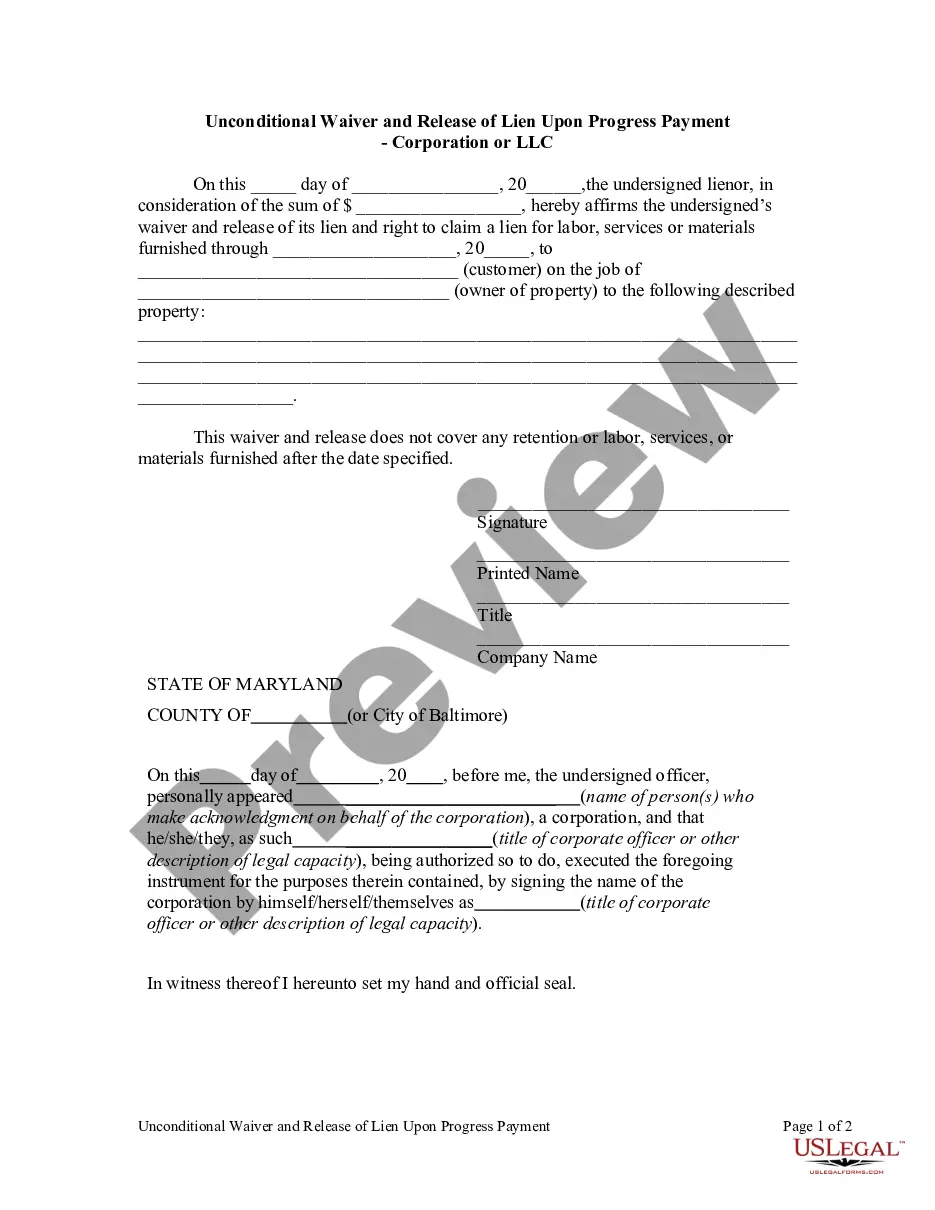

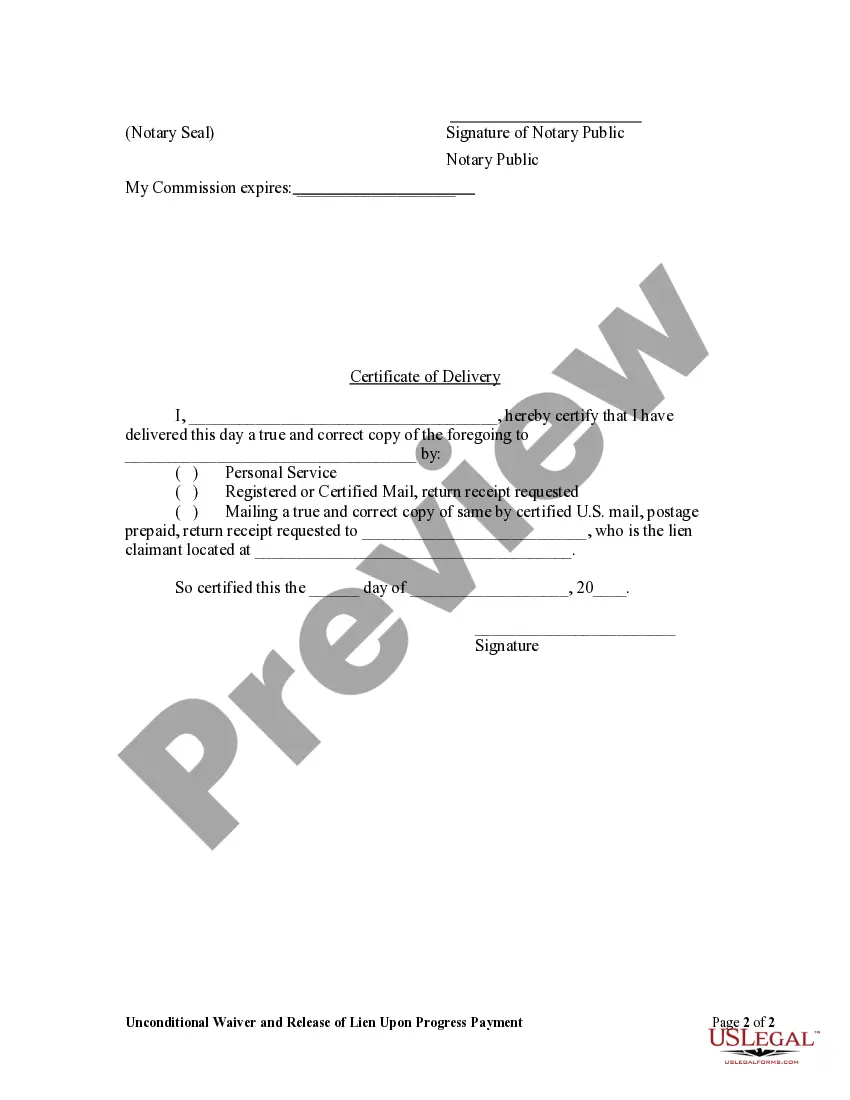

This Unconditional Waiver and Release Upon Progress Payment form is for use by a corporate or LLC lienor, in consideration of a certain sum of money to affirm its waiver and release of lien and right to claim a lien for labor, services or materials furnished through a certain date to a customer on the job of the owner of property.

Maryland Unconditional Waiver and Release Upon Progress Payment - Corporation or LLC

Description

How to fill out Maryland Unconditional Waiver And Release Upon Progress Payment - Corporation Or LLC?

Welcome to the most significant legal documents library, US Legal Forms. Here you will find any example including Maryland Unconditional Waiver and Release Upon Progress Payment - Corporation or LLC templates and save them (as many of them as you wish/require). Get ready official files in a couple of hours, rather than days or weeks, without having to spend an arm and a leg on an lawyer or attorney. Get your state-specific form in a few clicks and feel confident with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed user, just log in to your account and click Download next to the Maryland Unconditional Waiver and Release Upon Progress Payment - Corporation or LLC you require. Due to the fact US Legal Forms is web-based, you’ll always have access to your saved files, no matter what device you’re utilizing. Find them in the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check our guidelines listed below to start:

- If this is a state-specific form, check its validity in your state.

- Look at the description (if accessible) to learn if it’s the right example.

- See more content with the Preview option.

- If the document meets all your requirements, click Buy Now.

- To create your account, pick a pricing plan.

- Use a card or PayPal account to join.

- Download the document in the format you want (Word or PDF).

- Print the document and fill it out with your/your business’s information.

As soon as you’ve filled out the Maryland Unconditional Waiver and Release Upon Progress Payment - Corporation or LLC, send out it to your legal professional for confirmation. It’s an extra step but an essential one for being confident you’re entirely covered. Join US Legal Forms now and get a large number of reusable samples.