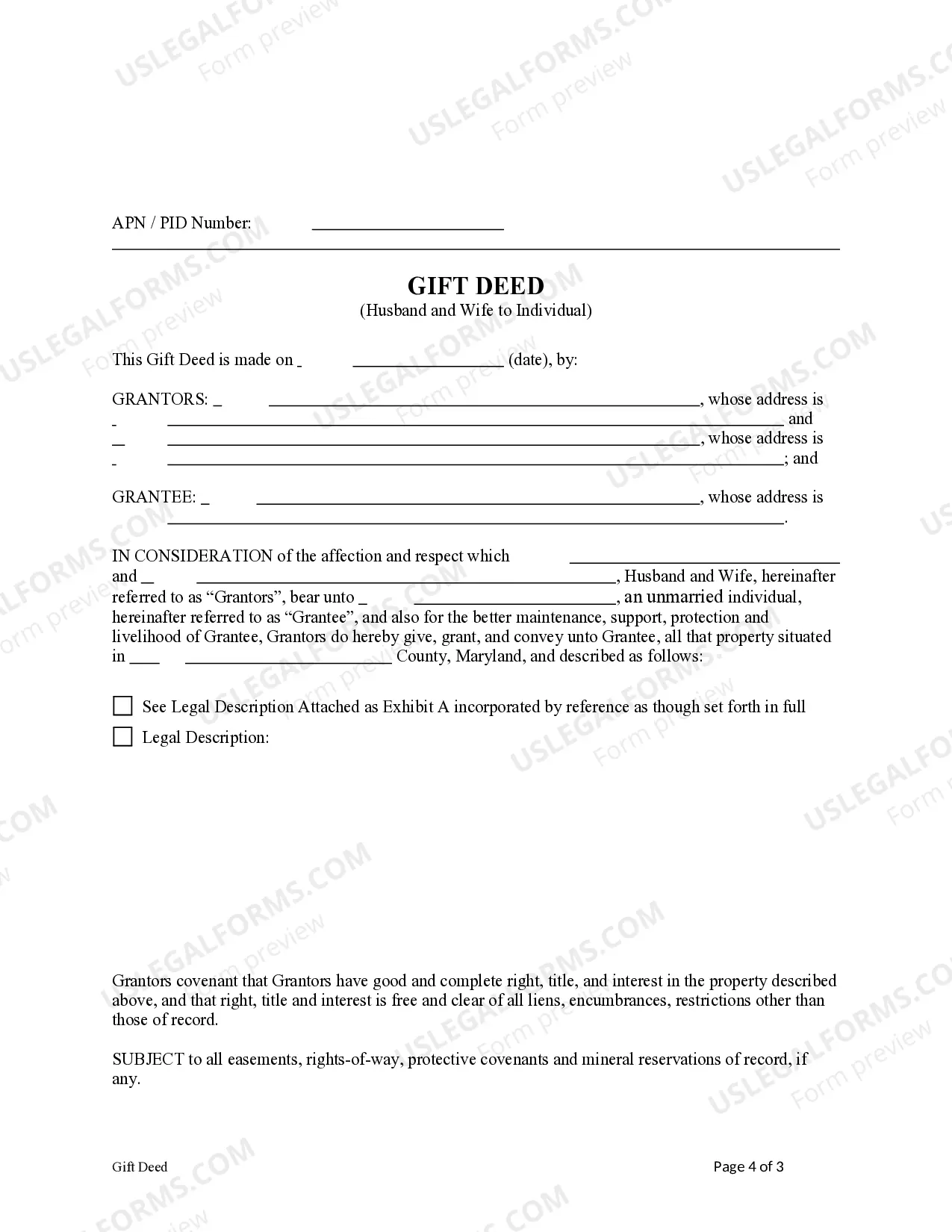

This form is a Gift Deed where the Grantors are husband and wife and the Grantee is an individual. This deed complies with all state statutory laws.

