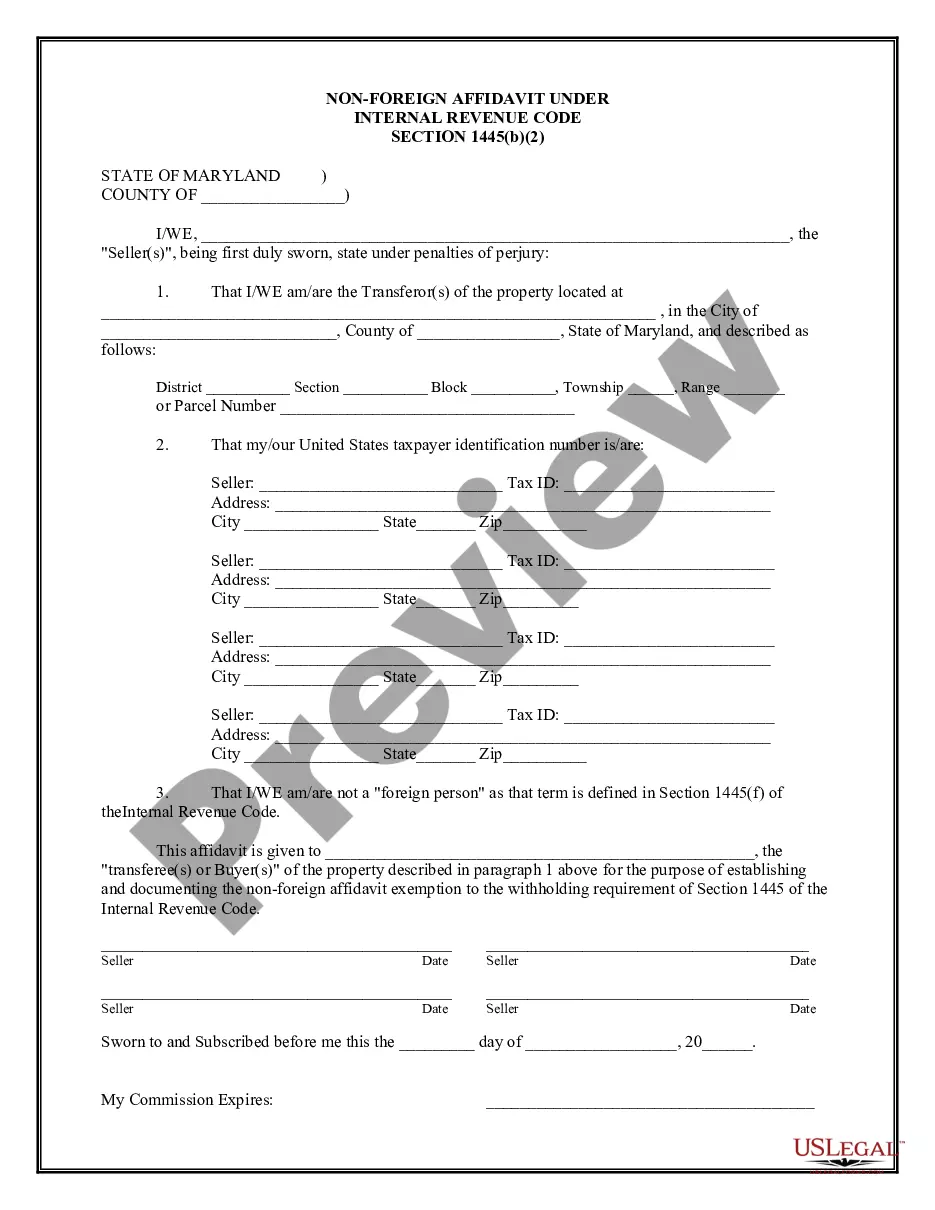

Maryland Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Maryland Non-Foreign Affidavit Under IRC 1445?

Greetings to the most notable legal documents library, US Legal Forms. Right here you will discover any template such as Maryland Non-Foreign Affidavit Under IRC 1445 forms and preserve them (as many of them as you wish/need to have). Create official paperwork in a few hours, rather than days or weeks, without spending a fortune with a lawyer or attorney.

Obtain your state-specific template in a few clicks and be assured knowing that it was prepared by our licensed lawyers.

If you’re already a registered user, just Log In to your account and then click Download next to the Maryland Non-Foreign Affidavit Under IRC 1445 you require. Since US Legal Forms is an online service, you’ll always have access to your saved forms, regardless of the device you’re using. Find them within the My documents tab.

Save the document in your desired format (Word or PDF). Print the document and complete it with your/your business’s details. After you’ve filled out the Maryland Non-Foreign Affidavit Under IRC 1445, forward it to your attorney for validation. It’s an additional step but an important one for ensuring you’re fully protected. Sign up for US Legal Forms today and gain access to a vast array of reusable templates.

- If you don't have an account yet, what exactly are you waiting for.

- Check our instructions below to get started.

- If this is a state-specific template, verify its relevance in your state.

- Examine the description (if available) to determine if it’s the appropriate template.

- View additional content using the Preview option.

- If the document meets all your requirements, click Buy Now.

- To create your account, select a pricing plan.

- Utilize a card or PayPal account to register.

Form popularity

FAQ

Can I get my IRS refund back early? In theory, yes. You can file a Form 843 (Claim for Refund), together with a Form 8288-B, to show the estimated tax on the sale. This is the IRS's official process for obtaining an early refund of FIRPTA withholding.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.