This form is a Quitclaim Deed where the grantor is a Trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Maryland Quitclaim Deed from a Trust to an Individual

Description Trust To Individual

How to fill out Maryland Quitclaim Deed From A Trust To An Individual?

Welcome to the most significant legal documents library, US Legal Forms. Here you will find any example including Maryland Quitclaim Deed from a Trust to an Individual forms and save them (as many of them as you want/require). Make official documents with a couple of hours, rather than days or even weeks, without having to spend an arm and a leg with an attorney. Get the state-specific sample in a few clicks and feel assured understanding that it was drafted by our qualified attorneys.

If you’re already a subscribed customer, just log in to your account and click Download near the Maryland Quitclaim Deed from a Trust to an Individual you need. Due to the fact US Legal Forms is web-based, you’ll generally get access to your downloaded templates, no matter what device you’re utilizing. Find them within the My Forms tab.

If you don't have an account yet, what are you awaiting? Check our guidelines listed below to start:

- If this is a state-specific form, check out its applicability in the state where you live.

- Look at the description (if accessible) to understand if it’s the proper example.

- See much more content with the Preview option.

- If the example matches your needs, just click Buy Now.

- To make your account, choose a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Save the file in the format you require (Word or PDF).

- Print the document and complete it with your/your business’s information.

After you’ve completed the Maryland Quitclaim Deed from a Trust to an Individual, send it to your lawyer for verification. It’s an extra step but a necessary one for being confident you’re completely covered. Join US Legal Forms now and get access to a large number of reusable samples.

Form popularity

FAQ

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.

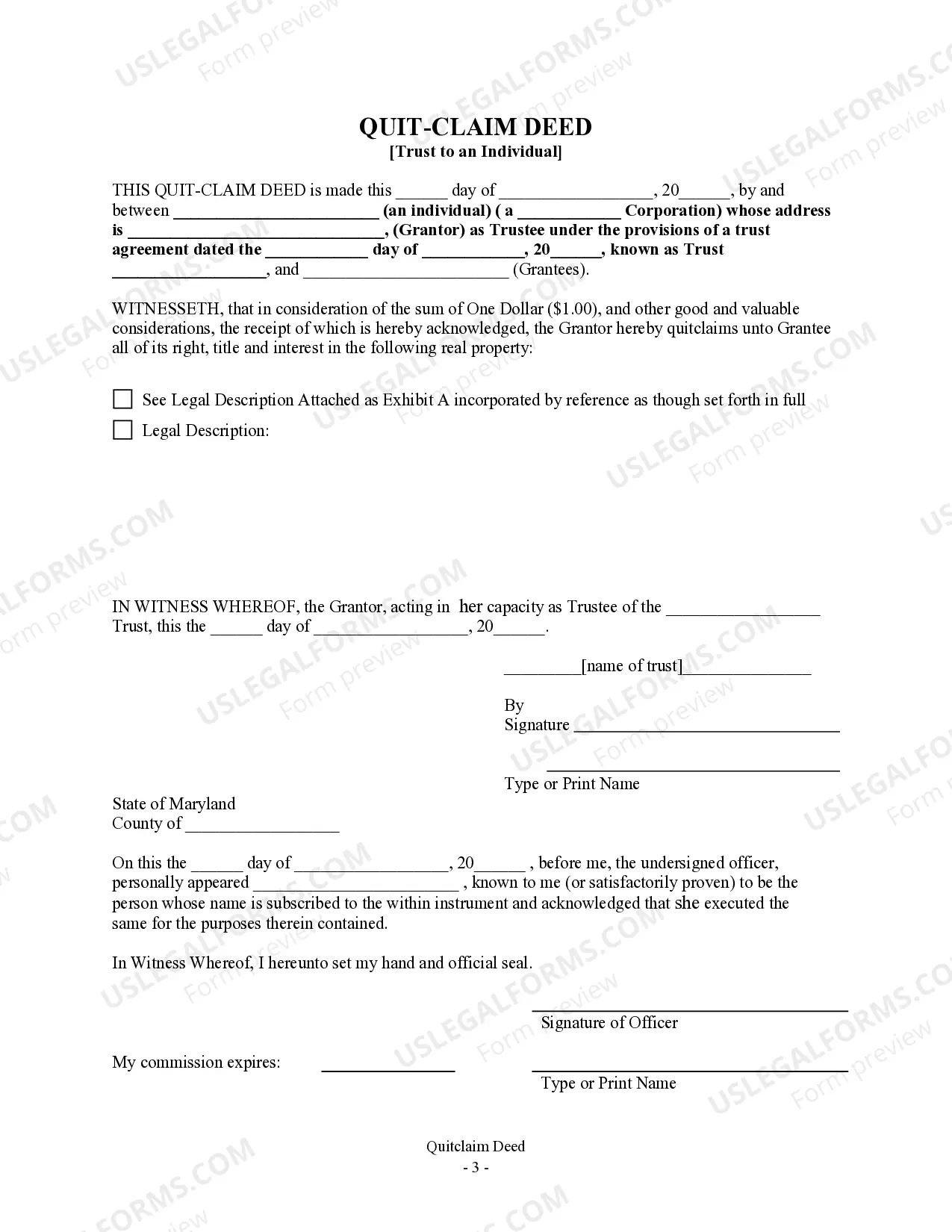

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Documents: To submit the quitclaim deed to the Clerk of the Circuit Court, you must have a Land Intake Sheet with the deed. Filing: Quitclaim deeds in Maryland are filed with the Clerk of the Circuit Court in the county where the property is located. Each county has its own filing fee.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.