Maryland Gift Deed

Description

Key Concepts & Definitions

Maryland Gift Deed: A legal document used to transfer ownership of property from one person to another without consideration, usually within family relations. Real Estate Transaction: Involves the legal processes behind the buying and selling of property. Deed Form Online: Digital formats of legal forms required for property transactions, available online for ease of access and submission.

Step-by-Step Guide to Processing a Maryland Gift Deed

- Check the Deed Maryland Requirements: Ensure all parties meet the criteria (e.g., must be mentally competent).

- Prepare the Gift Deed Form: Acquire and fill the deed form, which can be found in a legal forms library or online.

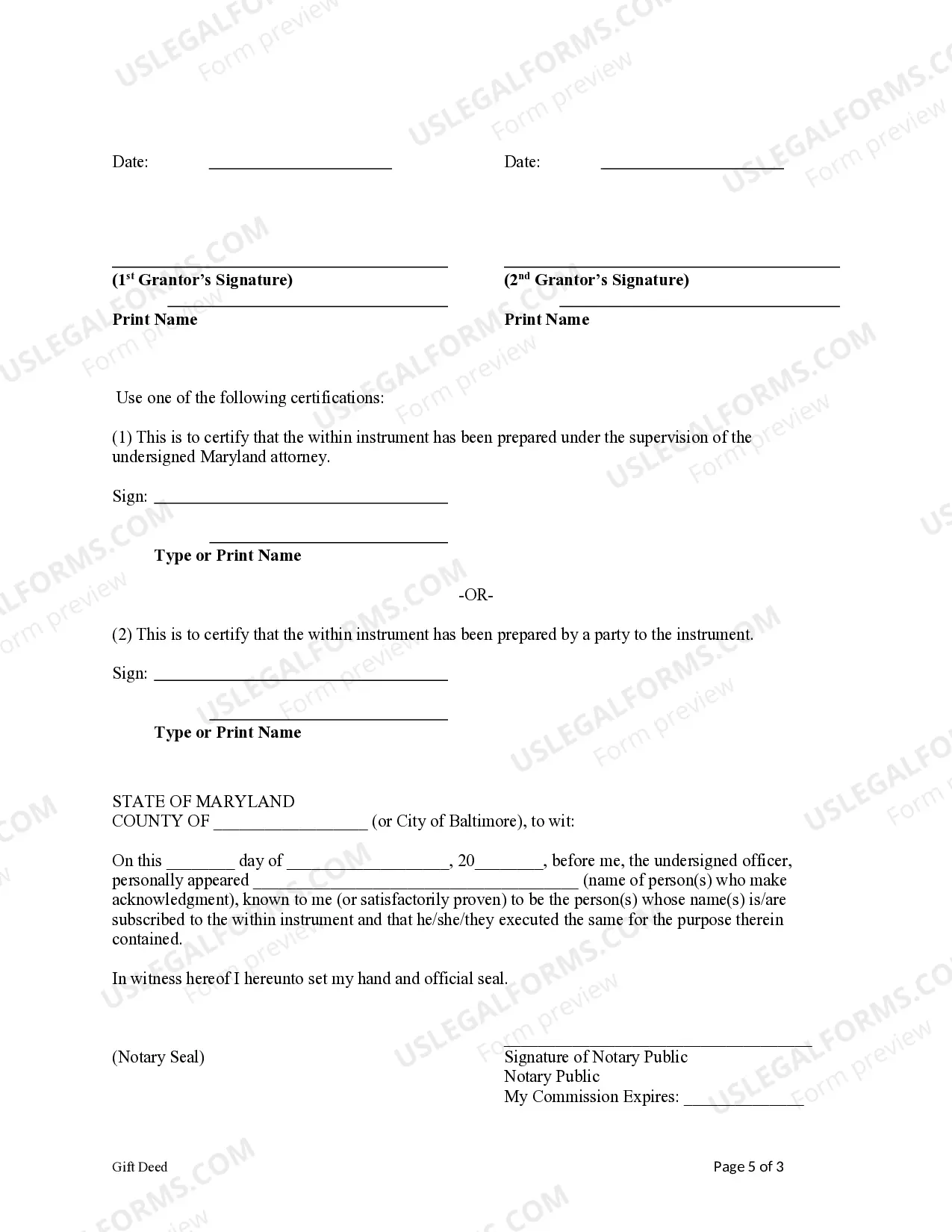

- Execution of the Deed: The donor must sign the deed in the presence of a notary.

