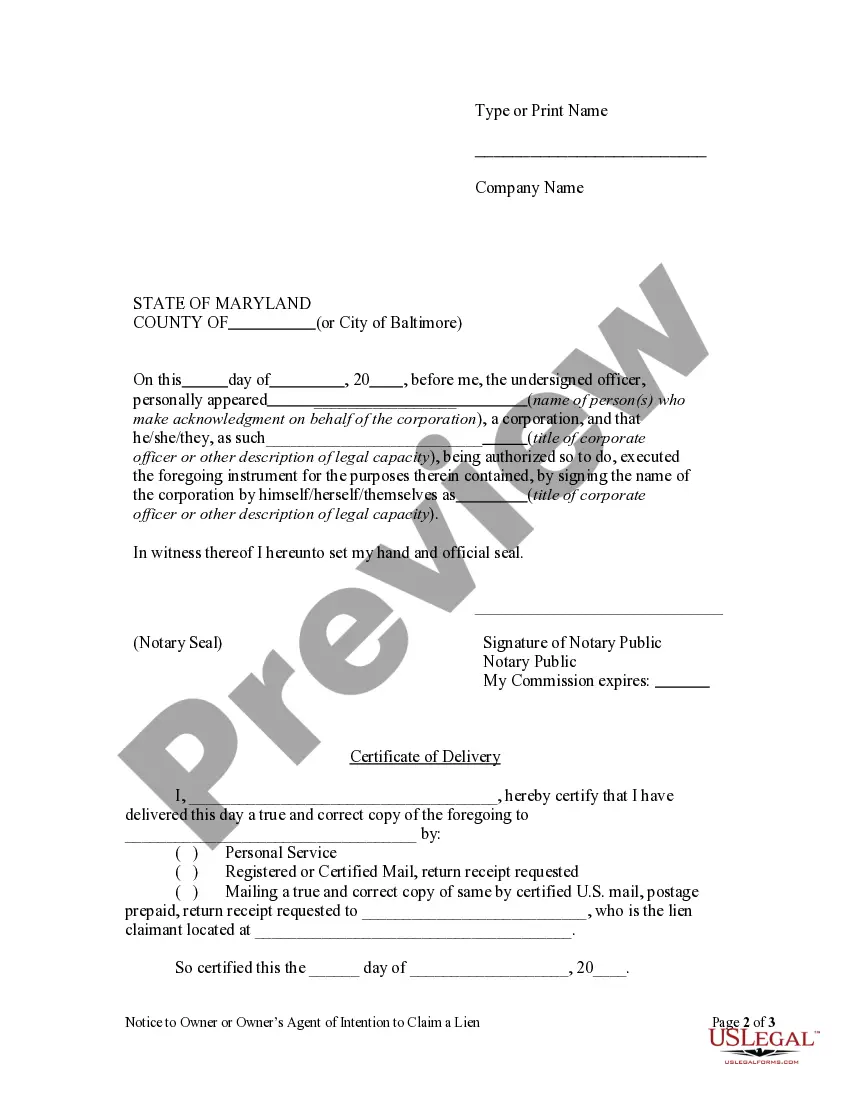

Maryland law requires a party who wishes to claim a lien to file a Petition to Establish a Lien in the appropriate court. A prerequisite to this filing is a valid Notice of Intent to Claim a Lien. The Notice of Intent must be provided to the property owner within one hundred twenty (120) days after doing the work or furnishing the materials. It must be served personally on the property owner or by certified or registered mail.

Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Corporation or LLC

Description Notice Intention Lien

How to fill out Agent Lien Fill?

