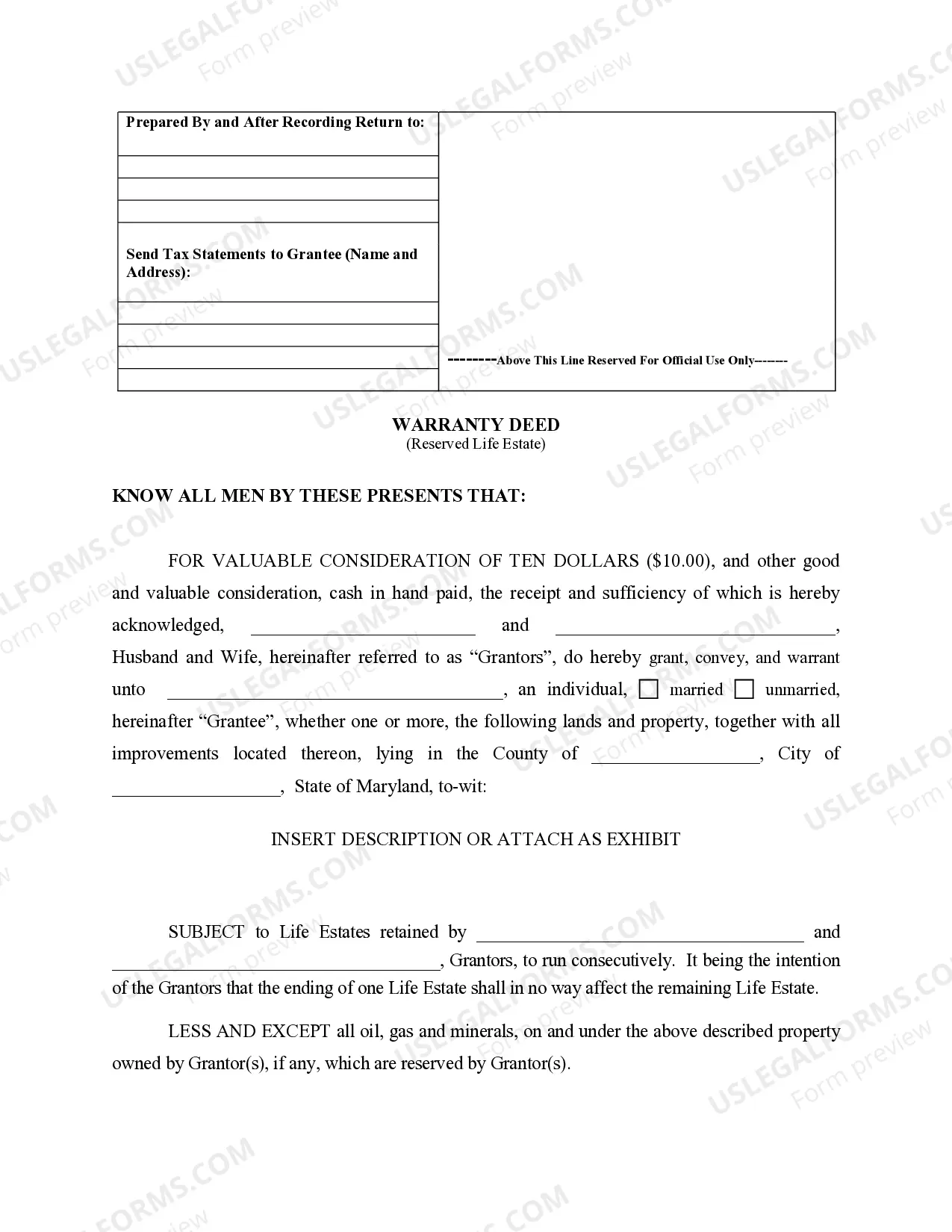

Maryland Warranty Deed to Child Reserving a Life Estate in the Parents

Description

How to fill out Maryland Warranty Deed To Child Reserving A Life Estate In The Parents?

You are invited to the most essential legal document repository, US Legal Forms. Here, you can locate any template such as Maryland Warranty Deed to Child Reserving a Life Estate in the Parents forms and save them (as numerous as you desire/need). Create official documents in merely a few hours, rather than days or weeks, without spending a fortune with a lawyer or attorney.

Obtain your state-specific form in just a few clicks and feel confident knowing it was prepared by our licensed legal experts.

If you’re already a subscribed member, just Log In to your account and then click Download next to the Maryland Warranty Deed to Child Reserving a Life Estate in the Parents you need.

- Since US Legal Forms is an online service, you’ll consistently have access to your downloaded documents, irrespective of the device you’re using.

- View them in the My documents section.

- If you don't possess an account yet, what are you waiting for.

- Review our instructions below to get started.

- If this is a state-specific form, verify its relevancy in the state where you reside.

- Examine the description (if available) to ascertain if it’s the right template.

- Explore more content with the Preview option.

- If the template suits your requirements, select Buy Now.

- To create an account, pick a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you desire (Word or PDF).

- Print the document and complete it with your/your business’s information.

- Once you’ve filled out the Maryland Warranty Deed to Child Reserving a Life Estate in the Parents, send it to your attorney for validation. It’s an additional step but a crucial one to ensure you’re fully protected.

- Join US Legal Forms today and gain access to a comprehensive collection of reusable templates.

Form popularity

FAQ

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

To access online forms, select "Individuals" at the top of the IRS website and then the "Forms and Publications" link located on the left hand side of the page. You will then see a list of printable forms, including the 1040, 1040-EZ, 4868 form for an extension of time and Schedule A for itemized deductions.

Single filers whose gross income meets or exceeds $10,150 and married taxpayers filing jointly with gross income at or above $20,300 are required to file Maryland tax returns.

You may download it for free at: http://www.adobe.com/go/getreader/ . If you need further assistance, you may contact Taxpayer Service at 410-260-7980 from Central Maryland or at 1-800-MD-TAXES from elsewhere.

Download them. You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices.

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

There were several notable changes to the form for the tax year 2020: you can read about them here.Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov and are being printed for taxpayers who need a hard copy.

Maryland 2019 Standard Deductions The Maryland state standard deductions for Tax Year 2019 are $2,250 for Single taxpayers and $4,550 for Heads of Household, surviving spouses, and Married Filing Jointly taxpayers.