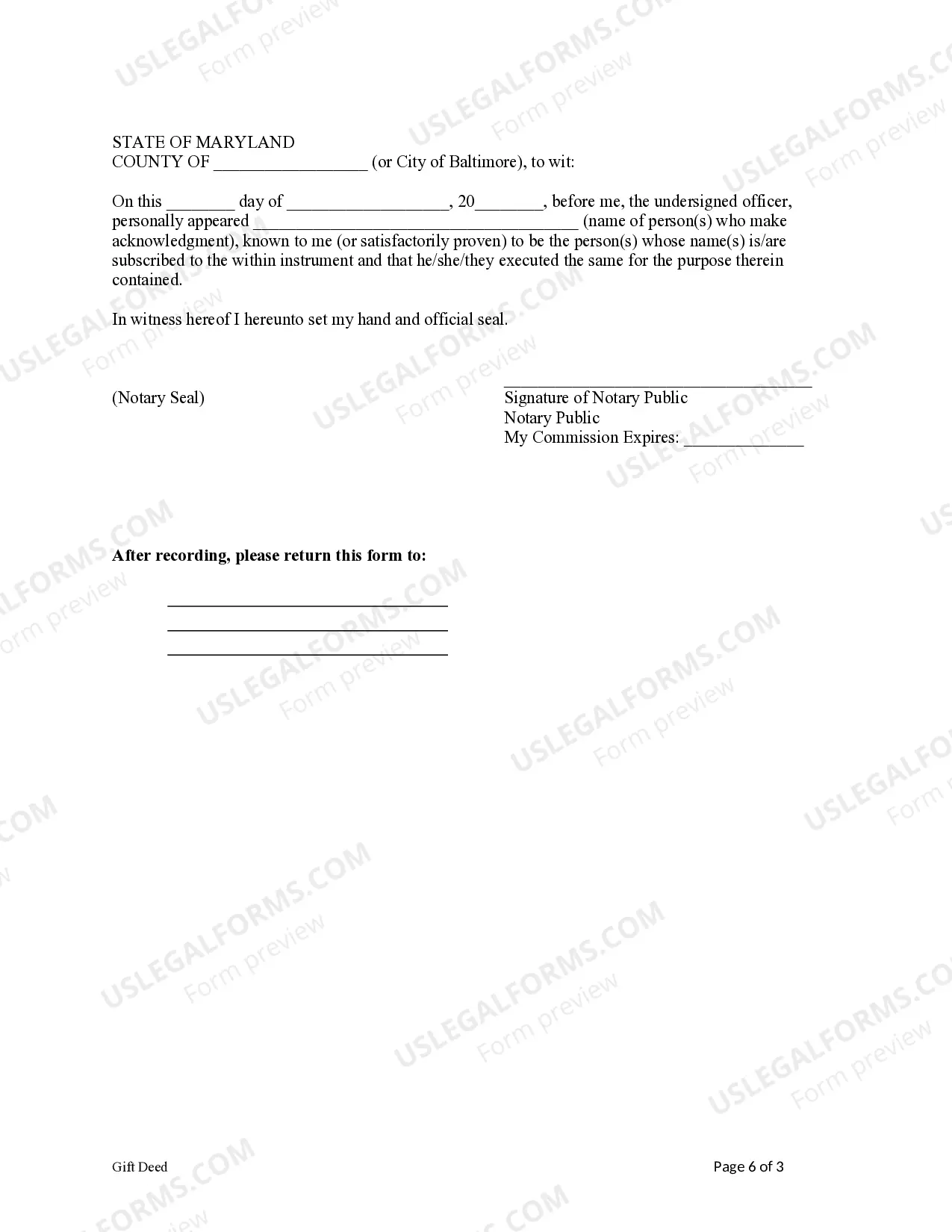

- Land Records Update: File the deed with the local land records office to legally record the transfer.