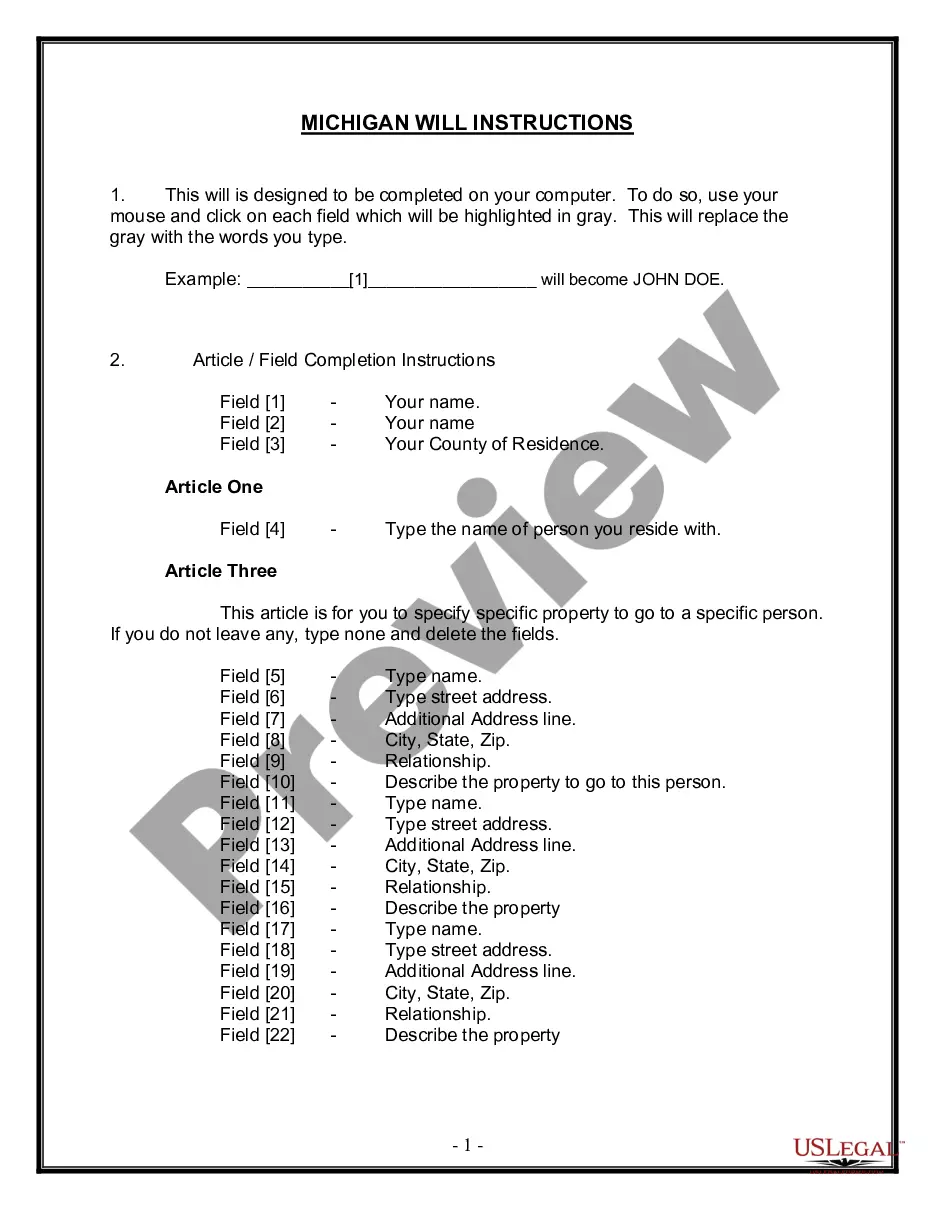

You are welcome to the most significant legal documents library, US Legal Forms. Here you can find any sample including Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Corporation or LLC forms and save them (as many of them as you wish/need to have). Prepare official papers within a few hours, rather than days or even weeks, without having to spend an arm and a leg with an lawyer or attorney. Get the state-specific sample in a couple of clicks and feel assured understanding that it was drafted by our accredited legal professionals.

If you’re already a subscribed customer, just log in to your account and click Download next to the Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Corporation or LLC you want. Due to the fact US Legal Forms is online solution, you’ll always have access to your saved files, no matter what device you’re using. See them in the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check out our instructions below to begin:

- If this is a state-specific form, check its applicability in your state.

- Look at the description (if offered) to learn if it’s the correct example.

- See much more content with the Preview feature.

- If the document fulfills all your requirements, just click Buy Now.

- To make your account, pick a pricing plan.

- Use a credit card or PayPal account to register.

- Download the template in the format you require (Word or PDF).

- Print the file and fill it out with your/your business’s info.

When you’ve completed the Maryland Notice to Owner or Owner's Agent of Intention to Claim a Lien by Corporation or LLC, send away it to your lawyer for confirmation. It’s an extra step but an essential one for making sure you’re fully covered. Become a member of US Legal Forms now and access a large number of reusable samples.

Agent Lien Uslegal Form popularity

Notice Owner Owners Other Form Names

Agent Lien Form FAQ

If you want to place a lien on a commercial rental property and you are not the landlord, you may need to put a lien on the property by filing with the court of record in the jurisdiction where the property is actually located.

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

The people who can file mechanic's liens are identified by state law. A subcontractor or supplier to a subcontractor may not be able to file a lien. Also, unlicensed contractors are often barred from filing a mechanic's lien.

Option 1: Create an account to file your Articles of Organization on the Maryland Business Express website. Once logged in, select Start a New Filing, and then Register a Business. Option 2: Access the Articles of Organization PDF from the Maryland State Department of Assessments and Taxation website.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

If contractors or suppliers aren't paid on a construction project in Maryland, they can file a mechanics lien to secure payment.

A mechanics lien is one of the most effective payment recovery methods that can pressure construction clients to pay up.When a property gets foreclosed or goes bankrupt, all construction parties with a valid mechanics lien against the property may still recover payment through the proceeds of the foreclosure sale.