Maryland Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description Md Bad File

How to fill out Notice Check Form?

Welcome to the largest legal files library, US Legal Forms. Here you will find any template such as Maryland Notice of Dishonored Check - Civil - Keywords: bad check, bounced check templates and save them (as many of them as you want/require). Prepare official files in a several hours, instead of days or even weeks, without spending an arm and a leg with an attorney. Get the state-specific sample in a few clicks and feel confident with the knowledge that it was drafted by our qualified attorneys.

If you’re already a subscribed customer, just log in to your account and then click Download near the Maryland Notice of Dishonored Check - Civil - Keywords: bad check, bounced check you require. Due to the fact US Legal Forms is online solution, you’ll generally have access to your saved forms, no matter the device you’re using. Find them in the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check our guidelines listed below to start:

- If this is a state-specific form, check out its applicability in the state where you live.

- See the description (if readily available) to understand if it’s the right template.

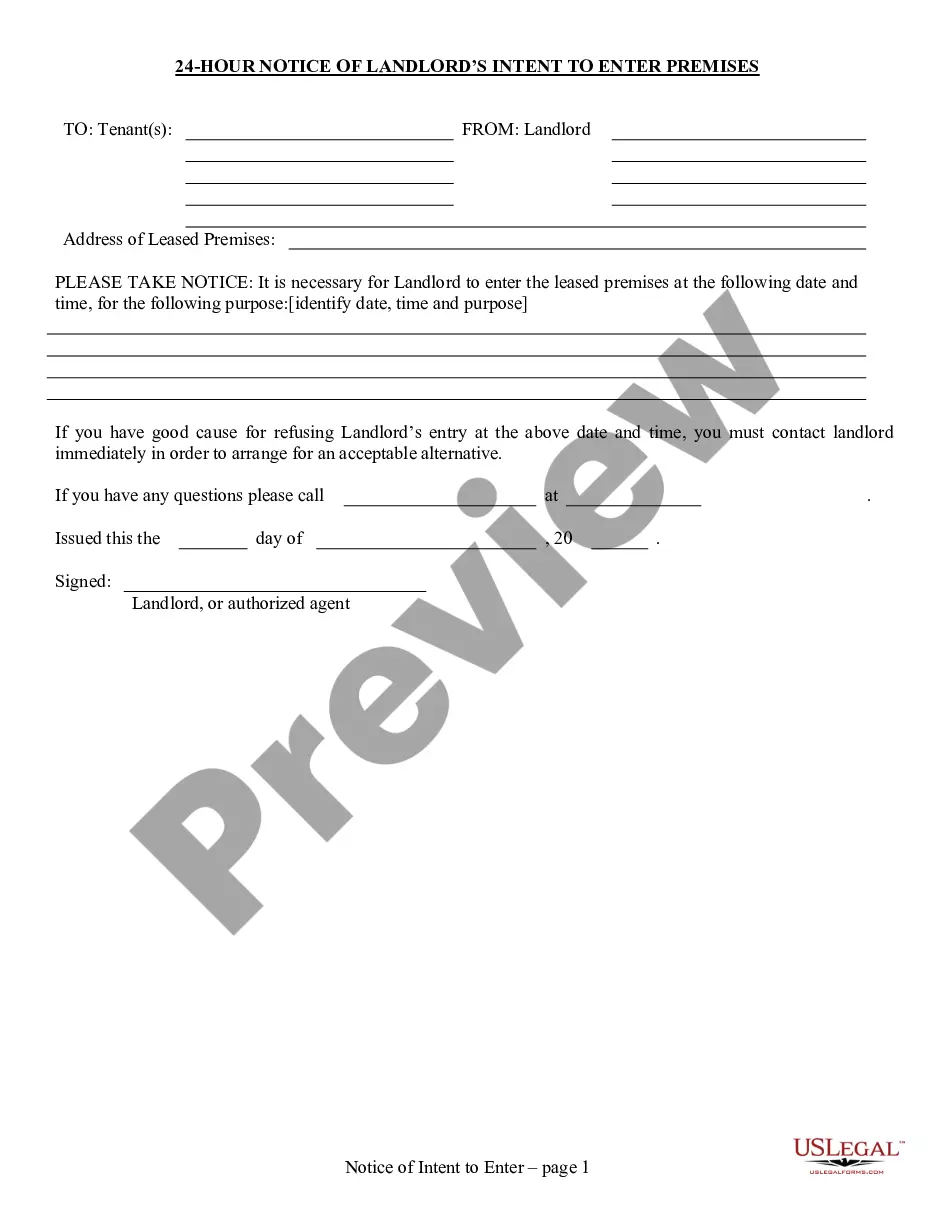

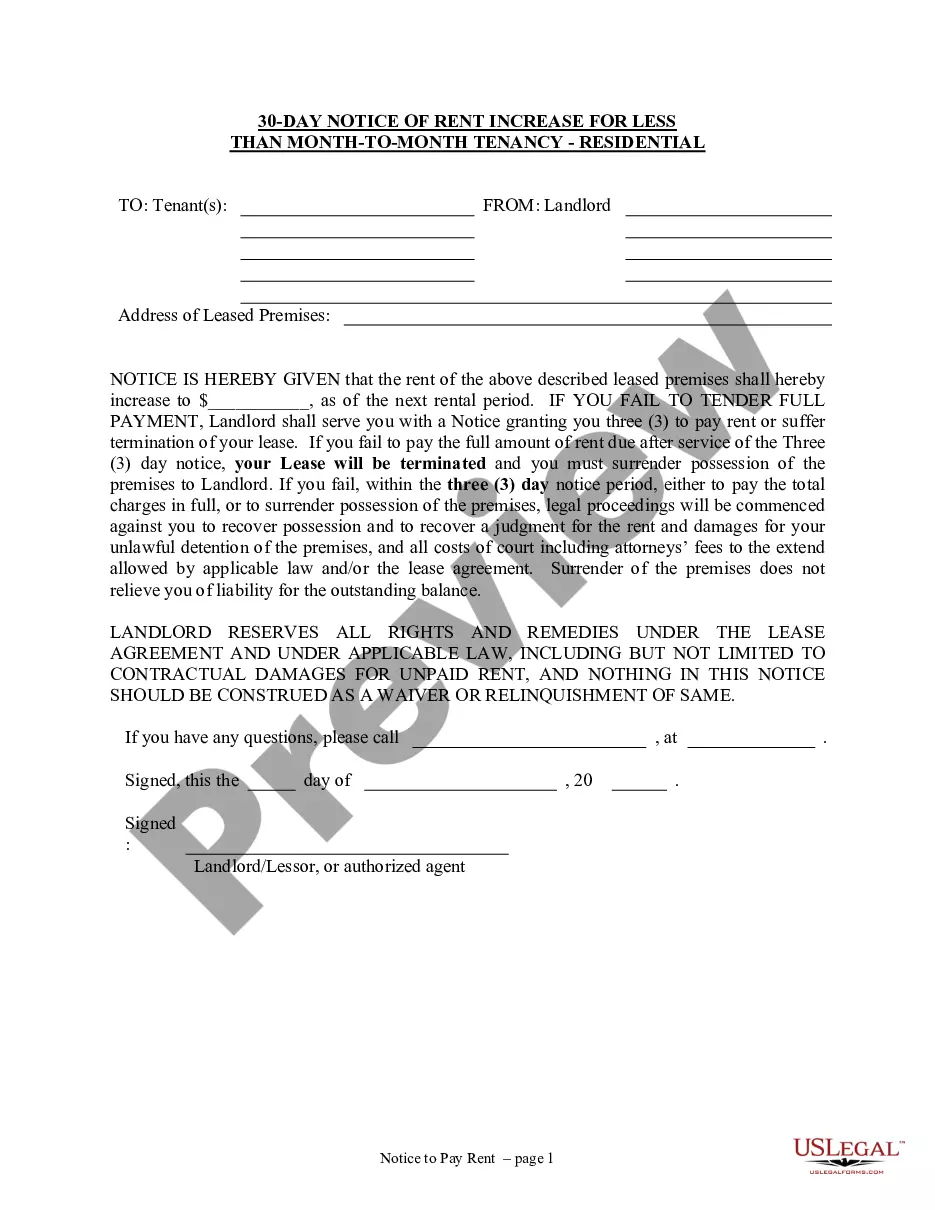

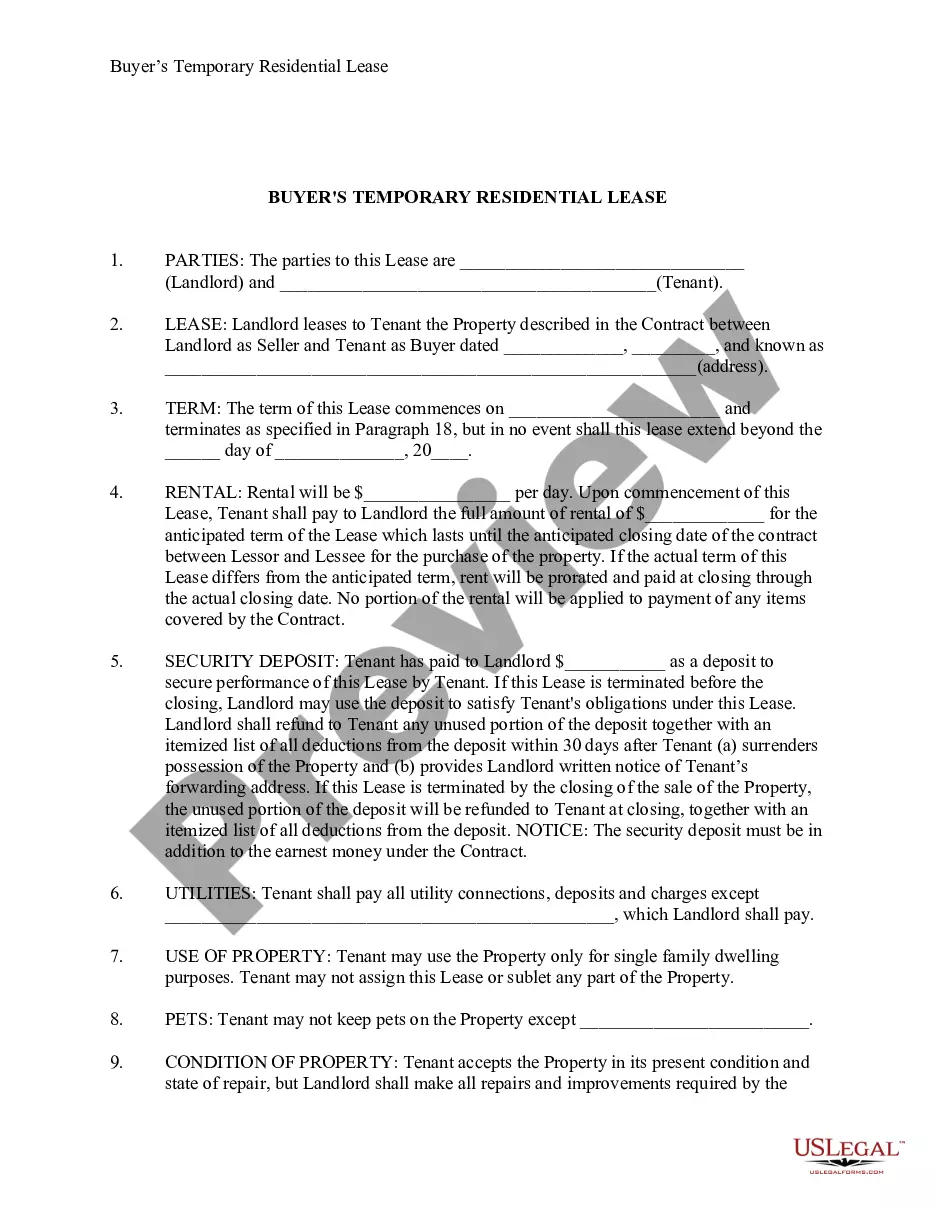

- See much more content with the Preview feature.

- If the example fulfills your requirements, just click Buy Now.

