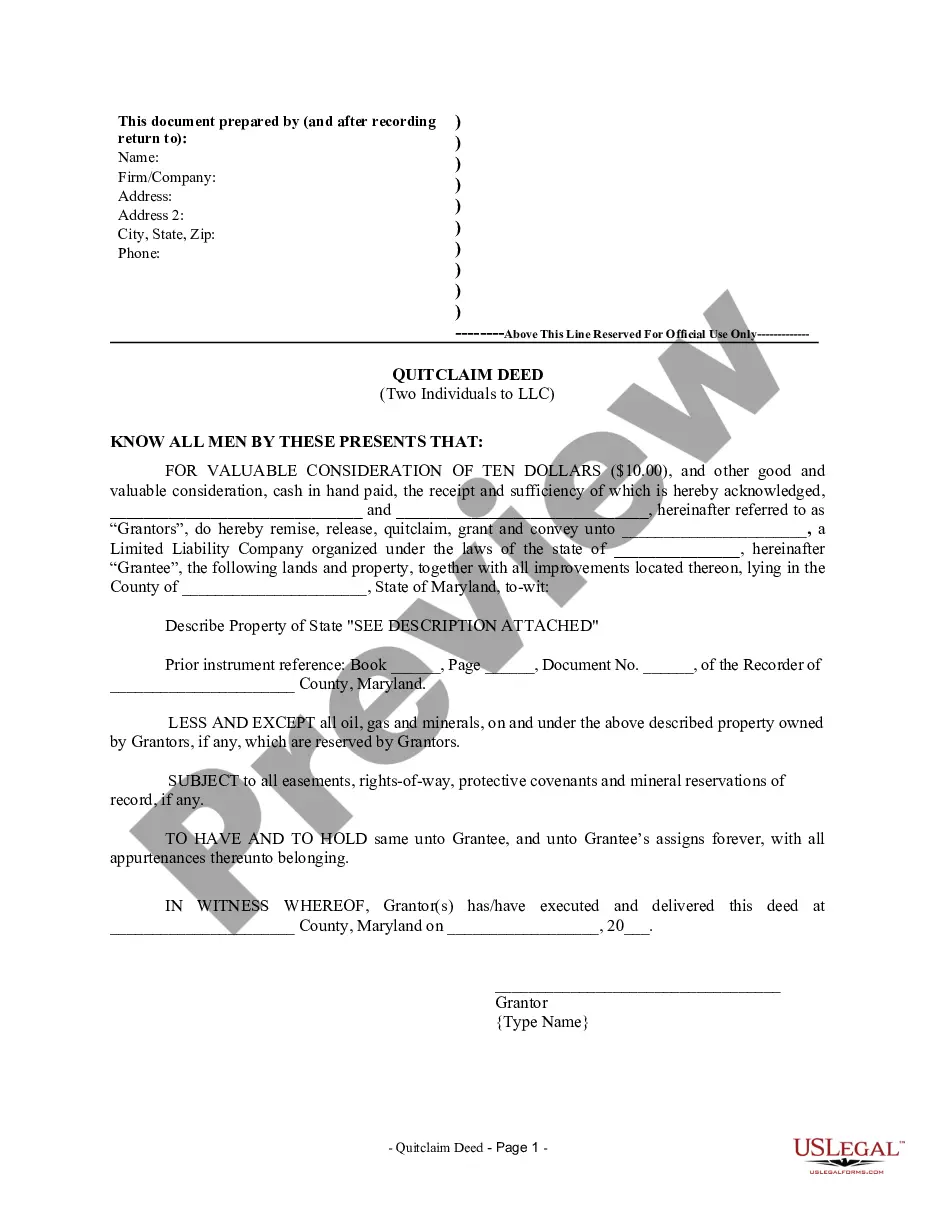

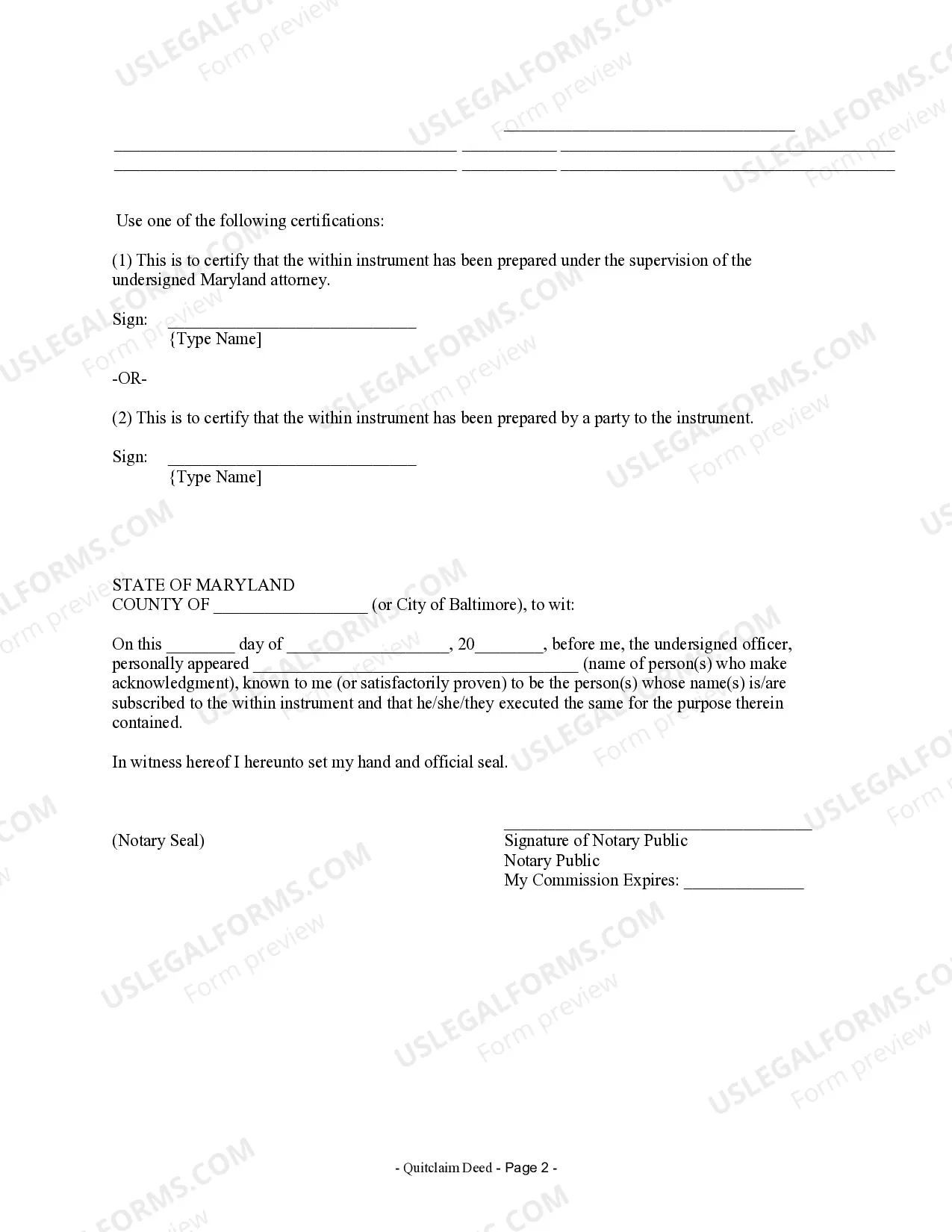

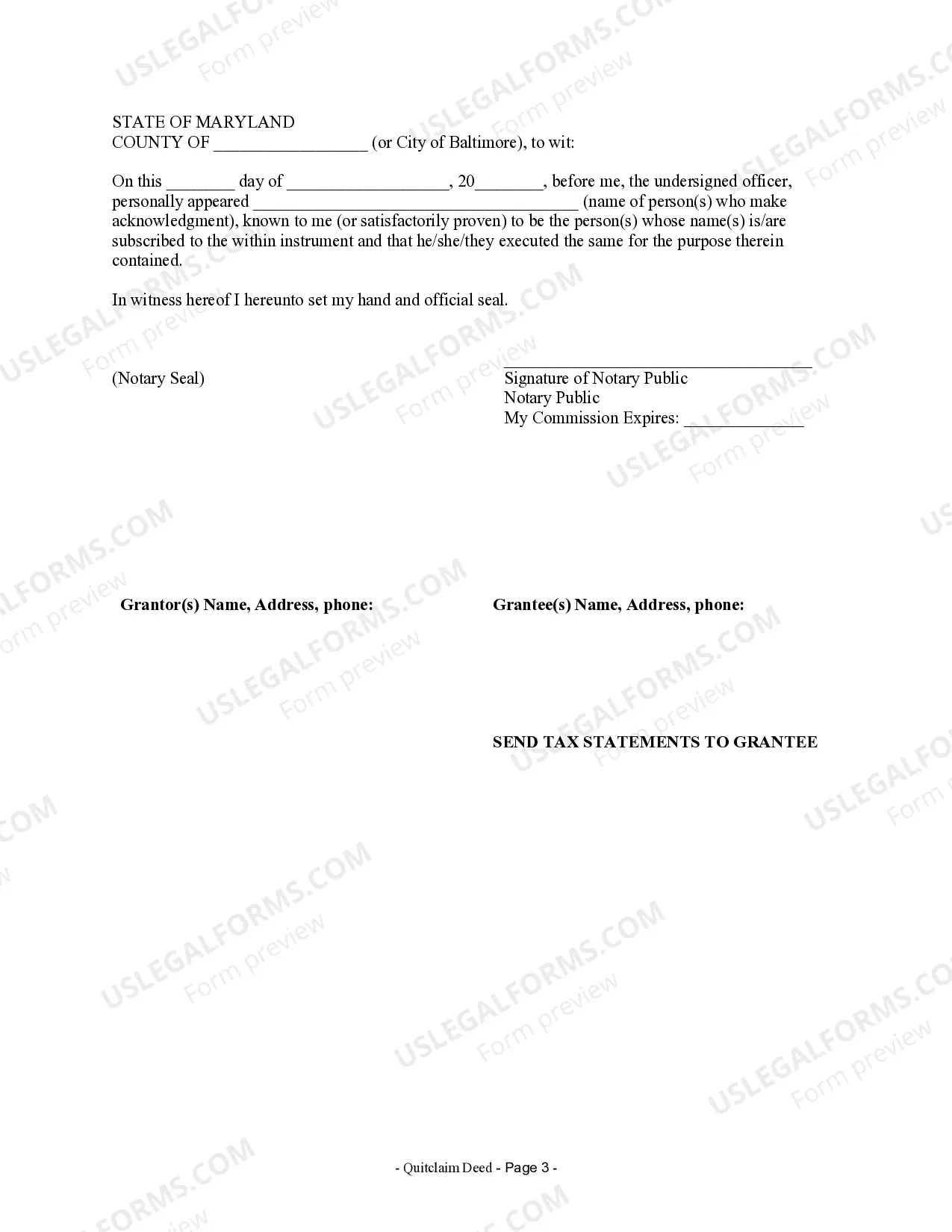

Maryland Quitclaim Deed by Two Individuals to LLC

Description Quitclaim Deed Llc Form

How to fill out Maryland Quitclaim Deed By Two Individuals To LLC?

Welcome to the greatest legal documents library, US Legal Forms. Right here you will find any example such as Maryland Quitclaim Deed by Two Individuals to LLC templates and save them (as many of them as you wish/need). Get ready official papers in a few hours, rather than days or even weeks, without having to spend an arm and a leg on an lawyer or attorney. Get the state-specific example in a couple of clicks and feel assured with the knowledge that it was drafted by our state-certified lawyers.

If you’re already a subscribed user, just log in to your account and click Download next to the Maryland Quitclaim Deed by Two Individuals to LLC you need. Due to the fact US Legal Forms is web-based, you’ll generally have access to your saved files, no matter what device you’re using. Find them within the My Forms tab.

If you don't have an account yet, what are you awaiting? Check our instructions below to begin:

- If this is a state-specific form, check its validity in the state where you live.

- Look at the description (if available) to understand if it’s the right template.

- See a lot more content with the Preview option.

- If the example meets all your requirements, just click Buy Now.

- To make an account, choose a pricing plan.

- Use a card or PayPal account to join.

- Save the document in the format you want (Word or PDF).

- Print the document and fill it with your/your business’s information.

When you’ve filled out the Maryland Quitclaim Deed by Two Individuals to LLC, send out it to your legal professional for confirmation. It’s an extra step but an essential one for making sure you’re fully covered. Sign up for US Legal Forms now and access thousands of reusable examples.

Form popularity

FAQ

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

For a flat fee of $240 - $250 in most cases (plus governmental recording fees) the firm can in most circumstances have an attorney prepared deed ready for signature in 2-4 business days. In most cases a true " Quit Claim Deed" is rarely the best choice.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.