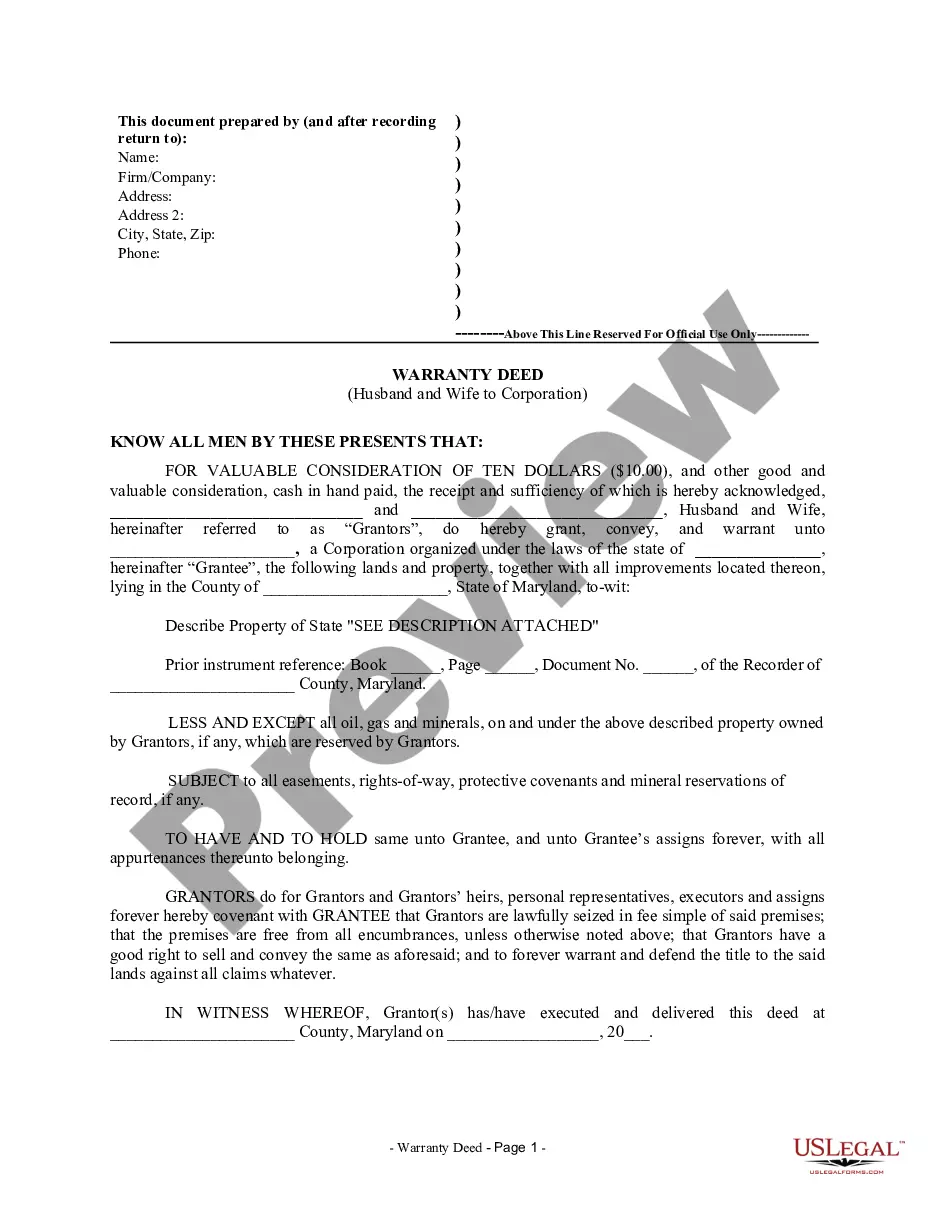

Maryland Warranty Deed from Husband and Wife to Corporation

Description

How to fill out Maryland Warranty Deed From Husband And Wife To Corporation?

You are welcome to the greatest legal files library, US Legal Forms. Right here you can find any template such as Maryland Warranty Deed from Husband and Wife to Corporation templates and download them (as many of them as you wish/need to have). Get ready official files with a several hours, instead of days or even weeks, without spending an arm and a leg with an lawyer or attorney. Get your state-specific sample in clicks and feel assured with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Maryland Warranty Deed from Husband and Wife to Corporation you require. Because US Legal Forms is online solution, you’ll generally have access to your saved templates, regardless of the device you’re utilizing. Locate them within the My Forms tab.

If you don't have an account yet, what are you waiting for? Check out our instructions below to start:

- If this is a state-specific sample, check out its applicability in the state where you live.

- See the description (if available) to understand if it’s the correct example.

- See far more content with the Preview option.

- If the sample meets all your requirements, just click Buy Now.

- To create an account, select a pricing plan.

- Use a card or PayPal account to register.

- Download the document in the format you require (Word or PDF).

- Print out the file and complete it with your/your business’s details.

After you’ve completed the Maryland Warranty Deed from Husband and Wife to Corporation, send out it to your lawyer for confirmation. It’s an extra step but a necessary one for being confident you’re fully covered. Become a member of US Legal Forms now and get a mass amount of reusable samples.

Form popularity

FAQ

Special warranty deed -- warrants that the seller did nothing personally during his ownership of the property that would create a defect in the title to the property. This is the type of deed most often used in Maryland.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

Typically, the only cost is between $25 and $55 to record the new deed and obtain a certificate from the city/county to show that all taxes are current. The deed should be notarized and must be prepared by one of the parties or under the supervision of a Maryland attorney.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.