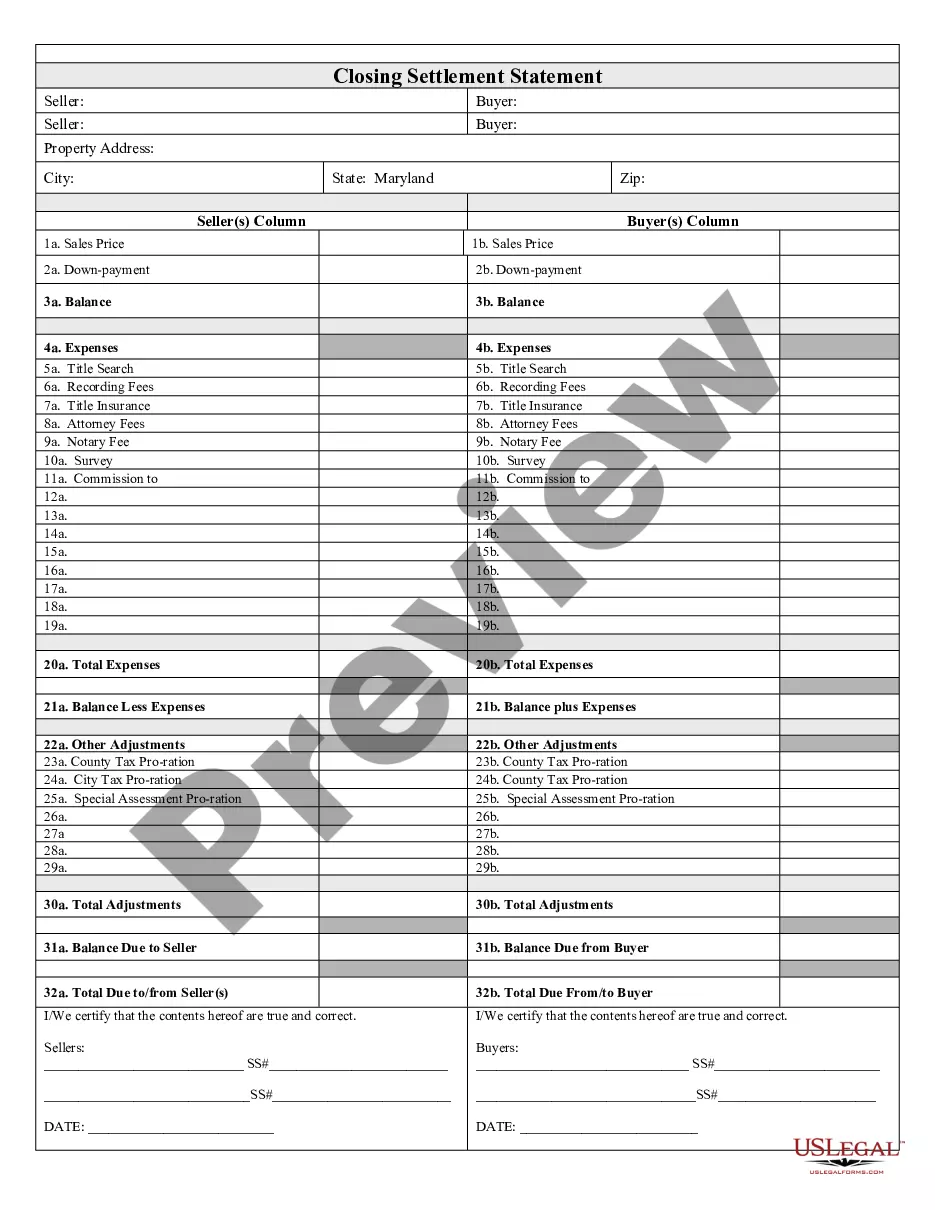

Maryland Closing Statement

Description Maryland Closing Statement

How to fill out Maryland Closing Doc?

Welcome to the biggest legal files library, US Legal Forms. Here you can get any sample such as Maryland Closing Statement forms and save them (as many of them as you wish/require). Prepare official files in just a several hours, instead of days or even weeks, without having to spend an arm and a leg with an lawyer or attorney. Get the state-specific sample in a few clicks and be assured understanding that it was drafted by our state-certified attorneys.

If you’re already a subscribed user, just log in to your account and click Download next to the Maryland Closing Statement you want. Because US Legal Forms is online solution, you’ll generally have access to your saved templates, no matter the device you’re using. Locate them within the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check out our instructions below to get started:

- If this is a state-specific document, check out its applicability in your state.

- See the description (if readily available) to learn if it’s the proper example.

- See far more content with the Preview option.

- If the example fulfills your needs, click Buy Now.

- To create an account, select a pricing plan.

- Use a credit card or PayPal account to sign up.

- Download the template in the format you want (Word or PDF).

- Print out the document and fill it with your/your business’s info.

After you’ve filled out the Maryland Closing Statement, send away it to your lawyer for confirmation. It’s an additional step but a necessary one for being sure you’re totally covered. Sign up for US Legal Forms now and get a large number of reusable examples.

Settlement Statement Form Form popularity

Maryland Settlement Statement Other Form Names

Maryland Closing Fill FAQ

Completing Part B of HUD-1Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed. Fill in the appropriate lines in sections J and K, which are summaries of the borrower's and seller's transactions, respectively.

The Deed: public record of the ownership of the property It often includes a description of the property and signed by both parties. Deeds are the most important documents in your closing package because they contain the statement that the seller transfers all rights and stakes in the property to the buyer.

- The final costs of a closing statement are often expressed in a document that is called the HUD or the HUD-1 Statement. HUD is an abbreviation for the Housing and Urban Development department part of the federal government that mandates the recording of certain information about real estate transactions.

Double-check the loan amount, loan type, loan term, interest rate, monthly payment amount, whether there is a prepayment penalty, whether you are paying points or receiving credits, and other key details. Compare the Annual Percentage Rate (APR) on the Closing Disclosure to the APR listed on your Loan Estimate.

Some common closing papers you can expect include your completed loan application, mortgage promissory note, deed of trust, loan estimate and closing disclosure, bill of sale, title insurance documents, affidavit of title, escrow statement, tax documents and notice of right to cancel.

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

The Mortgage Promissory Note. The Mortgage / Deed of Trust / Security Instrument. The deed (for property transfer). The Closing Disclosure. The initial escrow disclosure statement. The transfer tax declaration (in some states)