- To make your account, choose a pricing plan.

- Use a credit card or PayPal account to join.

- Save the template in the format you need (Word or PDF).

- Print the file and fill it out with your/your business’s information.

When you’ve filled out the Maryland Notice of Dishonored Check - Civil - Keywords: bad check, bounced check, send away it to your lawyer for confirmation. It’s an extra step but a necessary one for being confident you’re entirely covered. Become a member of US Legal Forms now and get thousands of reusable samples.

Maryland Civil Order Form popularity

Maryland Civil Sample Other Form Names

Md Bad Get FAQ

Writing a bad check is considered a wobbler crime in California, meaning it can be charged as either a misdemeanor or felony depending on circumstances of the crime. If the value of the check was under $450, the offense is generally charged as a misdemeanor. If the amount is over $450, you can be charged with a felony.

Writing a bad check is considered a wobbler crime in California, meaning it can be charged as either a misdemeanor or felony depending on circumstances of the crime. If the value of the check was under $450, the offense is generally charged as a misdemeanor. If the amount is over $450, you can be charged with a felony.

You'll need to have 100% of the money required available in your account for the check to be cashed. If you're short on funds, the request to cash the check will be denied, and you'll owe fees to your bank. Plus, the payee may have the right to charge you additional fees.

You may also sue someone who writes you a bad check without having a valid reason for doing so. You may also recover damages equaling three times the amount of the check, up to a maximum of $1,500, if you meet certain conditions: You must send a demand letter to the person who wrote the check.

Contact the bank that placed the negative information on your report. If the information is true, it isn't obligated to change or remove the information. You can, however, write a short explanation of the circumstances surrounding the bad check for inclusion in your report.

Send the letter certified mail. Visit your local district attorney's office if you do not hear back from the debtor. Bring your correspondence with you and a copy of the bad check. He will take the case over, and likely prosecute the check writer.

Writing bad checks can lead to several theft charges, but with the help of a skilled defense attorney, you can work to reduce or even dismiss charges.

Bouncing a check can happen to anyone. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

Under criminal penalties, you can be prosecuted and even arrested for writing a bad check.This can be seen as a felony in many states, especially when the checks are for more than $500. It's important to note that provision is made for accidents, because bookkeeping mistakes do happen.