A compilation album is an album featuring tracks from multiple recording artists, often culled from a variety of sources. The tracks are usually collected according to a common characteristic, such as popularity, source or subject matter

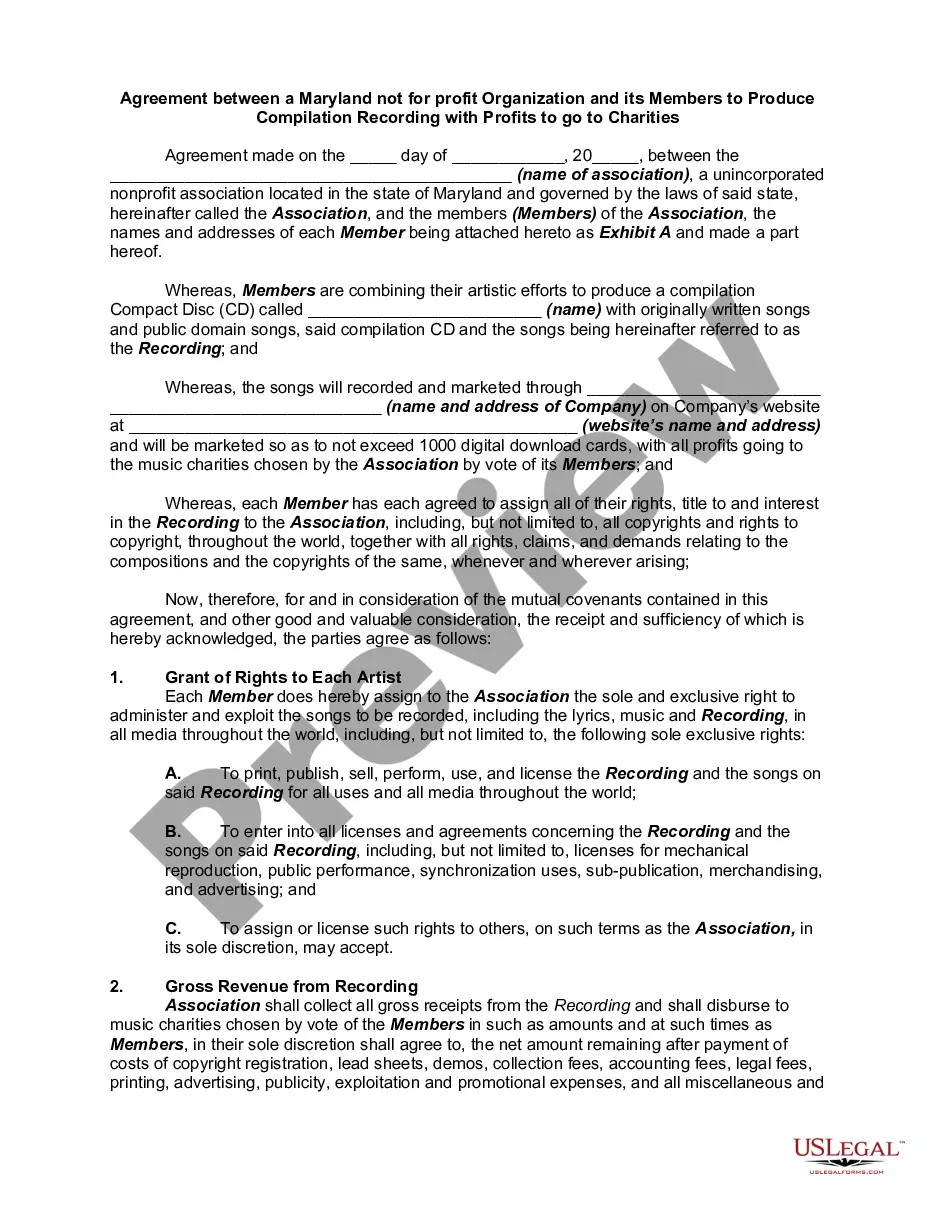

According to section 7-30-104 of the Maryland Code,

A nonprofit association in its name may acquire, hold, encumber, or transfer an estate or interest in real or personal property.