- Name Change Documentation: If the transfer includes a name change, ensure that proper documentation is filed.

Risk Analysis of Gift Deeds in Maryland

- Legal Disputes: Without proper documentation and adherence to legal procedures, gift deeds can lead to disputes among potential heirs or claimants.

- Financial Implications: Lack of proper advice might lead to unfavorable tax implications for both the donor and recipient.

- Incorrect Filing: Errors in the deed form or filing process can invalidate the transaction, leading to costly corrections.

Best Practices for Handling Maryland Gift Deeds

- Seek Legal Consultation: Consulting with a lawyer to understand all implications and ensure compliance with state laws.

- Verify All Information: All information on the deed, such as property descriptions and party details, should be accurate.

- Keep Records: Maintain copies of all documents related to the gift deed transaction for future reference.

FAQ

Q: Can I revoke a Maryland Gift Deed?

A: Once a Maryland gift deed is executed and filed, it is typically irrevocable unless specific provisions were made before execution.

Q: Are there tax implications for gift deeds in Maryland?

A: Yes, there can be federal tax implications and potentially state taxes; it is advised to consult with a tax advisor.

How to fill out Maryland Gift Deed?

You are invited to the largest legal document repository, US Legal Forms. Here you can discover any template such as Maryland Gift Deed forms and acquire them (as many of them as you desire/require). Prepare official documents in just a few hours, rather than days or even weeks, without needing to spend a fortune on a legal representative.

Obtain the state-specific form in a few clicks and feel assured knowing that it was created by our state-licensed attorneys.

If you’re already a registered user, just Log In to your account and click Download next to the Maryland Gift Deed you wish to obtain. Since US Legal Forms is online-based, you’ll always have access to your stored documents, regardless of the device you’re using. Find them under the My documents section.

Print the document and fill it out with your/your business’s information. Once you’ve completed the Maryland Gift Deed, provide it to your attorney for confirmation. It’s an additional step but a necessary one to ensure you’re fully protected. Join US Legal Forms now and gain access to thousands of reusable templates.

- If you do not have an account yet, what are you waiting for? Follow our guidelines below to get started.

- If this is a state-specific document, verify its relevance in the state where you reside.

- Examine the description (if available) to determine if it’s the correct template.

- View additional details using the Preview feature.

- If the document satisfies all your requirements, simply click Buy Now.

- To create an account, select a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you prefer (Word or PDF).

Form popularity

FAQ

Once a Maryland Gift Deed is properly executed and accepted, it generally cannot be revoked at will. This means that the transfer of property is final and binds both parties. However, there are some exceptions where a gift deed can be contested in court. It is important to understand the limitations and ensure that your intentions are clearly stated in the deed.

Maryland law allows vehicles to be gifted to family members without paying tax. However, you need to fill out the two sections on the back labeled Application for Title and Registration and Assignment of Ownership; the giver signs as seller, and the receiver as the buyer.

Maryland law allows vehicles to be gifted to family members without paying tax. However, you need to fill out the two sections on the back labeled Application for Title and Registration and Assignment of Ownership; the giver signs as seller, and the receiver as the buyer.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

You both should execute the title and list you as the buyer. You will both also have to execute a gift affidavit. You will then need to take the documents to MVA and have the vehicle titled and registered in your name alone.

To transfer a property as a gift, you need to fill in a TR1 form and send it to the Land Registry, along with an AP1 form. If either side is not using a Solicitor or Conveyancer, an ID1 form will also be needed.

In most states you can file a disclaimer or deed of disclaimer that says specifically you were placed in title without your knowledge or consent and disclaim the deed.

Details of the donor and donee (name, date of birth, residence, relationship to each other, father's name, etc.) The amount of money being gifted, Reason for gifting, if any.

During the transfer of ownership process, you won't have to pay any capital gains tax since you're not likely selling the car for a profit at $1. However, your daughter will have to pay whatever rate of sales tax your state charges on used vehicles when she goes to transfer the title.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.